Search results for: “LNG”

-

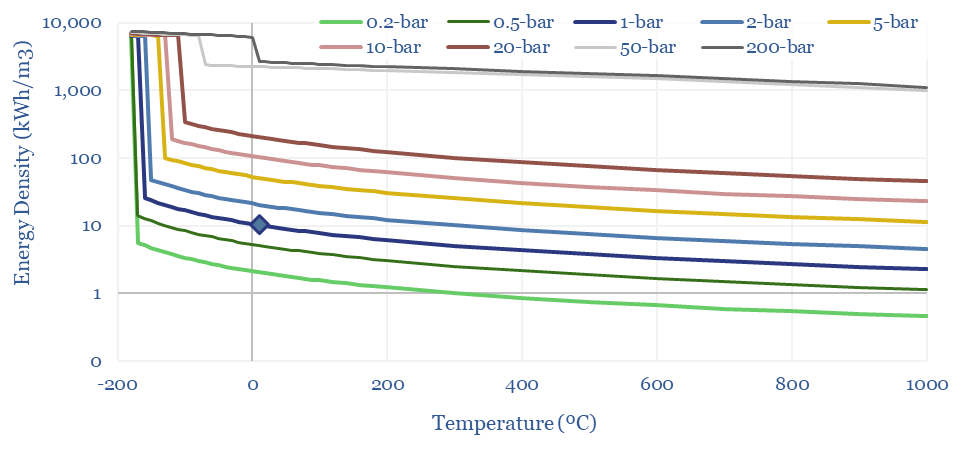

Density of gases: by pressure and temperature?

The density of gases matters in turbines, compressors, for energy transport and energy storage. Hence this data-file models the density of gases from first principles, using the Ideal Gas Equations and the Clausius-Clapeyron Equation. High energy density is shown for methane, less so for hydrogen and ammonia. CO2, nitrogen, argon and water are also captured.

-

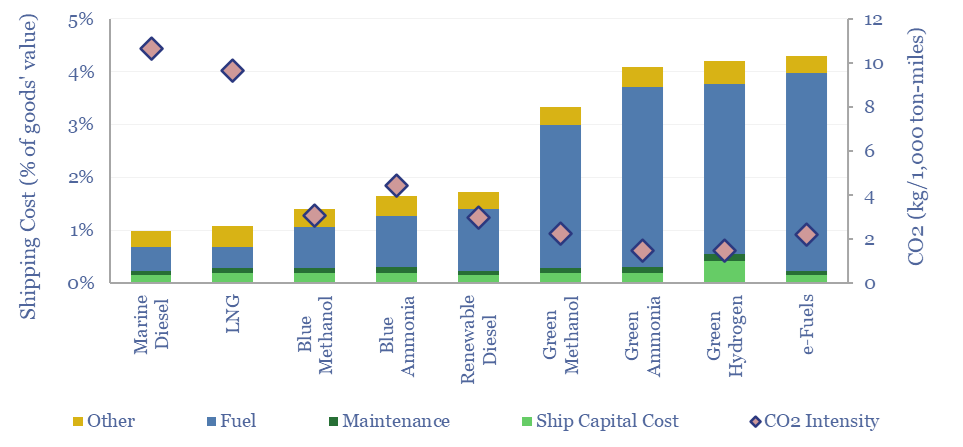

Decarbonize shipping: alternative fuel costs?

This data-file screens the costs of alternative shipping fuels, such as LNG, blue methanol, blue ammonia, renewable diesel, green methanol, green ammonia, hydrogen and e-fuels versus marine diesel. Shipping costs rise between 10% to 3x, inflating the ultimate costs of products by 0.1-30%, for CO2 abatement costs of $130-1,000/ton. We still prefer CO2 removals.

-

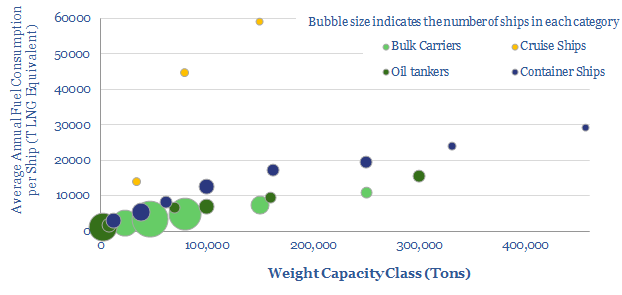

Global shipping and the switch from fuel oil?

The 240MTpa shipping-fuels market will be disrupted from 2020, under IMO sulphur regulations. Hence, this data-file breaks down the world’s 100,000-vessel shipping fleet into 13 distinct categories. We see 40-60MTpa upside to LNG demand from 2040.

