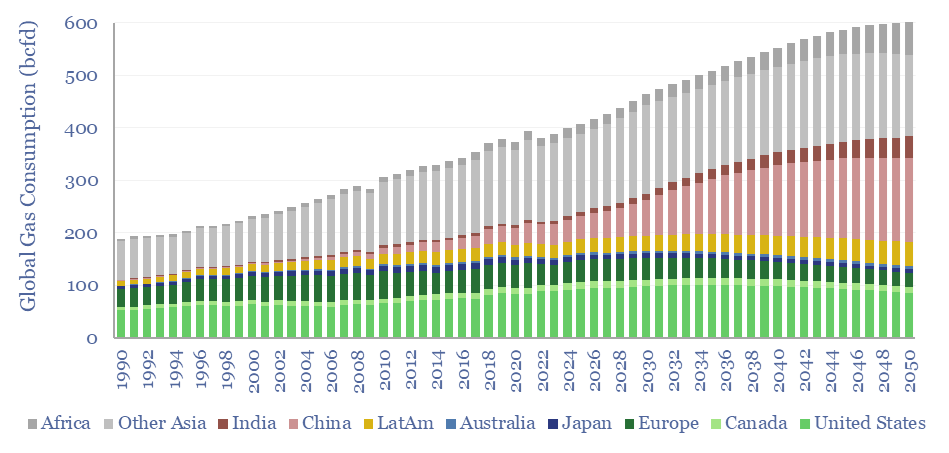

Global gas supply-demand is predicted to rise from 400bcfd in 2023 to 600bcfd by 2050, in our outlook, while achieving net zero would require ramping gas even further to 800bcfd, as a complement to wind, solar, nuclear and other low-carbon energy. This data-file quantifies global gas demand and supply by country.

Global gas production doubled in the c30 years from 1990-2019, rising at a 2.5% CAGR. The same trajectory would need to be sustained to 2050 on our long-term energy market supply-demand balances to reach net zero, while we predict the world will most likely continue growing its gas use at closer to 1.7% per year.

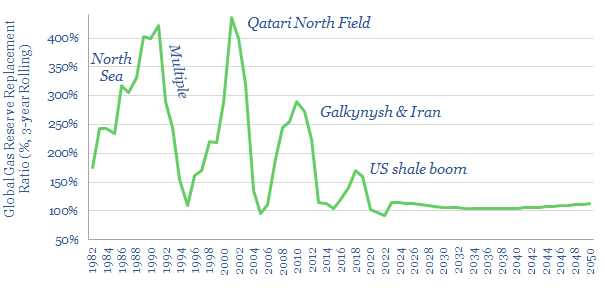

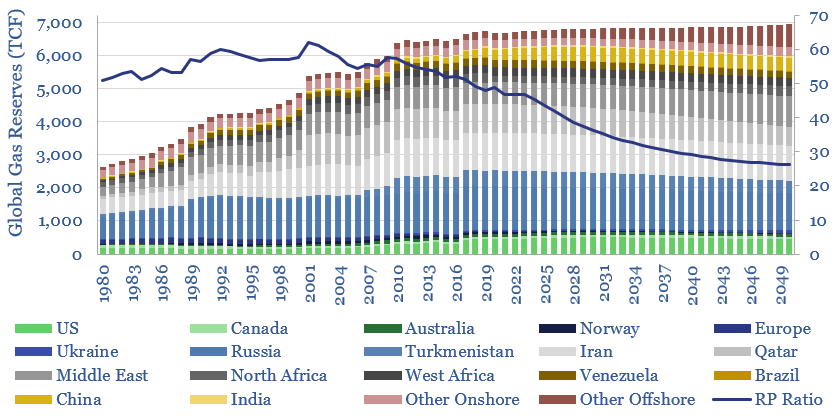

Amazingly, from 1990-2019, global gas reserves increased from 4,000 TCF to 7,000 TCF, for a reserve replacement ratio of 190%, although the numbers have been cyclical and have fallen below 100% in recent years (chart below).

