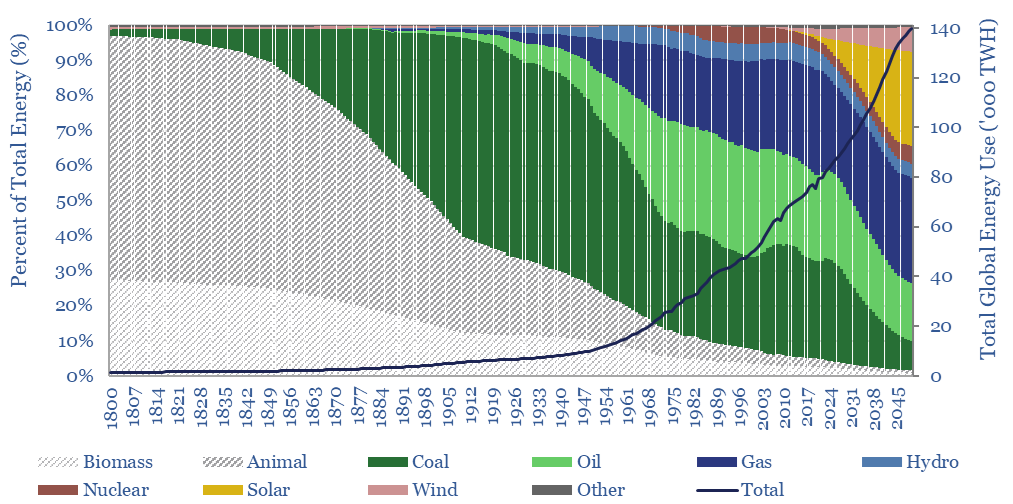

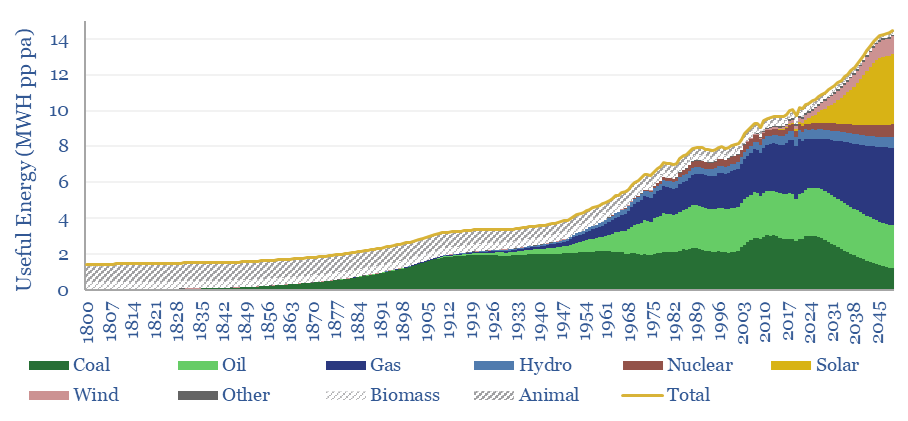

This data-file is a global energy market model for the energy transition. It contains long-term energy supply-demand forecasts by energy source; based on a dozen core input assumptions. Total useful energy consumed by human civilization rises from 80,000 TWH pa to 140,000 TWH pa by 2050. The mix is 30% gas, 30% solar, 15% oil, 8% coal, 7% wind, 5% nuclear, 4% hydro. Numbers can be stress-tested in the data-file.

Global useful energy surpassed 80,000 TWH in 2021, having risen at 2.5% per year in the past decade. It will continue rising to 140,000 TWH pa by 2050, per our breakdown of global energy demand by region. Improving the availability of useful energy has been a remarkable driver of human progress since the Industrial Revolution.

Wind and solar comprised 10% of all global electricity by 2021, of which two-thirds is wind, one-third is solar; making up 13.5% of OECD electricity and 8% of non-OECD electricity.

Ramp renewables first. By moving Heaven and Earth, it will be possible to accelerate renewables to provide almost 50,000 TWH of useful energy in 2050, or c40% of all global energy. An incredible ramp-up, mainly driven by solar, as semiconductors are emerging and the driver of a true energy transition.

Another 10% of 2050’s energy can come from nuclear and hydro. We see an outright ‘nuclear renaissance‘ underpinning 2.5x growth from nuclear through 2050.

What about the other 50%? It is simple arithmetic. Almost 10bn people on Planet Earth will collectively be consuming 140,000 TWH pa of useful energy by 2050. The remaining 50% must come from somewhere, or the result will be devastating energy shortages.