-

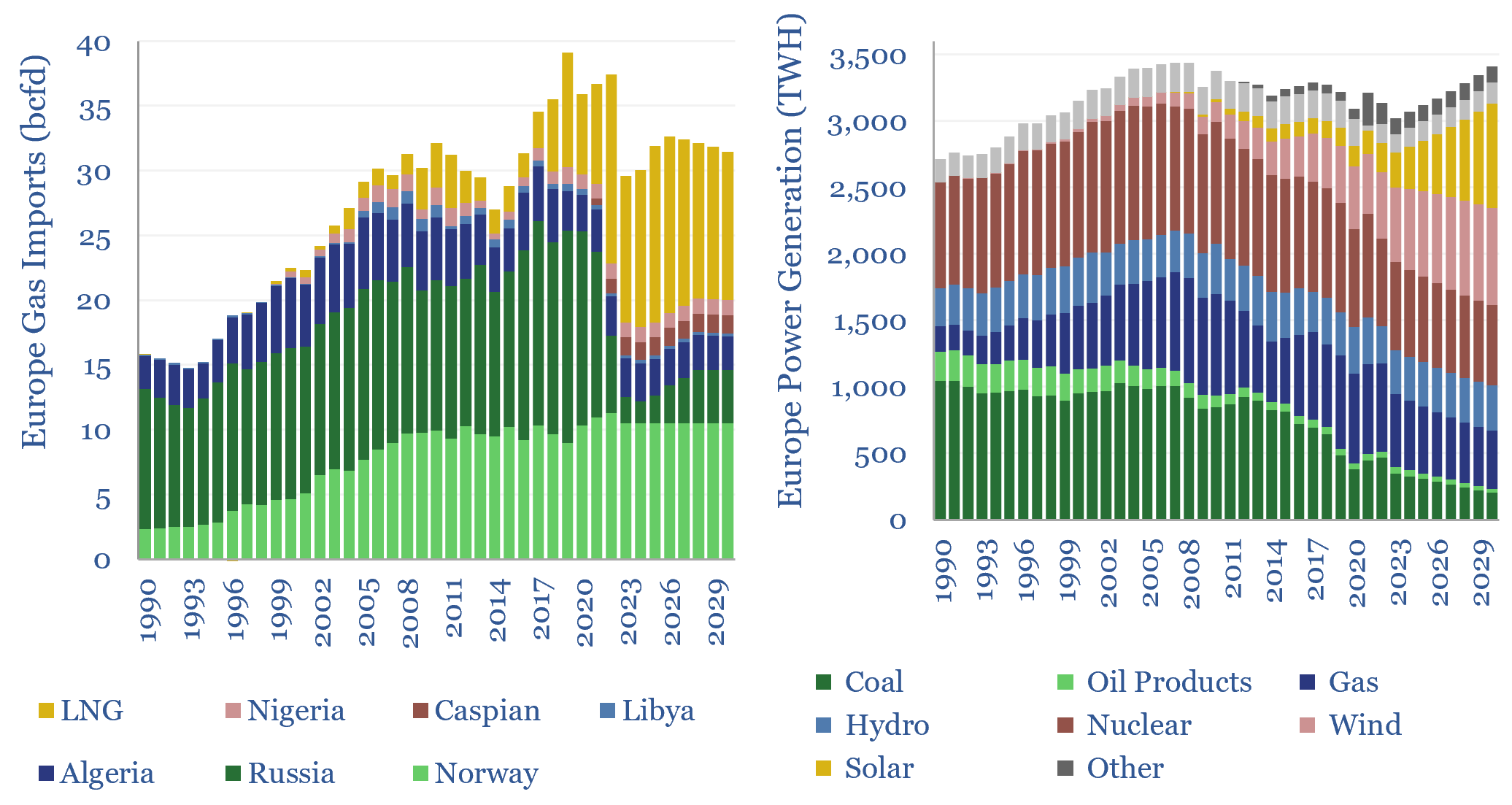

European gas and power model: natural gas supply-demand?

European gas and power markets will look better-supplied than they truly are in 2023-24. A dozen key input variables can be stress-tested in the data-file. Overall, we think Europe will need to source over 15bcfd of LNG through 2030, especially US LNG.

