Search results for: “gas turbine”

-

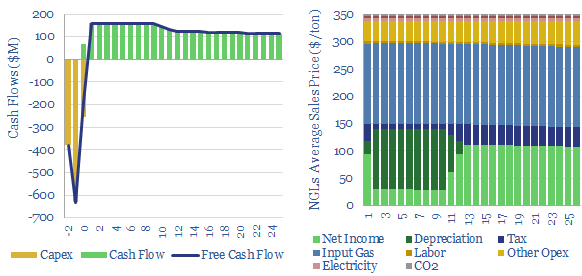

Gas fractionation: NGL economics?

Gas fractionation separates out methane from NGLs such as ethane, propane and butane. A full separation uses up almost 1% of the input gas energy and 4% of the NGL energy. The costs of gas fractionation require a gas processing spread of $0.7/mcf for a 10% IRR off $2/mcf input gas, or in turn, an…

-

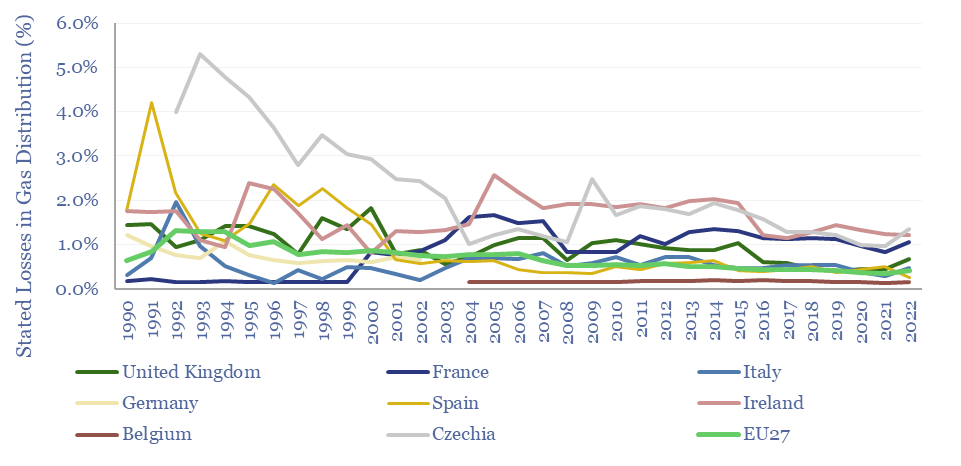

Gas distribution: loss rates, leakage, unaccounted gas?

1-4% of all the gas that flows into downstream gas distribution networks may fail to be metered and monetized. Stated leakage rates are usually around 0.5%, but could be higher. This data-file aggregates data from Eurostat and the UK’s Joint Office of Gas Transporters.

-

Compressed air energy storage: costs and economics?

Our base case estimates for Compressed Air Energy Storage costs require a 26c/kWh storage spread to generate a 10% IRR at a $1,350/kW CAES facility, with 63% round-trip efficiency, charging and discharging 365 days per year. Our numbers are based on top-down project data and bottom up calculations, both for CAES capex (in $/kW) and…

-

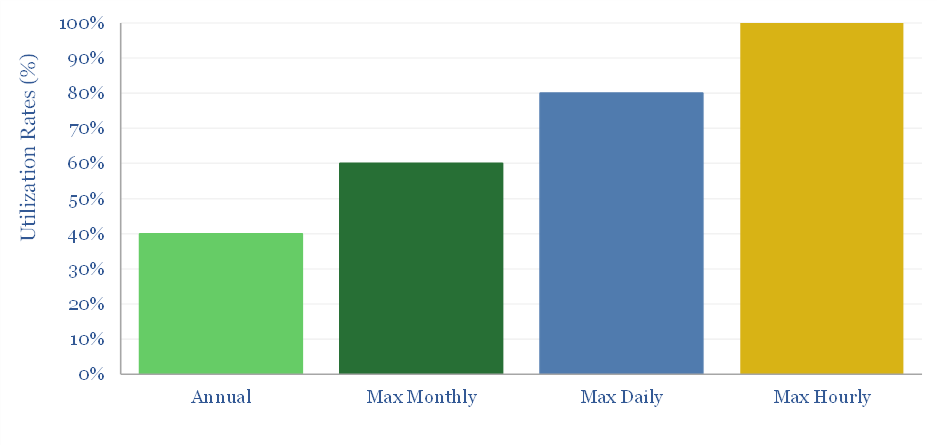

Gas power: does low utilization entail spare capacity?