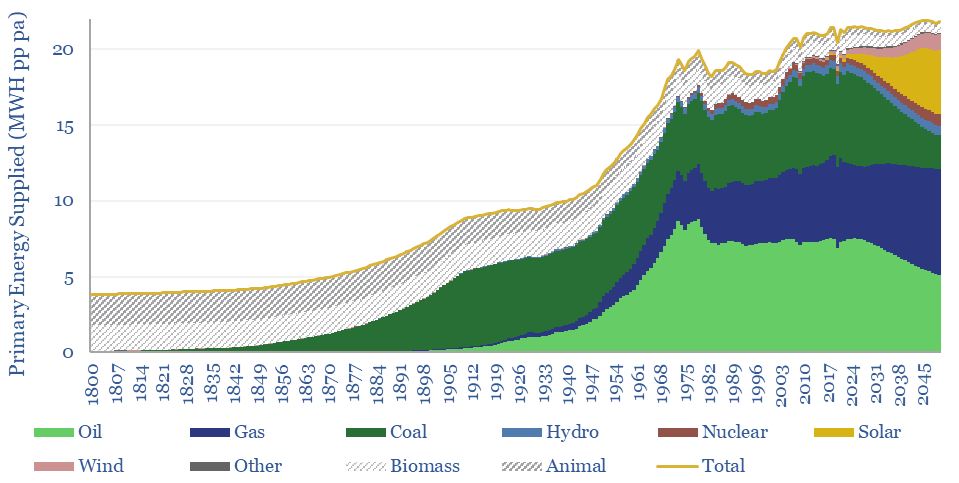

(What about efficiency gains, e.g., ramping electric vehicles? Our numbers above are already being quoted on a ‘net useful energy’ basis, after deducting efficiency losses from primary energy suppliers. I.e., they are already net of efficiency factors. Interestingly, gross numbers for primary energy supplies per capita already peaked in 2019 at around 21 MWH in 2019, which is seen slipping back to 20 MWH pp pa by 2050).

Phasing out coal. Given the need for fossil fuels in the world’s future energy system, we should clearly prefer the cleanest and lowest carbon fuels possible, which are inherently easier to decarbonize via CCS and nature-based solutions. This means phasing out coal by 2050, with a CO2 intensity of 0.37 kg/kWh-th. However coal is cheap and abundant in China and India, hence we expect the emerging world will continue burning 4GTpa in 2050 in our models of global coal supply-demand.

Natural gas is the crucial fuel for the energy transition. Natural gas is the lowest carbon fossil fuel, with 54% of its combustion energy coming from hydrogen in the methane molecule (CH4). Hence global gas ramps by 50% to 600bcfd in our model, and in order to achieve net zero by displacing coal, it would need to ramp as high as 800bcfd.

Oil demand moves sideways, rising gently to a peak of 104Mbpd in 2030, which is driven by the emerging world, then slowly declining back to 85Mbpd in 2050.

Electricity rises from 40% to 65% of the world’s total useful energy by 2050, from 30,000 TWH generated in 2023 to 90,000 TWH, per our model of global electricity supply-demand, and the remaining non-electric energy is used for heat, motion, materials.

This scenario could be compatible with reaching “net zero” and limiting global warming to 2C, but it would take 200bcfd more gas and a vast ramp in CCS and nature-based solutions, which is not currently happening. It looks more likely that the world is on course for a 2.5-3C climate change scenario.

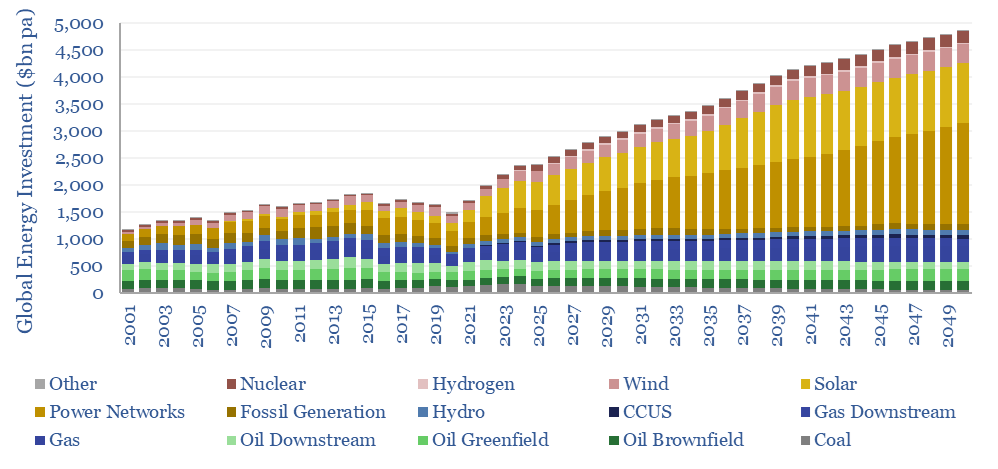

Total global investment in energy steps up from around $2trn pa to $5trn pa by 2050. The numbers are broken down in the data-file, but the largest increases are in solar and power grids, the latter of which we have called the biggest bottleneck in energy transition.

Other inputs include our modelling of wind and solar capacity additions, a long-term oil demand model, gas market models, coal supply forecasts and an increasingly favorable outlook on nuclear.

Annual data are provided back to 1750 to contextualize the energy transition relative to prior transitions in history.

You can ‘flex’ different assumptions, to see how it will affect future oil, coal and gas demand, as well as global carbon emissions. At the end of 2024, we are considering whether the future might hold vastly more solar than previously envisaged, and a variant of our model, as discussed in this research note, is also available in the download.