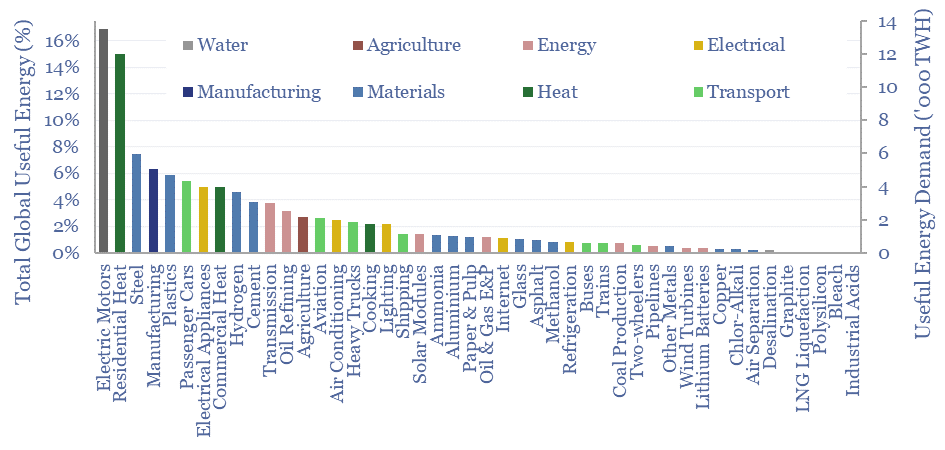

Human civilization will consume 80,000 TWH of useful energy in 2023. This is equivalent to a kitchen toaster, running 24 hours per day, 365 days per year, for every man, woman and child on the planet. 35% of global energy is used in manufacturing and materials, 30% is used in transportation and shipping, 20% is used in homes as heat and electricity, and 15% is used in providing commercial services. Our industry research and energy demand research focuses upon opportunities to drive the energy transition. This includes improving efficiency, lowering CO2 intensity, greater digitization, and supply chains for crucial metals and materials.

Demand

Global energy: supply-demand model?

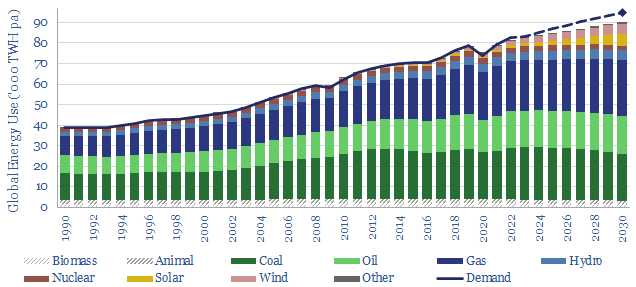

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2022-30. We fear chronic under-supply. This is masked by economic weakness in 2023, rises to 3% shortages in 2025, and 5% shortages in 2030. Numbers can be stress-tested in the model.

Download

Download

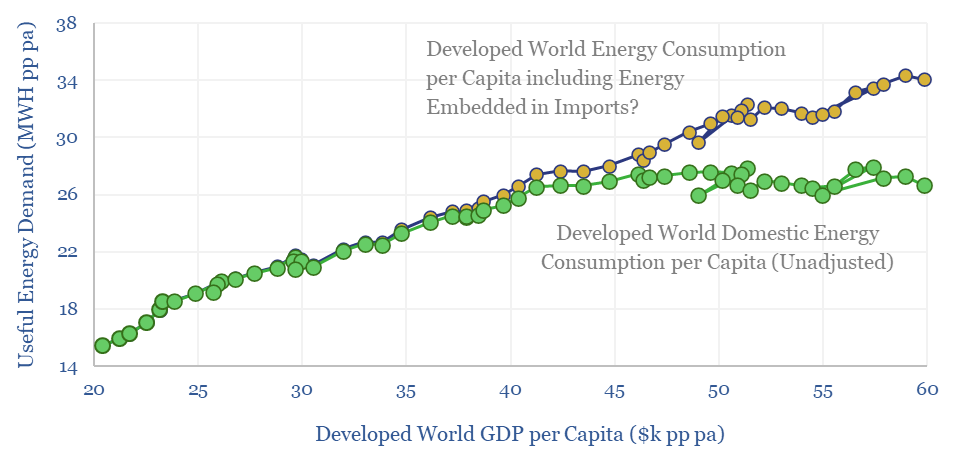

Global energy demand: false ceiling?

Wealthier countries’ energy use has historically slowed, then plateaued after reaching $40k of GDP per capita. Could this effect cause global energy demand to disappoint? This 15-page report argues it is unlikely. Adjust for the energy intensity of manufacturing and imports, and energy use continues rising with incomes.

Download

Download

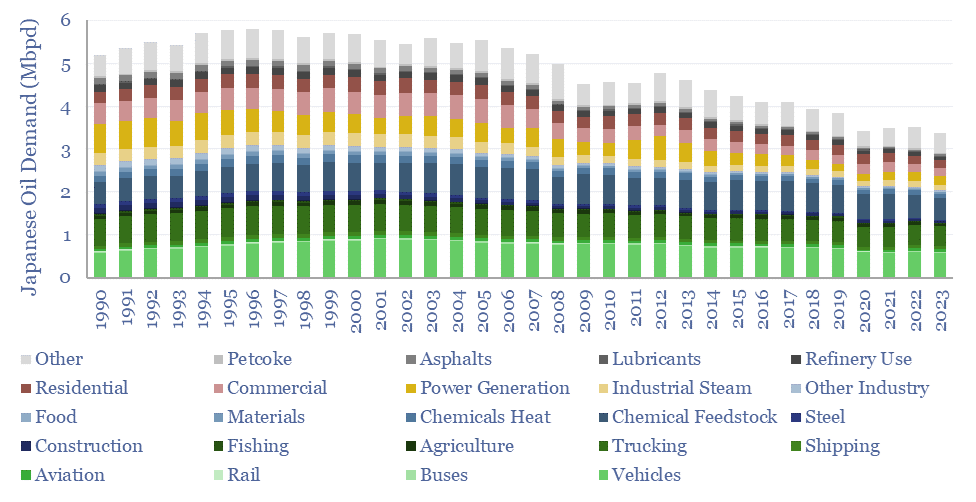

Japan oil demand: breakdown over time?

Japan’s oil demand peaked at 5.8Mbpd in 1996, and has since declined at -2.0% per year to 3.4Mbpd in 2023. To some, this trajectory may be a harbinger of events to come in broader global oil markets? While to others, Japan has unique features that do not generalize globally? Hence this report and data-file...

Download

Download

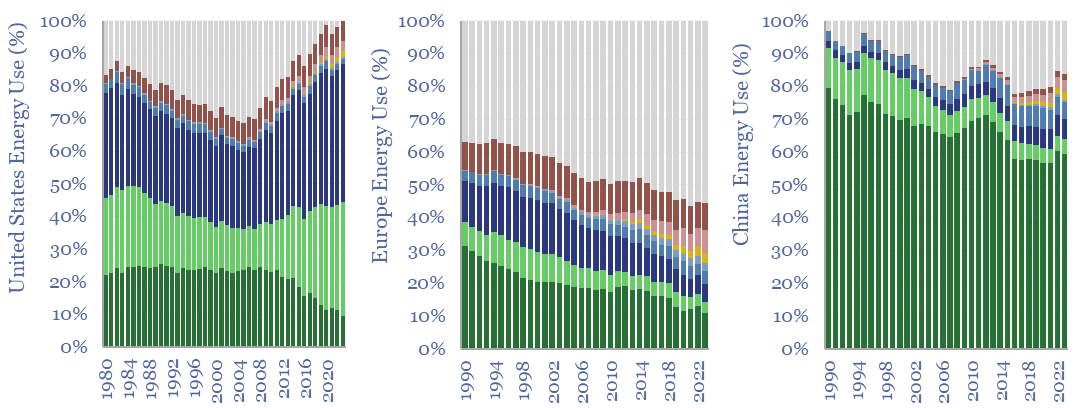

Energy security: right to self-determine?

