Search results for: “lithium”

-

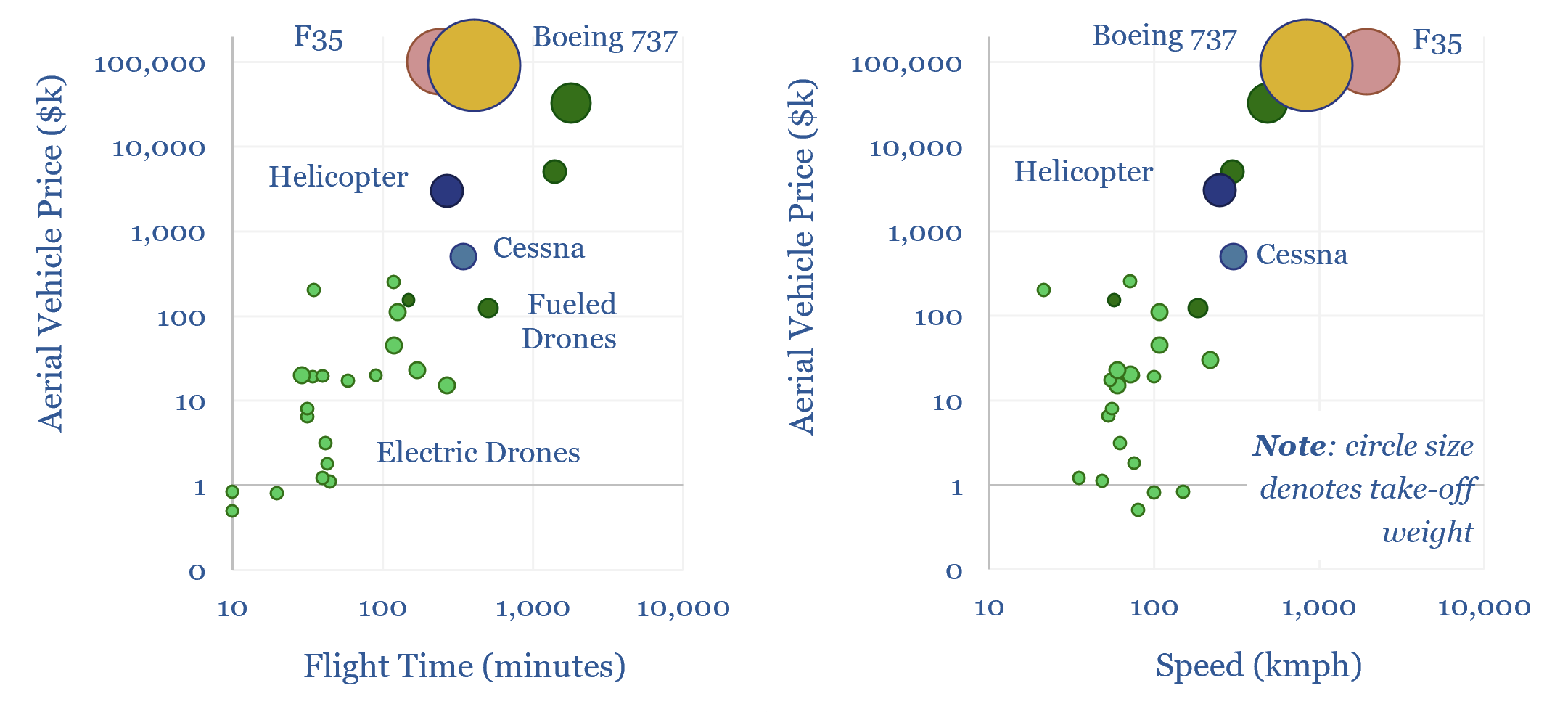

Drone deployment: vertical take-off?

