Shale is a technology paradigm where well productivity has risen by 3-7x over the past decade, through ever greater digitization. Shale economics are very strong, with 20% IRRs at $50/bbl oil on shale oil (model here) or at $2.8/mcf on shale gas. We think 100bn bbls of recoverable shale resources remain in the US and ultimately, liquids production could be ramped up from 10Mbpd in 2023 to 17Mbpd by 2030 (note here), and most of this will be needed as energy shortages loom.

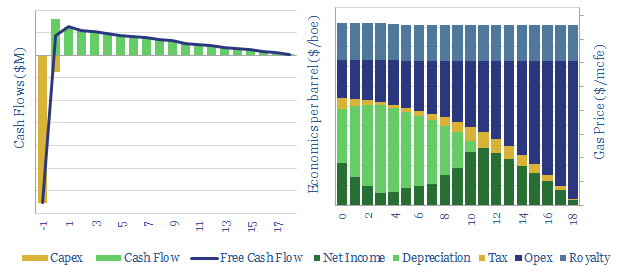

This data-file breaks down the economics of US shale gas, in order to calculate the NPVs, IRRs and gas price breakevens of future drilling in major US shale basins (predominantly the Marcellus).

Underlying the analysis is a granular model of capex costs, broken down across 18 components. Our base case conclusion is that a $2/mcf hub pricing is required for a 10% IRR on a $7.2M shale gas well with 1.8kboed IP30 production.

Economics are sensitive. There is a perception the US has an infinite supply of gas at $2/mcf, but rising hurdle rates and regulatory risk may require higher prices. For a similar model of shale oil, please see our model here.

In our energy transition models US shale likely adds +1Mbpd/year of production growth from 2023-2030, albeit flatlining in 2024, then re-accelerating on higher oil prices.

Amazingly, there is potential to underpin a 100-200MTpa US LNG expansion, with just 20-50 additional rigs. Although recently we wonder whether the US blue hydrogen boom will absorb more gas and outcompete LNG, especially as the US Gulf Coast becomes the most powerful clean industrial hub on the planet (note here).