The average major economy produces 70% of its own energy and imports the other 30%. This 12-page note explores energy self-sufficiency by country. We draw three key conclusions: into US isolationism; Europe’s survival; and the pace of EV adoption, both in China and in LNG-importing nations.

Download

Download

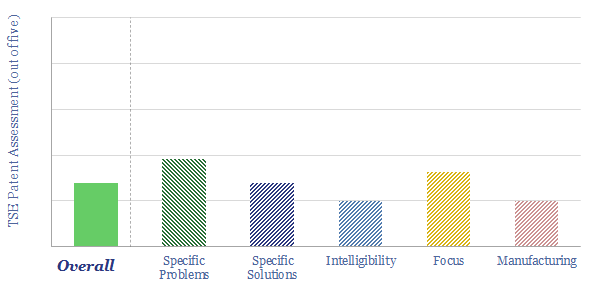

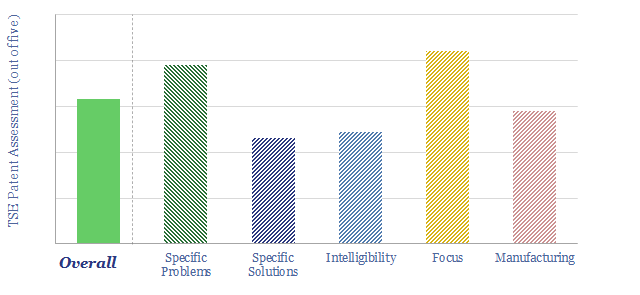

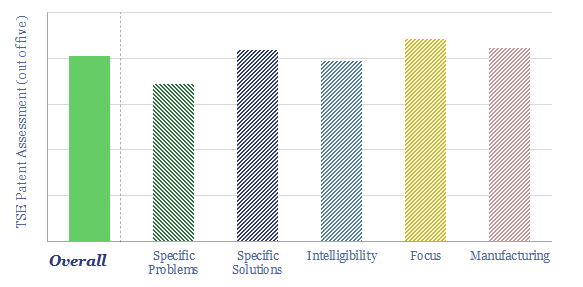

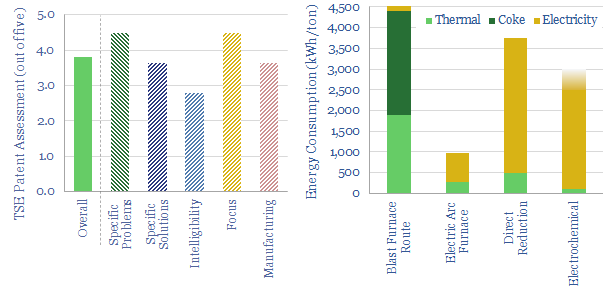

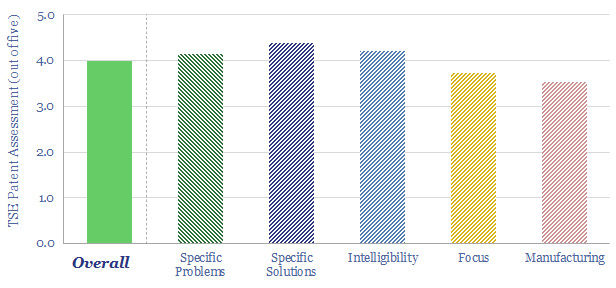

Mainspring Energy: linear generator breakthrough?

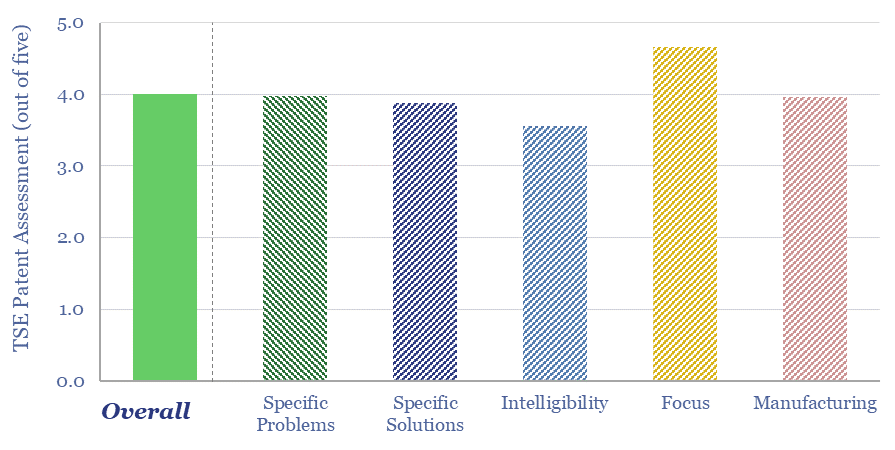

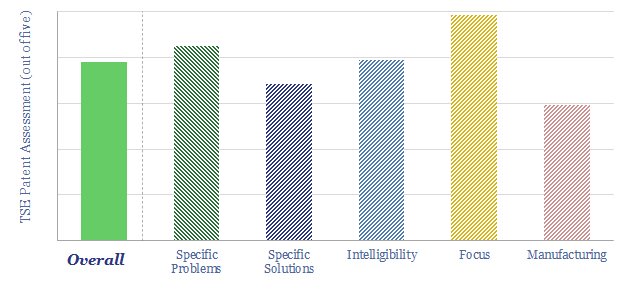

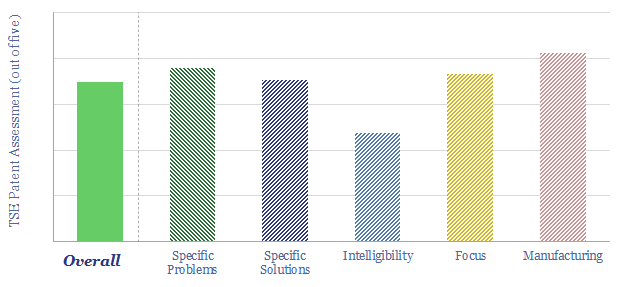

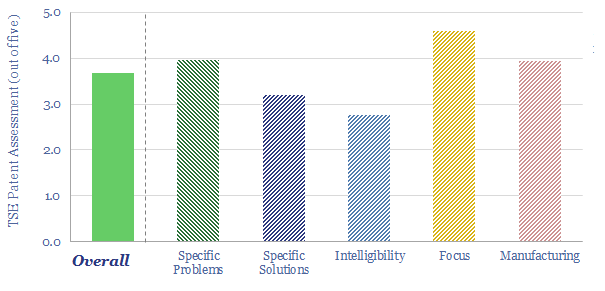

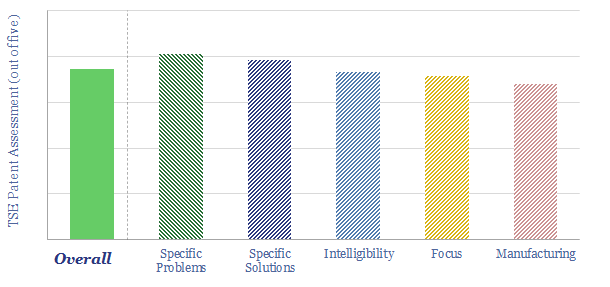

Linear generator technology can convert any gaseous fuel into electricity, with c45% electrical efficiency, and >80% efficiency in CHP mode. This data-file reviews Mainspring Energy's patents. We conclude that the company has locked up the IP for piston-seal assemblies in a linear generator with air bearings, but longevity/maintenance could be a key challenge to explore.

