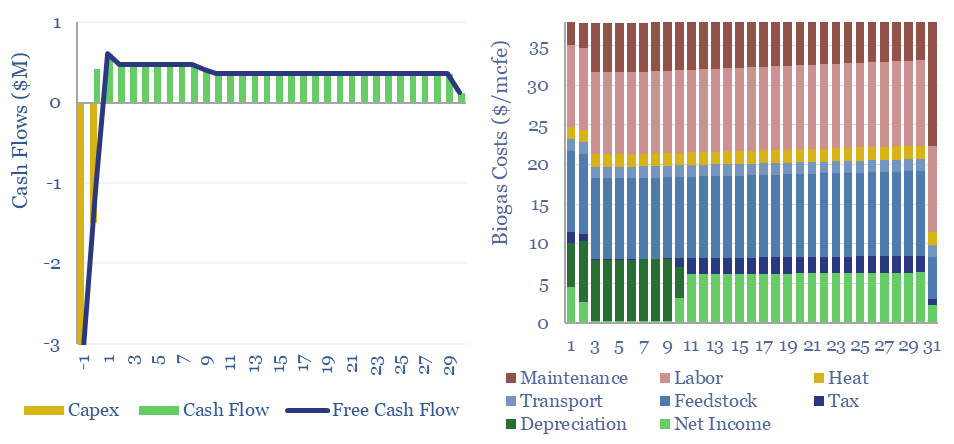

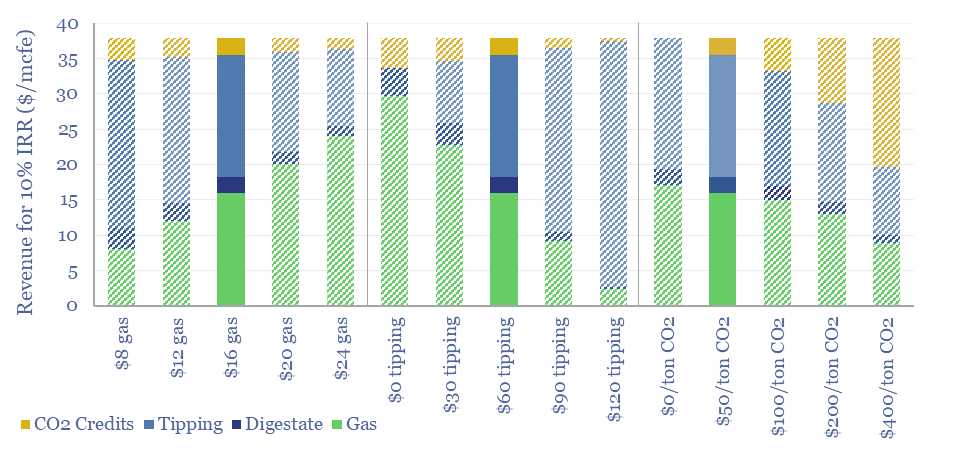

Biogas costs are broken down in this economic model, generating a 10% IRR off $180M/kboed capex, via a mixture of $16/mcfe gas sales, $60/ton waste disposal fees and $50/ton CO2 prices. High gas prices and landfill taxes can make biogas economical in select geographies. Although diseconomies of scale reward smaller projects?

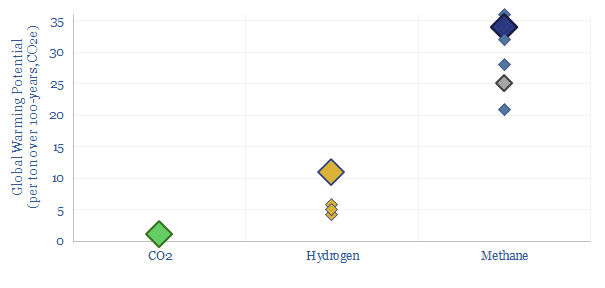

Biogas is a mixture of 50-70% methane and 30-50% CO2, produced from the anaerobic digestion of organic matter, such as manure, sewage or crop residues, or other organic waste. Archaea notes that 72% of US renewable natural gas comes from landfills, 20% from livestock, 5% from organic waste and 3% from wastewater.

This economic model captures the costs of biogas production, informed by 20 case studies, covering yields, capex, opex, IRRs and sensitivities.

