Search results for: “AI”

-

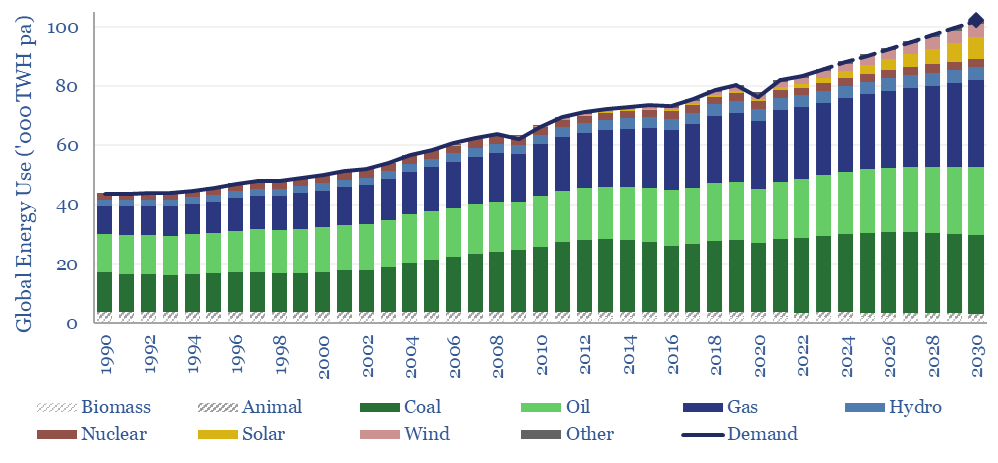

Global energy: supply-demand model?

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2023-30. Energy markets can be well-supplied from 2025-30, barring and disruptions, but only because emerging industrial superpowers will continuing using high-carbon coal.

-

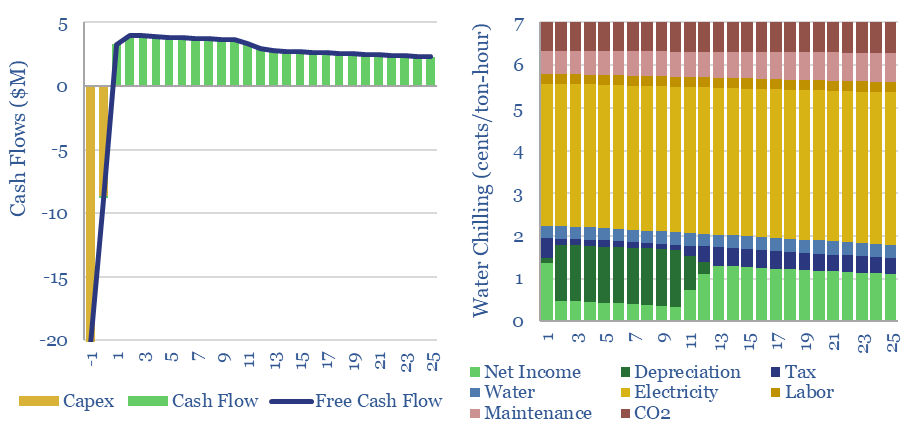

Industrial cooling: chillers and evaporators?

This data-file captures the costs of industrial cooling, especially liquid cooling using commercial HVAC equipment, across heat-exchangers, cooling tower evaporators and chillers. Our base case is that removing 100MW-th of heat has capex costs of $1,000/ton, equivalent to c$300/kW-th, expending 0.12 kWh-e of electricity per kWh-th, with a total cost of 7 c/ton-hour.

-

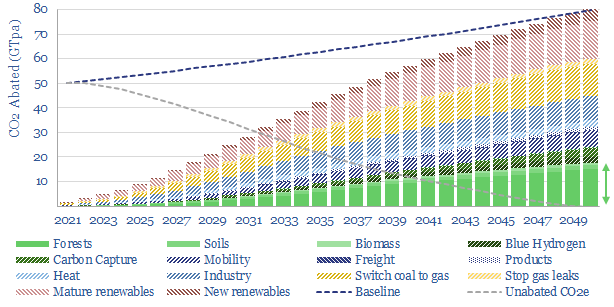

Nature based solutions to climate change?

