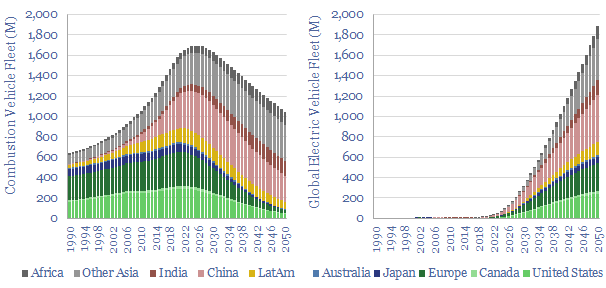

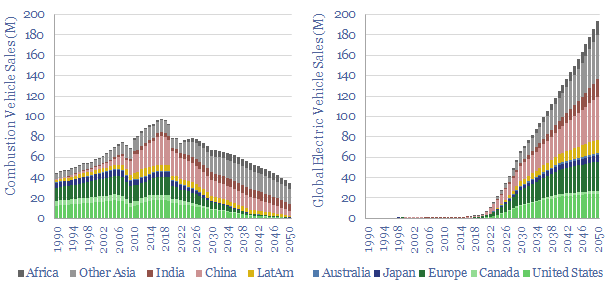

We have modeled the global light vehicle fleet, light vehicle sales by region, and the world’s shift from internal combustion engines (ICEs) towards electric vehicles (EVs) through 2050. Our base case model sees almost 200M EV sales by 2050, and a c40% decline to around 1bn combustion vehicles in the world’s fleet by 2050.

Our long-term forecasts for global oil demand see gasoline and diesel demand from light vehicles falling by 65% by 2050, as electric vehicles replace combustion vehicles. In thermodynamic terms, EVs are a superior technology. But how quickly do they ramp and replace internal combustion incumbents?

This data-file models the global vehicle fleet by region, starting with numbers from the OICA, adding our own estimates going back to 1990 and the running forecasts out to 2050.

The simple mathematical methodology is that the fleet in Year X equals the fleet in Year X-1 plus new vehicle sales minus retirements.

Today’s global vehicle fleet consists of 1.7bn light vehicles, of which 290M are in the US, 340M in Europe, 77M in Japan, 320M in China, 45M in India, 60M in Africa. This includes passenger vehicles and light commercial vehicles.

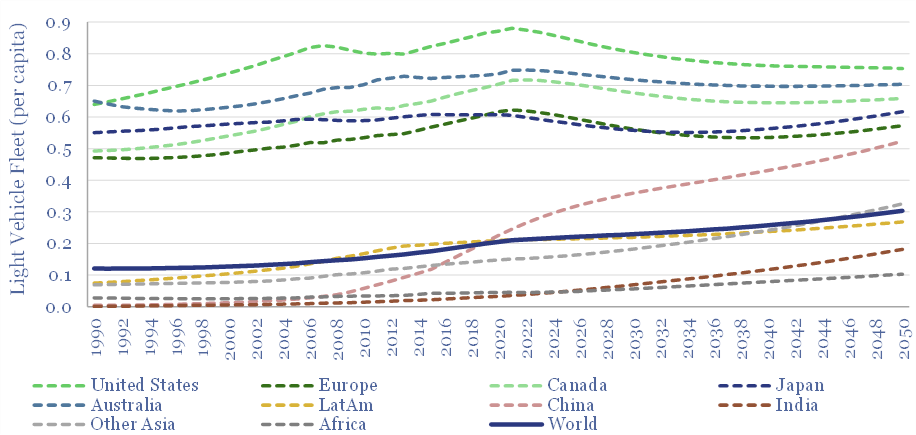

Global vehicle sales will rise by almost 3x, from c80M in 2022 to 230M in 2050. In per capita terms, this is an increase from 0.01 sales pp pa to 0.024 pp pa by 2050, mainly driven by GDP per capita rising from $13k pp pa to $22k pp pa, and especially in the emerging world.

Global vehicle ownership would thus increase c50%, from 0.2 pp to 0.3 pp. Vehicle ownership rates move sideways in the developed world; but rise in the emerging world. By 2050, car ownership rates are “only” 25% below today’s developed world levels in China, 50% below in other Asia, 60% below in LatAm, 75% below in India and 85% below in Africa.

An increasing portion of global vehicle sales are electric as part of our roadmap to net zero. Our base case is a scenario where effectively all vehicle sales in the developed world shift to electric, while the emerging world continues to buy a more even mixture (chart below).

Electric vehicle sales are forecast by region in the data-file. But the numbers can be varied in the data-file, to stress-test your own scenarios. This also drives the demand for key materials used in batteries, motors and traction inverters, such as lithium, fluorinated polymers, battery-grade nickel, graphite, copper, Rare Earth Metals and SiC.

Retirement rates of vehicles depend on their age and location. Further data on the typical retirement ages of vehicles is tabulated here. But in the model, we have had to assume a material acceleration in old vehicle retirement rates, to phase out ICEs faster.

We updated our electric vehicle sales forecasts in June-2024, reluctantly revising our 2025-30 forecasts downwards by 20-25%, for reasons linked to mass-market affordability. The logic and reasoning are described on the welcome tab of the model. We updated our numbers again in September-2024 after assessing income and attitudes.

Please download the data-file to stress test the evolution of global vehicle sales and the global vehicle fleet. Our base case sees a 40% reduction in the ICE fleet by 2050. But we think there are realistic alternative scenarios where the global ICE fleet may not decline materially from 2022 levels. Our own perspective from interrogating the model is that it also takes quite extreme assumptions to reduce the global vehicle fleet by over 75% by 2050.