Search results for: “climate model”

-

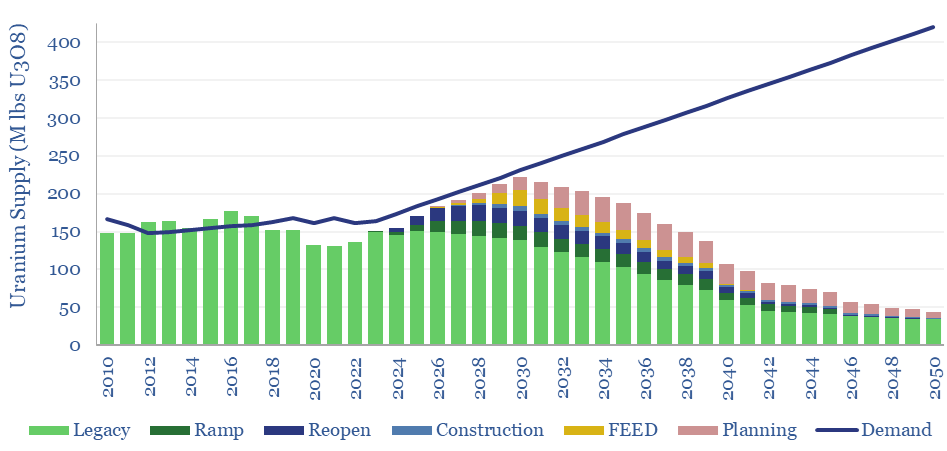

Global uranium supply-demand?

Our global uranium supply-demand model sees the market 5% under-supplied through 2030, including 7% market deficits at peak in 2025, as demand ramps from 165M lbs pa to 230M lbs pa in 2030. This is even after generous risking and no room for disruptions. What implications for broader power markets, decarbonization ambitions, and uranium prices?

-

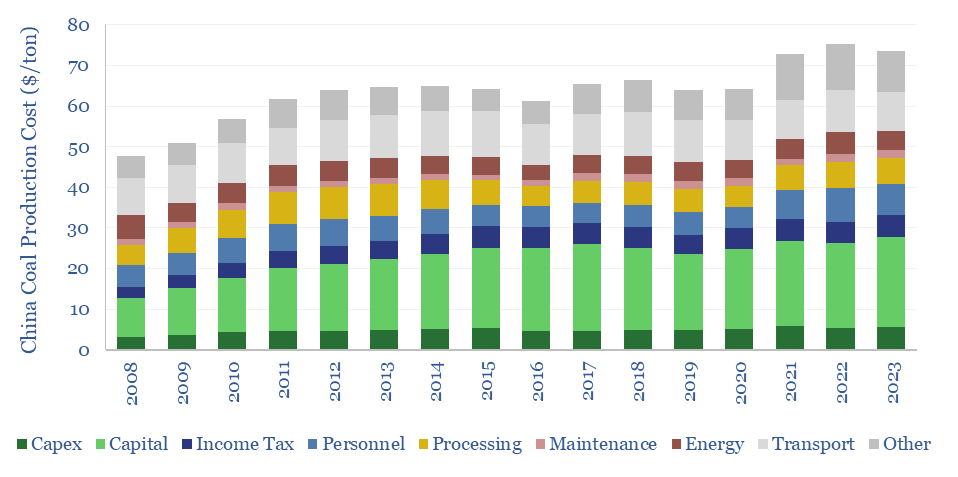

China coal production costs?

