Energy technologies: the pace of progress?

…as natural gas, LNG and nature-based solutions? Page 12 of the report is a five-point framework, which we have based on our findings in the report and our experiences over…

…as natural gas, LNG and nature-based solutions? Page 12 of the report is a five-point framework, which we have based on our findings in the report and our experiences over…

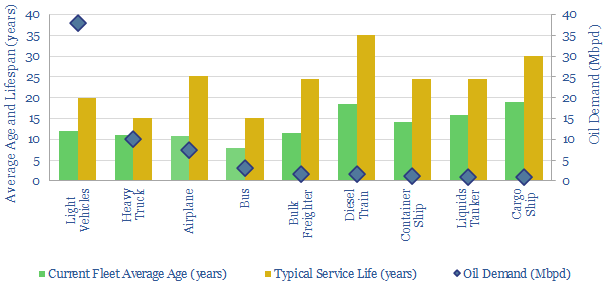

…here in the year of our lord 2023. Elsewhere, there are rail cars in service with half-a-century of history. In 2021, Mitsui noted it had scrapped its first LNG carrier,…

…‘all of the above approach’, which accelerates as many options as possible, including wind, solar, electrification, efficiency gains, gas, LNG, CCS, nuclear and nature-based solutions. $499.00 – Purchase Checkout Added to cart…

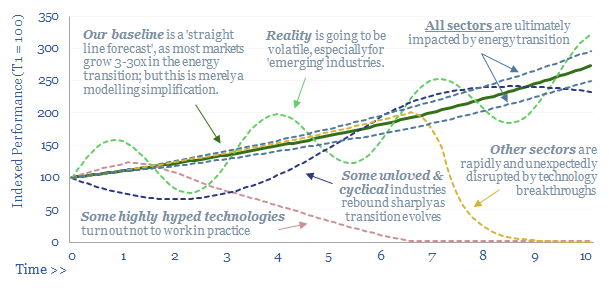

…Nature. And yet vast value remains in oil, gas, LNG, plastics, possibly even coal. Vast changes — and the expectation of vast changes — are particularly likely to create dislocations…

…And fractionation is usually done before natural gas is liquefied into LNG. Leading companies operating natural gas fractionation plants are constellated around the upstream and midstream industries, while companies such…

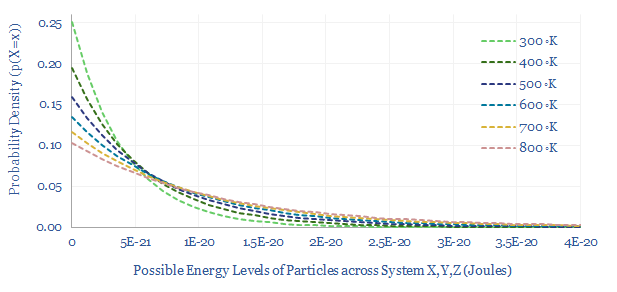

…cryogenics, industrial gases, LNG, CCS, hydrogen. Boltzmann in chemistry and materials? The Boltzmann expression? Maths using the Boltzmann constant often feature the expression exp(-E/kB.T). Here, exp denotes the natural exponent…

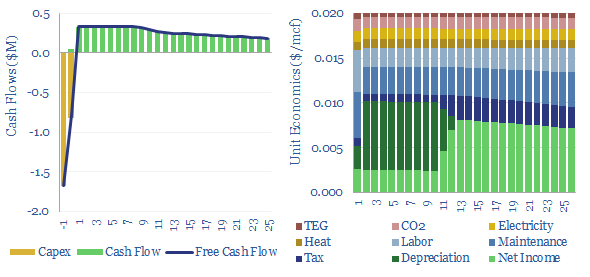

…reducing the water content of natural gas are to avoid issues in downstream equipment and pipelines, such as plugging or hydrate formation. For example, as an LNG plant cools the…

