Power grid circuit kilometers need to rise 3-5x in the energy transition. This trend directly tightens global aluminium markets by over c20%, and global copper markets by c15%. Slow recent progress may lead to bottlenecks, then a boom? This 12-page note quantifies rising power grid metals demand, demand for circuit kilometers, and who benefits?

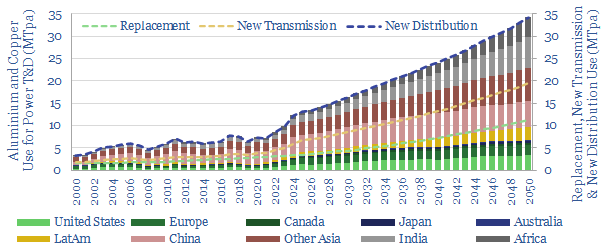

Power grids have recently used 5-6MTpa of aluminium (8% of demand) and 3MTpa of copper (10%), as global electricity demand has risen by +630 TWH pa globally over the past 20-years. The purpose of this report is to estimate future power grid metals demand.

How much growth for power grids? To derive our estimates, we have quantified (and multiplied) future electricity demand in TWH (page 2), power grid circuit kilometers per TWH of electricity (page 3) and tons of metals use per circuit kilometer (page 4).

Trends in the energy transition increase power grid aluminium and copper demand even further. Including utilization factors in the transmission network halving due to volatility of wind and solar (page 5), rising remoteness (page 6) and more metals-intensive electricity use, especially for electric vehicle chargers (page 7).

There is upside for metals in energy transition power grids, but we think that the growth in power cable demand is more likely to stoke aluminium than copper. Leading global copper producers and leading global aluminium producers are discussed on pages 8 and 9.

Circuit kilometers needed for power grids in the energy transition are estimated by region on page 10, and the underlying data-set is here. While demand for power grid metals rises by 15-20%, demand for power cables rises 4x. Leading cable producers are also discussed on page 10.

Will power grids present a bottleneck for the rise of wind and solar? We review some evidence on page 11, and discuss implications for rising returns at listed transmission and distribution utilities on page 12.