Search results for: “demand”

-

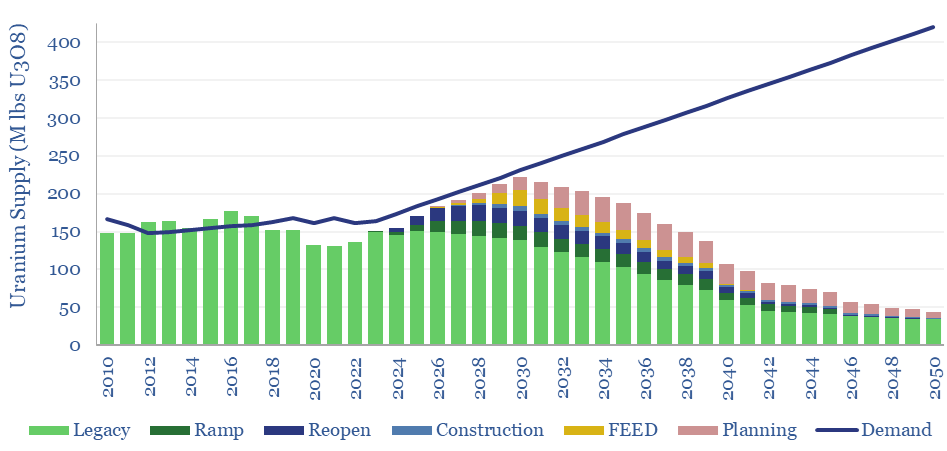

Global uranium supply-demand?

Our global uranium supply-demand model sees the market 5% under-supplied through 2030, including 7% market deficits at peak in 2025, as demand ramps from 165M lbs pa to 230M lbs pa in 2030. This is even after generous risking and no room for disruptions. What implications for broader power markets, decarbonization ambitions, and uranium prices?

-

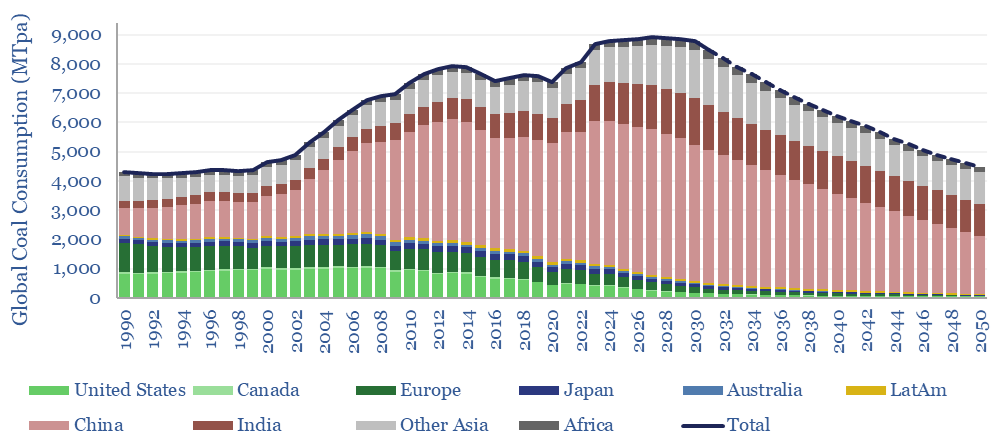

Global coal supply-demand: outlook in energy transition?

Global coal use likely hit a new all-time peak of 8.8GTpa in 2024, of which 7.6GTpa is thermal coal and 1.1GTpa is metallurgical. The largest consumers are China (5GTpa), India (1.3GTpa), other Asia (1.2GTpa), Europe (0.4GTpa) and the US (0.4GTpa). This model presents our forecasts for global coal supply-demand from 1990 to 2050.

