Search results for: “climate model”

-

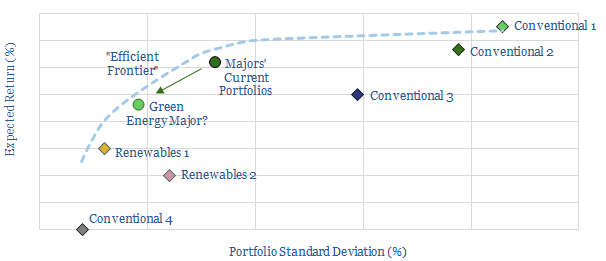

Portfolio Construction for Energy Majors?

This data-model calculates risk-adjusted returns for different portfolio weightings in the energy sector, as companies diversify across upstream, downstream, chemicals, corporate; and increasingly, renewables and CCS. A set of optimal portfolio allocations are calculated, which maximise Sharpe ratios. You can also stress-test your own inputs.

-

Pipeline costs: moving oil, products or other liquids?

Pipeline costs are modeled in this data-file. $1/bbl is needed to move oil, oil products and other liquid commodities around 500 km at Mbpd scale, and the energy requirements are around 2.1 kWh/bbl, emitting 0.8 kg/bbl of CO2. Economics of scale matter. As a rule of thumb, costs rise by 100% when volumes fall by…

-

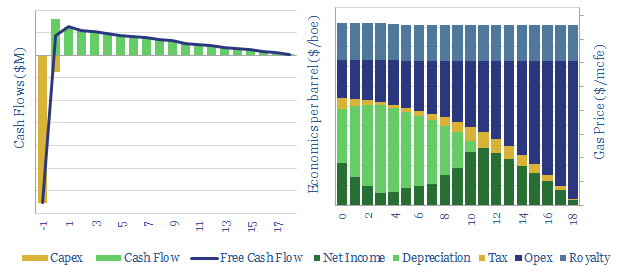

US shale gas: the economics?

This data-file breaks down the economics of US shale gas, in order to calculate the NPVs, IRRs and gas price breakevens. There is a perception that the US has an infinite supply of gas at $2/mcf, but rising hurdle rates and regulatory risk may require higher prices.

-

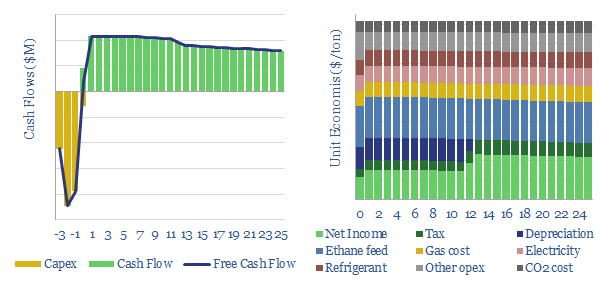

Ethane cracking: the economics?

This data-file captures the economics of ethane-cracking to produce ethylene. A typical US Gulf Coast facility could generate 15% IRRs at typical capex cost of $1,135/Tpa. CO2 intensity can be as high as 1.7T of CO2 per ton of ethylene, or potentially much lower depending on the facility’s energy efficiency.

-

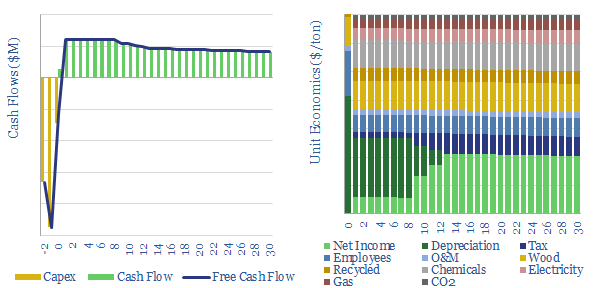

Paper production: energy economics?

Costs of paper production are estimated at $700/ton, at a $2,000/Tpa paper mill, requiring 5,000 kWh/ton of useful energy, and emitting 2.6 tons/ton of CO2, of which 2.2 tons/ton is likely sourced from burning organic material such as waste wood and black liquor. This data-file captures the energy economics of paper production.

-

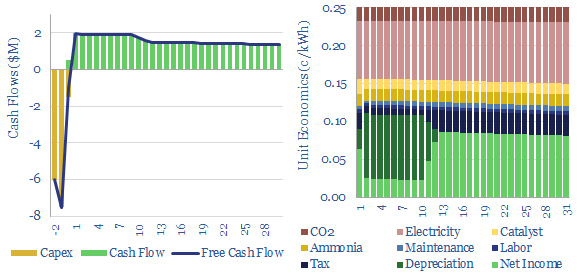

Selective catalytic reduction: costs of NOx removal?

This data-file captures selective catalytic reduction costs to remove NOx from the exhaust gas of combustion boilers and burners. Our base case estimate is 0.25 c/kWh at a combined cycle gas plant, which equates to $4,000/ton of NOx removed. Capex costs, operating costs, coal plants and marine fuels can be stress-tested in the model.

-

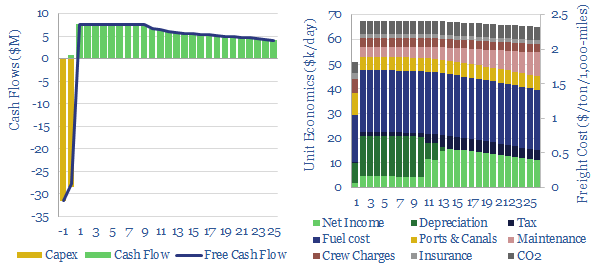

Bulk shipping: cost breakdown?

Bulk carriers move 5GTpa of commodities around the world, explaining half of all seaborne global trade. This model is a breakdown of bulk shipping cost. We estimate a cost of $2.5 per ton per 1,000-miles, and a CO2 intensity of 5kg per ton per 1,000-miles. Marine scrubbers increasingly earn their keep and uplift IRRs from…

-

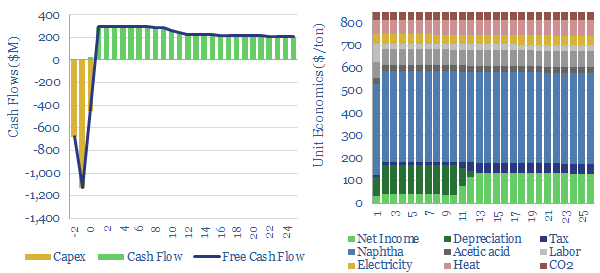

Purified terephthalic acid: PTA production costs?

A PTA price of $800-850/ton is needed to earn a 10% IRR on a new, integrated petrochemical facility, catalytically reforming naphtha into paraxylene, then oxidizing the paraxylene into purified terephthalic acid, with upfront capex cost of $1,300/Tpa. Feedstock costs, energy prices and CO2 prices matter too.

Content by Category

- Batteries (85)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (87)

- Data Models (801)

- Decarbonization (156)

- Demand (106)

- Digital (51)

- Downstream (44)

- Economic Model (196)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (266)

- LNG (48)

- Materials (79)

- Metals (70)

- Midstream (43)

- Natural Gas (144)

- Nature (75)

- Nuclear (22)

- Oil (161)

- Patents (38)

- Plastics (44)

- Power Grids (118)

- Renewables (148)

- Screen (109)

- Semiconductors (30)

- Shale (50)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (41)

- Written Research (339)