This data-file screens the costs of alternative shipping fuels, such as LNG, blue methanol, blue ammonia, renewable diesel, green methanol, green ammonia, hydrogen and e-fuels versus marine diesel. Shipping costs rise between 10% to 3x, inflating the ultimate costs of products by 0.1-30%, for CO2 abatement costs of $130-1,000/ton. We still prefer CO2 removals.

Shipping consumes 5Mbpd of global oil demand, emits 1.5% of the world’s CO2, and adds c1% to the final cost of a typical shipped product, using $1.8/gallon marine diesel at 9.0 kg/gal CO2 intensity.

This data-file appraises the costs of alternative shipping fuels, drawing on models from our prior work into methanol, lower-carbon ammonia, renewable-diesel, green hydrogen, and electrofuels.

In each case, we have estimated the increased fuel costs of alternative shipping fuels versus marine diesel; plus the increased capex costs of ships that can handle these different fuels, increased maintenance costs and other increased operational costs. This draws on our models of container ships, bulk shipping, LNG tankers and other vessel types.

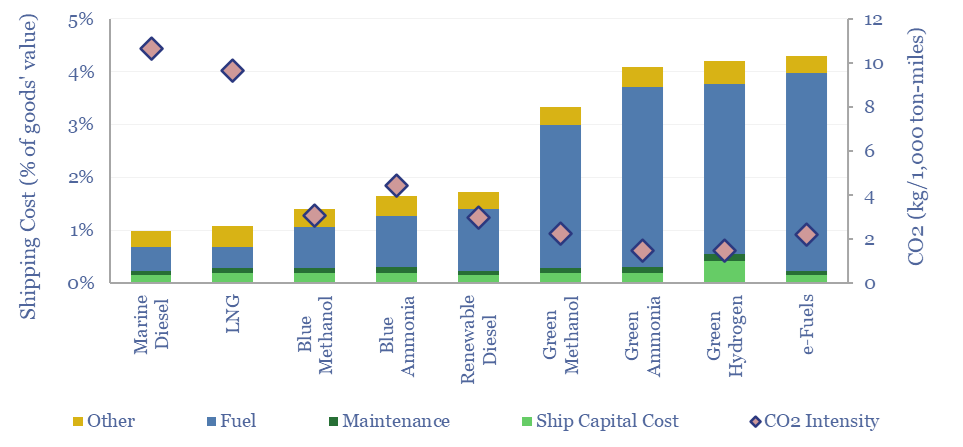

The title chart above shows a base case where shipping with marine diesel fuel adds 1% to the final price of a product that is transported between continents, and emits about 100kg of CO2 per ton of product that is shipped. Alternative shipping fuels add 0.1 – 3.3% to this baseline cost.

LNG is most competitive, adding just c10% to total shipping costs in LNG-fueled ships – possibly much less, or even deflating costs, when oil prices are higher, or LNG prices are lower. But LNG only lowers CO2 emissions by c10%. And even this is debatable, if a gas-fired marine engine suffers from methane slip.

Blue methanol, blue ammonia and renewable diesel are next most economical, but add 0.4 – 0.7% to the final costs of shipped products, while achieving 60-70% reductions in the CO2 intensity of shipping. This equates to a decarbonization cost of $135-260/ton.

Most costly are green methanol, green ammonia, green hydrogen and e-fuels, which add 2.3-3.3% to the final costs of shipped products, while achieving 80-90% reductions in the CO2 intensity of shipping. Thus, the decarbonization costs are an eye-watering $700-1,000/ton.

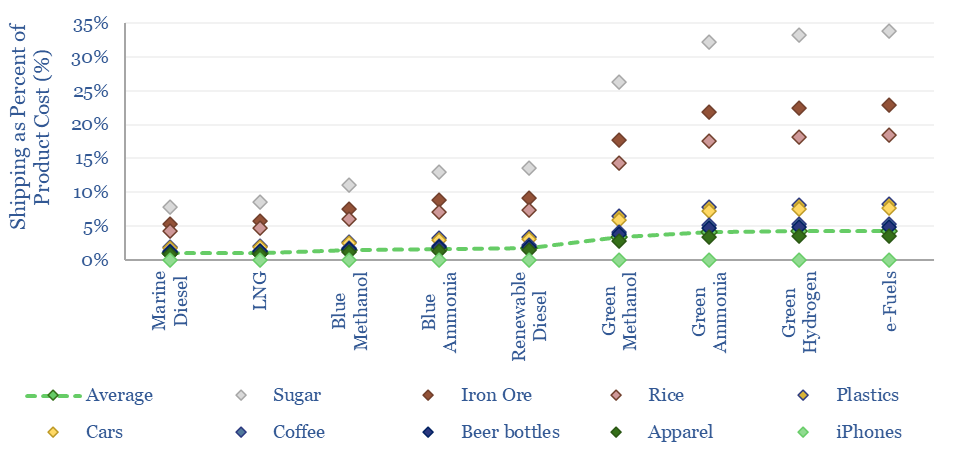

The numbers do vary markedly, however, based on the products being shipped, especially their mass, their costs and the shipping distance, which can all be stress-tested in the data-file.

For bulk products such as sugar, iron ore or grains, shipping using marine diesel can comprise as much as 5-10% of product prices, hence switching to the green fuels above can inflate end product costs by 20-30%.

Conversely, for light but high-value products, such as iPhones, shipping costs are basically irrelevant. You can use any fuel you like, and it will not even sway final product prices by 0.00%. Most other products are in between. Numbers can be stress-tested in the model.

The most economic options to decarbonize shipping are through larger and more efficient ships, using high-quality hydrocarbon fuels and coupling these ships with nature-based CO2 removals. Decarbonization must increasingly prove it can be competitive. We have also looked at carbon capture on ships.