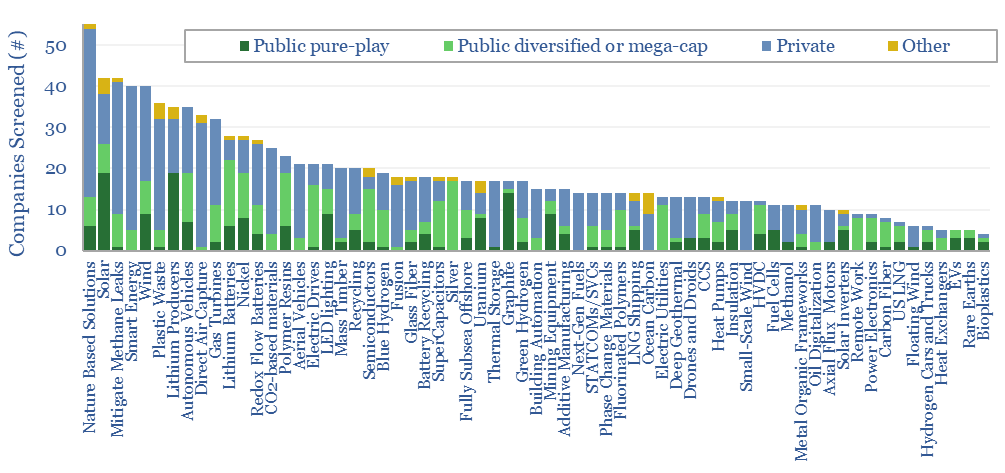

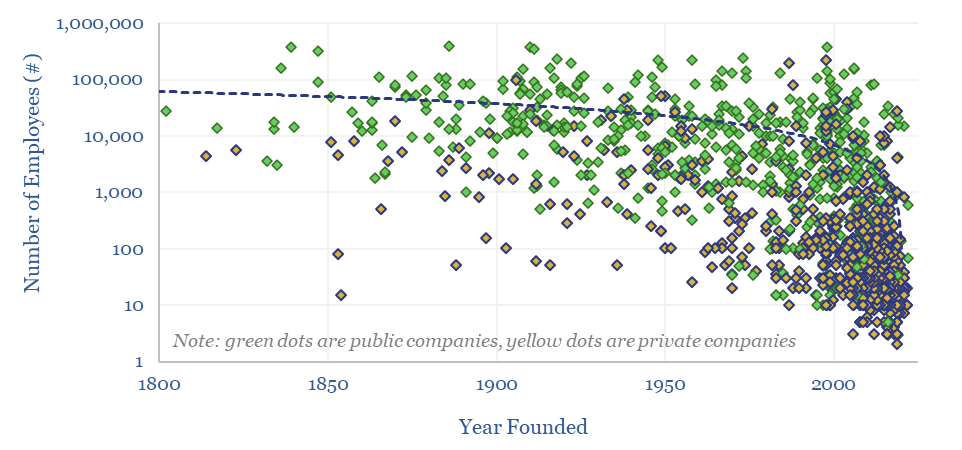

This database contains a record of every company that has ever been mentioned across Thunder Said Energy’s energy technology research, as a useful reference for TSE’s clients. The database summarizes 3,000 mentions of 1,700 energy transition companies, broader energy producing and consuming companies; their size, focus and a summary of our key conclusions, plus links to further research.

Our research library has become quite large, with over 2,000 research notes, data-files and models in the TSE research portal, since we started Thunder Said Energy in 2019. Hence the purpose of this data-file, which is only available to TSE’s full subscription clients, is to summarize all of the mentions of all of the companies, across all of our work.

For example, if a decision-maker is looking for information about ABC-Industries, and its linkage with energy transition, then a summary of key observations about ABC-Industries will be noted on the LongList tab, and all of the underlying mentions of ABC-Industries across different research notes can be filtered on the ‘Mentions’ tab, including links. Our methodology is described in the recent research note here.

Having a long list of energy transition companies, in a single database, also enables some interesting analytics, into the Very Hungry Caterpillar of companies in the world’s fast-evolving global energy and industrial landscape, amidst the transition to net zero.

