Search results for: “renewables”

-

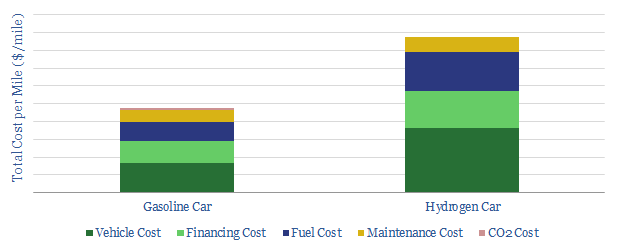

Hydrogen Cars: how economic?

We model the relative economics of hydrogen cars, which are c85% costlier than US gasoline in our base case. In Europe, c20% cost-deflation could bring hydrogen cars close to competitiveness.

-

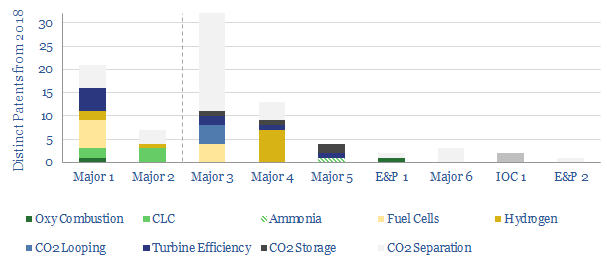

Major technologies to decarbonise power?

Oil Majors will play a crucial role in decarbonising the energy system, while also securing the future of fossil fuels. Hence, to help identify the leading companies, this-data file summarises over 80 patents for de-carbonising power-generation, drawn from our database of over 3,000 patent-filings from the largest energy companies in 2018.

-

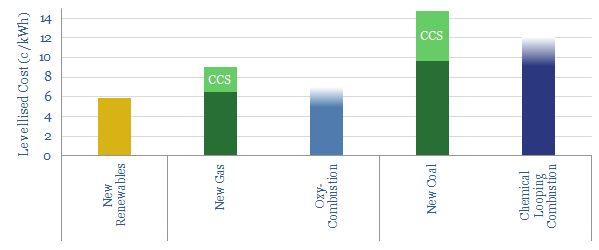

De-carbonising carbon?

Decarbonisation is often taken to mean the end of fossil fuels. More feasible is to de-carbonise fossil fuels. This 15-page note explores two top opportunities for low-cost decarbonisation of coal and gas: ‘Oxy-Combustion’ and ‘Chemical Looping Combustion’. Leading Oil Majors support these solutions.

-

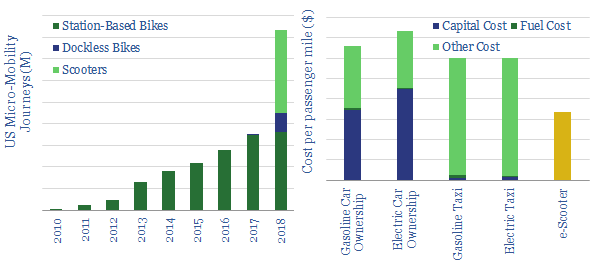

Energy Economics of e-Scooters

This workbook contains all our modelling on the energy economics of e-scooters; a transformational technology for urban mobility. Included are our projections of per-mile costs, energy-economics, battery charging times, new electricity demand and displacement of oil demand.

-

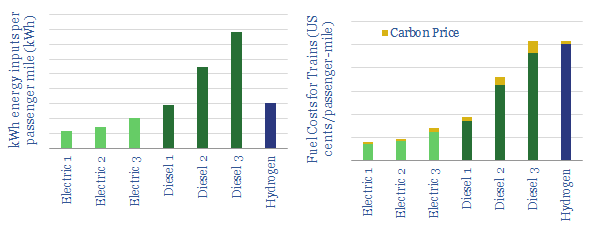

Power Trains? Electric, diesel or hydrogen

This data-file compares diesel trains, electric trains and hydrogen trains, according to their energy consumption, carbon emissions and fuel costs. The energy economics are best for electrifying rail-lines. Hydrogen costs must deflate 25-75% to be cost-competitive.

