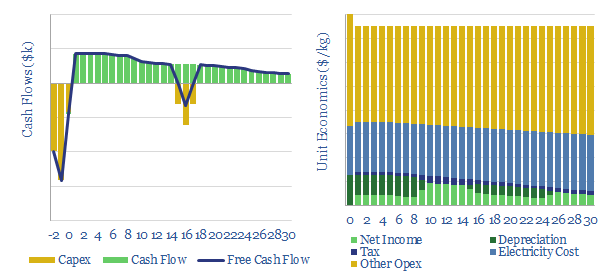

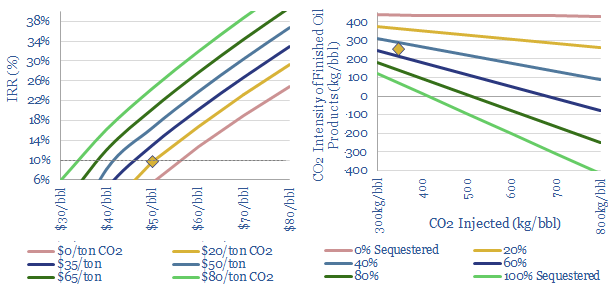

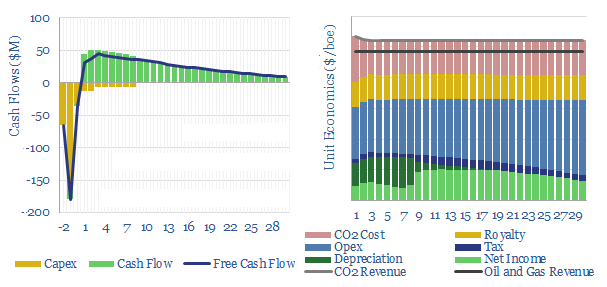

This data-file models the vertical greenhouse costs, an emerging method for growing greens, fruits and vegetables close to the consumer, in large multi-story facilities, lit by LED lighting. Economics can be attractive, with 10% IRRs in our base case condition, off 50kg/m2/year yields and $7.5/kg produce pricing.

Vertical greenhouses achieve 10-400x greater yields per acre than field-growing, by stacking layers of plants indoors, and illuminating each layer with LEDs. The opportunity is covered in our vertical greenhouse research note.

The main rationale for vertical greenhouses is to maximize land productivity, situate production closer to the consumer and earn a premium from fresher produce.

Historically, vertical farming was first described in 1915 by American geologist, Gilbert Ellis Bailey. The first vertical farms were actually built in the 1950s, to grow cress indoors at large scale. LED application for plant growth was first studied in the 1990s, as part of NASA’s preparations for future Moon and Mars bases. And modern experiments with vertical farms go back to 2009, when Sky Green Farms designed a 9-meter arrange of 120 aluminium towers to grow 0.5T of leafy vegetables per day.

Economics of vertical greenhouses can be attractive, with 10% IRRs in our base case condition, off 50kg/m2/year yields and $7.5/kg produce pricing.