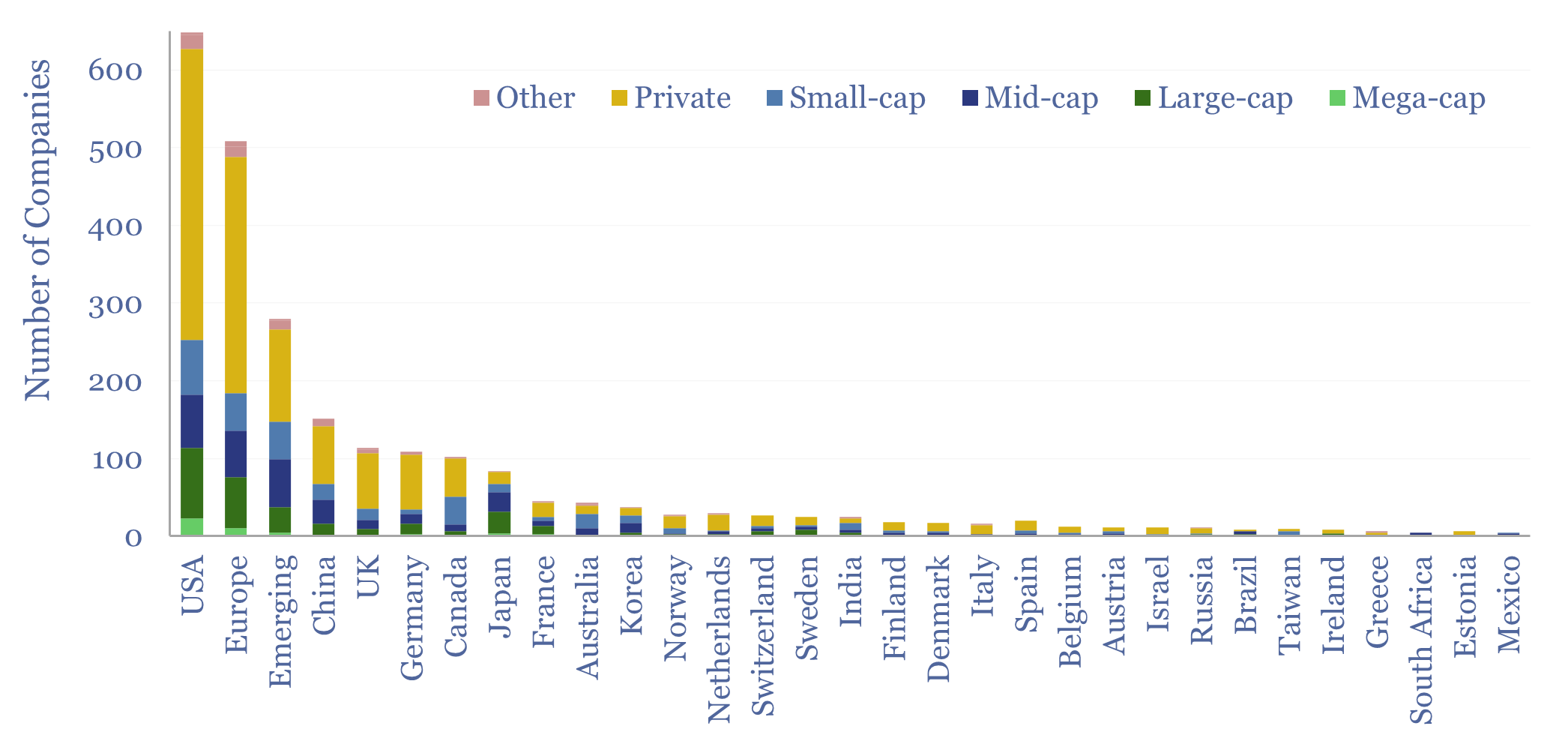

The geographies that are most represented in our database of energy transition companies include the US (650 companies, 38% of the companies, 38% of the mentions), Europe (510 companies, 30%, 34%), China (150, 9%, 8%), Canada (100, 6%, 5%), Japan (85, 5%, 6%), Australia (40, 3%, 2%), Korea (37, 3%, 2%). And counting.

