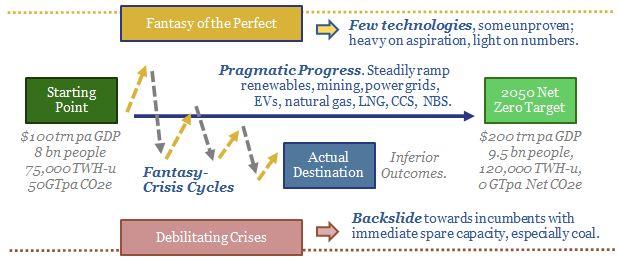

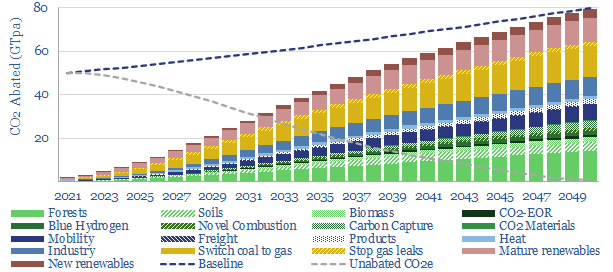

This 14-page note explores an alternative framework for energy transition: what if the fantasy of perfect energy consistently de-rails good pragmatic progress; then the world back-slides to high-carbon energy amidst crises? We need to explore this scenario, as it yields very different outcomes, winners and losers compared with our roadmap to net zero.

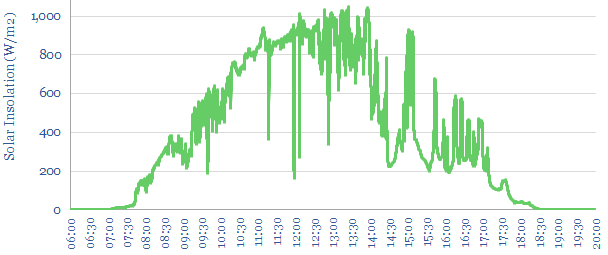

Energy transition fantasy crisis. New energies are amazing. But their future ramp-up creates uncertainties that will naturally deter investment. If future technologies are going to be close to perfect – low-cost, clean, abundant, practical – then why invest in anything less than perfect? The paradox is that under-investment in energy amplifies the risks of crises. And during a crisis, priorities shift. The goal is simply to end the crisis. Quickly. Even if it means backsliding towards higher-carbon energy. This is what we call a ‘fantasy crisis cycle’. The logic of this framework is explained on pages 2-3.

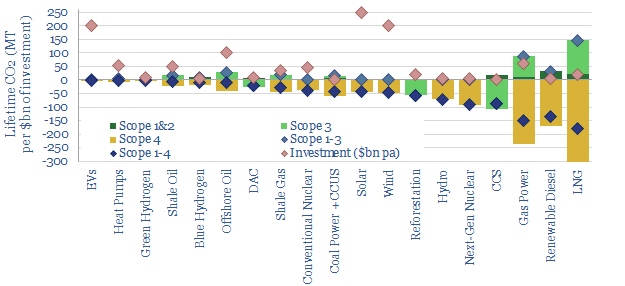

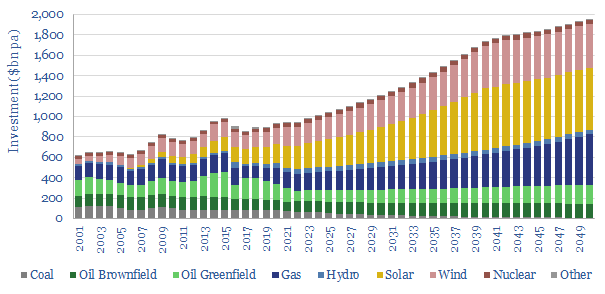

Pragmatism unravelled? Real world projects and technologies are almost always less than perfect. Thus they will tend to get overlooked when perfection is the standard. And they take a long time to construct, which means that they cannot help resolve crises. Thus we think that energy transition fantasy crisis cycles are going to lead to lower deployment of most of the pragmatic investments needed in our roadmap to net zero. Seven main categories and examples are noted on pages 4-5.

How to avoid energy transition fantasies? The thing about perfection is that it is easy to imagine and difficult to deliver. We suggest some criteria to identify fantasy thinking, and risk future technologies appropriately, on pages 6-7.

Any port in a storm? If we do not invest enough in energy and materials, then we will have shortages of energy and materials, and the most likely result is a series of crises. Crises and their implications are discussed on pages 8-9.

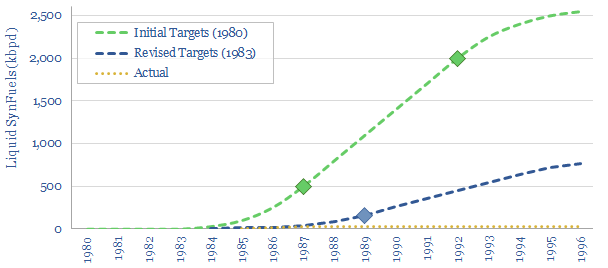

Fantasy crisis cycles. Case studies are presented of prior fantasy crisis cycles in energy industry history, going back to the 1950s, and running through to the present day, on pages 10-11.

Winners and losers? Nobody fares well in a crisis, in absolute terms. But some industries fare materially better in relative terms, especially relative to expectations during the fantasy phase, and relative to our usual roadmap to net zero. The outlook for large companies, large incumbents, especially coal producers, gets discussed on pages 12-14.