Download

Download

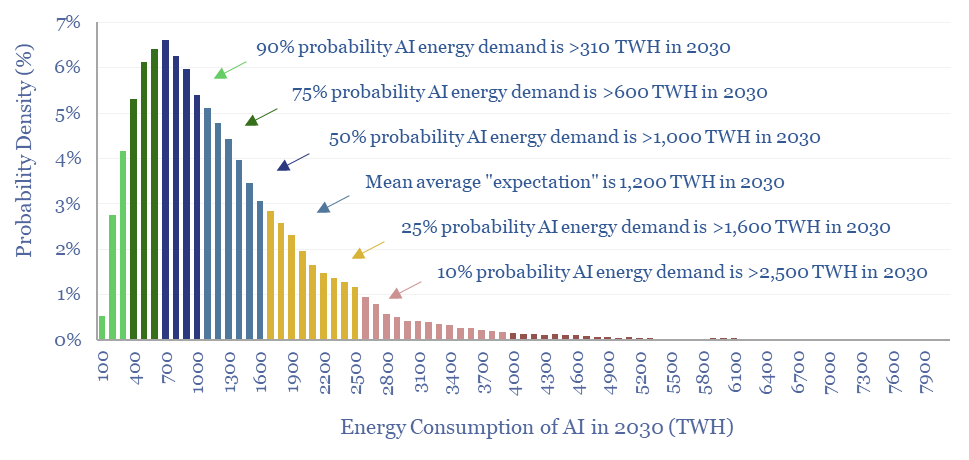

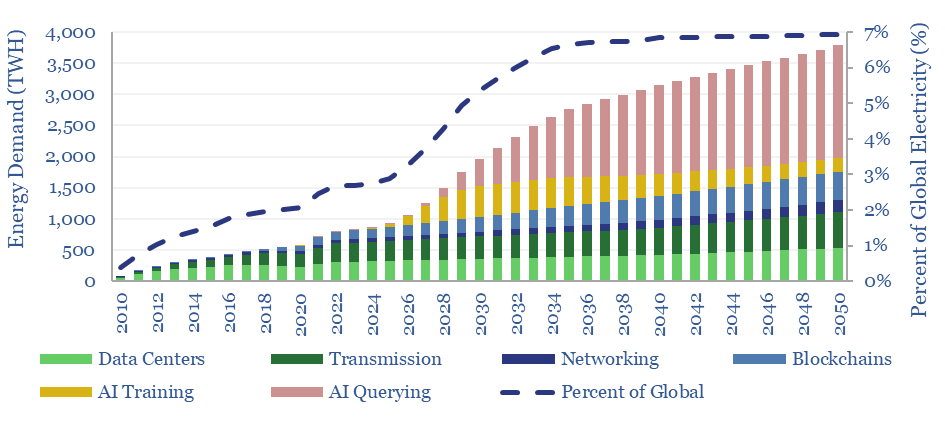

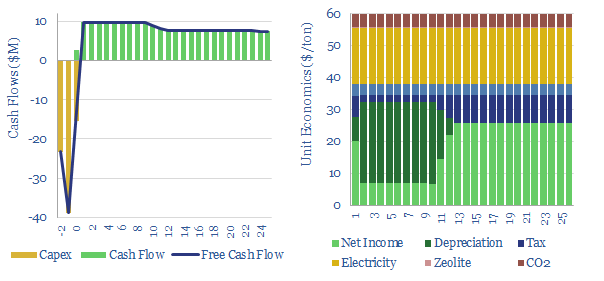

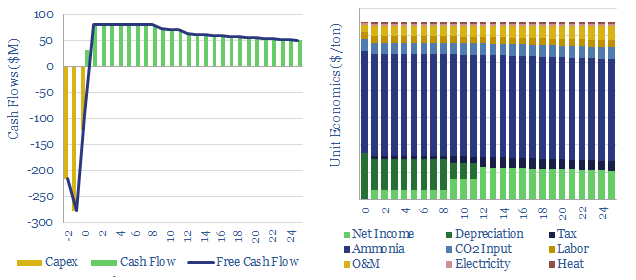

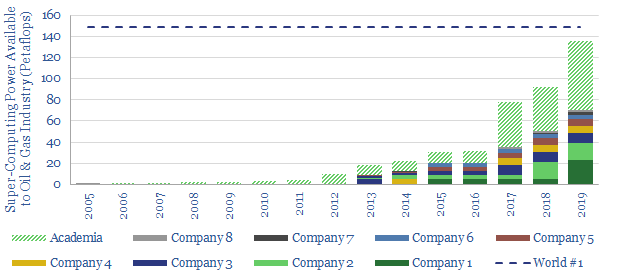

Energy intensity of AI: chomping at the bit?

Rising energy demands of AI are now the biggest uncertainty in all of global energy. To understand why, this 17-page note is an overview of AI computing from first principles, across transistors, DRAM, GPUs and deep learning. GPU efficiency will inevitably increase, but compute increases faster. AI most likely uses 300-2,500 TWH in 2030, with a base case of 1,000 TWH.

Download

Download

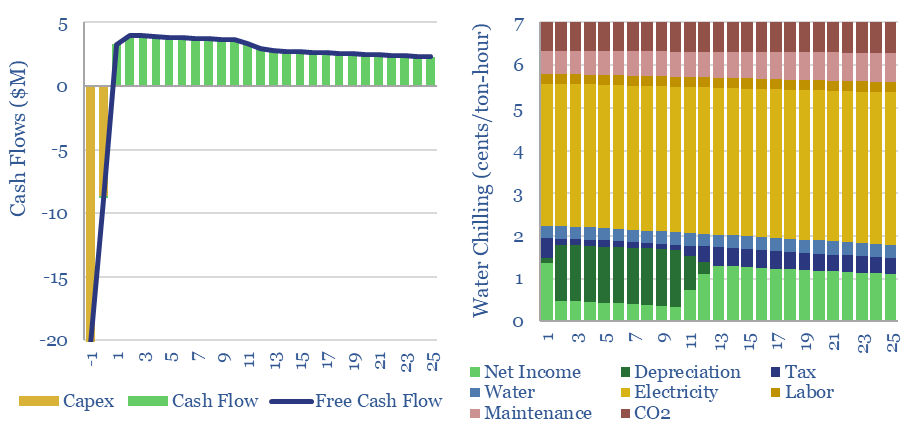

Industrial cooling: chillers and evaporators?

This data-file captures the costs of industrial cooling, especially liquid cooling using commercial HVAC equipment, across heat-exchangers, cooling tower evaporators and chillers. Our base case is that removing 100MW-th of heat has capex costs of $1,000/ton, equivalent to c$300/kW-th, expending 0.12 kWh-e of electricity per kWh-th, with a total cost of 7 c/ton-hour.

Download

Download

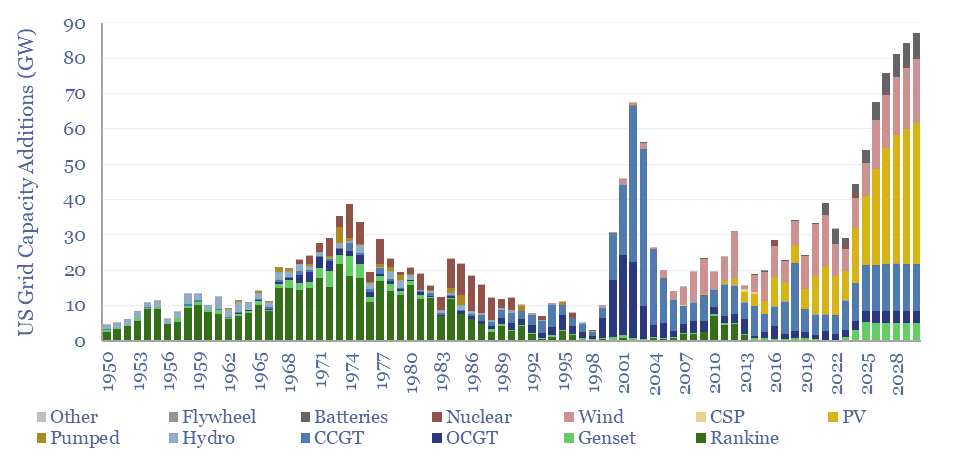

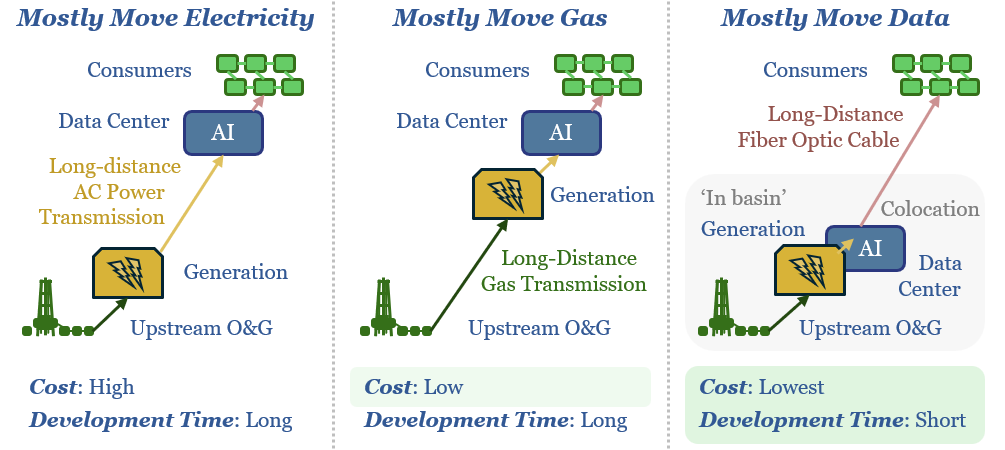

Energy and AI: the power and the glory?

