Real levelized costs can be a misleading metric. The purpose of today’s short note is simply to inform decision-makers who care about levelized costs. Our own modelling preference is to compare costs, on a flat pricing basis, using apples-to-apples assumptions across our economic models.

What are levelized costs?

What are levelized costs? Levelized costs, sometimes abbreviate as LCOEs, aim to summarize the costs of an electricity source with a single number, denoting what electricity price would be needed in order to earn an acceptable return, when constructing and operating a new electricity generating facility. This can enable useful comparisons.

Why do we hate levelized costs? All of the various advantages and disadvantages of a new electricity generation investment, within in a complex, real-world grid cannot entirely be captured by a single number. A couple of recent research notes onto this topic are linked below.

Nevertheless, with this caveat in mind, we have constructed levelized costs models for onshore wind, offshore wind, solar, hydro, nuclear, gas, coal, biomass, diesel gensets and geothermal. All of these numbers are shown on a nominal basis. If our levelized cost is quoted as 8c/kWh, then we assume the power facility will receive 8c/kWh in Year 1, 8c/kWh in Year 2, 8c/kWh in Year 3… and 8c/kWh in Years 25-100.

What are “Real” Levelized Costs?

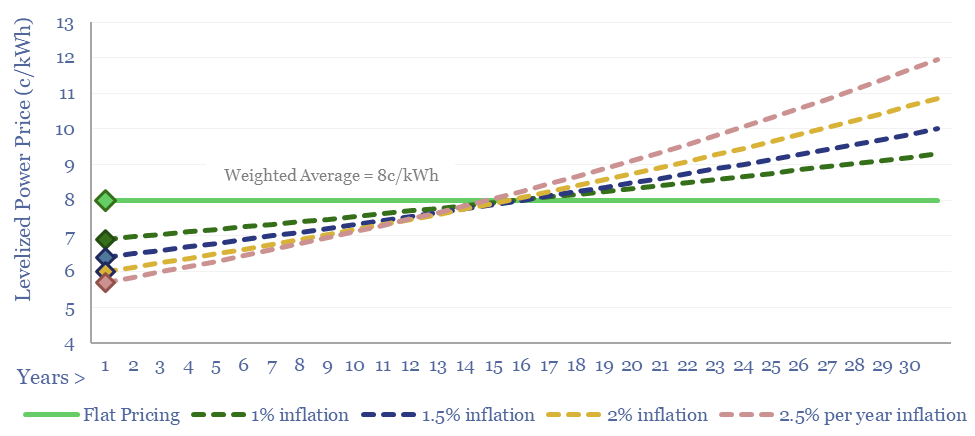

Some commentators present levelized costs on a ‘real basis’. What this means is that there is an annual escalation factor built into the power price. For example, a levelized cost of 8c/kWh means that the power price starts at 8c/kWh in Year 0, then it increases by, say, 1-2% per year thereafter. Or alternatively, “with inflation”.

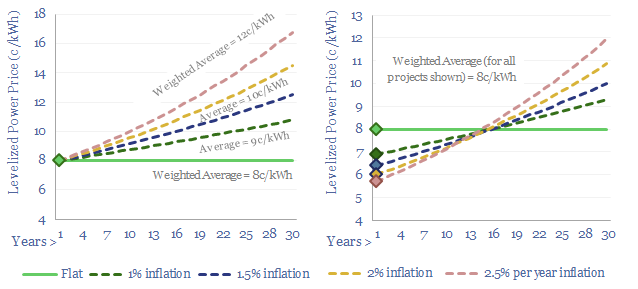

Price escalation helps to achieve higher IRRs. And hence if your hurdle rate is constant, real levelized costs (that benefit from pricing escalation) will be lower than nominal levelized costs (that do not benefit from pricing escalation) (chart below).

However, in our view, quoting levelized costs on a ‘real’ basis is misleading. It may distort the rankings of power generation sources, where these sources have different operating lives, or worse, where different cost escalation factors are built into different models.

Paradox #1. Ultimate cost is higher than levelized cost?

