-

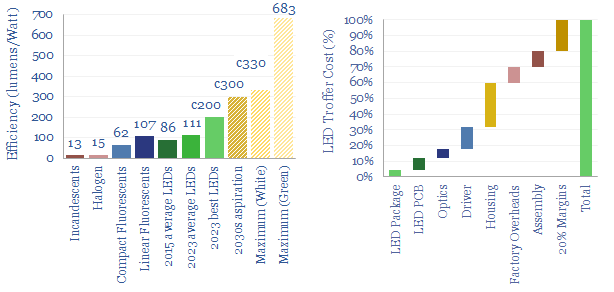

LEDs: seeing the light?

Lighting is 2% of global energy, 6% of electricity, 25% of buildings’ energy. LEDs are 2-20x more efficient than alternatives. Hence this 16-page report presents our outlook for LEDs in the energy transition. We think LED market share doubles to c100% in the 2030s, to save energy, especially in solar-heavy grids. But demand is also…

-

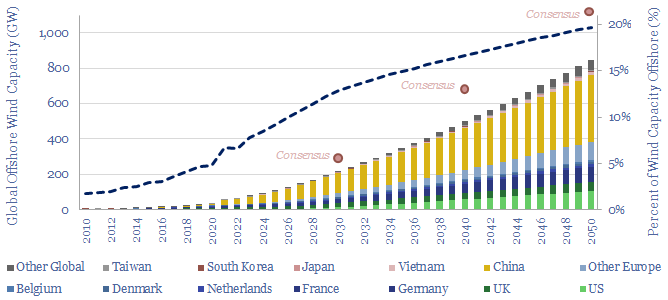

Offshore wind: the lion, the witch and the wardrobe?

This 14-page report re-visits our wind industry outlook. Our long-term forecasts are reluctantly being revised downwards by 25%, especially for offshore wind, where levelized costs have reinflated by 30% to 13c/kWh. Material costs are widely blamed. But rising rates are the greater evil. Upscaling is also stalling. What options to right this ship?

-

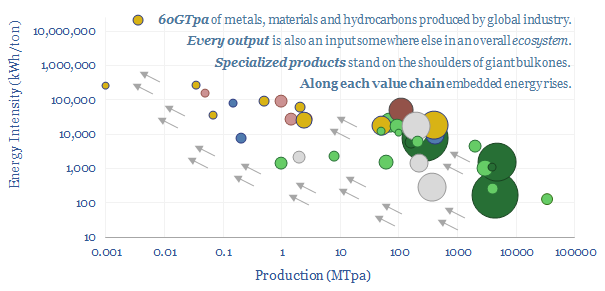

Industrial ecosystems: on the shoulders of giants?

This 14-page report explores whether global industrial activity is set to become ever more concentrated in a few advantaged locations, especially the US Gulf Coast, China and the Middle East. Industries form ecosystems. Different species cluster together. Elsewhere, you can no more re-shore a few select industries than introduce dung beetles onto the moon. These…

-

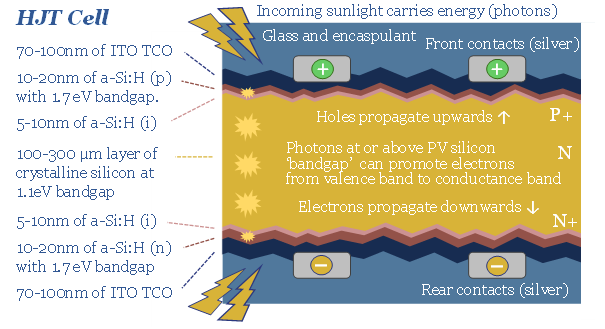

HJT solar: Indium summer?

HJT solar modules are accelerating, as they are efficient and easy to manufacture. But HJT could also be a kingmaker for Indium, used in transparent and conductive thin films (ITO). Our forecasts see primary Indium demand rising 4x by 2050. This 16-page note explores the costs and benefits of using ITO in HJTs, and who…

-

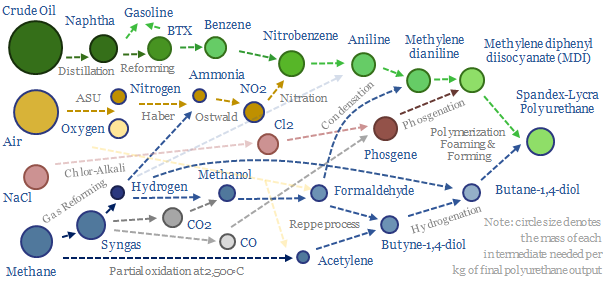

Polyurethanes: what upside in energy transition?

Polyurethanes are elastic polymers, used for insulation, electric vehicles, electronics and apparel. This $75bn pa market expands 3x by 2050. But could energy transition double historically challenging margins, by freeing up feedstock supplies? This 13-page note builds a full mass balance for the 20+ stage polyurethane value chain and screens 20 listed companies.