The US has >400GW of large gas-fired power plants running at 40% average annual utilization. Could they help power new loads, e.g., 60GW of AI data-centers by 2030? This 5-page note shows why low utilization does not entail spare capacity, and in turn, estimates the true spare capacity for loads such as data-centers.

-

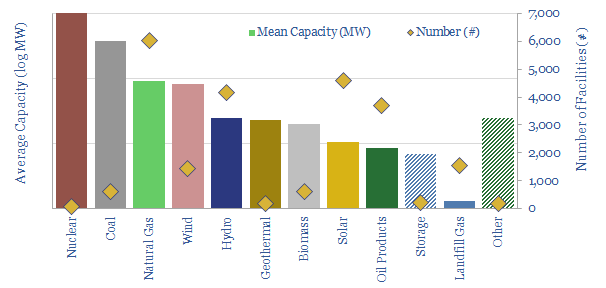

Power plants: average capacity?

This data-file aggregates granular data into the average capacity of different types of power plants: wind, solar, nuclear, gas, hydro, coal, biomass, landfill gas and geothermal. Energy transition is going to increase the number of inter-connections to the grid by 10-100x.

-

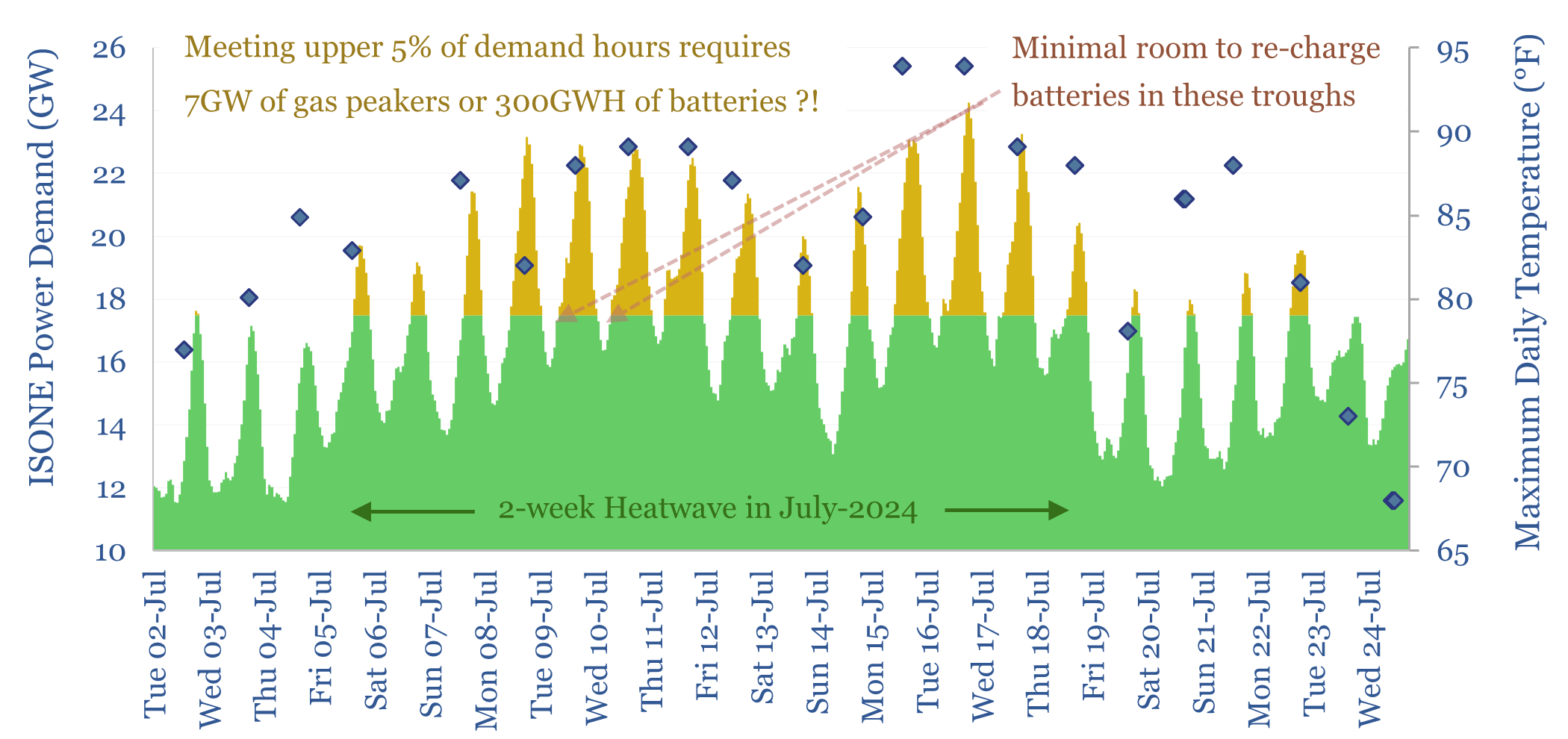

Peak loads: can batteries displace gas peakers?

