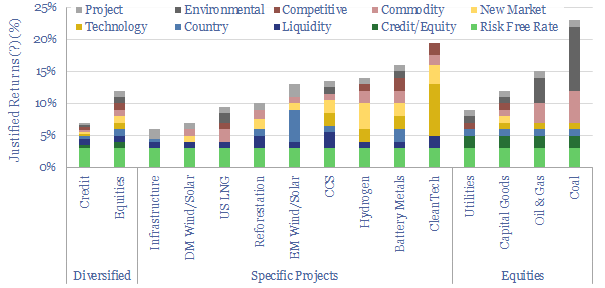

Investing involves being paid to take risk. And we think energy transition investing involves being paid to take ten distinct risks, which determine justified returns. This note argues that investors should consider these risk premia, which ones they will seek out, and which ones they will avoid.

Investment strategies for a fast-evolving energy transition?

Thunder Said Energy is a research firm focused on energy technologies and energy transition. Over the past 4-years, we have published over 1,000 research notes, data-files and models, to help our clients appraise different opportunities in the energy transition, across new energies, hydrocarbons and industrial decarbonization.

Energy transition is evolving very quickly. This means that many investors are continually iterating their investment strategies, stepping into new themes/sectors as they emerge, and candidly, it also means that many risks are mis-priced.

Hence we think it is helpful to consider risk premia. Which risk premia are you getting paid to take? Are you getting paid enough? Or worse, are you exposed to risk for which you are not getting paid at all?

Energy Transition: ten risk premia?

We think there are ten risk factors, or risk premia, that determine the justified returns for energy transition investing. Sweeping statements about the global energy system are almost always over-generalizations that turn out to be wrong. Nevertheless, we will make some observations, as we define each risk factor below.

(1) Risk free rate. The risk free rate is a baseline. It is the return available with almost no risk, when investing in cash deposits and medium-term Treasuries. Our perspective is that many technologies in the energy transition will be inflationary. They will stoke inflationary feedback loops. And in turn inflation puts upwards pressure on the risk free rate. Thus rising rates should raise the bar on allocating capital across the board and investors should consider how they are being compensated. Our favorite note on this topic is here.

(2) Credit/equity risk. This risk premium compensates decision makers for the risk of capital loss inherent in owning the debt and equity of companies. It might vary from sub-1% in the senior secured credit of highly creditworthy companies, through to a c3-5% equity risk premium, and c5-10% for smaller/private companies? Our perspective is that there is great enthusiasm to invest in the energy transition. This means credit/equity risk premia for some of the most obvious energy transition stocks may be compressed. But energy transition is also going to pull on many adjacent value chains, which have non-obvious exposure to the energy transition, while their risk premia have not yet compressed. So we think it is a legitimate investment strategy to target “non-obvious” exposure to the energy transition. Our favorite note on this topic is here.

(3) Project risk. Energy transition is the world’s greatest building project. But over 90% of all construction projects take longer than expected, or cost more than expected, and the average over-run is 60%. Opportunities with more of their future value exposed to delivering large projects have higher project risk. Infrastructure investors can happily stomach 5-10% total returns as they accept project risk. This might include building out power grids, pipelines, fiber-optic cables, and PPA-backstopped wind and solar. And thus another legitimate strategy in the energy transition investing is to get paid for appraising and defraying project risks; get paid for the ability to execute projects well.

(4) Liquidity risk. This premium compensates investors against the possible inability to withdraw capital in a liquidity crunch. It is clearly higher for small private companies than publicly listed large-caps. Energy transition sub-sectors that might debatably warrant higher liquidity premia are CCS projects (50-year monitoring requirements after disposal), reforestation projects (40-100 year rotations for CO2 credit issuance) and infrastructure with very long construction times. A legitimate strategy for endowments and pension funds in the energy transition hinges on their large size and longevity, which allows them to withstand greater liquidity risk than other groups of investors. Another legitimate strategy is to earn higher returns by taking higher liquidity risk, building up a portfolio of privately owned companies with exposure to the energy transition, rather than investing in public companies that will tend to have lower liquidity risk premia.