-

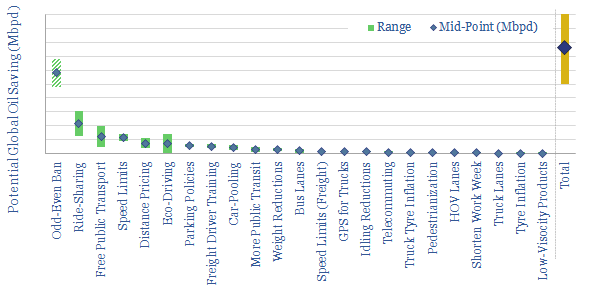

Oil demand: how much can you save in a crisis?

Oil consuming countries are encouraged to have emergency plans to save 7-10% of their demand in a crisis. This data-file outlines how. c10Mbpd could be saved globally. But it requires extreme measures. Largest are odd-even rationing, ride-sharing, free public transit and lower highway speed limits.

-

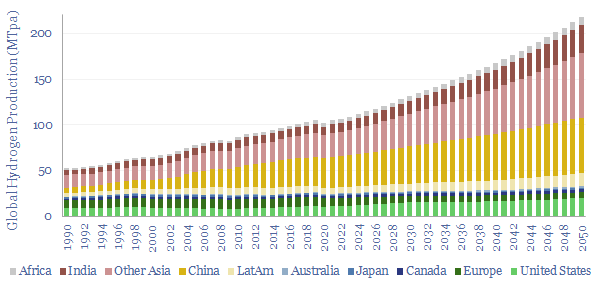

Global hydrogen supply-demand: by region, by use & over time?

Global production of hydrogen is around 110MTpa in 2023, of which c30% is for ammonia, 25% is for refining, c20% for methanol and c25% for other metals and materials. This data-file estimates global hydrogen supply and demand, by use, by region, and over time, with projections through 2050.

-

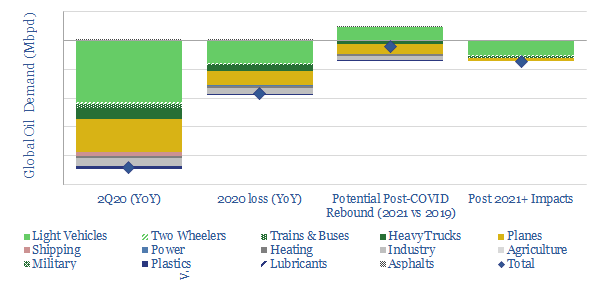

COVID-19 Impacts on Global Oil Demand?

Global oil demand could decline -22Mbpd YoY in 2Q20, due to COVID-19, with losses averaging 9-12 Mbpd across 2020. Our model looks line-by-line around the global oil market, to help you stress-test your own scenarios under different input assumptions.

-

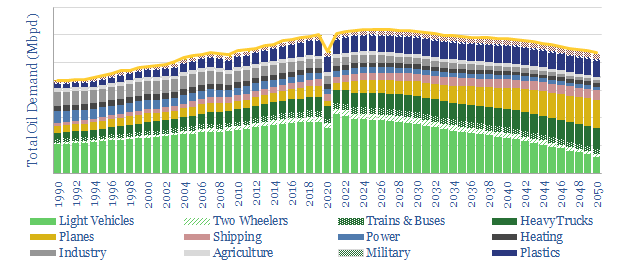

On the road: long-run oil demand after COVID-19?

Another devastating impact of COVID-19 may still lie ahead: a 1-2Mbpd upwards jolt in global oil demand. This 17-page note upgrades our 2022-30 oil demand forecasts by 1-2Mbpd above our pre-COVID forecasts. The increase is from road fuels, reflecting lower mass transit, lower load factors and resultant traffic congestion.

-

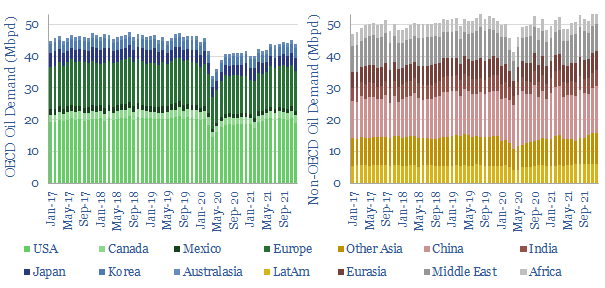

Global oil demand: rumors of my death?