Nature based solutions are likely to deliver c20-25% of the decarbonization in a realistic roadmap to net zero. Reforestation is low-cost (c$50/ton), technically ready, convenient and helps nature. Key challenges are improving the quality of nature-based CO2 removals and accelerating momentum. We see upside for companies that can clear these hurdles. Our top ten conclusions…

-

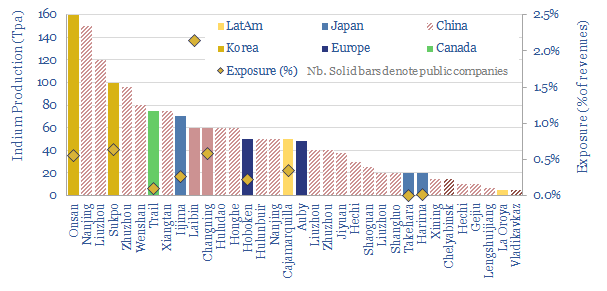

Indium producers: companies and market outlook?

35 indium producers are screened in this data-file, as our energy transition outlook sees primary demand rising 4x from 900 tons in 2022 to over 3.5ktons in 2050, for uses in HJT solar cells and digital devices. 60% of global supply is produced by 20 Chinese companies. But five listed materials companies in Europe, Canada,…

-

Energy transition: ten positive themes?

It can feel gloomy, forecasting 2-6% global energy shortages, bottlenecks on material value chains that must scale by 3-30x, and even fearing that global conflicts will volatilize commodity prices. Yet there are ten themes that particularly excite us, presented here, from faster technology progress, to world-changing efficiency technologies and a new age of ‘advanced materials’.

-

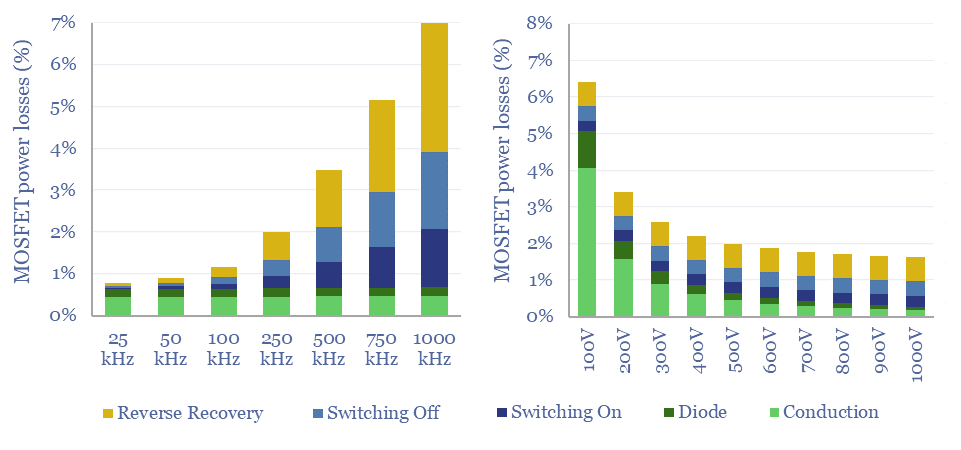

MOSFETs: energy use and power loss calculator?

MOSFETs are fast-acting digital switches, used to transform electricity, across new energies and digital devices. MOSFET power losses are built up from first principles in this data-file, averaging 2% per MOSFET, with a range of 1-10% depending on voltage, switching, on resistance, operating temperature and reverse recovery charge.