(5) Country risk. This premium compensates investors against deteriorating economic conditions, tax-rises, regulatory penalties or cash flow losses in specific countries. This is becoming relevant for wind and solar, as many investors are increasingly willing to take country risk to achieve higher hurdle rates, and given the vast spread in different countries’ power prices and grid CO2 intensities (chart below). It is no good if only a few countries globally decarbonize. Net zero is a global ambition. And so another very legitimate strategy in the energy transition is to specialize in particular countries, where those country risks can be managed and defrayed, while driving energy transition there.

(6) Technology risk. This risk premium compensates investors for early stage technologies not working as intended, or suffering delays in commercialization, which derail the delivery of future cash flows. One observation in our research has been that some technologies at first glance seem to be mature, but on closer inspection still have material technology risks (such as green hydrogen electrolysers, post-combustion CCS). But technology risk is interesting for two reasons. First, we think that investors can command some of the highest risk premia (i.e., highest expected returns) for taking technology risk, compared to other risk premia on our list. Second, appraising technology risk is a genuine skill, possessed by some investors, a font at the wellspring of “alpha”. We enjoy appraising technology risk by reviewing patents (see below).

(7) New market risk. This risk premium compensates investors for immature markets. For example, if you produce clean ammonia, then you can sell it into existing ammonia fertilizer markets which does not carry any new market risk; or you can sell it as a clean fuel to decarbonize the shipping industry, which involves persuading the shipping industry to iron out ammonia engines, despite challenging combustion properties, prevent NOx emissions, and retrofit existing bulk carriers and container ships, which clearly does carry new market risk. Another interesting example is that in geographies with high renewables penetration, there may be some hidden market risk in reaching ever-higher renewables penetration? Our personal perspective is that new market risk is the most ‘uncompensated’ risk in the energy transition. It is pervasive across many new energies categories, many investors are exposed to this risk, and yet they are not paid for it. Although maybe another legitimate strategy in the energy transition is to collect new market risk premia while helping to create new markets?

(8) Competition risk. This risk premium compensates against unexpected losses of market share and cash generation due to new and emerging competition. It also includes the risk of your technology “getting disrupted” by a new entrant. Across our research, the area that most comes to mind is in batteries. There is always a headline swirling somewhere about a disruptive battery breakthrough that will crater demand for some incumbent material. Arguably, competition risk goes hand in hand with technology risk and new market risk. It is not enough to develop a technology that is 20% better than the incumbent if someone else develops a technology that is 40% better. Again, we think investors may not get compensated fairly for taking competition risk, while excess returns may accrue to investors that can appraise this risk well.

(9) Commodity risk. This risk premium compensates investors for the inherent volatility of commodity markets, which can have deleterious effects on valuations, liquidity, solvency, sanity (!). Consider that within the past five years, oil prices started at $80/bbl, collapsed into negative territory in Apr-2020, then recovered above $120/bbl in mid-2022. Our work has progressively gone deeper into cleaner hydrocarbons, metals, materials. Our energy transition roadmap contains bottlenecks where total global demand must rise by 3-30x. Yet our perspective is that many investors are reluctant to take commodity risk. Stated another way, commodity risk can be well-compensated. If you have the mental resiliency to ride this roller-coaster.

(10) Environmental risk. This risk premium compensates investors against tightening environmental standards, deteriorating environmental acceptance or regulations that lower future cash generation, especially in CO2 emitting value chains. It is sometimes called “stranded asset risk”. The most obvious example is investing in coal, where investors can get paid c10% dividend yields to own some of these incumbents. Our perspective is that environmental risk premia blew out to very high levels in 2019-2021, and they still remain high, especially if you believe that an era of energy shortages lies ahead (note below). Another perspective is that it feels “easier” to get paid a 5-10% environment risk in an insurance policy against future energy shortages, than to earn a 5-10% risk premium by doing the due diligence on a new and emerging technology? And finally, it is a legitimate strategy in the energy transition to own higher-carbon businesses, then improve their environmental performance, so that the market will reward these companies with lower environmental risk premia.

Economic models: moving beyond 10% hurdle rates?

We have constructed over 160 economic models of specific value chains, in new energies and in decarbonizing industries. Usually, we levy a 10% hurdle rate in these models, for comparability. But the justified hurdle rate should strictly depend upon energy transition risk premia discussed above.

Please contact us if we can help you appraise any particular ideas or opportunities, to discuss their justified hurdle rates, or to discuss how these risk premia align with your own energy transition investing strategy.

The very simple spreadsheet behind today’s title chart is available here, in case you want to tweak the numbers.