China coal production costs are estimated on a full-cycle basis in this data-file, averaging $75/ton across large listed miners, with assets in Shanxi, Inner Mongolia and Shaanxi. The costs are increasing at $1.3/ton/year, as mines move deeper and into smaller seams. Smaller regional have 1.5-2x higher costs again, and will hit LNG price parity around…

-

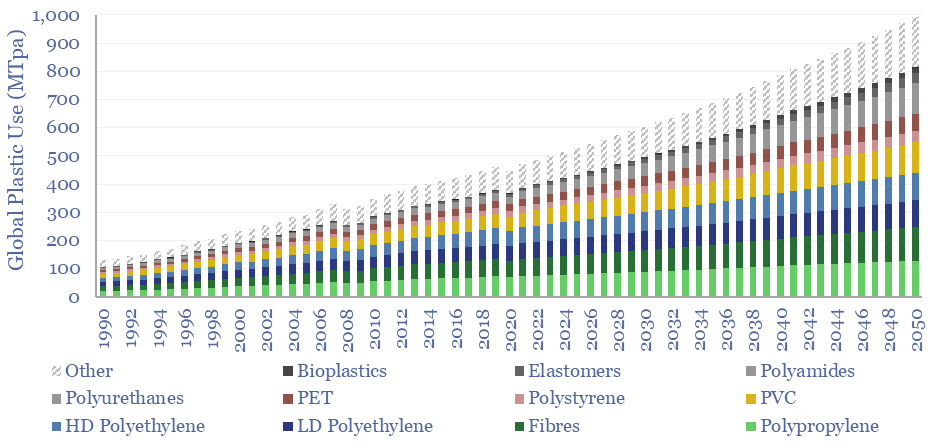

Global plastic demand: breakdown by product, region and use?

Global plastic is estimated at 470MTpa in 2022, rising to at least 800MTpa by 2050. This data-file is a breakdown of global plastic demand, by product, by region and by end use, with historical data back to 1990 and our forecasts out to 2050. Our top conclusions for plastic in the energy transition are summarized.

-

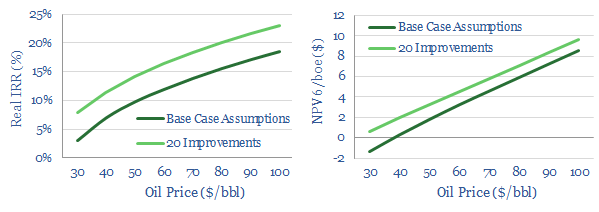

Offshore Economics: the Impact of Technology

This data-file quantifies the impact that technology can have on offshore economics. A typical offshore oilfield is modelled across 250 lines. The project is then re-modelled capturing our “top twenty” offshore technologies, to quantify the potential improvement: a doubling of NPV6, and a c4-5% improvement in IRR.

-

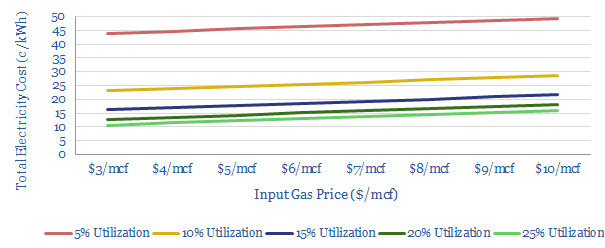

Fast-charge the electric vehicles with gas?

There is upside for natural gas, as EV penetration rises: we model that gas turbines can economically power fast-chargers for 13c/kWh. Carbon emissions are lowered by c70% compared with oil. And the grid is spared from power demand surges. Download our data-file to stress-test the sensitivities.

-

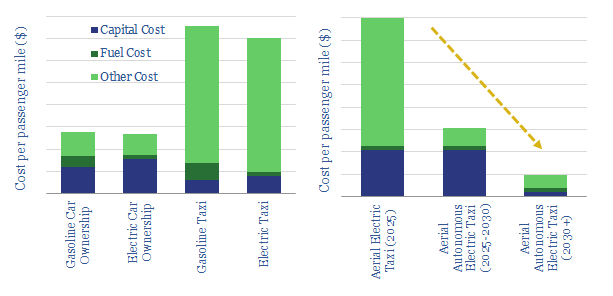

Aerial Vehicles Re-Shape Transportation Costs?

This model calculates costs per passenger-kilometer for transportation, based on input costs. Aerial vehicles could compete with taxis as early as 2025. By the 2030s, their costs can be c60% below car ownership.

