-

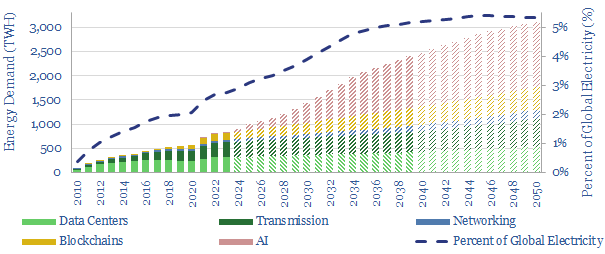

What is the energy consumption of the internet?

Powering the internet consumed 800 TWH of electricity in 2022, as 5bn users generated 4.7 Zettabytes of traffic. Our guess is that the internet’s energy demands double by 2030, including due to AI (e.g., ChatGPT), adding 1% upside to global energy and 2.5% to global electricity demand. This 14-page note aims to break down the…

-

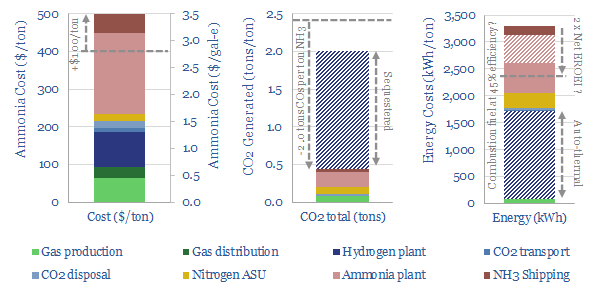

Blue ammonia: options strategy?

Blue ammonia can economically decarbonize the fertilizer industry, using low-cost natural gas; with options to decarbonize combustion fuels in the future. This 12-page report covers where we see the best opportunities, as reforms to the 45Q have already kick-started a 20MTpa boom of new US projects.

-

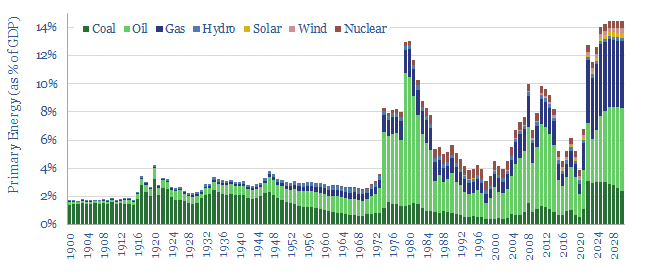

Energy macro: our top ten charts?

Is the global energy system on the precipice of persistent shortages, and record prices, in the mid-late 2020s? We worry that cumulative under-investment in the global energy system has now surpassed $1trn since 2015, relative to our energy transition roadmap. Our top ten slides into global energy ‘macro’ are set out in this presentation.

-

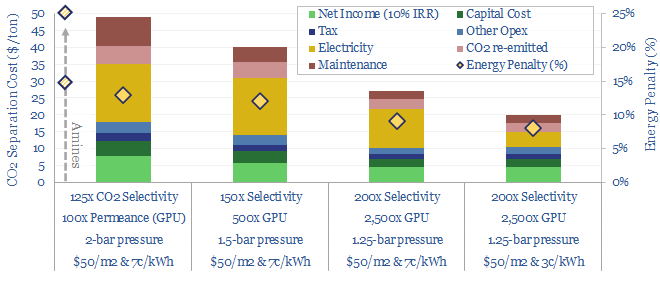

Membranes for carbon capture: separation anxiety?

Next-generation membranes could separate out 95% of the CO2 in a flue gas, into a 95% pure permeate, for a cost of $20/ton and an energy penalty below 10%, which greatly exceeds the best amines. This 15-page note lays out ten key questions, to help decision makers de-risk next-generation CCS membranes. The technology is early-stage.…

-

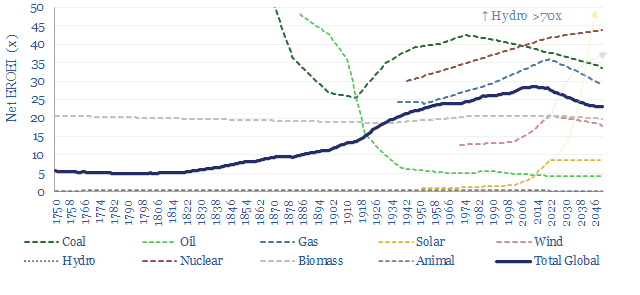

EROEI: energy return on energy invested?