-

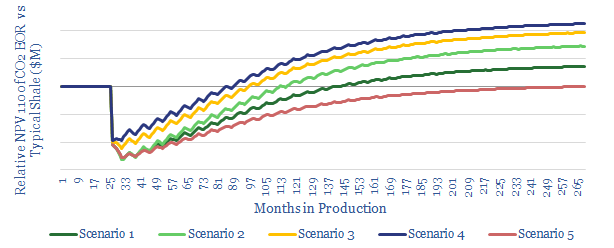

CO2-EOR in Shale: the economics

We model the economics for CO2-EOR in shales, after interest in this topic spiked 2.3x YoY in the 2019 technical literature. We see 15% IRRs in our base case, creating $1.6M of incremental value per well, uplifting type curves by 1.75x. Greater upside is readily possible. Most exciting is the prospect for Permian EOR to…

-

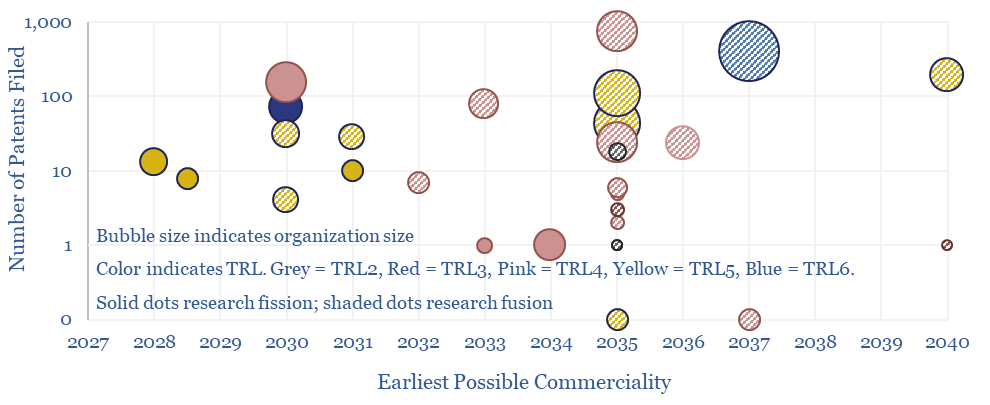

Next-generation nuclear companies: future fission and fusion?

This data-file screens c30 next-generation nuclear companies at the cutting edge of fission and fusion technology. The median one employs 100 people, is developing a 150MWe reactor, and could reach commerciality by 2035. But how has this landscape of companies progressed in the past few years?

-

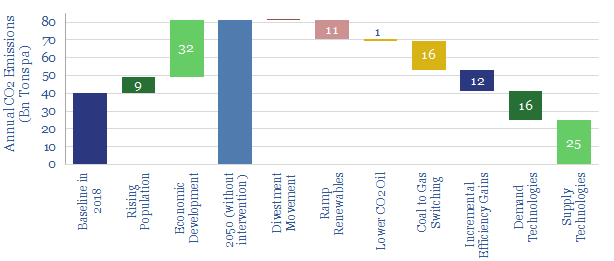

Investing for an Energy Transition

What is the best way for investors to drive decarbonisation? We argue a new ‘venturing’ model is needed, to incubate better technologies. CO2 budgets can also be stretched furthest by re-allocating to gas, lower-carbon oil and lower-carbon industry. But divestment is a grave mistake.

-

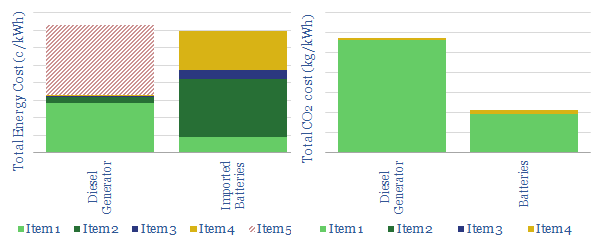

Shipping in batteries: the economics?

What if it were possible to displace diesel from high-cost, high-carbon island grids, by charging up large batteries with gas- and renewable power, then shipping the batteries? We model the economics to be cost-competitive, while CO2 emissions can be halved. Futher battery cost deflation will also help.

-

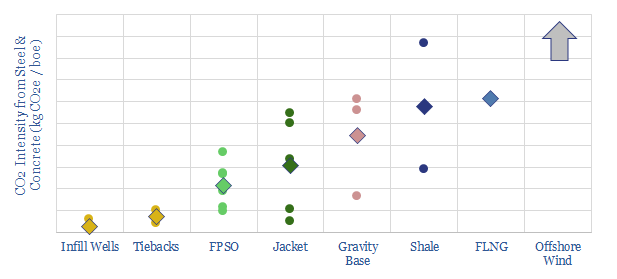

Development Concepts: how much CO2?

We tabulate c25 oil projects, breaking down the total tons of steel and concrete used in their topsides, jackets, hulls, wells, SURF and pipelines. Infill wells, tiebacks and FPSOs make the most CO2-efficient use of construction materials per barrel of production, helping to minimise emissions. Fixed leg platforms are higher CO2, then gravity based structures, then…

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)