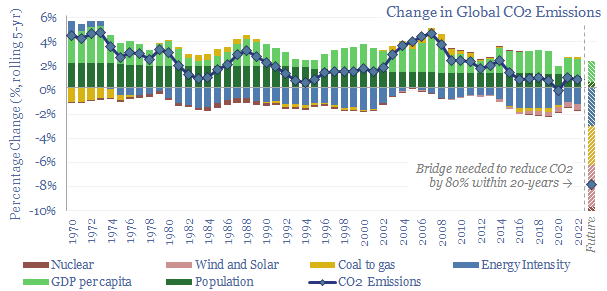

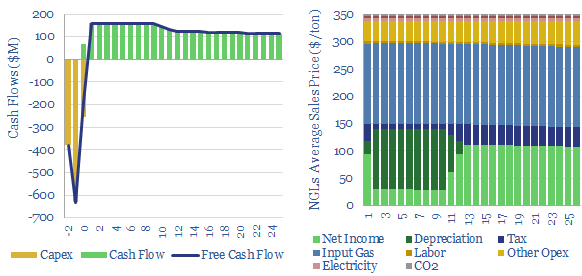

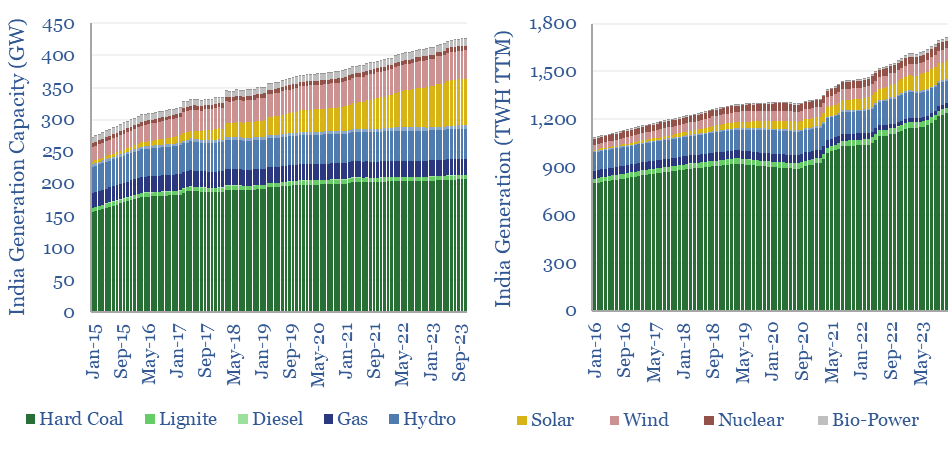

…growth rate of 5% per annum (chart below). Russia’s invasion of Ukraine has not helped, as Europe’s sudden thirst for LNG has pulled gas away from emerging world geographies. India’s…

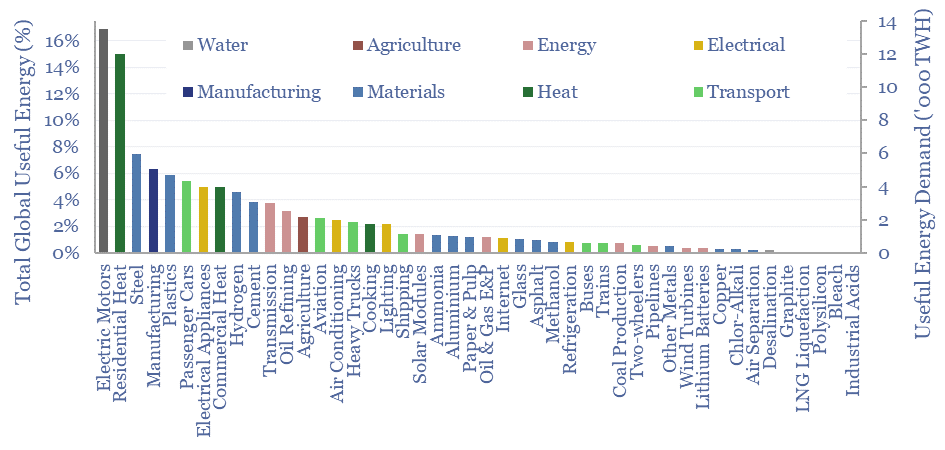

…chlor-alkali, coal production, commercial heat, cooking, copper, desalination, electric motors, electrical appliances, glass, graphite, heavy trucks, hydrogen, industrial acids, internet, lighting, lithium batteries, LNG liquefaction, manufacturing, methanol, oil & gas…

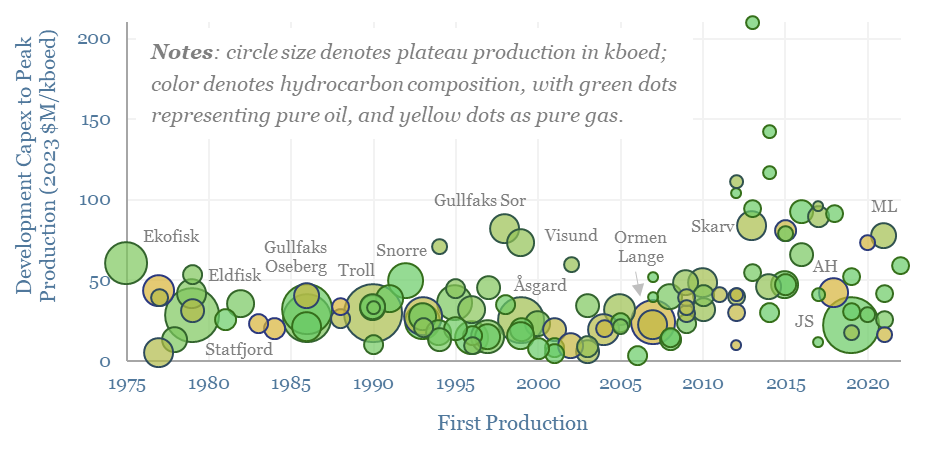

…cleaned data-set is available for download below. Across all energy sub-sectors, there are benefits to counter-cyclical investment, whether we are considering oil, gas, LNG, nuclear, wind, solar or power grids….