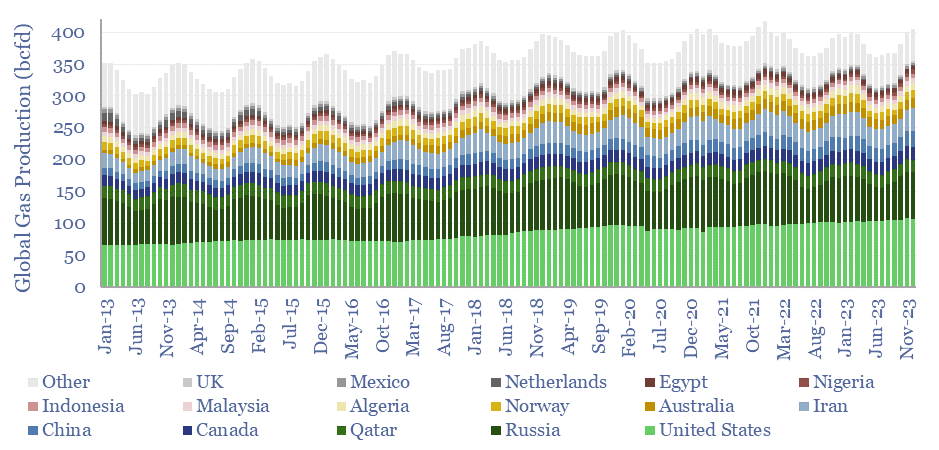

Another fascinating feature of gas markets is their flexibility, shown by plotting monthly gas production by country over time (chart below). In the Northern Hemisphere, production runs 6% higher than the annual average in December-January and 6% lower than average in June-August, as producers consciously flex their output to meet fluctuations in demand. Gas output does not show volatility, but voluntarity!

On our numbers through 2050, a reserve replacement ratio of 95% is needed, while the ‘reserve life’ (RP ratio) will likely also decline from around 45-years today to 30-years in 2050. Please download the data-file for reserve numbers and production numbers by country.

Onshore resource extensions are seen primarily coming from shale, with continued upside in the US, and vast new potential in the Middle East, North Africa and possibly even European shale as a way of replacing Russian gas.

Global gas consumption by region and over time is also estimated in the data-file, flatlining at 150bcfd in the developed world, but rising by 2x in the emerging world, with the largest gains needed in China, India and other Asia (chart below).

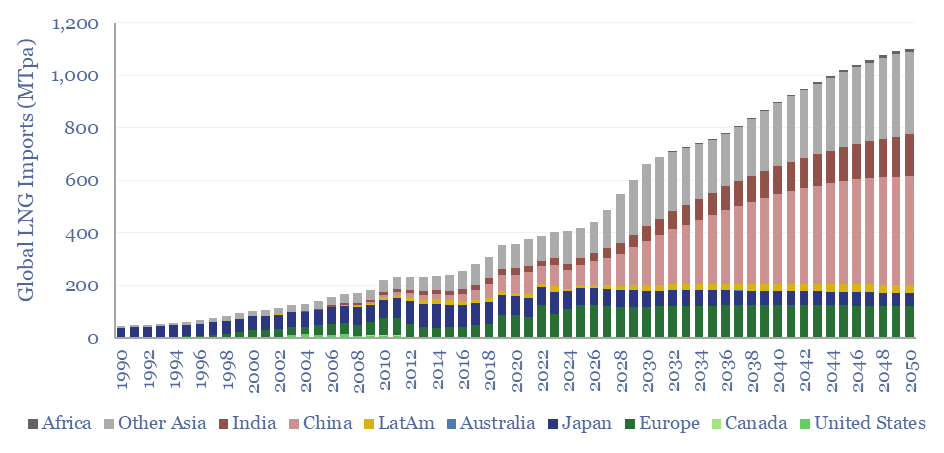

Global LNG demand would almost need to treble to meet this ramp-up, linking to our model of global LNG supplies. Within today’s LNG market, 25% flows to Europe, 20% to Japan, and 55% to the emerging world. By 2050, the emerging world would be attracting 80% of global LNG cargoes, with the largest growth in China and India.

Our best guesses for how a doubling of global gas production might unfold is captured in this model of global gas forecasts by country/region. On the other hand, there is no guarantee that coal-to-gas switching will occur on the needed scale for global decarbonization, especially as 2023/24 has seen emerging world countries (India, China) ramping coal instead for energy security reasons.