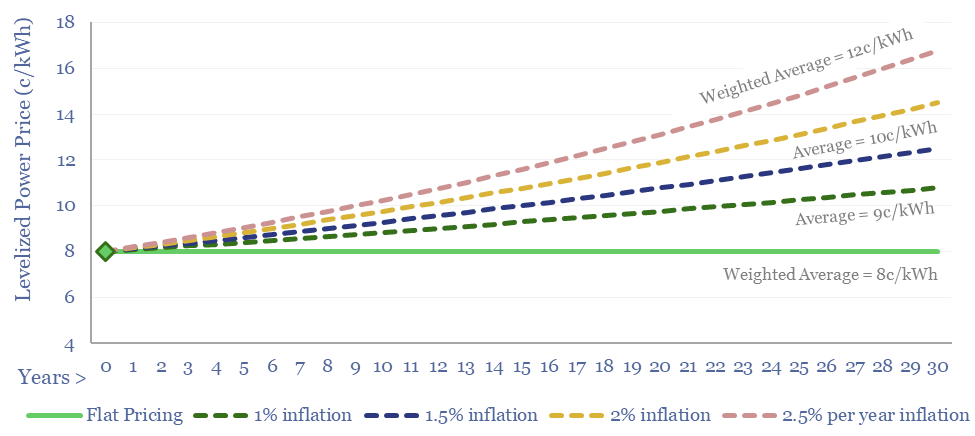

One reason we think it is misleading to quote levelized costs on a real basis is that it consigns consumers to higher power prices than advertized. Consumers might be quite annoyed, if an option is quoted to cost 8c/kWh, weighed up against other options, selected on the basis of this 8c/kWh cost, and then 20-years later, they are buying electricity from this 8c/kWh project at 12c/kWh (chart below). “How can the power price be 12c/kWh, when we invested in power plants costing 8c/kWh?”.

Paradox #2. Levelized costs fall when future prices rise?

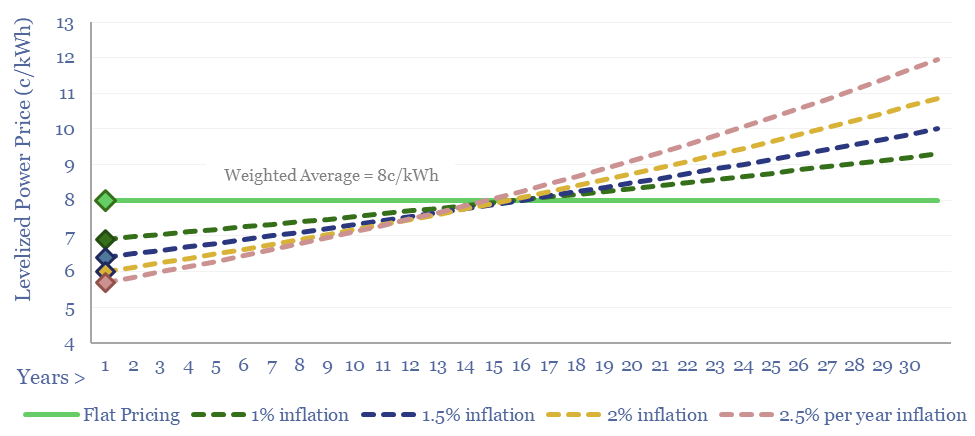

A second reason we think it is misleading to quote levelized costs on a real basis is that it makes today’s levelized costs dependent upon tomorrow’s inflation. Paradoxically, if inflation expectations rise, then real levelized costs seem to fall.

For example, imagine a project that needs 8 c/kWh over the life of the project to generate a passable IRR. If the base case assumption is for 1% per year inflation, then the real levelized cost is 7c/kWh. But if we raise our inflation expectations to 2% per year, our project sees its levelized costs deflate to 6c/kWh (chart below). Even though it is the exact same project, with the exact same capex and opex??

Without wishing to sound accusatory, we think that some commentators are wedded to a narrative that particular energy technologies are on a path of perennial deflation. This is not entirely true, for example, in the recent case of offshore wind.

In our view, it would be unhelpful for such commentators to preserve their deflation narrative, for example, by systematically revising up their future inflation expectations, so that their quoted cost estimates continue “falling” from one year to the next, even when project developers are very clearly signalling that their costs are rising. Ultimately, we think decarbonization progress requires openly acknowledging challenges, so that decision makers can work to resolve those challenges.

Paradox #3: defeating the purpose of a simple model?

“All models are wrong, but some models are useful”. This is the mantra underlying the 170 economic models that we have built and published into different technologies, power sources and materials, as part of our energy transition research. The other mantra is to make these models as simple as possible, and no simpler!

Hence across all of our models, we have opted to model pricing on a flat basis. This allows the models to ask “what price is needed for an acceptable IRR?”, on a simple, easily understandable, and comparable basis. This also avoids the risk of different models embedding potentially different cost escalation factors, impairing their comparability.

But what about inflation? Yes commodity prices change over time, as is well-captured in our various commodity price databases. But the drivers of these annual pricing variations are difficult to predict ex-ante (including wars, weather, pandemics, recessions). And there are also good arguments that some commodity prices resist inflation over the very long term. Of course, if you wish to adjust our different models, and add annual pricing variations, then you are welcome to do that.

For the reasons above, we will continue favoring flat pricing, and simple, apples-to-apples assumptions, in our economic models.