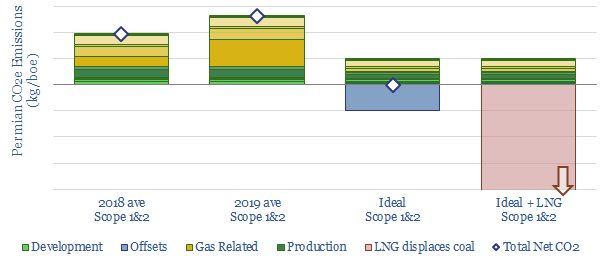

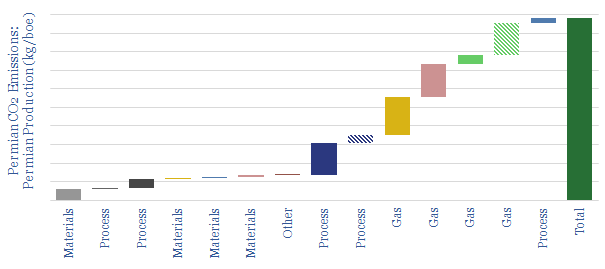

The CO2 intensity of shale oil averages 25kg/bbl, on a Scope 1&2 basis, of which 60% is from gas flaring and methane leaks. This model disaggregates CO2 emissions of shale oil, across 14 different contributors, aggregating across a dozen different models constructed by Thunder Said Energy.

This data-file models the CO2 intensity of a typical shale well, specifically a Permian shale oil well, looking line by line, across the CO2 intensity of concrete and steel, drilling, hydraulic fracturing, the supply chains bringing in sand, water and personnel, lifting, flaring, methane leaks, gas gathering and compression for gas transport.

Our base case estimate is that the Scope 1&2 CO2 intensity of shale oil is around 25 kg/bbl. This tallies with real-world data reported by operator.

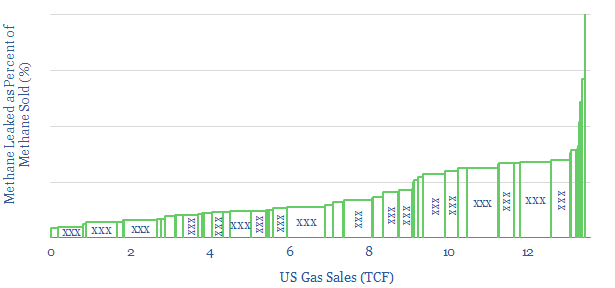

The largest contributors to the CO2 footprint of shale are flaring and methane leaks, which collectively account for 60% of the total Scope 1&2 emissions. This is why there is such importance on improving gas utilization (e.g., from booming blue hydrogen value chains) and preventing methane leaks.

For a comparison with the CO2 intensity of other oil and gas processes, please see our data-file here. US shale oil embeds modestly higher Scope 1&2 CO2 than large offshore resources, but materially less CO2 than heavy oils and geographies with heavy flaring.

Our ‘idealized shale’ scenario follows in a separate tab, showing how it could be achievable to make Permian shale production a ‘carbon neutral’ resource.

CO2 intensity can also be flexed by changing different input assumptions, such as methane leakage, flaring activity and well productivity; while we will be happy to share underlying models with you, for further sensitivity analysis.