Electric vehicles are a world-changing technology, 2-6x more efficient than ICEs, but how quickly will they ramp up to re-shape global oil demand? This 14-page note presents our electric vehicle outlook and finds surprising ‘stickiness’. Even as EV sales explode to 200M units by 2050 (2x all-time peak ICE sales), the global ICE fleet may only fall by 40%. Will LT oil demand surprise to the upside or downside?

Global oil demand is seen plateauing at 103Mbpd through 2030, then declining to 85Mbpd as part of our roadmap to net zero, including a 65% reduction in light vehicle demand, from c40Mbpd to c15Mbpd. But what EV sales and ICE retirements are actually likely? (page 2).

Most of the technologies we have followed over the past five-years have gained traction more slowly than we might have naively expected, as discussed in our recent research note here, but we do see EVs ramping quickly and changing the world (page 3).

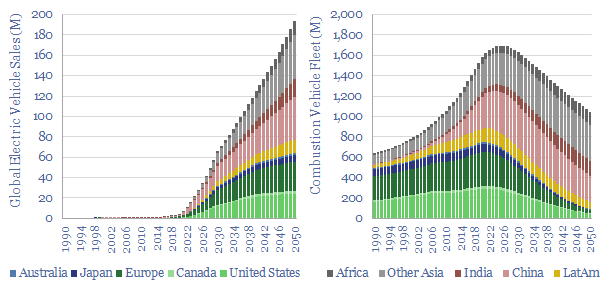

Today’s global vehicle fleet consists of 1.7bn light vehicles, as captured in our new model of global vehicle sales by region. Definitions and modelling assumptions are set out on pages 4-7.

Our base case model suggests that combustion vehicle sales already peaked at 94M in 2017 and fall two-thirds by 2050, while electric vehicle sales ramp to 65M in 2030 and almost 200M in 2050. As a result, the EV fleet overtakes the ICE fleet in 2043, while the ICE fleet peaks in 2026 and declines by 40% to 1bn combustion vehicles by 2050 (page 8).

Is this realistic? We think that these numbers are extremely generous to EVs, extremely harsh on ICEs, and if we had to guess, ICEs will surprise to the upside. Sensitivities and controversies are reviewed on pages 9-13.

Our electric vehicle outlook also requires overcoming bottlenecks in lithium, fluorinated polymers, battery-grade nickel, graphite, copper, Rare Earth Metals and SiC. Mechanically, you can also multiply the number of vehicles discussed in this note by the material balances in our battery models.

Our main conclusion from the modelling exercise in this research note is that even after moving Heaven and Earth to ramp up electric vehicle sales to 200M units per year by 2050, the world’s fleet of combustion vehicles will be surprisingly sticky. The value and opportunity for incumbent companies is also surprisingly sticky (page 14).