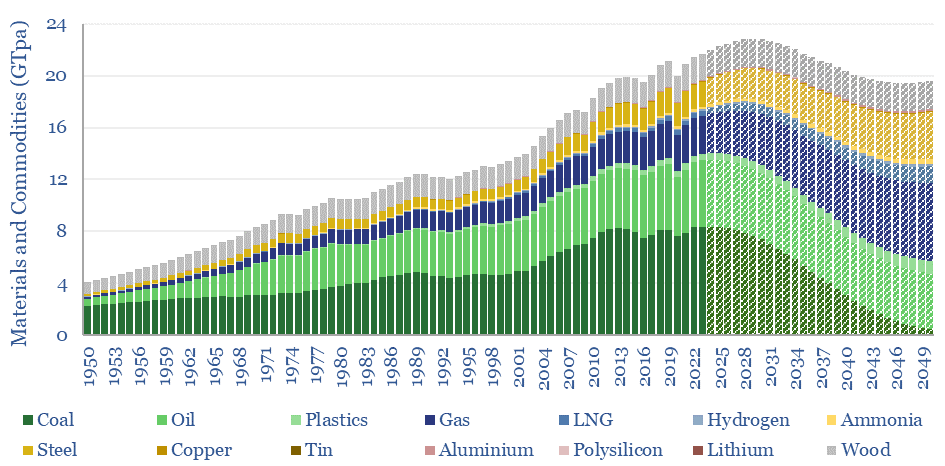

This 15-page note evaluates 10 commodity disruptions since the Stone Age. Peak demand for commodities is just possible, in total tonnage terms, as part of the energy transition. But it is historically unprecedented. And our plateau in tonnage terms is a doubling in value terms, a kingmaker for gas, plastics and materials. 30 major commodities are reviewed.

Confessions of a technology analyst. Over the past five years, we have been guilty of blurring the normative and the predictive. What we would like to happen from a moral, ideological and environmental perspective, is not necessarily what will happen.

This 15-page report is about evaluating past evidence of commodity disruptions, and making sober predictions. Examples of peak demand in abundant global commodities are surprisingly hard to find.

The Iron Age officially ended in AD43 when the Romans brought new technology to Britannia, yet global iron/steel demand remains at an all-time high of 2GTpa and rises another 80% by 2050.

The Bronze Age ended in 1,000 BC, yet global demand for copper and tin are still making new highs, and likely double again by 2050.

The Stone Age ended in 3,000 BC, yet stony concrete and coal, remain the #1 and #2 materials in the world, at >30GTpa and 8GTpa.

Where commodities have peaked it is often for good reason. Smelly and barbaric whale oil was 20x more expensive than rock oil. Asbestos is carcinogenic, yet has only seen demand fall by 75% in the past 50-years.

Statistics like these, elaborated on pages 2-9 of the report, make it seem unlikely that three of the largest commodity markets in the world by tonnage – coal, oil and gas – will all fall by over 80% within just 25-years.

The stickiness of commodity demand is explained on pages 10-12, including the most striking facts on global energy inequality, rebound effects and the need for substitutes (coal only collapses if gas doubles).

Our predictions for energy commodities – total global energy, solar+wind, oil, gas and coal – are updated on pages 13-14.

Our ranked outlook for thirty of the most important material commodities in the energy transition are summarized on page 15, and the full database is available for TSE clients.