Drones cost just $1k-100k each. They may use 95-99% less energy than traditional vehicles. Their ascent is being helped by battery technology and AI. Hence this 14-page report reviews recent progress from 40 leading drone companies. What stood out most was a re-shaping of the defense industry, plus helpful deflation across power grids, renewables, agriculture,…

-

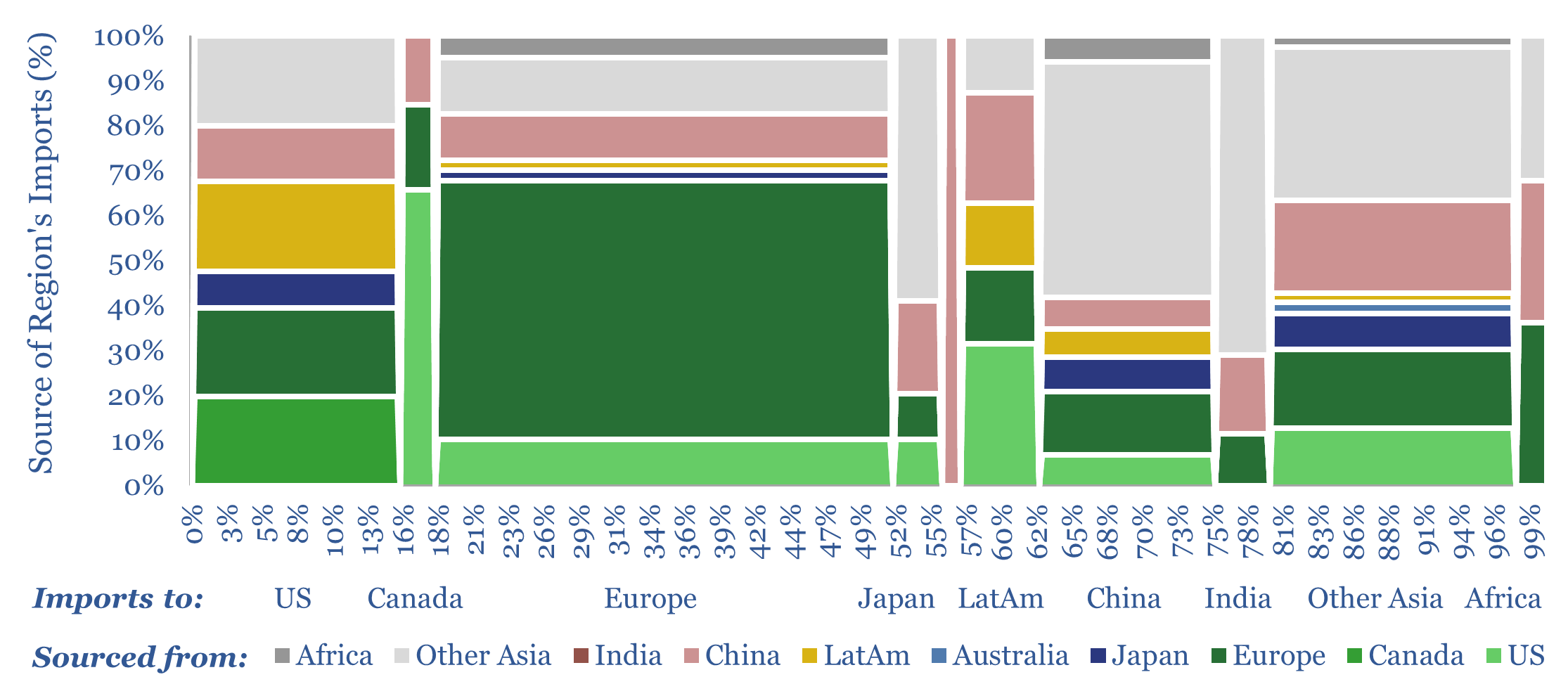

Global trade: balance or darkness?

Global trade has been growing more adversarial. US foreign relations are also shifting. Hence this 16-page note maps 20 trade categories, across energy, materials and capital goods; in each case, breaking down global imports by source, and global exports by destination. Our top ten conclusions follow.