-

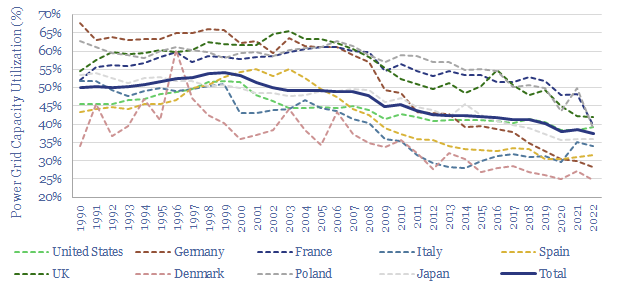

Renewables: the levelized cost paradox?

There is an economic paradox where shifting towards lower cost supply sources can cause inflation in the total costs of supply. Renewable-heavy grids are subject to this paradox, as they have high fixed costs and falling utilization. As power prices rise, there are growing incentives for self-generation. Energy transition requires a balanced, pragmatic approach.

-

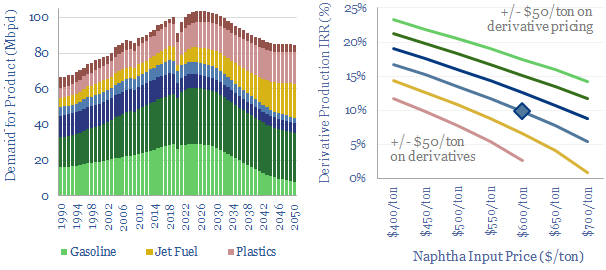

Crude to chemicals: there will be naphtha?

Oil markets are transitioning, with electric vehicles displacing 20Mbpd of gasoline by 2050, while petrochemical demand rises by almost 10Mbpd. So it is often said oil refiners should ‘become chemicals companies’. It depends. This 18-page report charts petrochemical pathways and sees opportunity in chemicals that can absorb surplus BTX.

-

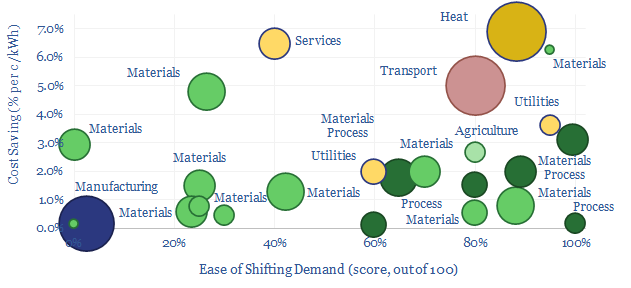

Smooth operators: who benefits from volatile power grids?

Some industries can absorb low-cost electricity when renewables are over-generating and avoid high-cost electricity when they are under-generating. The net result can lower electricity costs by 2-3c/kWh and uplift ROCEs by 5-15% in increasingly renewables-heavy grids. This 14-page note ranges over 10,000 demand shifting opportunities, to identify who can benefit most.

-

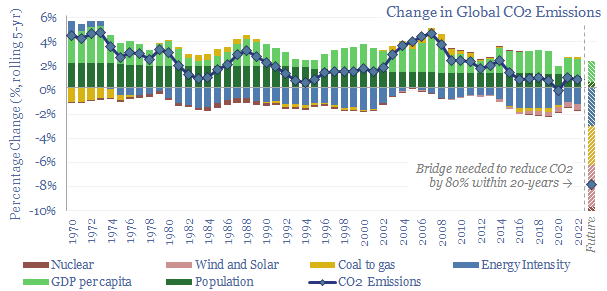

Global decarbonization: speeding up or slowing down?

This 16-page report breaks down global CO2 emissions, across six causal factors and 28 countries-regions. Global emissions rose at +0.7% pa in 2017-22, unchanged on 2012-17, even as global income growth slowed by -0.5% pa. Depressing. The biggest reason is underinvestment in gas. Reaching net zero requires vast acceleration in renewables, infrastructure, nuclear, gas and…

-

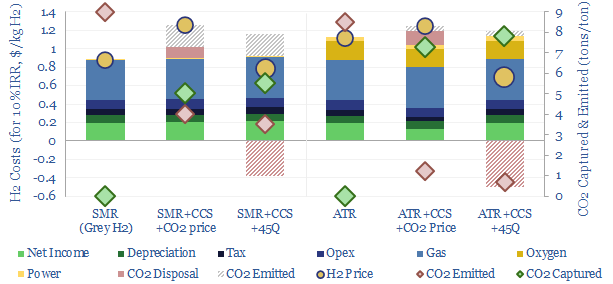

Hydrogen reformers: SMR versus ATR?

Blue hydrogen value chains are gaining momentum. Especially in the US. So this 16-page note contrasts steam-methane reforming (SMR) versus autothermal reforming (ATR). Each has merits and challenges. ATR looks excellent for clean ammonia. While the IRA creates CCS upside for today’s SMR incumbents, across industrial gases, refining and chemicals.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)