EROEI is the best metric for comparing end-to-end energy efficiencies. Wind and solar currently have EROEIs that are lower and ‘slower’ than today’s global energy mix; stoking upside to energy demand and capex. But future wind and solar EROEIs could improve 2-6x. This 13-page report explores whether this will be the make-or-break factor determining the…

-

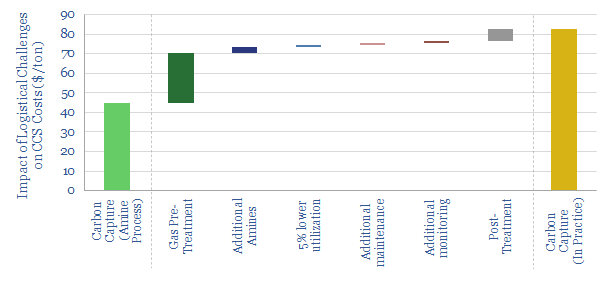

CCS challenges: by any amines necessary?

Post-combustion CCS has more practical challenges than we had previously assumed, which are explored in this 13-page report. Today’s established amines require extensive pre- and post-treatment of gases; to prevent degradation, plant corrosion and toxic emissions. This might double real-world CCS costs. But it also creates more opportunity for novel CCS processes, which are rapidly…

-

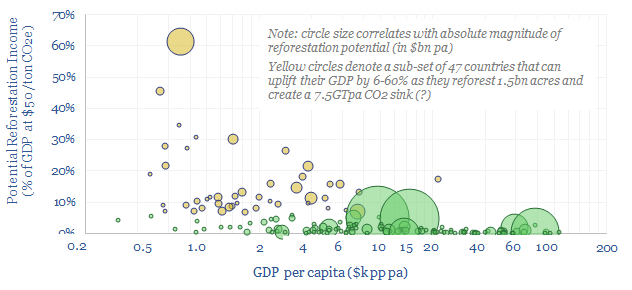

Growing economies: reforest and reinvest?

CO2 removal credits could add 6-60% to the GDP of 47 emerging countries as they reforest 1.5bn acres and create a 7.5GTpa CO2 sink, while the resultant cash flows could double these countries’ investment rates. Reinvesting in wind, solar, electrification avoids higher carbon fuels and deforestation for firewood. Reinvesting in timber value chains maximizes CO2…

-

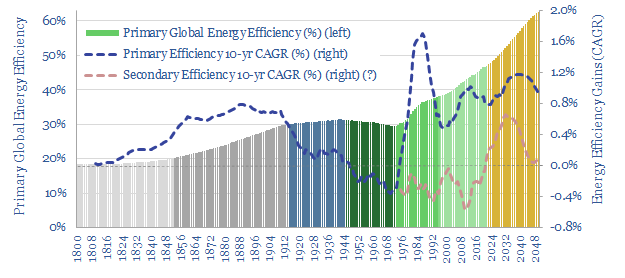

Energy efficiency: a riddle, in a mystery, in an enigma?

Projections of future global energy demand depend on energy efficiency gains which are hoped to step up from 1% per year since 1970, to above 3% per year to 2050 by some forecasters. But efficiency is vague. This 17-page note worries that global energy demand will surprise to the upside as energy efficiency gains disappoint…

-

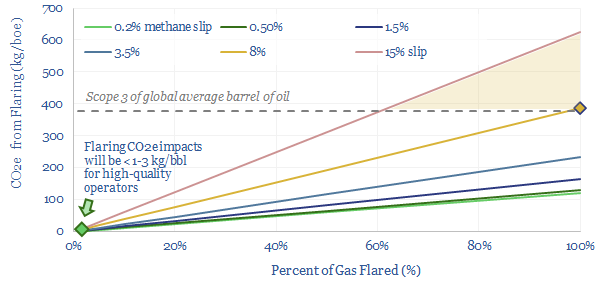

Flaring reduction: fire extinguishers?

Controversies over oil industry flaring are re-accelerating, especially due to the methane slip from flares, now feared as high as 8% globally. The skew entails that more CO2e could be emitted in producing low quality barrels (Scope 1) than in consuming high quality barrels (Scope 3). Environmental impacts are preventable. This 10-page note explores how,…

-

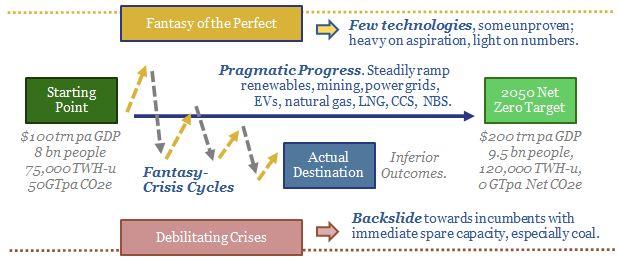

Energy transition: the fantasy of the perfect?

This 14-page note explores an alternative framework for energy transition: what if the fantasy of the perfect consistently de-rails good pragmatic progress; then the world back-slides to high-carbon energy amidst crises? We need to explore this scenario, as it yields very different outcomes, winners and losers compared with our roadmap to net zero.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)