Peak loads in power grids are caused by heatwaves (in the US) and cold snaps (in Europe), which last 2-14 days. This 16-page report finds that very large batteries would be needed to ride through these episodes, costing 2-20x more than gas peakers. But the outlook differs interestingly between the US vs Europe.

-

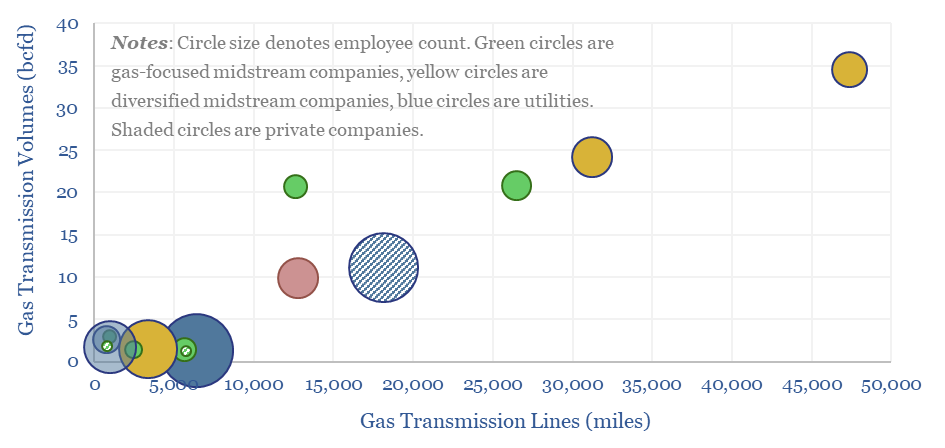

US gas transmission: by company and by pipeline?

This data-file aggregates granular data into US gas transmission, by company and by pipeline, for 40 major US gas pipelines which transport 45TCF of gas per annum across 185,000 miles; and for 3,200 compressors at 640 related compressor stations.

-

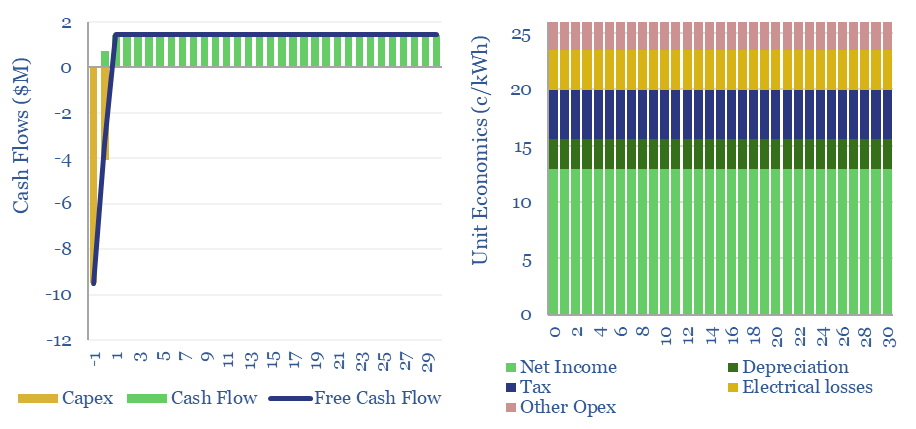

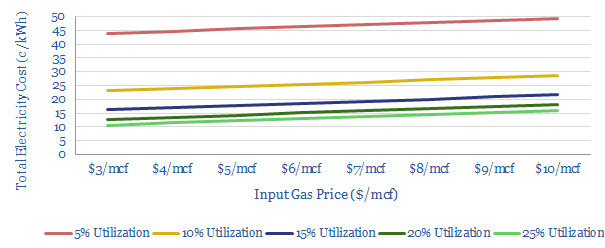

Fast-charge the electric vehicles with gas?

There is upside for natural gas, as EV penetration rises: we model that gas turbines can economically power fast-chargers for 13c/kWh. Carbon emissions are lowered by c70% compared with oil. And the grid is spared from power demand surges. Download our data-file to stress-test the sensitivities.

