Search results for: “renewables”

-

Shoals: solar-electronic breakthrough?

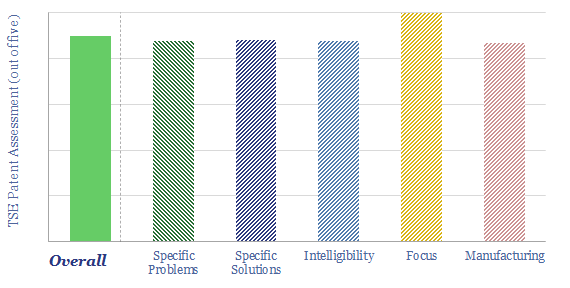

Shoals Technologies Group manufactures electrical balance of system solutions for solar energy projects, focused on promoting reliability, safety and ease of installation. Electrical installation costs can be lowered 40%. Our patent review finds a technology moat on 35% EBITDA margins.

-

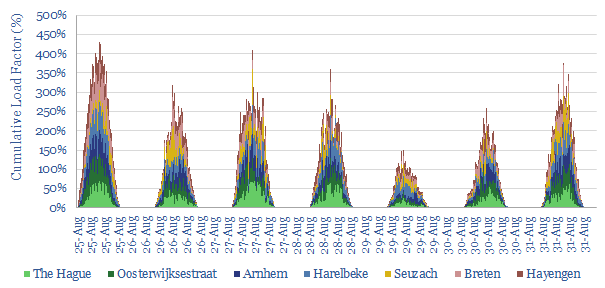

Inter-correlations between solar assets?

This data-file aggregates granular data from seven solar assets around Western Europe over a sample week. Absolute volatility is around 2-4% of nominal capacity every 15-minutes, while inter-correlations range from 60-90% depending on the distance between the different assets.

-

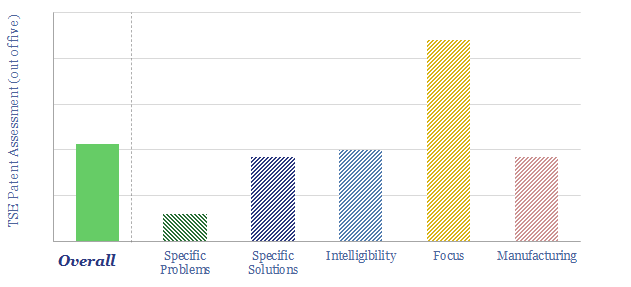

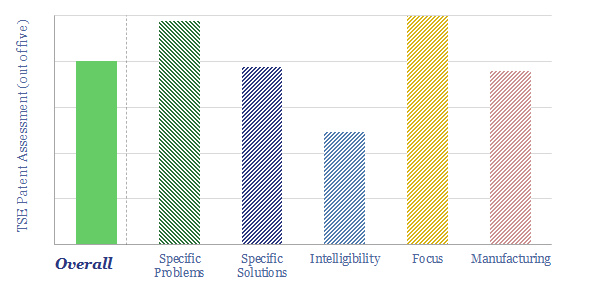

Monolith: turquoise hydrogen breakthrough?

Monolith claims it is the “only producer of cost effective commercially viable clean hydrogen today” as it has developed a proprietary technology for methane pyrolysis. But overall this was not one of our most successful patent screens. Some specific question marks are noted in the data-file.

-

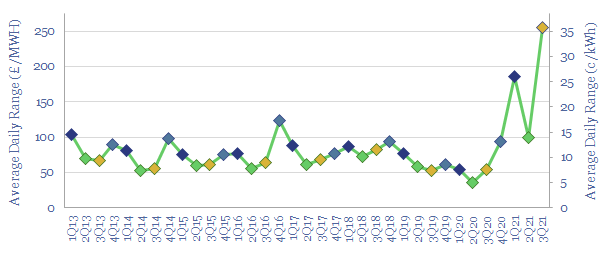

Grid volatility: are batteries finally in the money?

UK power price volatility has exploded in 2021. The average daily range has risen 4x from 2019-20, to 35c/kWh in 3Q21. At this level, grid-scale batteries are strongly ‘in the money’. So will the high volatility persist? This is the question in today’s 6-page note.

-

Synchronous condensers: the economics?

This data-file captures the costs of installing a synchronous condenser, downstream of a renewable power facility, to emulate the inertia, reactive power and short circuit power from conventional generators. 1.0 – 2.5 c/kWh of costs may be added to the power supplies flowing out of the SC.