‘Rumors of my death have been greatly exaggerated’. Mark Twain’s quote also applies to global oil consumption. This note aggregates demand data for 8 oil products and 120 countries over the COVID pandemic. We see 3.5Mbpd of pent-up demand ‘upside’, acting as a floor on medium-term oil prices.

-

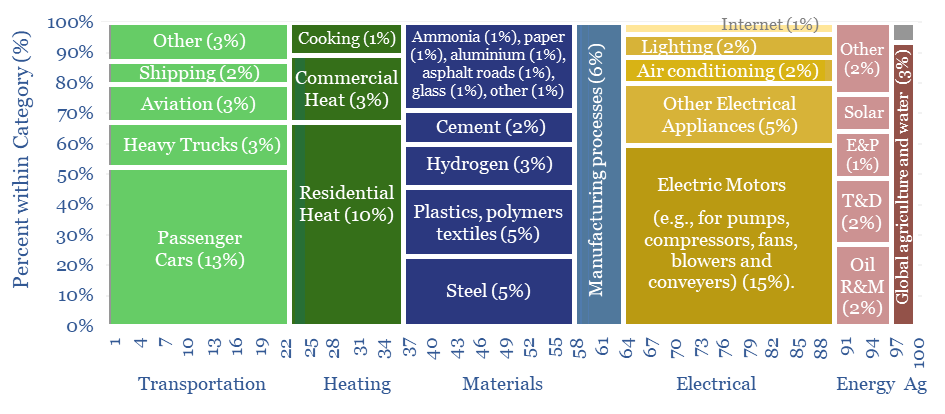

Global energy demand: nervous breakdown?

We have attempted a detailed breakdown of global energy demand across 50 categories, to identify emerging opportunities in the energy transition, and suggesting upside to energy demand forecasts? This 12-page note sets out our conclusions and is intended a useful reference.

-

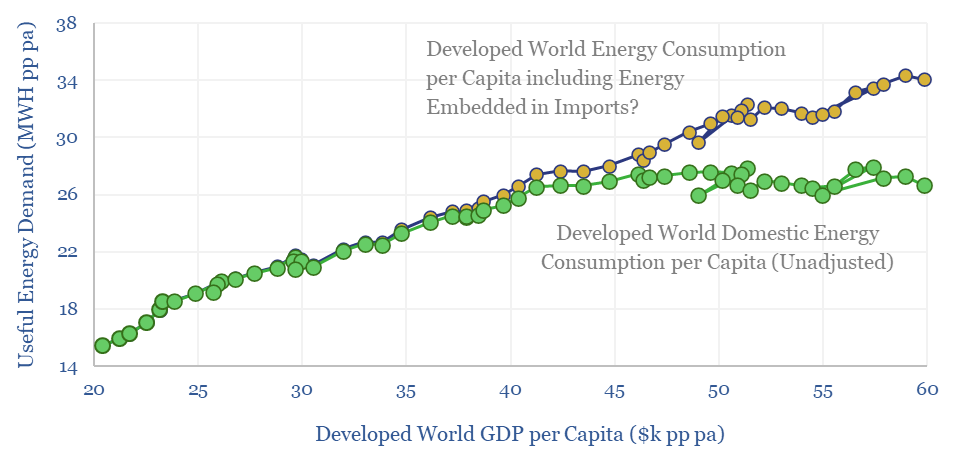

Global energy demand: false ceiling?

Wealthier countries’ energy use has historically slowed, then plateaued after reaching $40k of GDP per capita. Could this effect cause global energy demand to disappoint? This 15-page report argues it is unlikely. Adjust for the energy intensity of manufacturing and imports, and energy use continues rising with incomes.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)