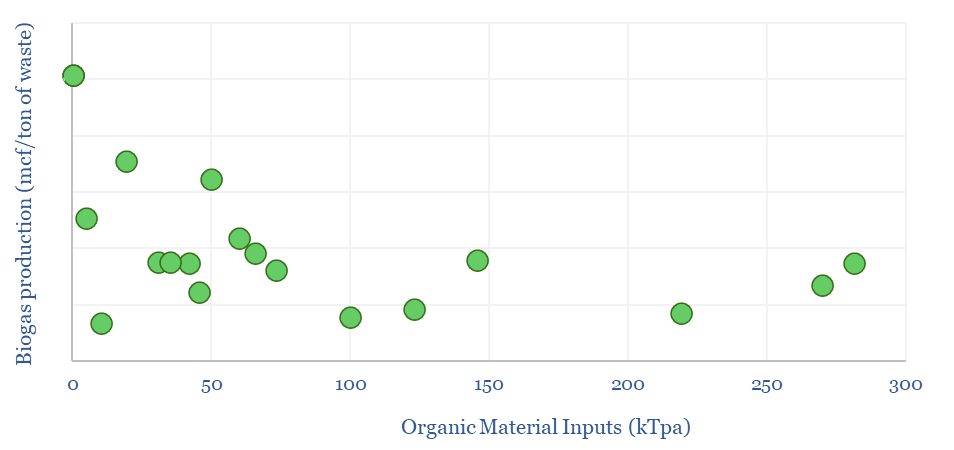

Biogas yields average around 4 mcf per ton of input material, although smaller plants may find it easier to source high-quality feedstocks, with greater quantities of volatile organic matter, and greater conversion of that matter into biogas (chart below).

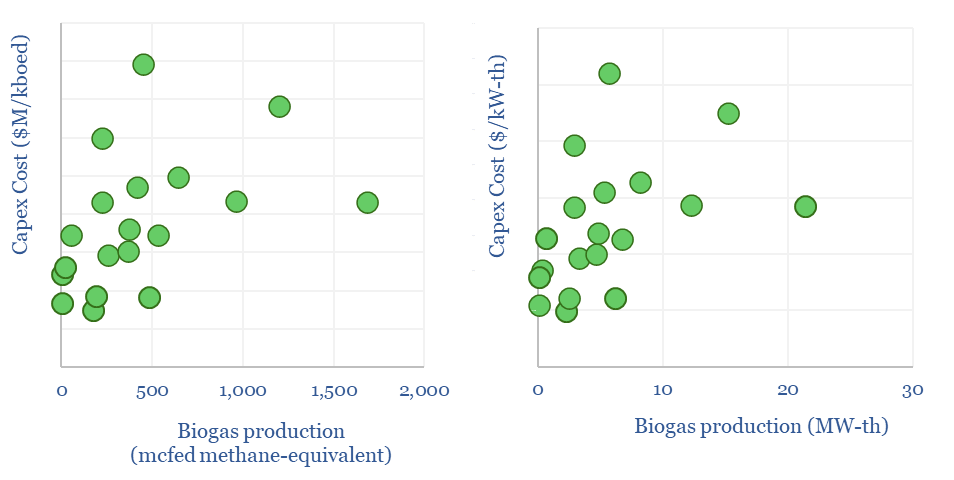

The capex costs of biogas plants are also tabulated from the 20 case studies in this data-file. Costs vary. But good rules of thumb might be $200/Tpa of feedstocks. In energy industry terms, this is equivalent to around $180M/kboed, or around 6x the costs of offshore hydrocarbons, or around $2,500/kW-th, which again is around 2x higher than the per kW-e costs of solar or onshore wind.

Biogas production facilities need to earn around $35-40/mcfe of methane-equivalent production in order to generate a 10% IRR on their up-front capex. There are four main revenue streams: gas, waste disposal fees, CO2 prices or incentives, and the value of residual digestate, which can be used as fertilizer or bedding in agriculture.

Our base case biogas cost model sees a 10% IRR from a combination of $16/mcf methane, $60/ton disposal fees and a $50/ton CO2 incentive. However, $120/ton landfill taxes can take the methane-equivalent price down to as little as $2.5/mcf. Hence the economics depend on landfill taxes and gas prices in different countries.

Biogas production in Europe currently comprises around 1-2% of the total gas grid, although some studies have estimated that total biogas production could reach 10-20% of total, or around 50-100bcm pa in Europe, via a “huge scale-up”.

One interesting observation from the charts above is that unlike other economic models in our library, biogas facilities may not benefit from economies of scale. Smaller facilities seem to cost less in capex terms and achieve higher yields. This suggests an opportunity for middle-markets private equity and companies with many small facilities?

Please download the data-file to stress-test biogas production costs. We are also constructive on some of the economic opportunities in landfill gas and biochar.