The power demands of AI will contribute to the largest growth of new generation capacity in history. This 18-page note evaluates the power implications of AI data-centers. Reliability is crucial. Gas demand grows. Annual sales of CCGTs and back-up gensets in the US both rise by 2.5x? This is our most detailed AI report to date.

Download

Download

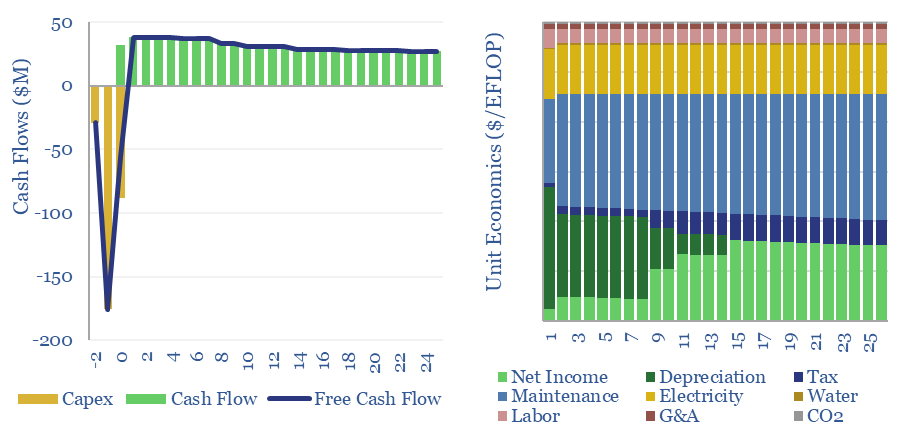

Data-centers: the economics?

The capex costs of data centers are typically $10M/MW, with opex costs dominated by maintenance (c40%), electricity (c15-25%), labor, water, G&A and other. A 30MW data-center must generate $100M of revenues for a 10% IRR, while an AI data center in 2024 may need to charge $3M/EFLOP of compute.

Download

Download

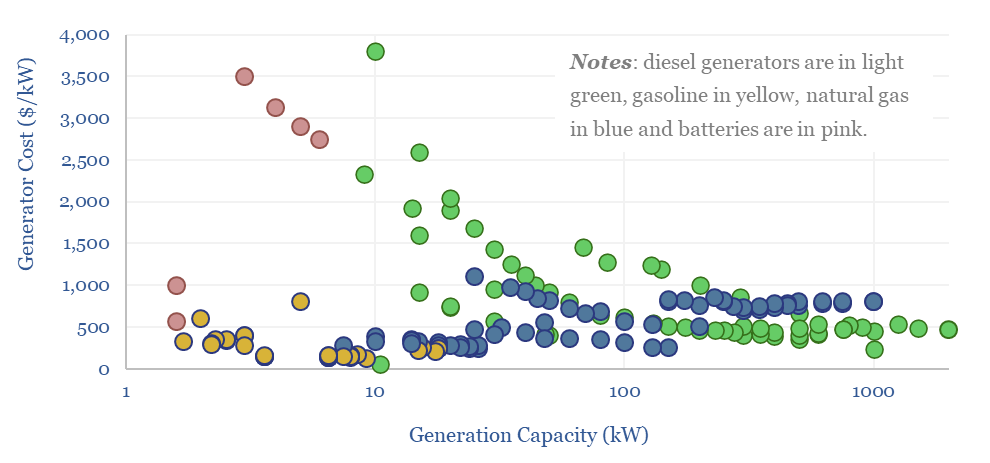

Generac: power generation products?

Generac is a US-specialist in residential- and commercial-scale power generation solutions, founded in 1959, headquartered in Wisconsin, with 8,800 employees and $7bn of market cap. What outlook amidst power grid bottlenecks? To answer this question, we have tabulated data on 250 Generac products.

Download

Download

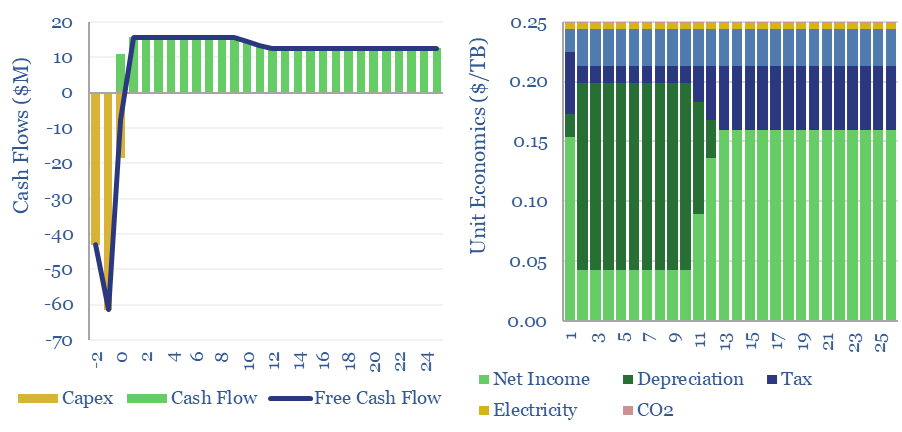

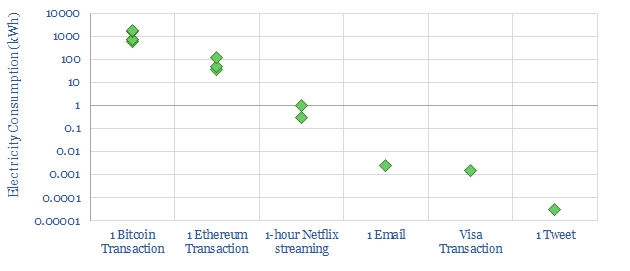

Internet energy consumption: data, models, forecasts?

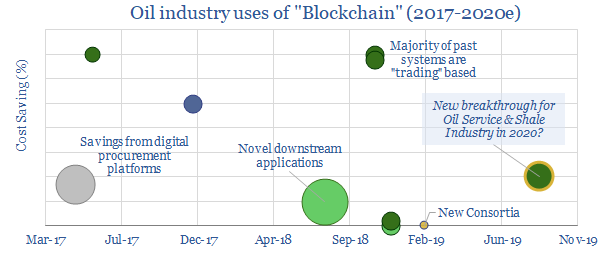

This data-file forecasts the energy consumption of the internet, rising from 800 TWH in 2022 to 2,000 TWH in 2030 and 3,750 TWH by 2050. The main driver is the energy consumption of AI, plus blockchains, rising traffic, and offset by rising efficiency. Input assumptions to the model can be flexed. Underlying data are from technical papers.