-

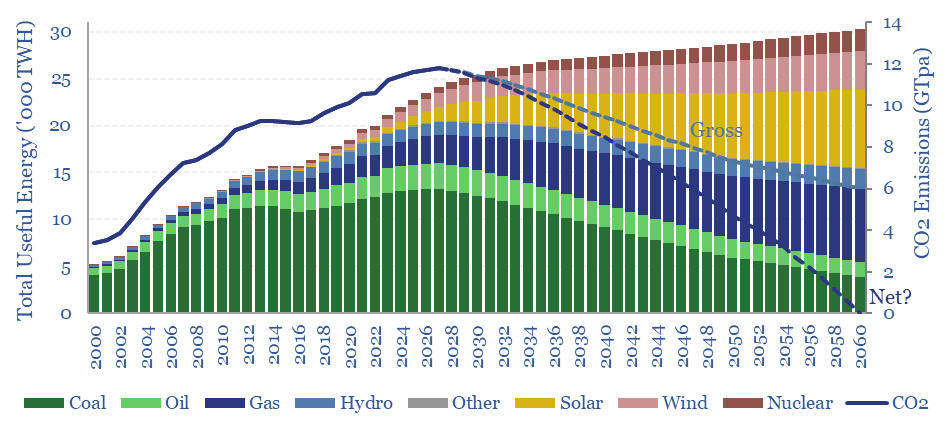

China Energy Demand and CO2 Emissions, 2000-2060

This data-file is our China Energy Model and China CO2 Model, disaggregating China’s energy demand by industry, across coal, oil, gas, wind, solar, hydro and nuclear, across c200 lines, from 2000-2060, with 20-input variables that can be stress-tested. There are routes to reach Net Zero in China by 2060, but it requires some heroic assumptions.

-

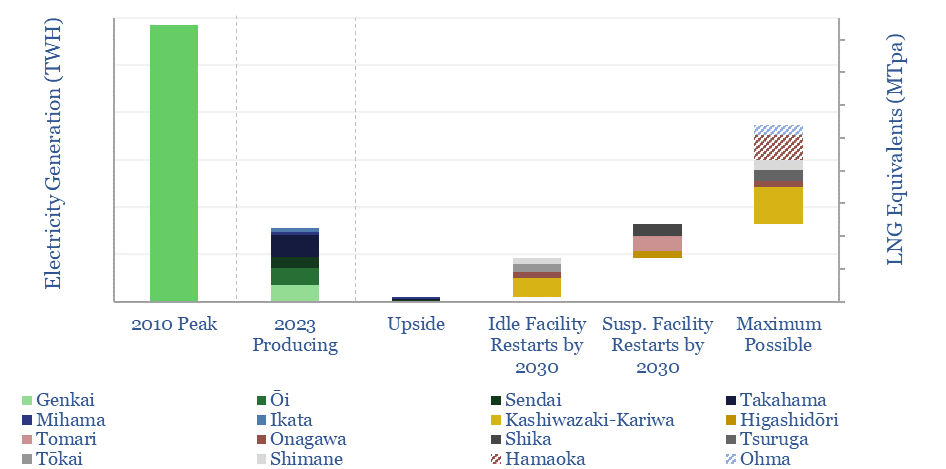

Japan: nuclear restart tracker?

This data-file on looks through 17 major nuclear plants in Japan with 45GW of operable capacity, covering the key parameters and re-start news on each facility. Japan’s nuclear restart had ramped output back to 78TWH pa by 2023, and may rise by a further 100 TWH by 2030, to meet targets for 20% nuclear in…

-

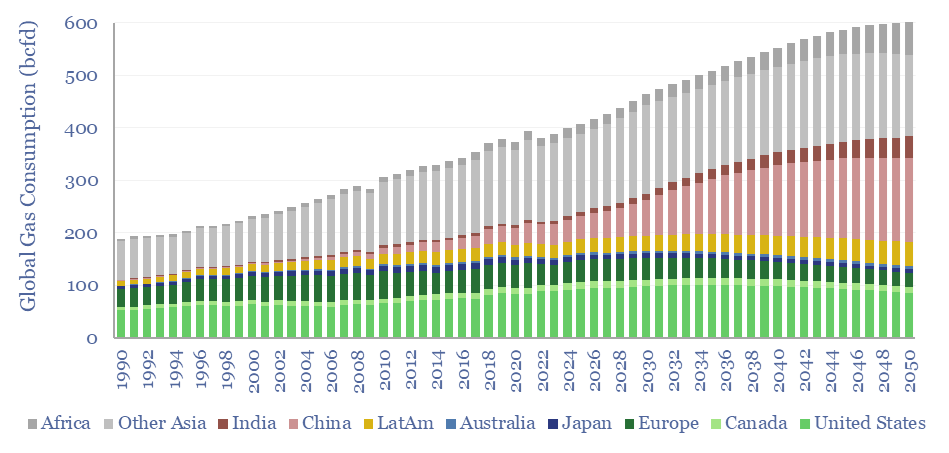

Global gas supply-demand in energy transition?

Global gas supply-demand is predicted to rise from 400bcfd in 2023 to 600bcfd by 2050, in our outlook, while achieving net zero would require ramping gas even further to 800bcfd, as a complement to wind, solar, nuclear and other low-carbon energy. This data-file quantifies global gas demand and supply by country.

