Nickel solutions: unblocking a battery bottleneck?

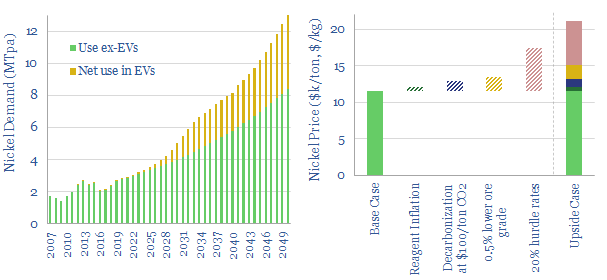

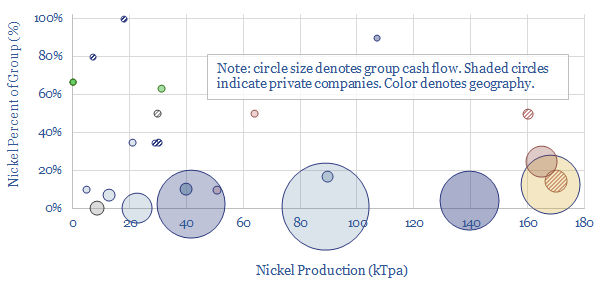

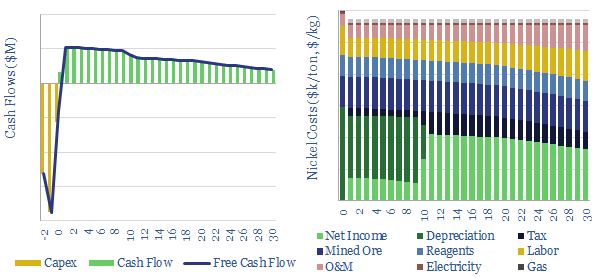

…We focus in on a laterite – HPAL – MHP – nickel sulphate pathway in this work. Nickels and dimes. Economics of producing battery grade nickel (in $/ton) are captured…

…We focus in on a laterite – HPAL – MHP – nickel sulphate pathway in this work. Nickels and dimes. Economics of producing battery grade nickel (in $/ton) are captured…

…position, cash flow, concentration in nickel, and underlying asset exposure. CO2 intensity varies by a very wide 10x margin, from sub-10 tons/ton nickel to 100 tons/ton. The global nickel market…

…model. Further research. Our latest commentary on the economics of producing battery-grade nickel is linked here. The screen on leading nickel producers is linked here. For an overview on global nickel…

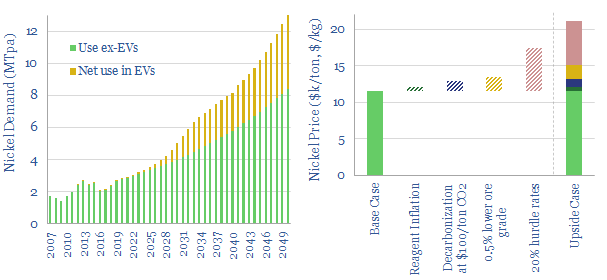

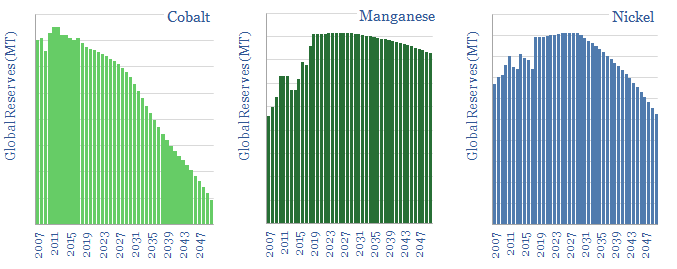

This data-file models whether there will be sufficient materials to build EV batteries. Specifically, will there be enough nickel, manganese and cobalt to build the batteries behind the vast rise of…

…their ten-year averages in 2022, as internationally traded prices rose sharply for nickel, rose modestly for aluminium and zinc, and remained high for copper (chart below). Base metal prices by…

Who will ‘win’ the intensifying competition for finite lithium ion batteries, in a world that is hindered by shortages of lithium, graphite, nickel and cobalt in 2022-25? Today’s note argues…