-

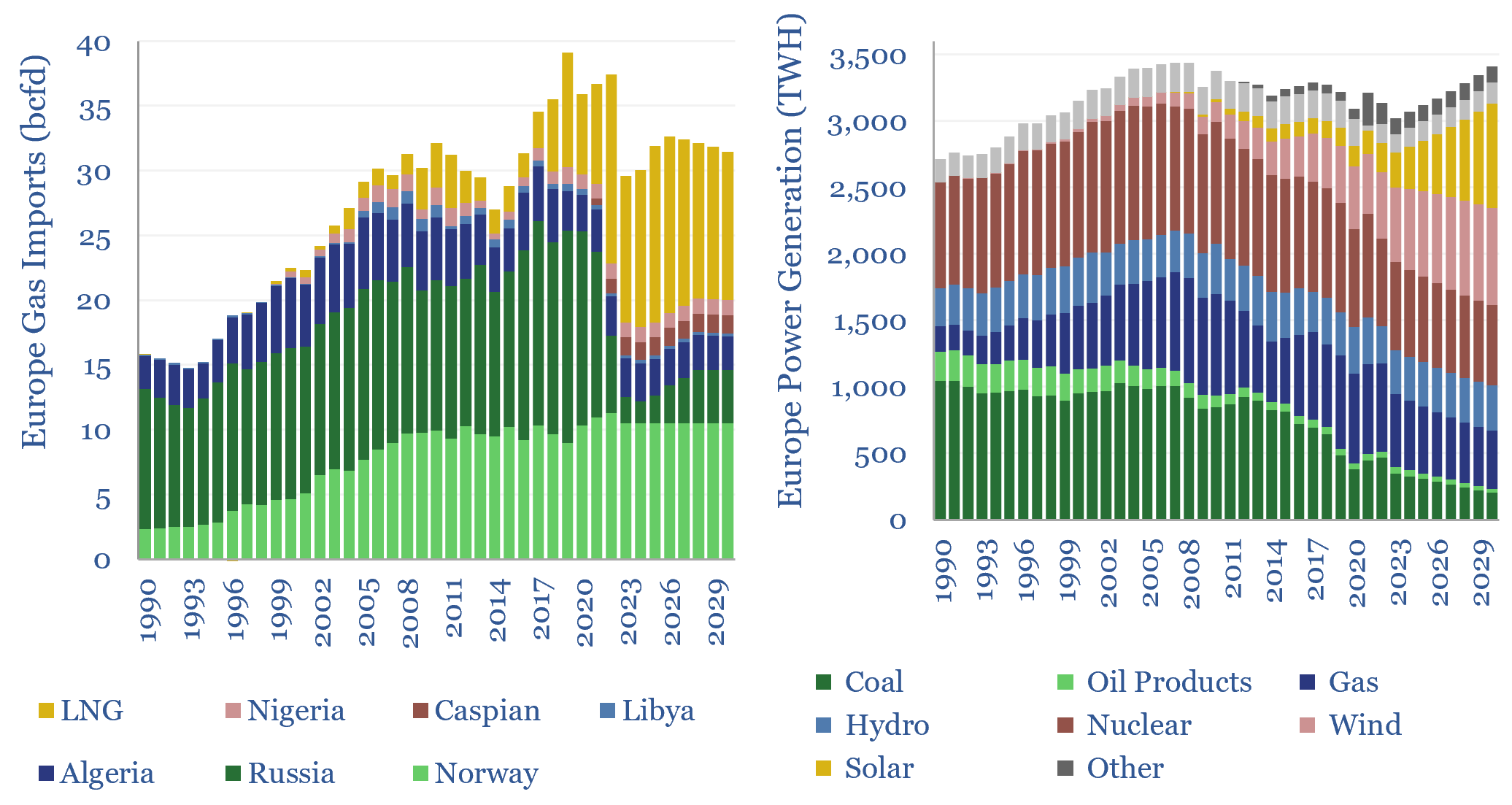

European gas and power model: natural gas supply-demand?

European gas and power markets will look better-supplied than they truly are in 2023-24. A dozen key input variables can be stress-tested in the data-file. Overall, we think Europe will need to source over 15bcfd of LNG through 2030, especially US LNG.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

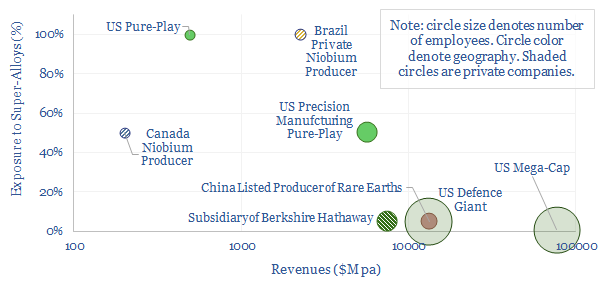

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)