-

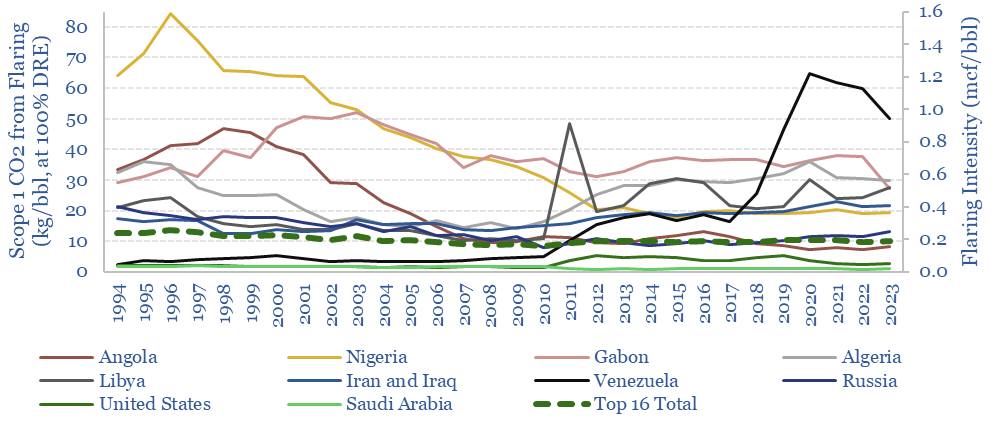

Global Flaring Intensity by Country

This data-file tabulates global flaring intensity in 16 countries: in absolute terms (bcm per year), per barrel of oil production (mcf/bbl) and as a contribution to CO2 emissions (kg/boe). 2021 saw 144bcm of global flaring, averaging 0.2 mcf/bbl and 10 kg/boe of direct emissions. Lower decile countries flared 0.7 mcf/bbl, which is over 40 kg/boe.

-

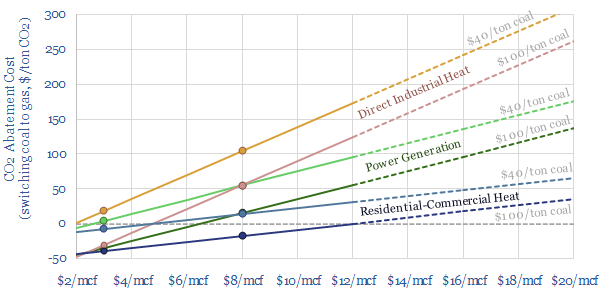

Coal-to-gas switching: what CO2 abatement cost?

Coal-to-gas switching halves the CO2 emissions per unit of primary energy. This data-file estimates the CO2 abatement costs. Gas is often more expensive than coal. But as a rule of thumb, a $30-60/ton CO2 price makes $6-8/mcf gas competitive with $60-80/ton coal. CO2 abatement costs are materially lower in the US and after reflecting efficiency.…

-

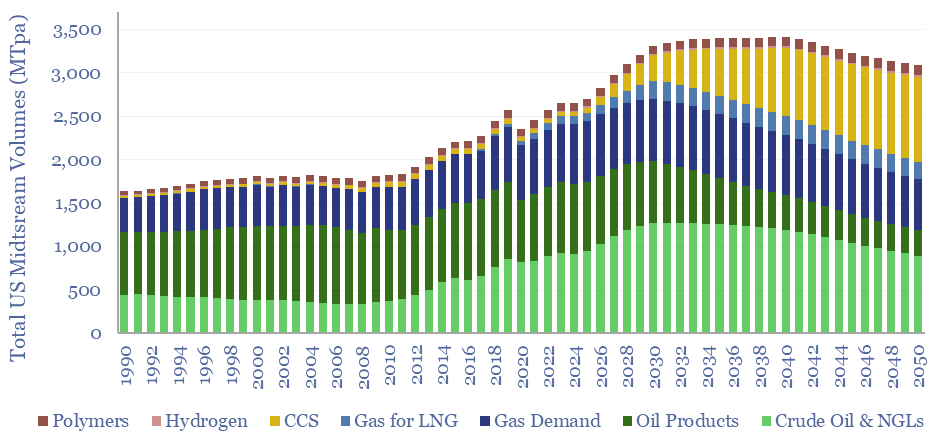

Midstream opportunities in the energy transition?

The midstream industry moves molecules, especially energy-molecules, and especially in pipelines. Despite the mega-trend of electrification, there are still strong midstream opportunities in the energy transition, backstopping volatility and moving new molecules. This short note captures our top ten conclusions. (1) Our overall outlook on the US midstream industry sees the total tonnage of molecules…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)