Download

Download

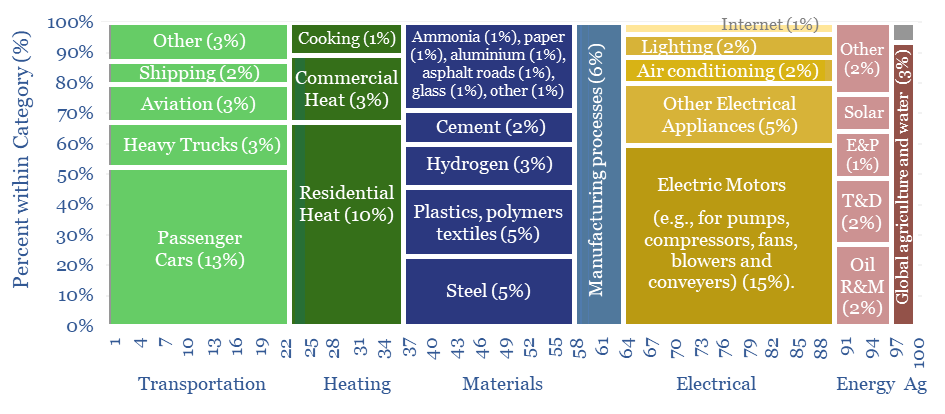

Global energy demand: nervous breakdown?

We have attempted a detailed breakdown of global energy demand across 50 categories, to identify emerging opportunities in the energy transition, and suggesting upside to energy demand forecasts? This 12-page note sets out our conclusions and is intended a useful reference.

Download

Download

Global energy demand by end use?

This data-file is a breakdown of global energy demand by end use, drawing across our entire research library, to disaggregate the global energy system across almost 50 applications, across transportation, heat, electricity, materials and manufacturing. Numbers, calculations, efficiencies and heating temperatures are in the data-file.

Download

Download

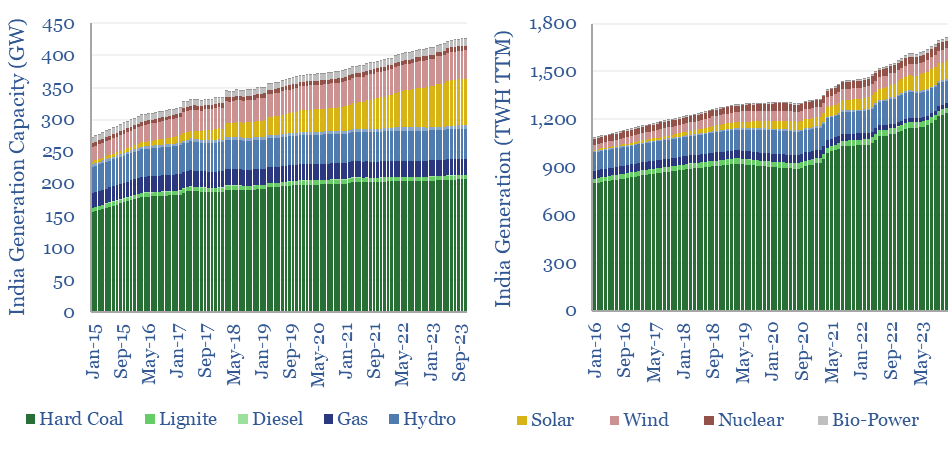

India: electricity demand and power grid over time?

India's electricity demand is growing by 6-8% (+100-140 TWH) per year, but 75% of the total still comes from coal, which has itself grown at a 5% CAGR over the past half-decade. Wind and solar would need to grow 4x faster than 2023 levels for thermal generation just to flatline. What implications and opportunities for global energy markets?

Download

Download

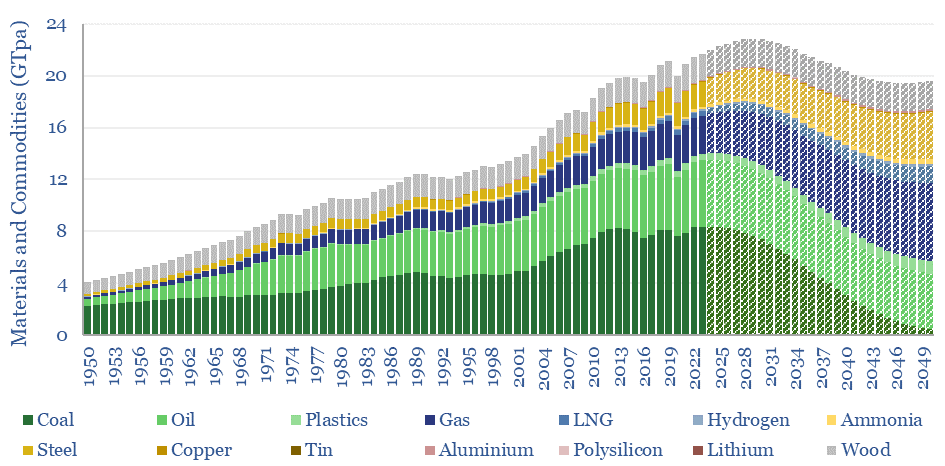

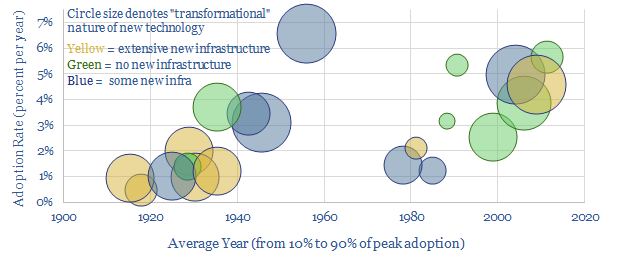

Peak commodities: everything, everywhere, all at once?

This 15-page note evaluates 10 commodity disruptions since the Stone Age. Peak demand for commodities is just possible, in total tonnage terms, as part of the energy transition. But it is historically unprecedented. And our plateau in tonnage terms is a doubling in value terms, a kingmaker for gas, plastics and materials. Outlooks for 30 major commodities are reviewed.

Download

Download

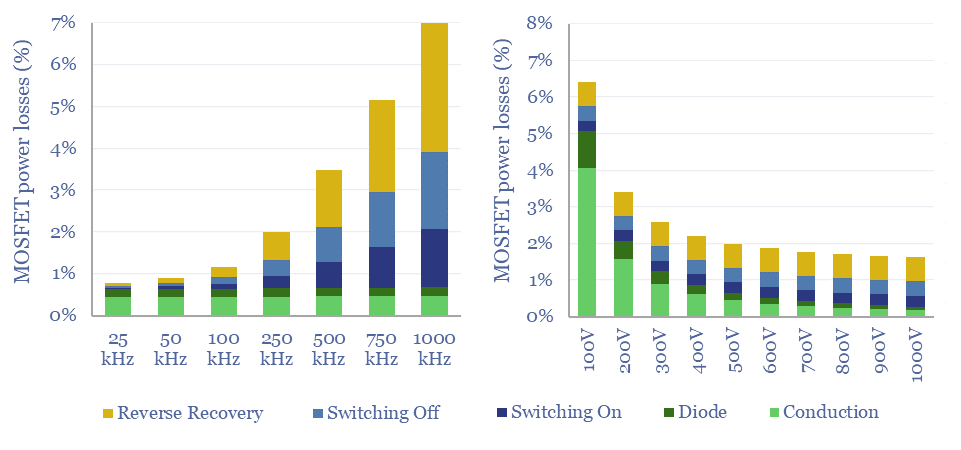

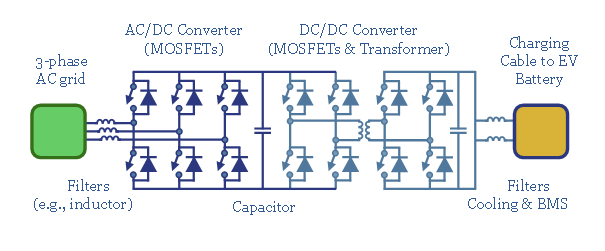

MOSFETs: energy use and power loss calculator?

MOSFETs are fast-acting digital switches, used to transform electricity, across new energies and digital devices. MOSFET power losses are built up from first principles in this data-file, averaging 2% per MOSFET, with a range of 1-10% depending on voltage, switching, on resistance, operating temperature and reverse recovery charge.

