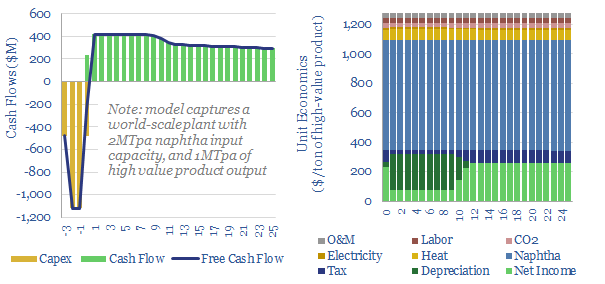

Naphtha cracking costs $1,300/ton for high value products, such as ethylene, propylene, butadiene and BTX aromatics, in order to derive a 10% IRR constructing a new, greenfield naphtha cracker, with $1,600/Tpa capex costs. CO2 intensity averages 1 ton of CO2 per ton of high value products. This data-file captures the economics for naphtha cracking, which matters, as a cornerstone of the modern materials industry.

Naphtha cracking is the dominant source of petrochemical building blocks, especially in Europe and Asia, and a crucial starting point for producing modern polymers, crucial materials, which are needed for consumers and across our energy transition research.

What is naphtha? Naphtha is the C6-C12 fraction from oil refineries, containing molecules with typical boiling points of 60-200ºC.

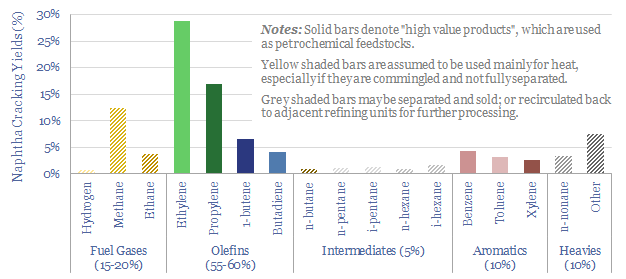

What is naphtha cracking? Naphtha is mixed in a 2:1 ratio with steam, super-heated to 700-900◦C to start “breaking bonds”, then quickly quenched to control the product mix, which is later fractionated.

The purpose of the steam is to minimize coking, which deposits carbon on process units and requires shut-downs for maintenance. A more detailed description of the overall process is laid out in the data-file.

A methodological challenge for appraising the costs of naphtha cracking is the complexity. Around 230 reactions, involving 80 chemical species feature in process sheets.

Our suggestion to simplify the complexity of naphtha cracking is to think about yields as comprising 55-60% olefins (ethylene, propylene, etc), 15-20% fuel gases (which are recirculated and burned to provide heat for the highly endothermic cracking reaction and high-pressure steam), 10% aromatics (BTX), 5% pentanes and hexanes, and 10% heavier fractions which are most likely sent back to adjacent refinery units (chart below).

For modelling the economics of naphtha cracking, we consider the olefins and aromatics ‘high value’ molecules and they comprise around 65% of the product mix.

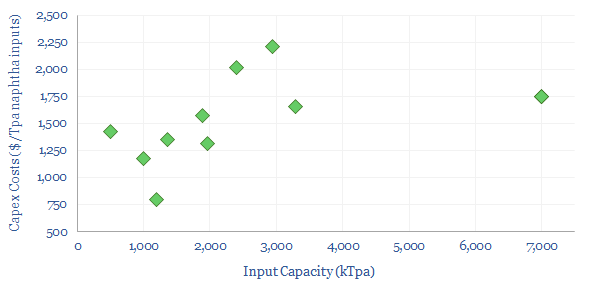

Typical capex costs for naphtha crackers run to $1,600/Tpa of input capacity, which equates to $1,700/Tpa of outputs and $2,500/Tpa of high-value outputs (chart below). Underlying details are in the data-file, based on public disclosures from recent projects.

Economics of naphtha cracking. Generating a 10% IRR at a greenfield naphtha cracker requires a high value product price of $1,300/ton. Generally pricing will be highest for butadiene, then propylene and aromatics, and lower for ethylene. Ethylene is also produced via dedicated ethane crackers.

Naphtha cracking cost breakdown? 60% of costs are associated with naphtha inputs, although this depends on the oil price, which can be flexed in the model. In our recent research, we argue that the rise of electric vehicles will dent demand for naphtha more rapidly than other oil fractions, which may lower feedstock costs and boost margins in petrochemicals, especially creating upside for polyurethanes in the energy transition.

Another c10% of naphtha cracking costs are associated with heat, electricity and CO2 prices, which can also be varied in the data-file. Energy costs are quantified from technical papers, across electricity use and heat use, both measured in kWh/ton (or GJ/ton, if you prefer those units).

CO2 intensity is estimated at around 1 ton of CO2 per ton of high value products in our build-up. Some regions have chosen to add higher CO2 prices than others. Some studies that have crossed our desk report higher CO2 intensities, although often this is a definitional issue, as similar CO2 overall emissions get ascribed to different products (e.g., should CO2 be ascribed by product mass or product value?).

Some of the leading companies providing naphtha cracking process technologies include Lummus, KBR, Technip Energies, Linde, Axens. A useful table of crackers in Europe is published by Petrochemicals Europe. A listed downstream company in Central Europe is also currently expanding its naphtha cracking capacity.