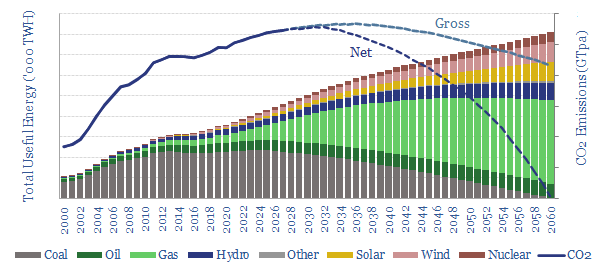

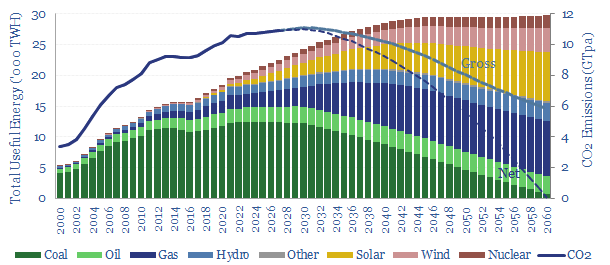

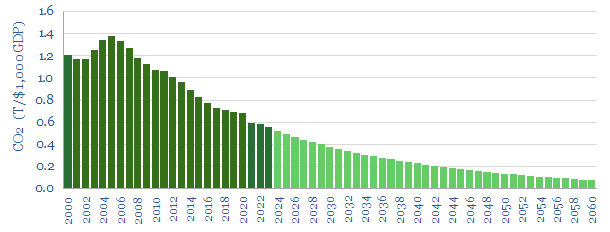

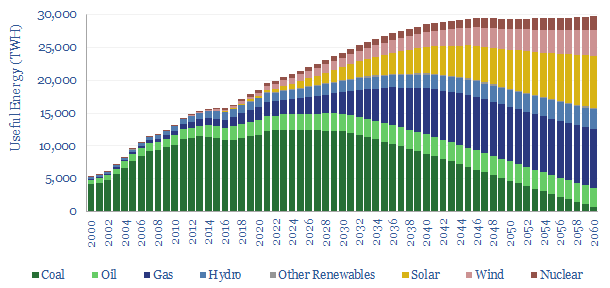

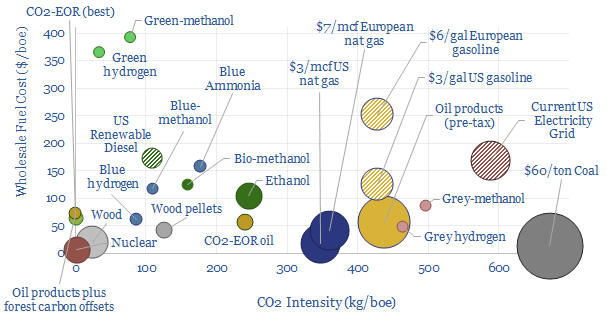

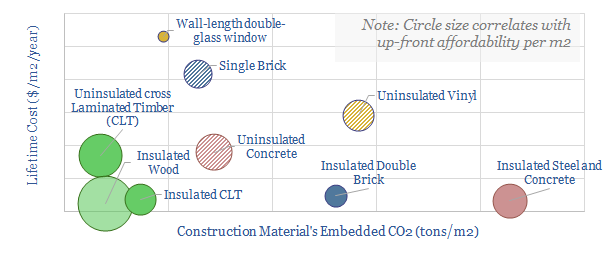

However the CO2 intensity will depend heavily upon the CO2 intensity of the underlying grid, as our numbers assume 1,000kWh/m2/year of LED light is required.

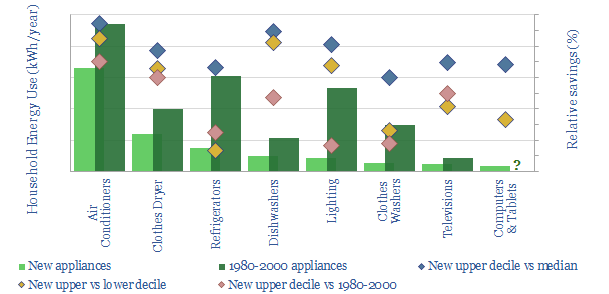

LED-lighting vertical greenhouses takes 1,000kWh of electricity per m2 per year, emitting 3kg of CO2 per kg of food, if the grid is 50% gas and 50% renewables.

CO2 costs of vertical greenhouses can also be compared with field crop production.

Data in thos models cover the typical capex, opex, energy costs and other vertical greenhouse costs, sourced from technical papers, which are also summarized in the final three tabs of the model.

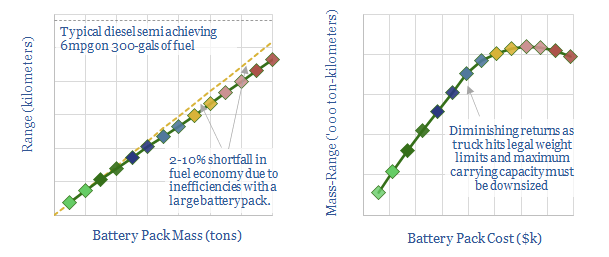

Backstopping renewables is another opportunity for vertical greenhouses, as LED lights can readily be turned on and off, adding flexibility to power grids.

Vertical greenhouses could become carbon negative, if they are >75% powered by renewables, and increase yields per acre by c300x, as claimed by some

CO2 enrichment is another opportunity, absorbing excess CO2 to improve yields, as a variant on other CCS value chains.