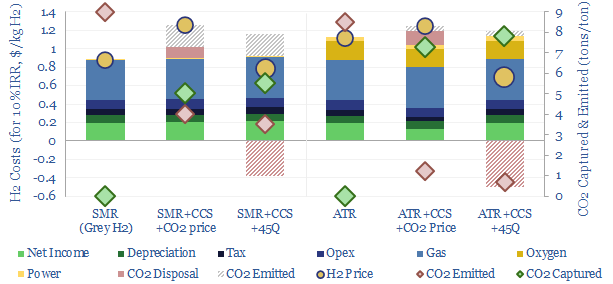

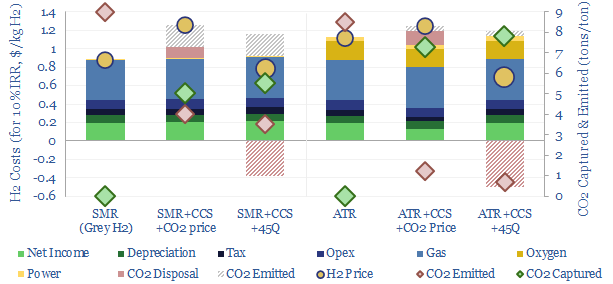

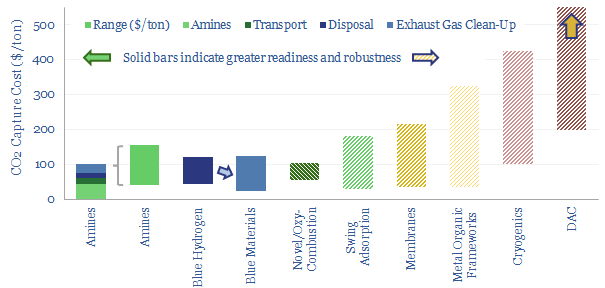

Blue hydrogen value chains are gaining momentum. Especially in the US. So this 16-page note contrasts steam-methane reforming (SMR) versus autothermal reforming (ATR). Each of these different hydrogen reformers has…

…the Inflation Reduction Act are already kickstarting a boom in blue value chains, from blue ammonia, to blue steel, to blue chemicals. This exciting theme is gathering momentum at a…

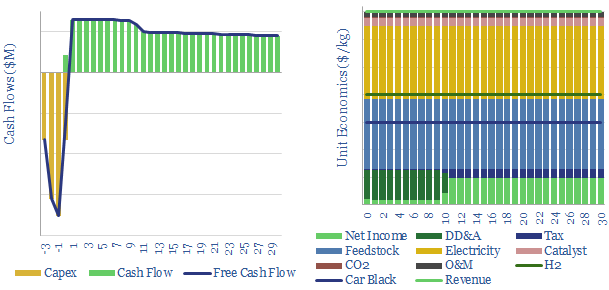

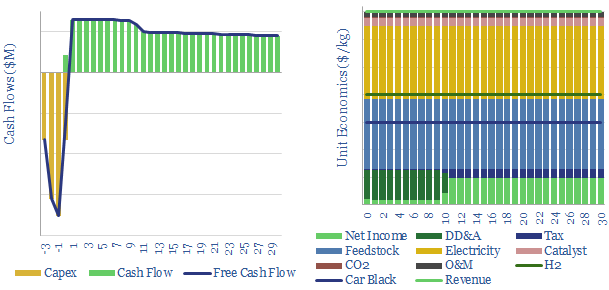

…may unlock lower costs for turquoise hydrogen than blue hydrogen or green hydrogen. The disadvantage is that methane decomposition is endothermic, thus an exterior energy source is required. If this…

