This data-file captures the marginal cost of North Sea gas projects. We have built a generic model for finding and developing a new UK gas field, showing windfall taxes and uncertain policies have raised full-cycle marginal costs from $7/mcf to $13.5/mcf. We have run a more detailed case study, at the Jackdaw HPHT project, where Shell took a final investment decision in 2022, targeting over 40kboed of production, but has since faced legal challenges.

Europe is waking up to the unpleasant realization that it is short of low-cost energy, and consequently has been subject to importing large quantities of energy from countries that have not always had our own best interests at heart. Europe’s energy self-sufficiency has fallen more than any other region globally. Hence what prospects are there to re-accelerate energy production?

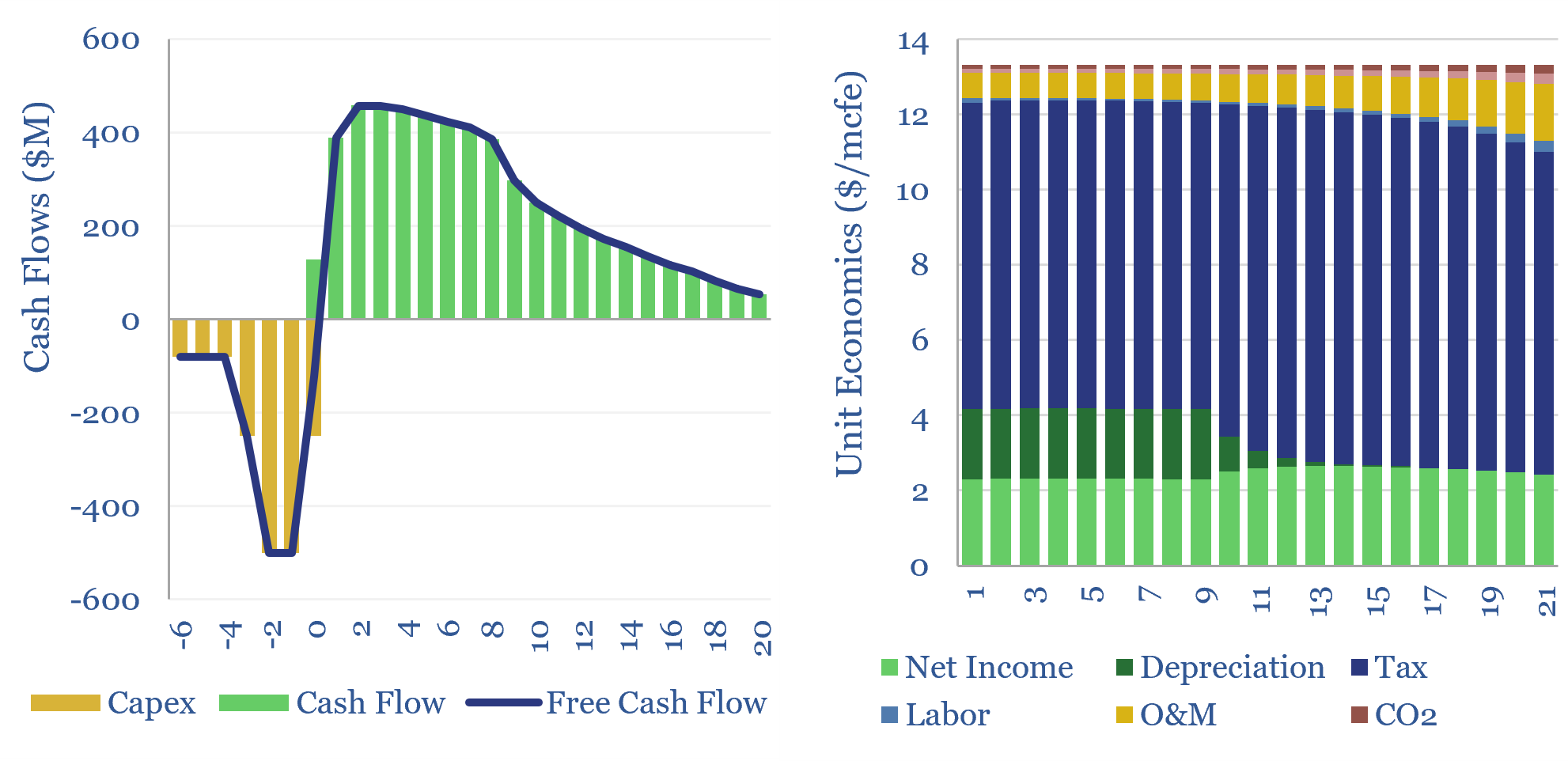

To answer this question, we have constructed a generic model for exploring, finding and developing new domestic gas resources in Europe, to meet European natural gas demand, as shown in the title chart above. We think that the current incentive price is currently $13.5/mcf, while for contrast, it is around $2-3/mcf for US shale gas, and gas prices by country are as low as $1.7/mcf in Russia and $2/mcf in many Middle Eastern countries.

