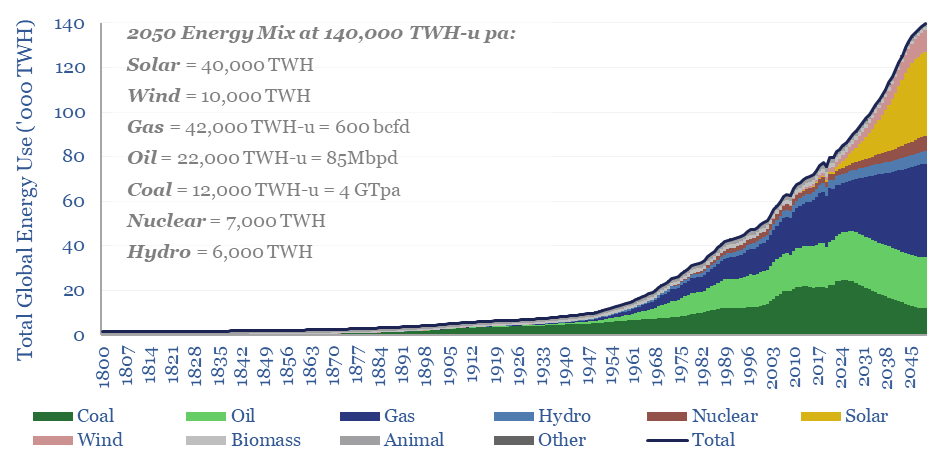

This 15-page note outlines the largest changes to our long-term energy forecasts in five years. Over this time, we have consistently underestimated both coal and solar. So both are upgraded. But we also show how coal can peak after 2030, based on cost factors alone. Global gas is seen rising from 400bcfd in 2023 to 600bcfd in 2050.

Peak coal demand is a necessity for net zero scenarios. But it is an embarrassment for net zero modelers.

Our own numbers from 2022, for example, hoped global coal would peak at 8.2 GTpa in that year, run sideways for 1-2 years, then fall off a cliff by 2050. Yet global coal use hit 8.8GTpa in 2024, and has been revised upwards in five of the past six years (page 2).

There is a famous Albert Einstein quote about how insanity is doing the same thing over and over again and expecting different results. Thus, it is starting to feel insane to us, that every year, we update our models, smudge up prior year coal consumption in China and India, then insouciantly claim this year must be the year these countries will decide to stomach $50-80/ton CO2 abatement costs for gas switching (page 3).

Hence this 15-page note has followed some sober reflection in December-2024, as we updated all our energy supply-demand models for the past year. As a result, we are making some of the largest changes in our energy models since starting TSE, with materially more coal and solar in the long-term mix. But global coal use really and truly can peak.

How coal can peak is that coal costs will rise, solar costs will fall and eventually gas will be more competitive than coal for backing up the solar. The rising cost structure of China’s listed coal producers and broader coal-mining industry is shown on pages 4-6.

Solar capacity additions are the other line item in global energy balances that have consistently been upgraded, with every year’s trajectory seeming to defy even the most bullish forecasts from the previous year, for a decade. Hence this note contains large upgrades to our solar forecasts, which unlock fascinating new global energy demand, as shown on pages 7-9.

The key chart in this note is on page 10, which contrasts electricity costs in Asia from 2008 to 2050, across coal, gas and LNG. How coal can peak is that marginal solar has now deflated below marginal coal, coal costs keep rising, and from 2030, imported LNG starts to displace marginal coal in backing up the solar (see page 10).

Large updates to our global energy outlook follow. Coal demand does peak, but our 2050 coal forecasts are revised sharply upwards, especially in China’s energy supply-demand mix. Our forecasts for global electricity supply-demand and solar are also revised sharply upwards. Global gas supply-demand is still seen rising by 50% to 600bcfd by 2050. Key charts are on pages 11-15.

The note also dovetails with our top ten predictions for 2025.