-

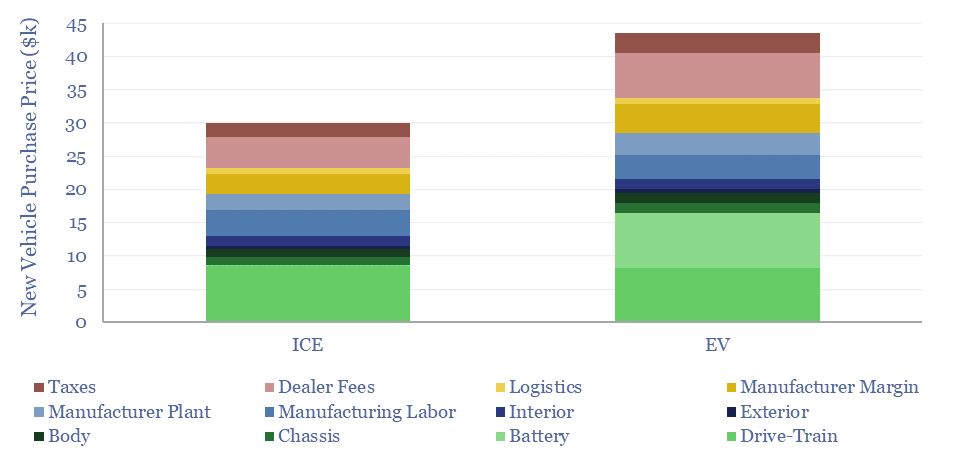

Electric vehicle cost breakdown by component?

This data-file disaggregates the $30k total cost of a typical new ICE and the c$45k total cost of a typical new EV, as a sum-of-the-parts, across 25 cost lines. Drivetrain costs are similar at $8-9k each. The key challenge for the EV is the battery. The electric vehicle cost breakdown shows promise for improving power…

-

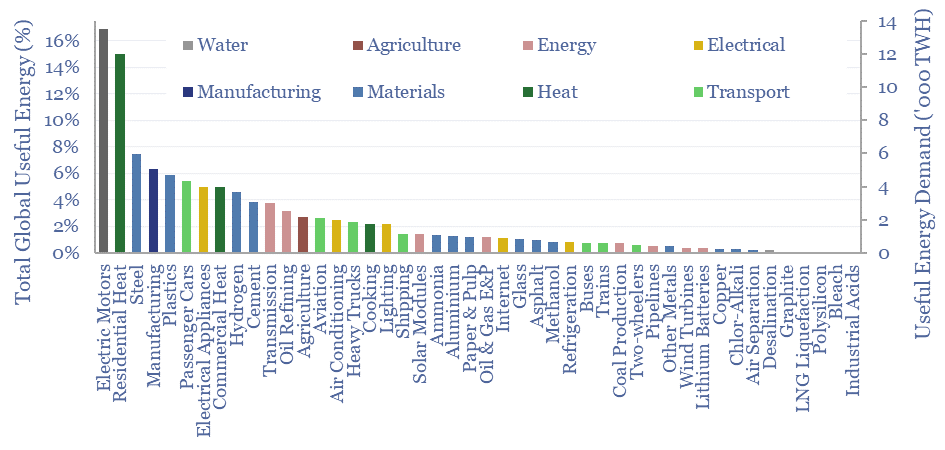

Global energy demand by end use?

This data-file is a breakdown of global energy demand by end use, drawing across our entire research library, to disaggregate the global energy system across almost 50 applications, across transportation, heat, electricity, materials and manufacturing. Numbers, calculations, efficiencies and heating temperatures are in the data-file.