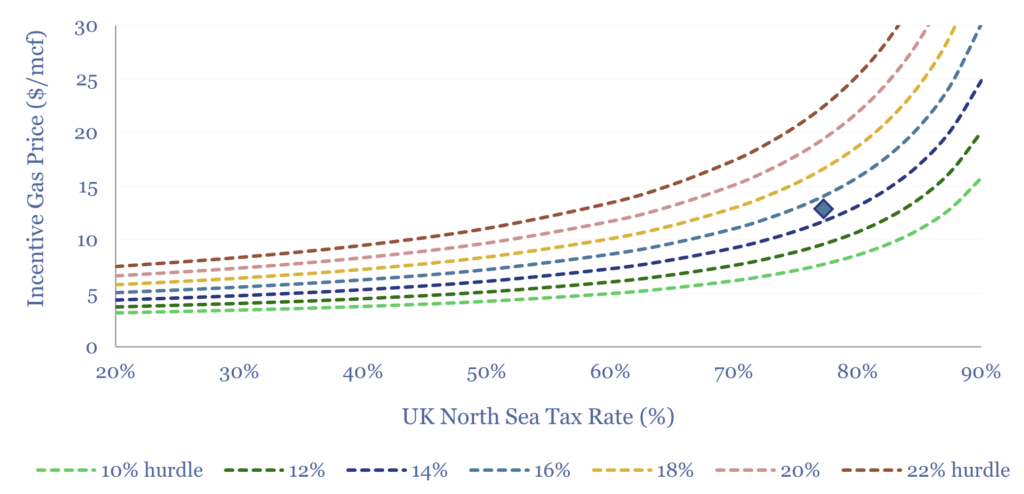

The incentive cost of North Sea gas comes down mostly to tax rates and hurdle rates, as shown in the sensitivity below. In the decade prior to 2022, North Sea tax rates were 62%, then a windfall tax was imposed in 2022, and in October-2024, the British government increased the windfall tax from 35% to 38%, resulting in a 78% total effective tax rate through 2030. That is, of course, the UK government’s prerogative, but it does inflate the incentive price for developing domestic resources.

Hurdle rates have also increased, due to risks around execution, further policy impacts, and environmental disruptions. For example, in January-2025 a court in Scotland ruled that Shell and Equinor, respectively, could not produce hydrocarbons from the Jackdaw (see below) and Rosebank fields, as the approvals for their development had [sic] not adequately considered Scope 3 emissions. Greenpeace stated “this is a historic win”. Well, not if you are a serious person, who wants to attract future investment into your country’s energy industry. Under the current mood music, we would want at least a 15% return to deploy new capital in the UKNS, and probably more like 20%.

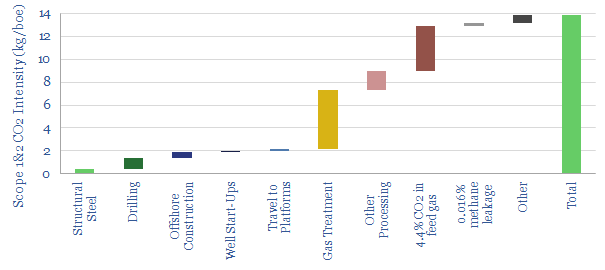

That is where Jackdaw started out, to be fair. We modeled the project in detail, in 2022, which is also included in this data-file, noting that the “The risk, is not so much with prices as with implementation. The environmental impact statement gives a base case of 75Mboe of saleable resource, within a P10-P90 range that varies by 3x, from 40Mboe to 110Mboe. The reservoir is a complex array of turbidites, containing fluids at 191ºC and 17,000 psi, including 35-45 API gas condensate, 17% wax with a 46ºC wax appearance temperature, 4.2% CO2 and 30ppm H2S. To state the obvious, a field that fails to produce is going to face large potential write-offs. So it is delivery, not gas prices, that will mostly dictate economics”.

Environmental credentials of the Jackdaw field were actually relatively strong, despite the recent legal challenges. We were able to construct a build-up of total CO2 intensity from disclosures in the EIS (chart below). Shell’s target is to produce 6% of the North Sea’s gas for 1% of its CO2. Peak CO2 emissions during production will be 130kTpa, which has been reduced from 280kTpa in initial designs (details in data-file). We think total life CO2 intensity will be something around 14kg/boe, which is in line with some of the lowest-carbon gas resources in our broader screens around the CO2 intensity of producing natural gas.

To stress-test the costs of North Sea gas (IRRs, NPVs), both in general, and specifically around the Jackdaw HPHT project, including gas prices, opex, capex, development delays, and other variables, please download the data file.