Phasing out gas is likely to be a policy choice made by some cities or States, as part of the energy transition. The purpose of this note is simply to examine possible consequences. Which could be stark. Somewhere after c75% of customers have been shed, costs balloon by 70-170% for remaining customers, methane leaks worsen, local gas distributors suddenly go bankrupt, and governments must step in to ensure safe decommissioning and reliable backups. Taxpayers foot the bill.

A baseline: how do gas utilities work?

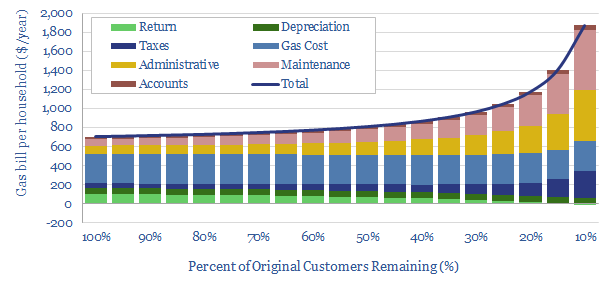

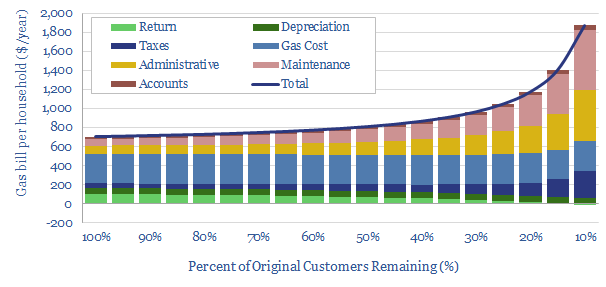

As a starting point, the typical, small municipal gas network might serve a few thousand to a few tens of thousands of customers, charging around $700 per household per year (60mcf pa at $12/mcf) (note below), and more for larger consumers, such as industrial/commercial consumers (data also below).

Network effects mean that costs are a function of the customer count. Furthermore, costs will rise if the number of customers falls. For example, a recent technical paper has evaluated 250 shrinking utilities in the United States, over several years, concluding that customer losses tend to yield 0.5-to-one revenue declines (Davis, L, & Hausman, C. (2021). Who Will Pay for Legacy Utility Costs? Energy Institute WP 317).

In other words, $1 of lost revenue typically results in $0.5 of additional revenue being raised from remaining customers. The idealized maths of this process are captured below…

Specifically, we estimate that if a gas network falls to c20% of its original size, the remaining customers would be likely to pay 70% more (rising from $700 pa to $1,200 pa) while the gas utility’s ability to earn a profit has effectively been wiped out. The balance could be different in practice. But let us explore the consequences of this scenario…

Five hidden consequences of phasing out gas

(1) Tipping points? The more customers leave a gas network, the faster costs start rising for remaining customers. In turn, this might accelerate the rate at which new customers leave the network. So the shift away from incumbent gas networks could start slowly, then accelerate, then happen particularly quickly. This suggests governments wishing to phase out gas may need a good plan up-front, before this sudden acceleration sets in.

(2) Huge costs for those who cannot switch? If the ultimate size of a gas network falls by 80%, the cost per customer rises 70%. If the size falls 90% then costs per customer rise 170%. If there were some customers who could not switch away from gas (e.g., insufficient capital/credit to make the upgrade), then they would be saddled with very high energy costs. Those most impacted are likely to be those with the least financial resilience. Again, this means governments may need to step in and come to the rescue in some way.

(3) Maintenance costs of the gas networks hardly decrease just because customers are moving away. The pipes are still in the ground. But fewer customers dents the profitability of gas distributors. Hence there may be a temptation to cut back on maintenance spending, or some other financial difficulty for maintaining existing as networks properly. In turn, this could have negative environmental consequences, worsening methane leaks, which already tend to be higher at smaller and more cash-strapped gas utilities (note and data-file below).

(4) Bankrupted distributors? Once c75% of the customers have left a gas network, it will become very difficult for these gas distributors to remain profitable at all, according to our analysis. Thus they may shut down entirely, yielding ‘stranded assets’ and the bankruptcy of thousands of small firms (charted in the data-file above). Critics of the fossil fuel industry often jeer at stranded assets, as though it is some kind of milestone of progress to be celebrated. The reality is that governments would need to step in, take over control of these gas networks, and then pay to have them safely decommissioned. Using taxpayer money.

(5) What alternatives? The old adage for a century has been that a mixture of gas and electricity offers a helpful lifeline in the depths of winter. Gas pipelines tend to be trenched underground. Hence if a vicious winter snowstorm comes through and knocks out the overhead power lines, Mrs Miggins is going to have some kind of alternative heating source and is not going to freeze to death in her home. Again, one of our main question marks over renewable-heavy power grids is whether they will have sufficient resiliency in extreme conditions (note below, looking at hot conditions, but a similar logic applies in the cold).

Conclusions: are there better options?

Our own personal view is that some governments may not be prepared to shoulder the consequences noted above. Nor do they need to. Well functioning gas heating can be perfectly compatible with decarbonization goals in the energy transition, if the gas is used efficiently, without methane leaks, and the residual CO2 is offset or decarbonized at source. This may be superior to ‘phasing out gas’ and dealing with the issues noted above.

Our research below explores a selection of these different themes…