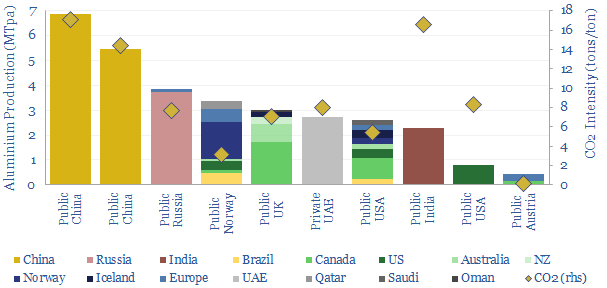

Leading aluminium producers are reviewed in this data-file, across ten companies, producing half of the world’s global output, two-thirds of its non-China output. Scale ranges 1MTpa to 7MTpa. CO2 intensity of primary aluminium production ranges from 3 tons/ton to 17 tons/ton across these companies.

Aluminium is an important commodity for the energy transition, used in overhead transmission cables for power grids, for light-weighting vehicles to improve their fuel economy, for aircraft frames, for the frames of solar panels, and in the heat exchangers that enable heat recovery at power plants or the cryogenics behind ASUs and LNG.

This hinges on aluminium’s materials properties. It is 70% lighter than copper, and about 70% more economical, despite being 60% more resistive. It is also 65% lighter than steel.

The global aluminium market stood at 68MTpa in 2022, marginal costs of production are modeled around $3/kg, and CO2 intensity averages 10 tons of CO2 per ton of product (model here).

Half of global production comes from ten aluminium producers, screened in this data-file. China now meets 60% of all global supply, of which the two largest producers are Chalco and Hongqiao. And the other eight companies in the data-file cover two-thirds of the world’s non-China aluminium supplies.

Exposure to aluminium is quantified by company. 8 out of 10 of the companies are aluminium ‘pure plays’ with 80% exposure to aluminium, or higher, on an EBITDA basis. Rio Tinto and Vedanta have more diversified portfolios. And even within the purer-plays, Norsk Hydro is c20% hydro power generation.

CO2 intensity varies widely, from 3 tons CO2 per ton of aluminium metal production at the lowest carbon primary producers globally to 17 tons/ton at higher-carbon Chinese producers. Some sources even quote the top of the CO2 curve at 20 tons/ton.

The largest reason for varying CO2 intensities is the different CO2 intensities of underlying power grids, which explains about 14 tons/ton of the variation. The remaining 3-4 tons/ton of CO2 intensity that is not due to power grids is broken down in our aluminium model.

Among the large primary producers, our view is that the companies with the most credible decarbonization plans are Norsk Hydro, Alcoa and Rio Tinto. These companies also have lower carbon asset bases today. And decarbonization plans are noted in the data-file.

We have also tabulated each company’s geographic exposures, exposure to aluminium, employee headcount, recent revenues, share listing details and our notes.