Download

Download

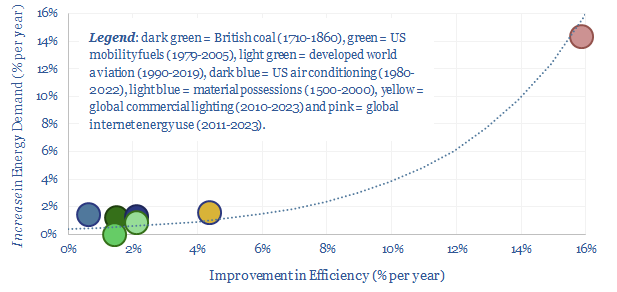

Jevons Paradox: what evidence for energy savings?

Using a commodity more efficiently can cause its demand to rise not fall; as greater efficiency opens up unforeseen possibilities. This is Jevon’s Paradox. Our 16-page report finds it is more prevalent than we expected. Efficiency gains underpin 25% of our roadmap to net zero. To be effective, commodity prices must also rise and remain high, otherwise rebound effects will raise demand.

Download

Download

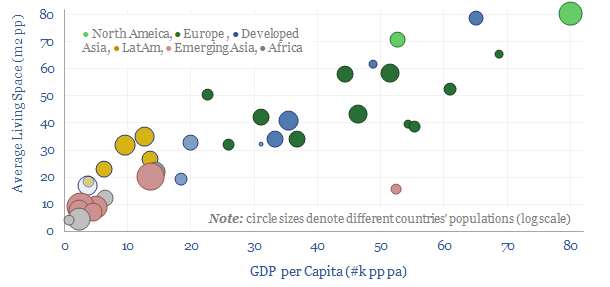

Average home sizes: living space per person?

Average home sizes matter for overall residential energy demand, heating and cooling demand. Hence the purpose of this data-file is to aggregate average home sizes by country, then translate the data into living space per capita. A good rule of thumb is that each $1k pp pa of GDP translates one-for-one into 1m2 pp pa of useful living space.

Download

Download

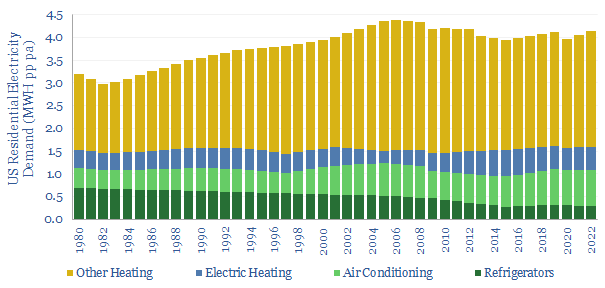

Residential energy consumption over time?

US residential energy consumption runs at 3,000 MWH per annum, equivalent to one quarter of total US energy consumption. Total demand has run sideways since 1980 as rebound effects and new demand sources have offset underlying efficiency savings?

Download

Download

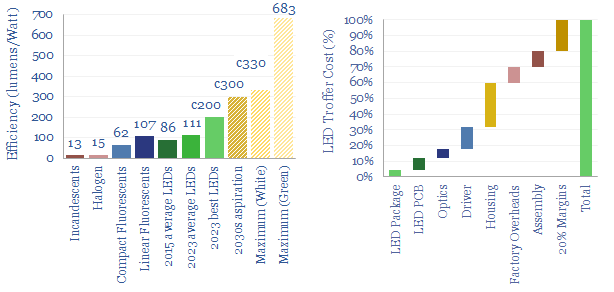

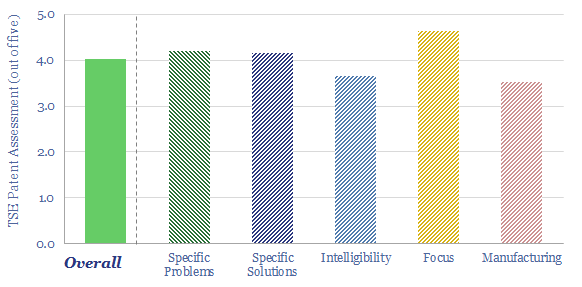

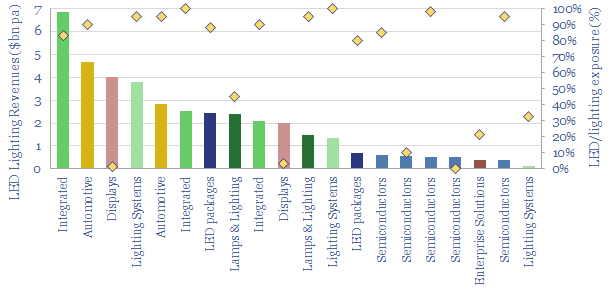

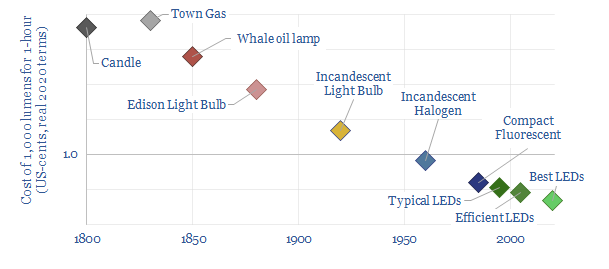

LEDs: seeing the light?

Lighting is 2% of global energy, 6% of electricity, 25% of buildings’ energy. LEDs are 2-20x more efficient than alternatives. Hence this 16-page report is our outlook for LEDs in the energy transition. We think LED market share doubles to c100% in the 2030s, to save energy, especially in solar-heavy grids. But demand is also rising due to ‘rebound effects’ and use in digital devices. We have screened 20 mature and (mostly) profitable pure plays.

Download

Download

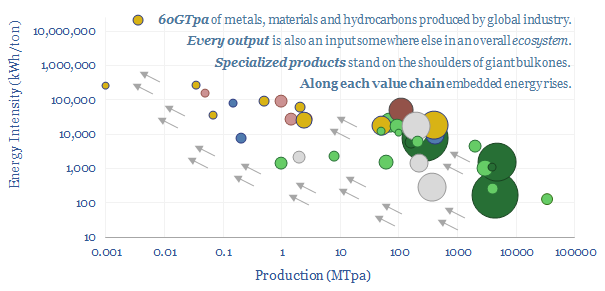

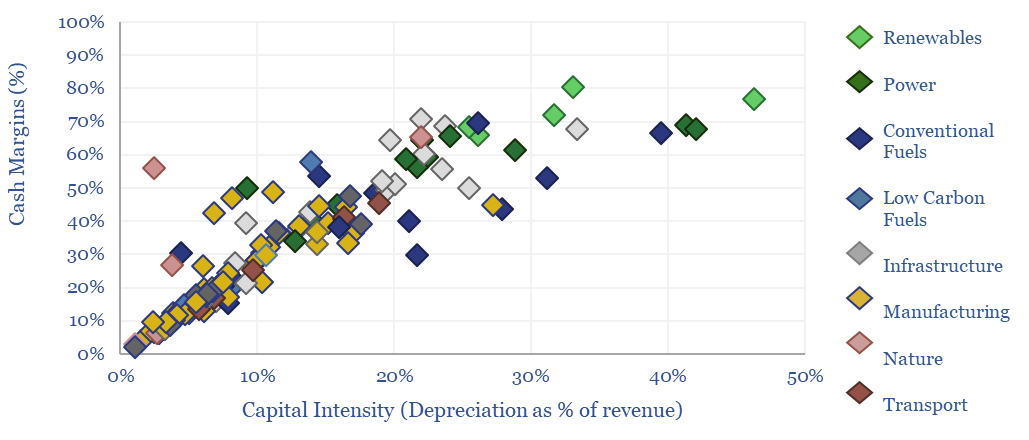

Industrial ecosystems: on the shoulders of giants?

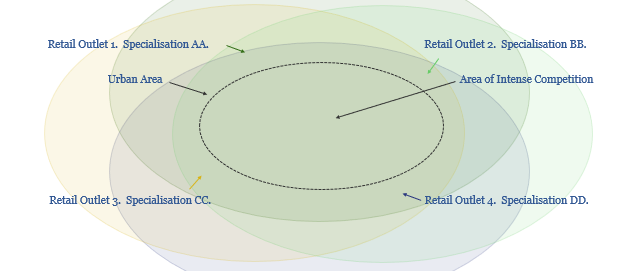

This 14-page report explores whether global industrial activity is set to become ever more concentrated in a few advantaged locations, especially the US Gulf Coast, China and the Middle East. Industries form ecosystems. Different species cluster together. Elsewhere, in our view, you can no more re-shore a few select industries than introduce dung beetles onto the moon. These mega-trends matter for economic forecasts and valuations.