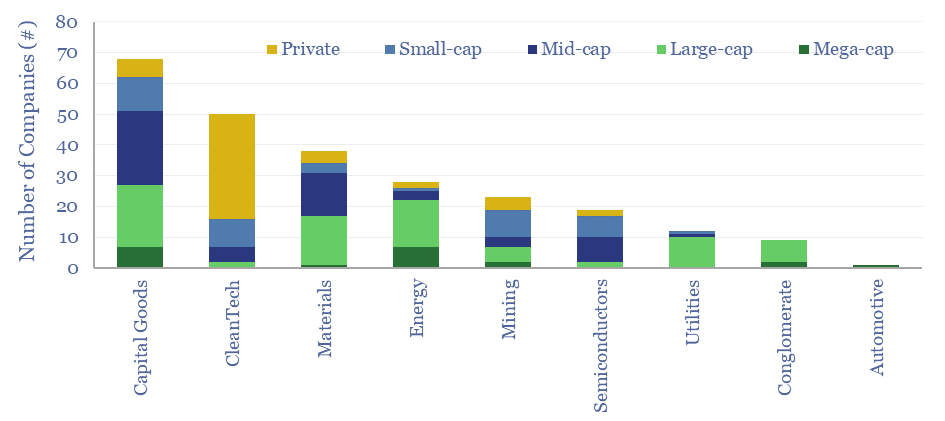

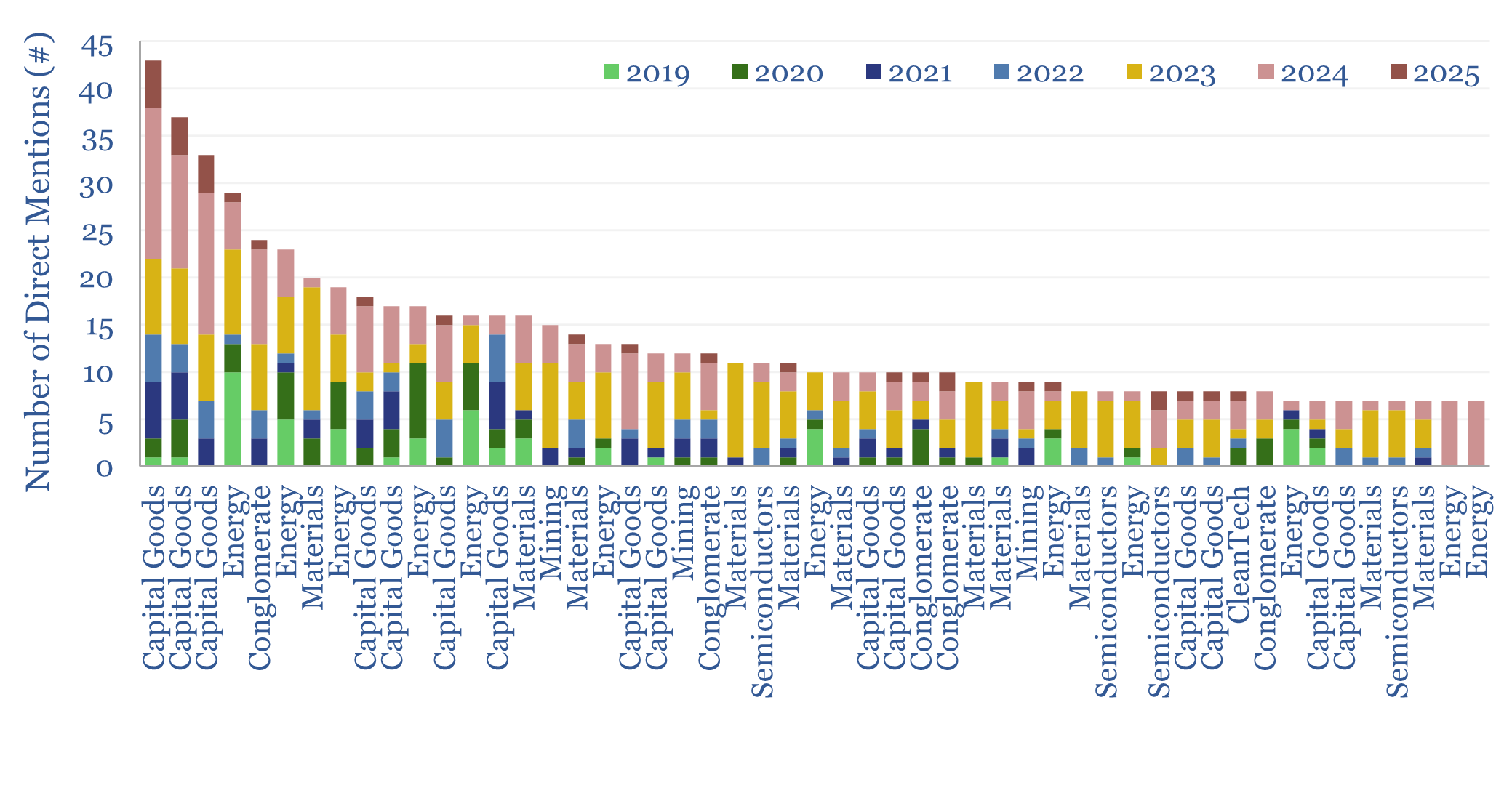

Zooming in a little further, there are 250 companies that have come up repeatedly in TSE research, or where we have conducted more in-depth work, across 8 sectors and 50 sub-sectors. 50 were CleanTech companies, of which 75% tended to private, and the remaining 25% were small-cap or mid-cap companies (chart below).

Other segments. 70 are capital goods companies, 30 are materials companies, and other heavily discussed industries in our research are energy, mining and semiconductors, ranging from small-privates to mega-cap giants.

Zooming in even further, there are 50 companies that have come up at least 6 times in TSE’s thematic research, which is focused on opportunities, themes and bottlenecks in the world’s transition towards net zero. These warrant a closer look.

For example, In 2021-22, we became obsessed with the idea that power electronic switchgear would increasingly be needed to help electricity scale up from 40% to 60% of the world’s energy system by 2050, save energy – from variable frequency drives to power factor management – and to accommodate more volatility in renewable-heavy grids. Thus the company we wrote most about in 2021-22 was Eaton. Which subsequently doubled.

Hence we have started a new quarterly series of research reports and updates to this database, simply noting the companies that have featured most prevalently in our research over the trailing several months, and since the inception of TSE, as a useful summary for decision-makers who have not necessarily been able to read 100% of our output, and may wish to dig deeper into these companies as part of their own processes. The latest instalment covers our energy transition conclusions in 2Q24. In 3Q24 we have also evaluated vehicle value chains.

The data-file is exclusively available to TSE subscription clients. Any purchases of the data-file will be automatically converted into a TSE full subscription. And we will continue updating the database over time.