-

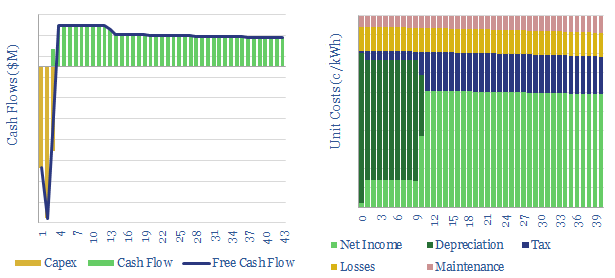

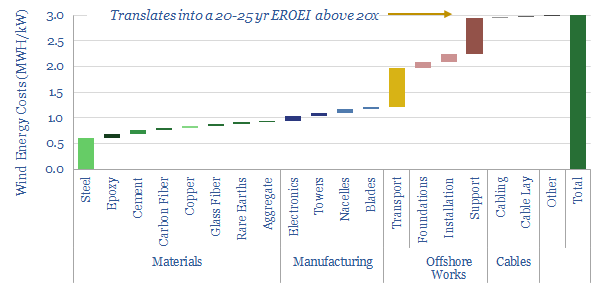

Wind power: energy costs, energy payback and EROEI?

This data-file estimates 3MWH of energy is consumed in manufacturing and installing 1kW of offshore wind turbines, the energy payback time is usually around 1-year, and total energy return on energy invested (EROEI) will be above 20x. These estimates are based on bottom-up modelling and top-down technical papers.

-

ESS: redox flow battery breakthrough?

ESS is emerging as a leader in medium-duration energy storage (4-12 hours), with an iron flow battery costing 2-5c/kWh (assuming >daily cycling) and lasting 20,000 cycles. The patent library is high quality. We note five challenges to consider. The largest is round-trip efficiency.

-

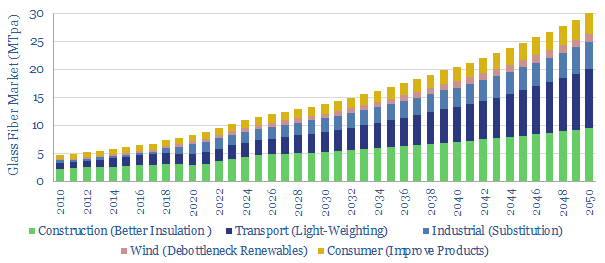

Glass fiber: what upside in the energy transition?

Glass fiber makes up 50% of a wind turbine blade, lightens vehicles and insulates homes for 30-70% energy savings. Hence we see demand rising 3.5x in the energy transition. To appraise the opportunity, this 13-page note assesses the market, costs, CO2 intensity and leading companies.

-

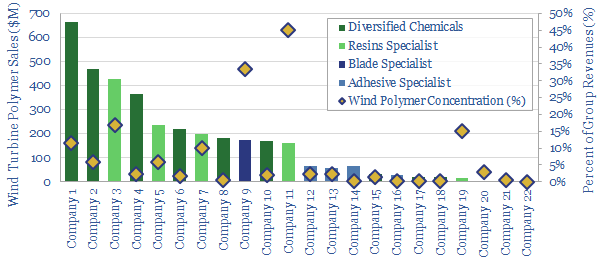

Wind turbines: screen of resin and polymer specialists?

This data-file tabulates details for 20 companies that make epoxy- or polyurethane resins and adhesives, especially those that feed into the construction of wind turbines. We think there are 5 public companies ex-China with 5-35% exposure to this sub-segment of the wind industry.

-

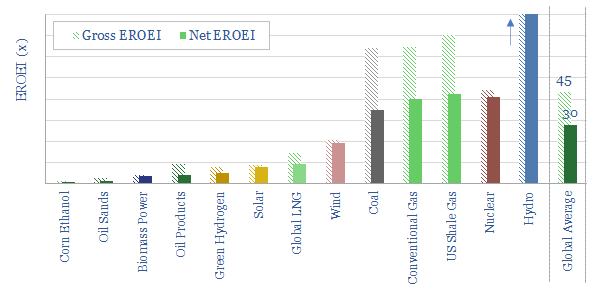

Energy return on energy invested?

Global average EROEI is around 30x. Sources with EROEI above average are hydro, nuclear, natural gas and coal. Sources with middling EROEIs of 10-20x are solar, wind and LNG. Sources with weaker EROEIs are oil products, green hydrogen and some biofuels.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)