Download

Download

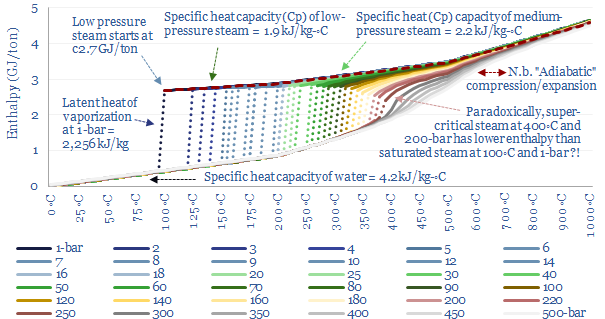

Energy needed to produce steam: enthalpy and entropy data?

This data-file quantifies the energy needed to produce steam, for industrial heat, chemicals, CCS plants and hydrogen reforming? As rules of thumb, low pressure saturated steam at 100◦C requires 2.6 GJ/ton (720kWh/ton), medium pressure dry steam at 6-bar and 300◦C requires 3 GJ/ton (830kWh/ton) and super-critical steam at 250-bar and 600◦C requires 4 GJ/ton (1,150kWh/ton).

Download

Download

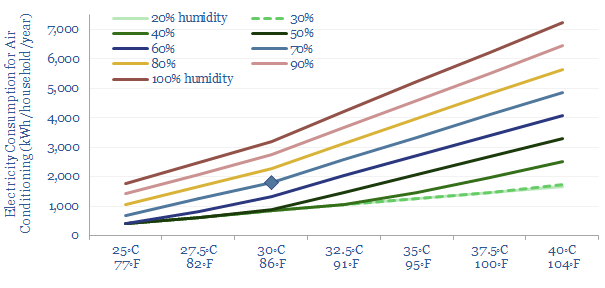

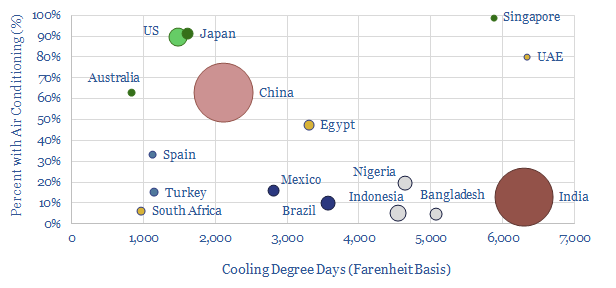

Air conditioning: energy consumption?

The average US home uses 2,000 kWh of electricity for air conditioners each year. Air conditioning energy consumption is broken down from first principles in this data-file, as a function of temperatures, humidity, heating days, household size, insulation and coefficient of performance (COP). What routes to lower the air conditioning energy demand and CO2 emissions?

Download

Download

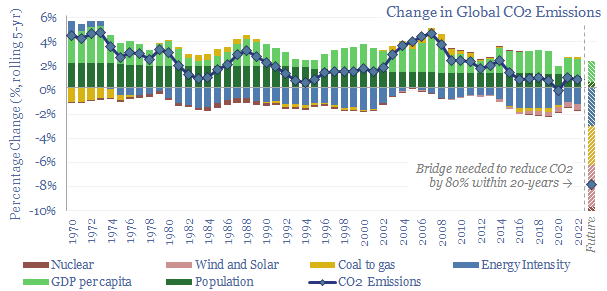

Global decarbonization: speeding up or slowing down?

This 16-page report beaks down global CO2 emissions, across six causal factors and 28 countries and regions. Global emissions rose at +0.7% pa CAGR from 2017-2022, of which +1.0% pa is population growth, +1.4% pa rising incomes, -1.4% pa efficiency gains, -0.5% renewables, 0% nuclear, +0.2% ramping back coal due to underinvestment in gas. Depressingly, progress towards net zero slowed down in the past five years. Reaching net zero requires vast acceleration in renewables, infrastructure, nuclear, gas and nature.

Download

Download

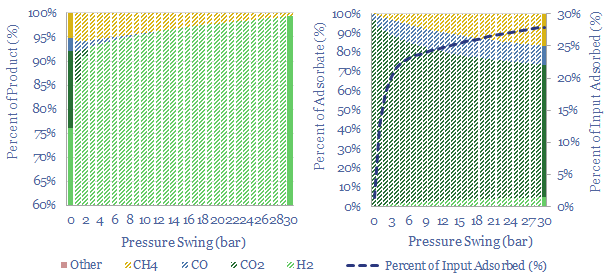

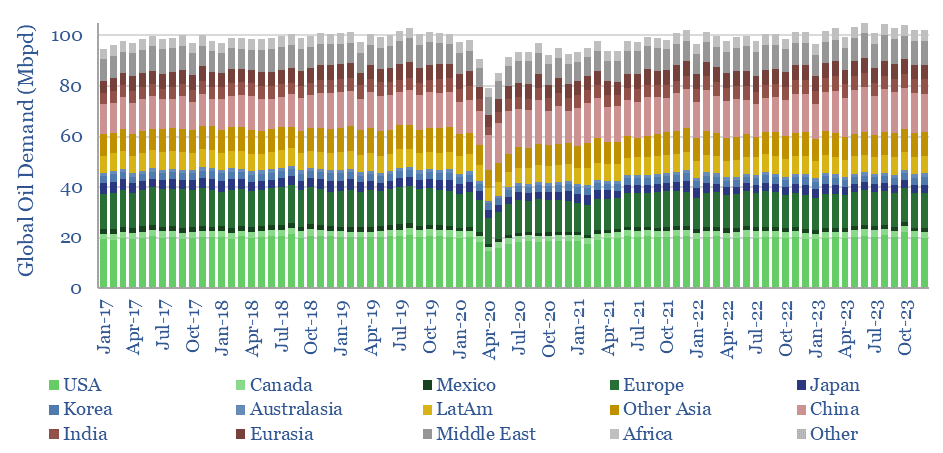

Industrial gas separation: swing producers?

Swing Adsorption separates gases, based on their differential loading onto zeolite adsorbents at varying Pressures. The first PSA plant goes back to 1966. Today, tens of thousands of PSA plants purify hydrogen, biogas, polymers, nitrogen/oxygen and possibly in the future, can capture CO2? This 16-page note explores the technology, costs, challenges, companies.

Download

Download

Pressure swing adsorption: energy economics?

Pressure swing adsorption purifies gases according to their differing tendencies to adsorb onto adsorbents under pressure. Pressure swing adsorption costs $0.1/kg when separating pure hydrogen from reformers, and $2-3/mcf when separating bio-methane from biogas. Our cost breakdowns include capex, opex, maintenance, zeolite replacement, compression power and CO2 costs.

Download

Download

What is the energy consumption of the internet?

Powering the internet consumed 800 TWH of electricity in 2022, as 5bn users generated 4.7 Zettabytes of traffic. Our guess is that the internet’s energy demands double by 2030, including due to AI (e.g., ChatGPT), adding 1% upside to global energy and 2.5% to global electricity demand. This 13-page note aims to break down the numbers and their implications.

Download

Download

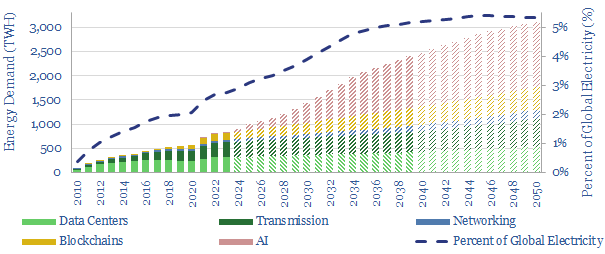

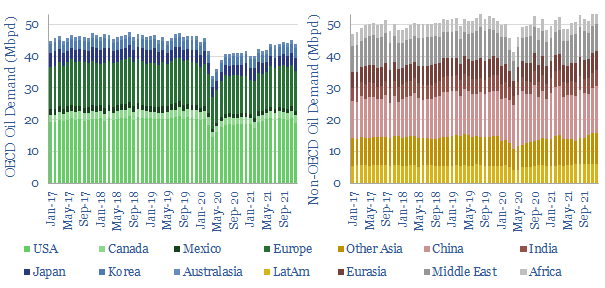

Global oil demand: breakdown by product by country?

