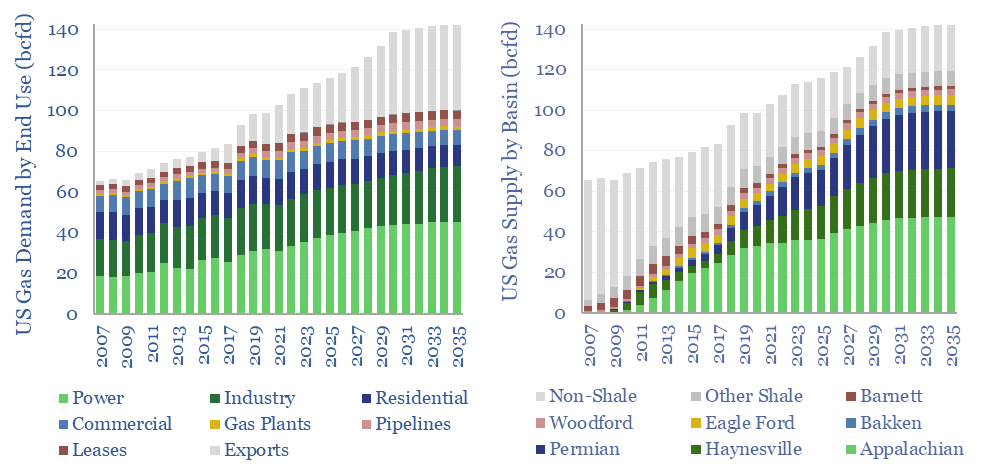

Modeling US gas supply and demand can be nightmarishly complex. Yet we have evaluated both, through 2035. This 13-page report outlines the largest drivers of demand, requires a +3% pa CAGR from the key US shale gas basins, and argues the balance of probabilities lies to the upside.

US gas supply-demand matters in the energy transition, in our US energy models and across the shale industry. But the forecasting can be woefully complex, as gas is the bottom of the US LCOE cost curve, and hence it acts as a balancing line.

Hence to forecast US gas consumption, first you need to forecast total US energy consumption, then you need to deduct all other sources of energy supply. Especially in the power sector. In turn, this makes gas demand for power sensitive to all of these other variables.

After five years of research, we actually have done the necessary work to forecast US gas supply and demand, based on the energy consumption of AI, electric vehicles, wind, solar, nuclear, coal phase-outs, grid bottlenecks, gas peakers, global LNG, key export markets, materials demand, reshoring, blue hydrogen, blue ammonia, blue steel, blue chemicals and CCS. It is all connected.

Our definition of US gas markets – what is included and not included in 2023’s 113bcfd market – is spelled out on page 2.

Our outlook for US gas demand in power is discussed on pages 3-5, including bridges of US electricity demand growth, the share that will come from gas, and possible upside on changes in the efficiency of the gas-fired fleet, as baseload plants run more like peakers.

Our outlook for US LNG exports is discussed on pages 6-7. Recent data show countries such as China switching diesel trucks to LNG, and there is upside to our numbers.

Our outlook for gas heating is discussed on pages 8-11. Growth in industrial gas is well underpinned. But after excluding the impacts of weather, recent data suggest a slower phase-back of residential gas heating.

Our outlook for US gas supply, to meet rising demand, is discussed on pages 12-13. It hinges on our US shale forecasts, Marcellus productivity, shale gas economic models, and most interestingly, whether an oil price pullback could pull harder on shale gas basins.

Hence the note concludes by discussing what gas prices might be needed to unlock these requisite volumes. We look forward to discussing our US gas supply-demand outlook with TSE subscription clients.