-

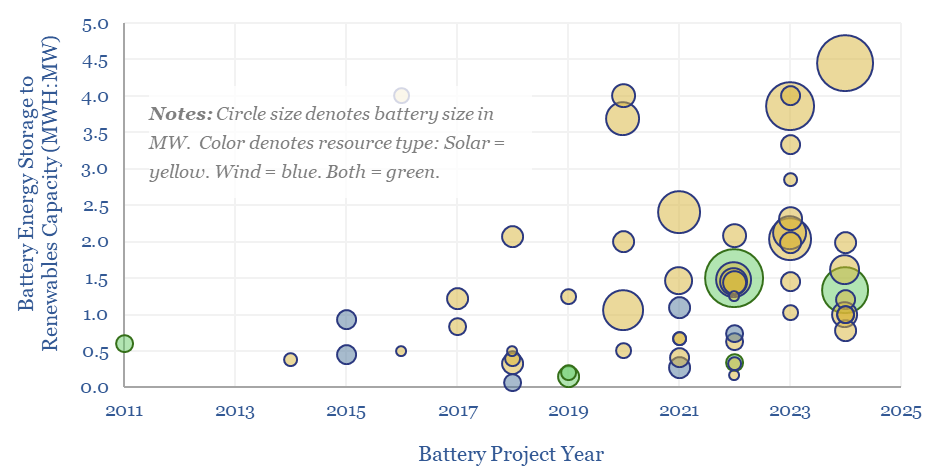

Renewables plus batteries: co-deployments over time?

More and more renewables plus batteries projects are being developed as grids face bottlenecks? On average, projects in 2022-24 supplemented each MW of renewables capacity with 0.5MW of battery capacity, which in turn offered 3.5 hours of energy storage per MW of battery capacity, for 1.7 MWH of energy storage per MW of renewables.

-

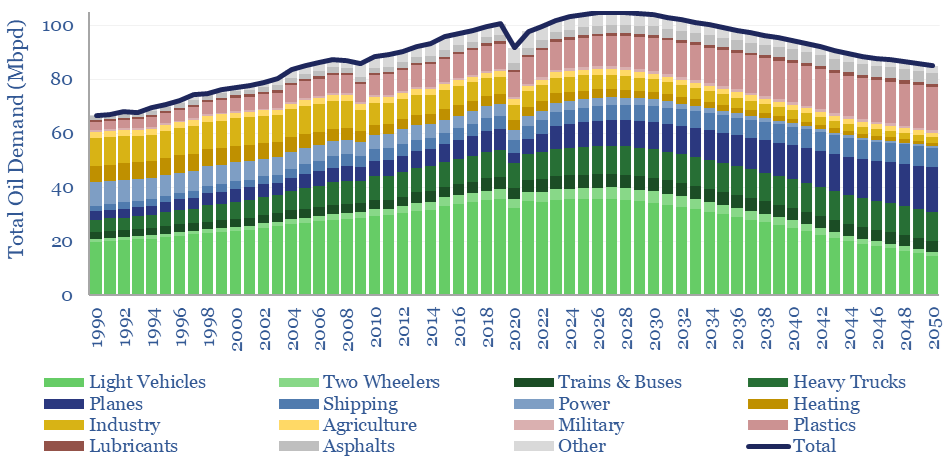

Global oil demand forecasts: by end use, by product, by region?

This model forecasts long-run oil demand to 2050, by end use, by year, and by region; across the US, the OECD and the non-OECD. We see demand gently rising through the 2020s, peaking at 105Mbpd in 2026-28, then gently falling to 85Mbpd by 2050 in the energy transition.

-

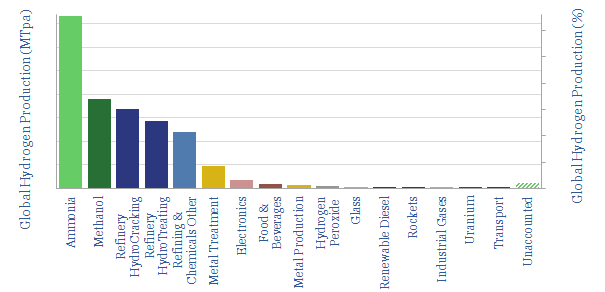

Global hydrogen: market breakdown?

This data-file is a global hydrogen market breakdown, disaggregating the 110MTpa market (mainly ammonia, methanol and refining), how it is met via different production technologies, and our estimates of those technologies’ costs (in $/kg) and CO2 intensities (in kg/kg or tons/ton).

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)