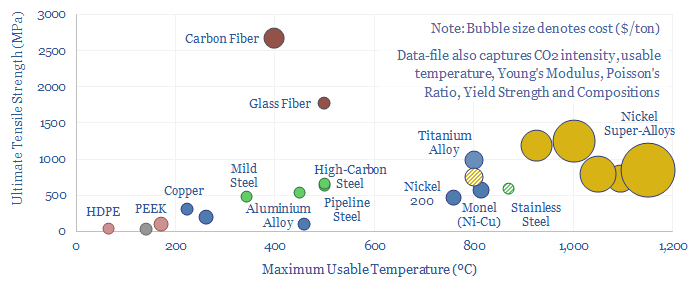

This data-file aggregates information into the strength, temperature resistance, rigidity, costs and CO2 intensities of important structural metals and materials. It shows why nickel-based super-alloys are used in gas turbines…

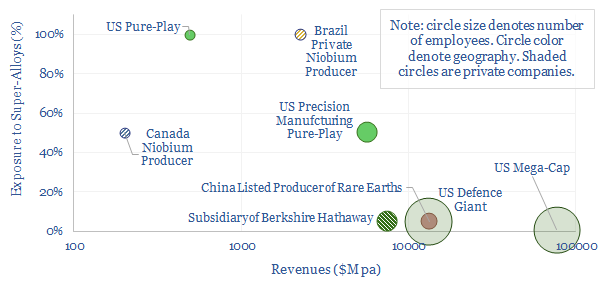

…turbine efficiency by as much as 5pp. More than half of these awardees are using AI methods and/or niobium alloying. The data-file does not include producers of nickel, a crucial…

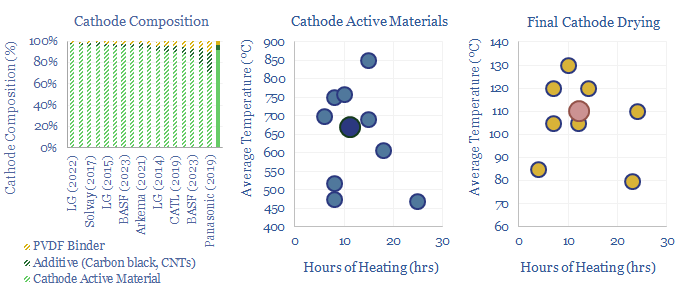

Lithium ion batteries famously have cathodes containing lithium, nickel, manganese, cobalt, aluminium and/or iron phosphate. But how are these cathode active materials manufactured? This data-file gathers specific details from technical…

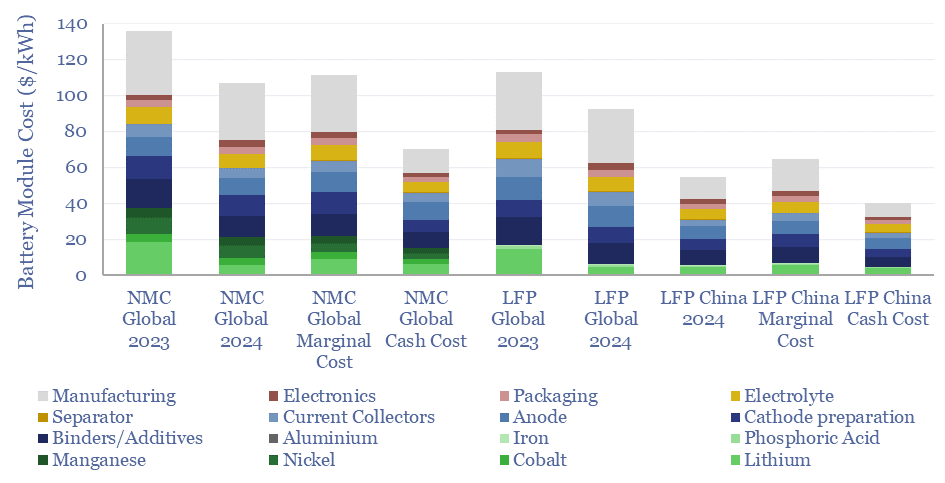

…the materials used in lithium ion batteries and their costs. The breakdown covers 25 categories (e.g., lithium, nickel, graphite), across 10 different battery chemistries (e.g., NCA, NMC, LFP and others,…