-

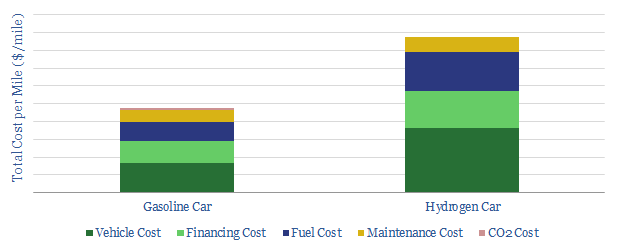

Hydrogen Cars: how economic?

We model the relative economics of hydrogen cars, which are c85% costlier than US gasoline in our base case. In Europe, c20% cost-deflation could bring hydrogen cars close to competitiveness.

-

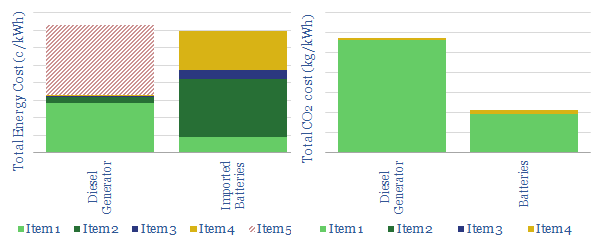

Shipping in batteries: the economics?

What if it were possible to displace diesel from high-cost, high-carbon island grids, by charging up large batteries with gas- and renewable power, then shipping the batteries? We model the economics to be cost-competitive, while CO2 emissions can be halved. Futher battery cost deflation will also help.

-

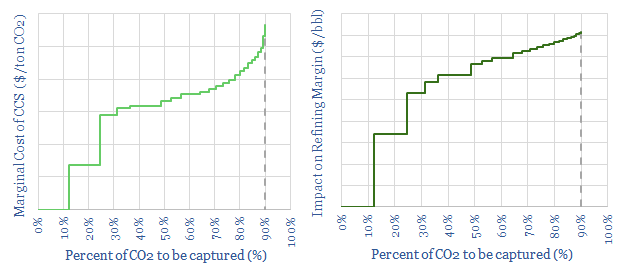

Carbon Capture Costs at Refineries?

Refineries emit 1bn tons pa of CO2, or around 30kg per bbl of throughputs. Hence this model tests the relative costs of retro-fitting carbon capture and storage (CCS), to test the economic impacts. c10-20% of emissions will be lowest-cost to capture. The middle c50% will cost c3x more. But the final 25% could cost up…

-

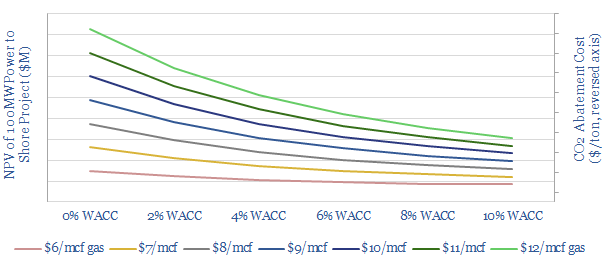

Power from Shore: the economics?

We model the economics of powering an oil platform from shore, using cheap renewable power instead of traditional gas turbines. This can lower upstream CO2 emissions by by around 70%, saving 5-15kg/bbl, for a cost of $50-100/ton. NPVs can be positive with low WACCs and high gas prices, but the primary aim is low-cost decarbonisation.

Content by Category

- Batteries (85)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (87)

- Data Models (801)

- Decarbonization (156)

- Demand (106)

- Digital (51)

- Downstream (44)

- Economic Model (196)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (266)

- LNG (48)

- Materials (79)

- Metals (70)

- Midstream (43)

- Natural Gas (144)

- Nature (75)

- Nuclear (22)

- Oil (161)

- Patents (38)

- Plastics (44)

- Power Grids (118)

- Renewables (148)

- Screen (109)

- Semiconductors (30)

- Shale (50)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (41)

- Written Research (339)