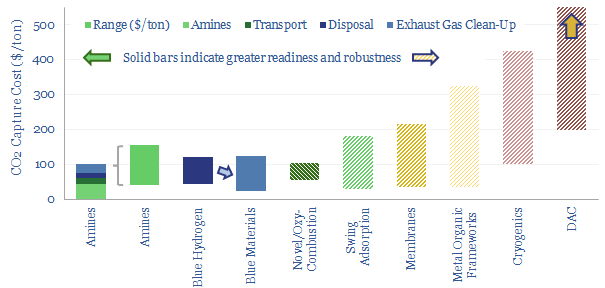

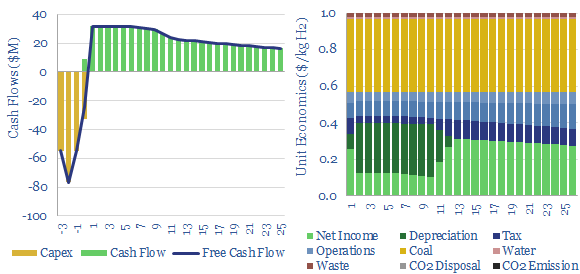

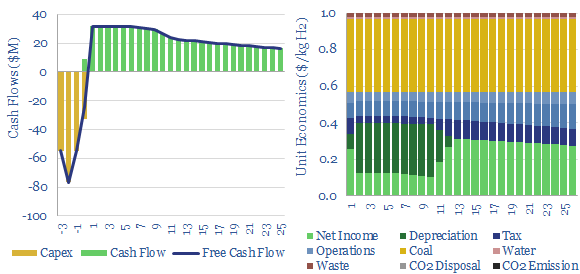

…hydrogen and turquoise hydrogen as leading options. The costs of syngas and the costs of hydrogen from coal gasification depend on input variables. Capex costs are usually around $1,000/kWth of…

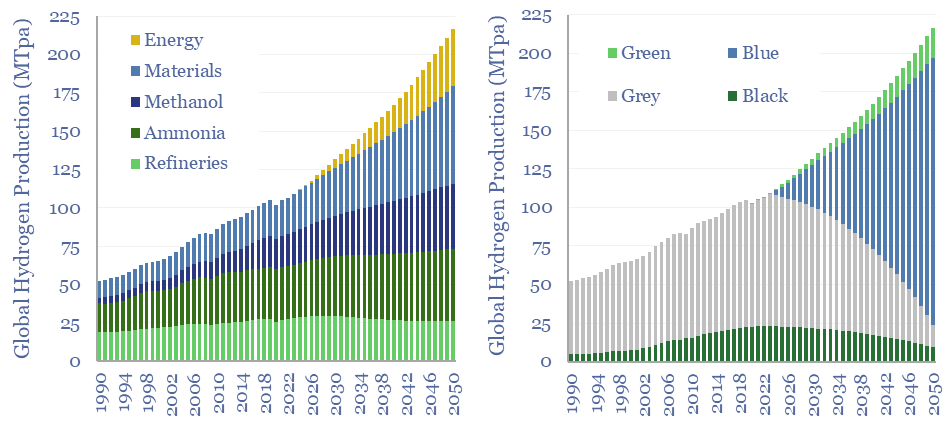

…varies by region. The trajectory looks very different in US hydrogen markets, Europe, the broader OECD and non-OECD (pages 12-16). Blue hydrogen value chains are now booming in the US,…

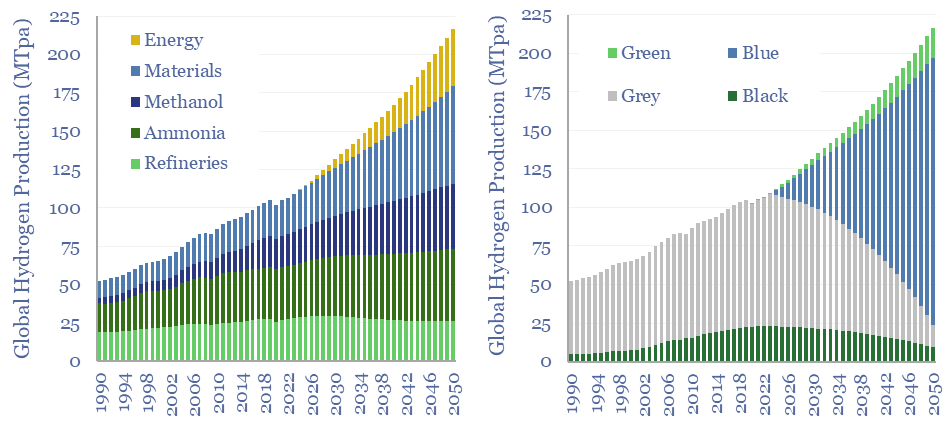

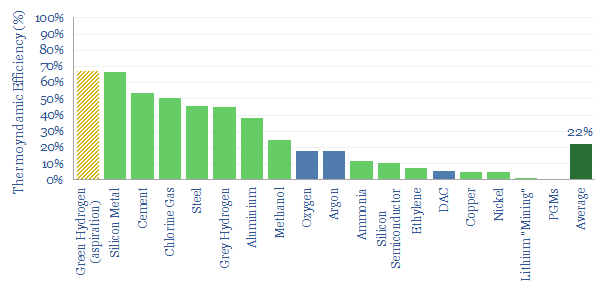

…Economy. Well over 80% of 2050’s hydrogen market is likely to be blue hydrogen. This is ultimately derived from natural gas energy (increasing gas demand). And it is still not…

