New AI data-centers are facing bottlenecked power grids. Hence this 15-page note compares the costs of constructing new power lines, gas pipelines or fiber optic links for GW-scale computing. The latter is best. Latency is a non-issue. This work suggests the best locations for AI data-centers and shapes the future of US shale, midstream and fiber-optics?

One of the biggest questions in energy markets this year concerns the rise of AI. Specifically, how is the world going to electrify a possible 150GW of new AI data-centers by 2030, amidst bottlenecked power grids and bottlenecked gas grids?

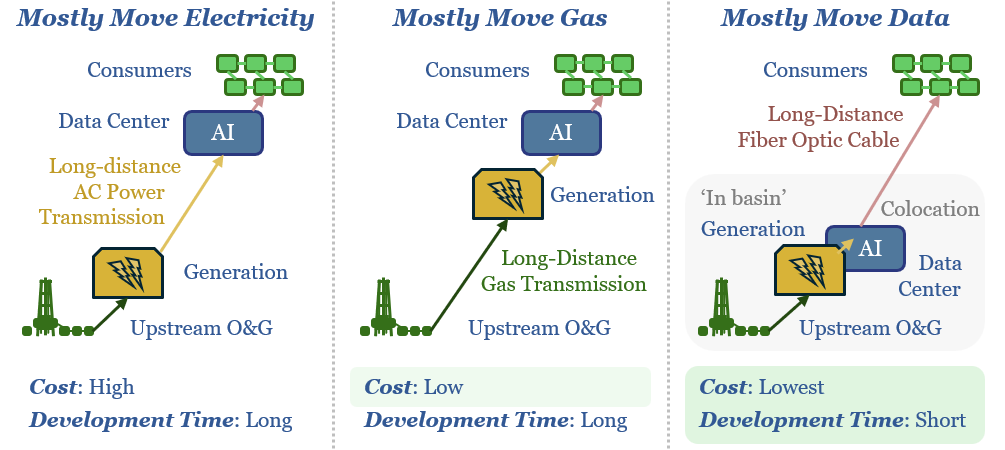

This 15-page note considers the options for moving molecules, electrons and information to and from AI data-centers. Ultimately, the best locations for AI data-centers will offer the best service, at the lowest cost, and after some acceptably low lead-time.

Mostly moving electricity to an AI data-center requires constructing new AC transmission lines, or possibly even HVDCs. This turns out to be the most costly option and has the highest lead-time. Capex costs (in $M/km), total costs (in c/kWh) and logistical conclusions are on pages 2-3.

Mostly moving gas to an AI data-center requires constructing new gas pipelines, but has the advantage of alleviating power grid bottlenecks, by self-generating power on site. This is a high-cost option in $M/km terms, but a low cost in c/kWh terms, and must also overcome logistical challenges, as discussed on pages 4-5.

Mostly moving data from an AI data-center requires constructing new fiber optic links, but has the advantage of alleviating power grid bottlenecks and gas infrastructure bottlenecks, by siting the data-center within a US shale basin. This has by far the lowest costs in $M/km terms and c/kWh terms, plus other logistical advantages, per pages 6-9.

Latency myths. The pushback we are anticipating is that an AI data-center needs to be close to end-consumers, because otherwise the latencies on AI query responses will be overly high. This is simply untrue. Data and counter-arguments are outlined on pages 10-12.

Locations for AI data-centers may largely be determined by the locations of upstream gas. Further help may come from a cooler, wetter climate, lowering the energy and financial costs of data-center cooling.

There is a strange symmetry bringing the shale and AI industries together: the former suffering bottlenecks in energy demand and export infrastructure; the latter suffering bottlenecks in supply and import infrastructure. Conclusions for shale and midstream are on pages 13-14.

The fiber optic industry also sees large growth, hence we end by noting the market size, growth, material usage and leading companies on page 15.