-

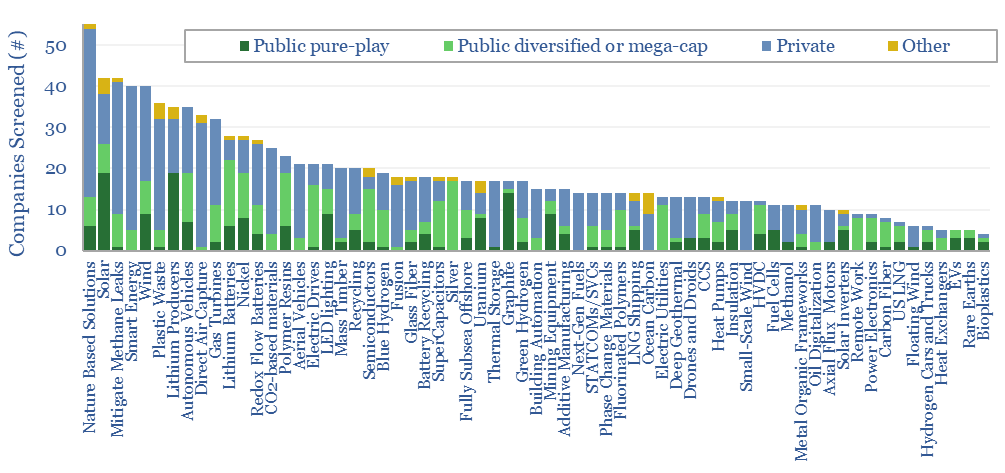

Energy transition companies?

This database contains a record of every company that has ever been mentioned across Thunder Said Energy’s energy transition research, as a useful reference for TSE’s clients. The database summarizes over 3,000 mentions of 1,400 energy transition companies, their size, focus and a summary of our key conclusions, plus links to further research.

-

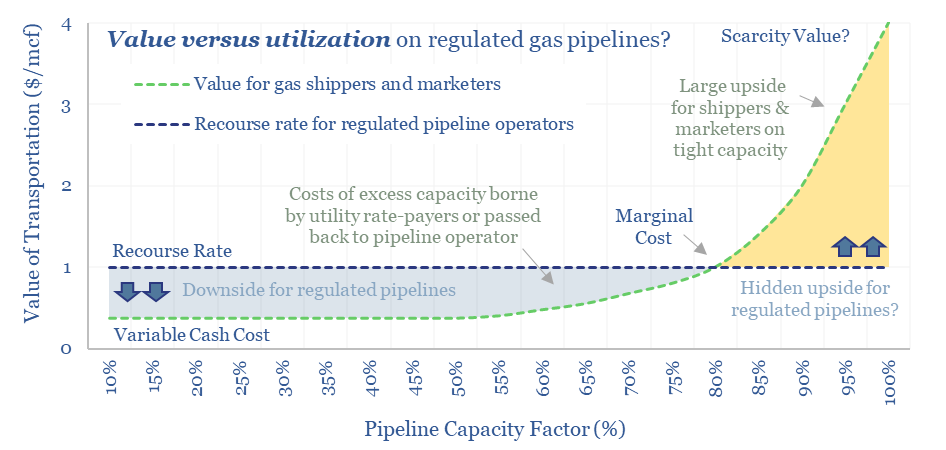

Midstream gas: pipelines have pricing power ?!

FERC regulations are surprisingly interesting!! In theory, gas pipelines are not allowed to have market power. But they increasingly do have it: gas use is rising, on grid bottlenecks, volatile renewables and AI; while new pipeline investments are being hindered. So who benefits here? Answers are explored in this 13-page report.

Content by Category

- Batteries (84)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (36)

- Company Diligence (85)

- Data Models (790)

- Decarbonization (156)

- Demand (103)

- Digital (50)

- Downstream (44)

- Economic Model (194)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (260)

- LNG (48)

- Materials (77)

- Metals (69)

- Midstream (43)

- Natural Gas (144)

- Nature (75)

- Nuclear (22)

- Oil (161)

- Patents (38)

- Plastics (43)

- Power Grids (116)

- Renewables (147)

- Screen (107)

- Semiconductors (30)

- Shale (50)

- Solar (66)

- Supply-Demand (45)

- Vehicles (88)

- Wind (40)

- Written Research (331)

Show More