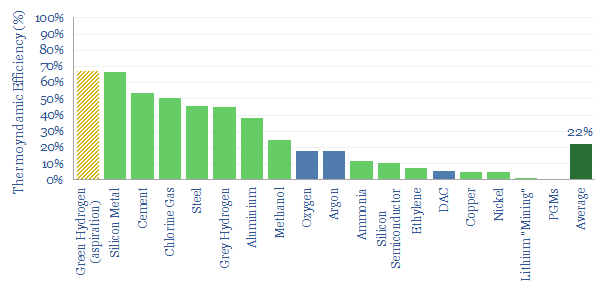

…the decomposition of CH4. Some might see this as an argument for making hydrogen out of CH4 rather than out of H2O, for example, in blue hydrogen or turquoise hydrogen…

…network on the Gulf Coast, helium and LNG process technologies. It is expanding into blue hydrogen and green hydrogen + hydrogen transport. The NEOM Green Hydrogen project in Saudi Arabia…

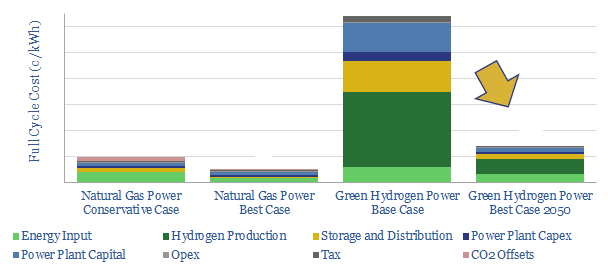

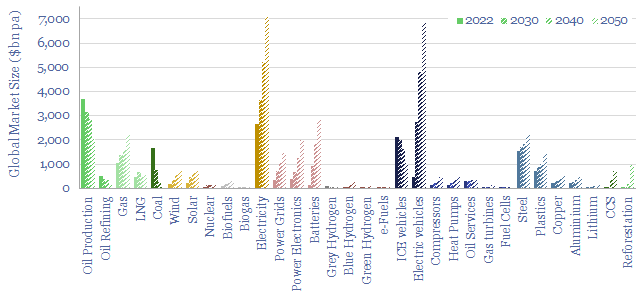

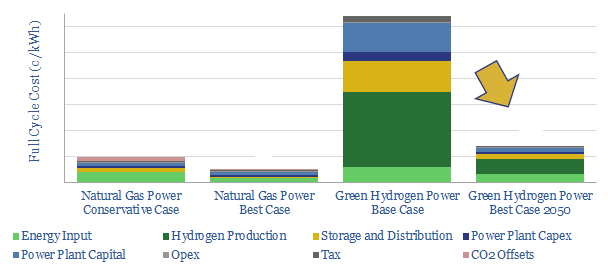

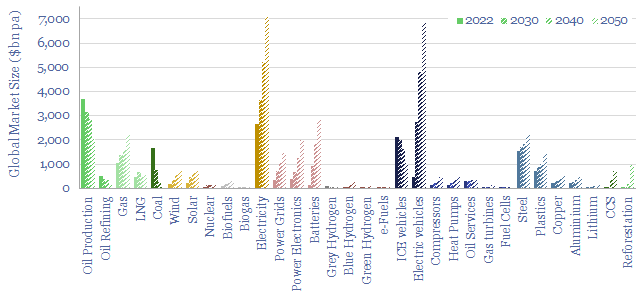

…green hydrogen ($8/kg) specifically because blue hydrogen is less expensive. Market size = volume x price. Hence if the volumes were the same, then green hydrogen markets would be 8x…

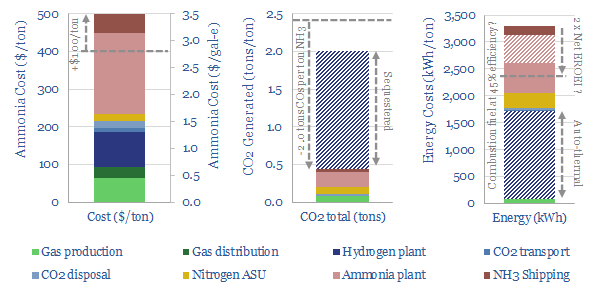

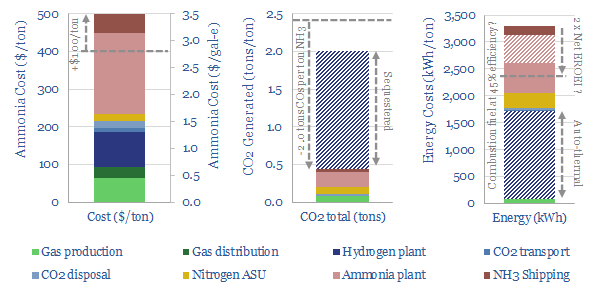

Blue ammonia can economically decarbonize the fertilizer industry, using low-cost natural gas; with options to decarbonize combustion fuels in the future. This 12-page report covers where we see the best…