This data-file breaks down global oil demand, country-by-country, product-by-product, month-by-month, across 2017-2022. The goal is to summarize the effects of COVID, and the subsequent recovery in oil markets. Global oil demand is hitting new highs, even though several product categories are still not fully recovered.

Download

Download

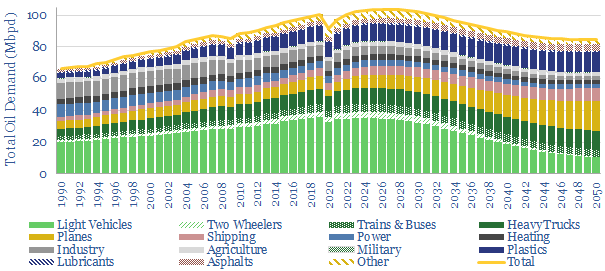

Global oil demand forecasts: by end use, by product, by region?

This model forecasts long-run oil demand to 2050, by end use, by year, and by region; across the US, the OECD and the non-OECD. We see demand gently rising through the 2020s, peaking at 104Mbpd in 2025-27, then gently falling to 85Mbpd by 2050 in the energy transition.

Download

Download

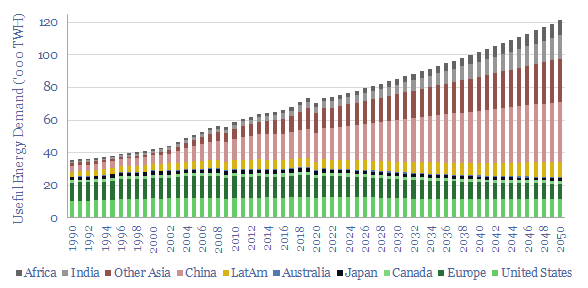

Global energy demand: by region and through 2050?

This model captures global energy demand by region through 2050, rising from 70,000 TWH in 2019-22 to 120,000 MWH in 2050. Demand rises c2% pa. Energy use per global person rises at 1% pa from 9.3 MWH pp pa to 12.6 MWH pp pa. Meeting human civilization's energy needs is crucial to the energy transition.

Download

Download

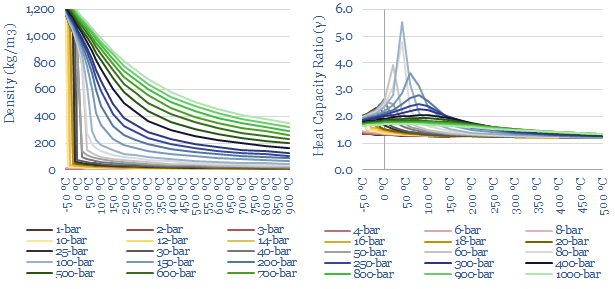

CO2 compression: stranger things?

CO2 is a strange gas. This matters as energy transition will require over 120 GW of compressors for 6GTpa of CCUS. This 13-page notes explains CO2’s strange properties, which helps to fine-tune appropriate risking factors for vanilla CCS, blue hydrogen, CO2-EOR, CO2 shipping, super-critical CO2 power cycles. There is also a wide moat around leading turbomachinery companies.

Download

Download

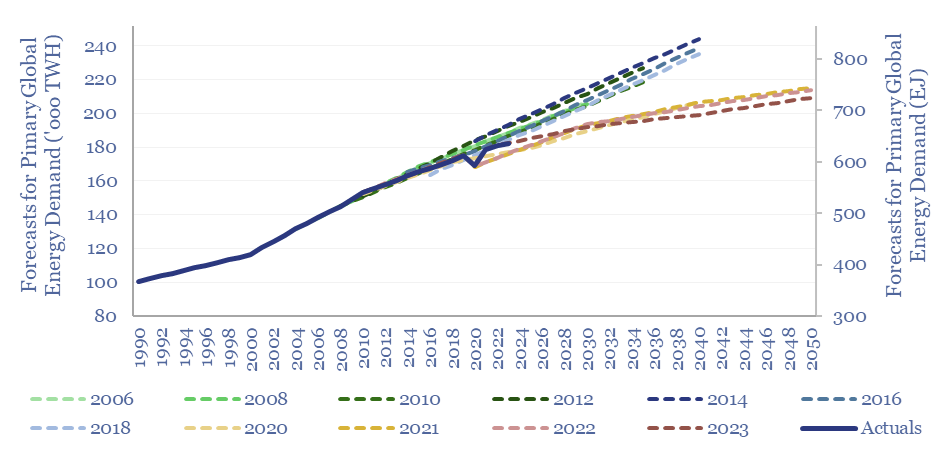

Energy demand forecasts: making predictions about the future?

How accurate are energy demand forecasts? Long-term forecasts for total global energy demand can easily be wrong by +/- 10%. Oil market forecasts tend to be amiss by 0.6% x the number of years away. Oil and coal seem to have been consistently under-estimated since 2020. Solar and wind were consistently underestimated in 2010-20, but less so for recent forecasts?

Download

Download

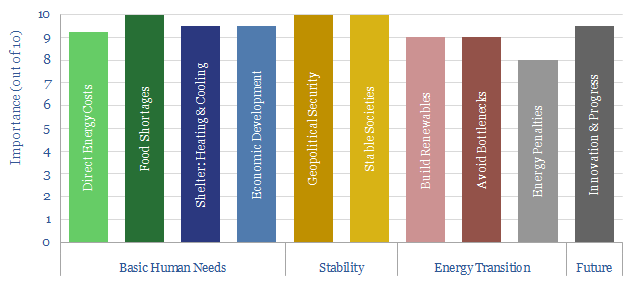

Energy shortage: fear in a handful of dust?

Should restoring the world’s energy surplus be seen as the most important ESG goal of the 2020s? This 12-page note outlines our top ten considerations, as our energy balances have deteriorated even further in the last year. Under-supply could persist through 2030. Shortages have cruel consequences. And unexpected ripple effects. Energy surplus also helps energy transition.

Download

Download

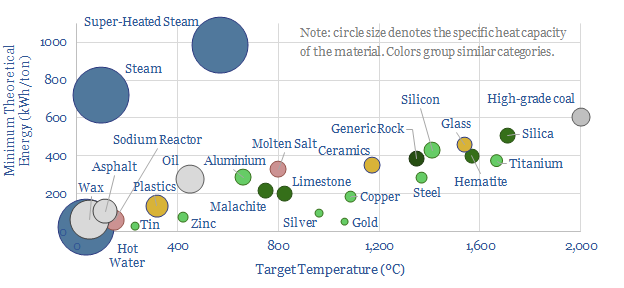

Heating-melting: how much energy is needed?

How do we quantify the minimum energy needed to heat materials and melt materials? This data-file calculates values, in kWh/ton, from first principles, based on target temperatures, specific heat capacities and latent heat capacities. A good rule of thumb is 25 kWh of useful energy to heat each ton of material by each 100ºC.

Download

Download

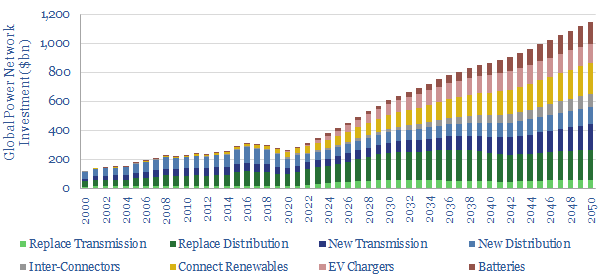

Power grids: global investment?

Global investment into power networks averaged $280bn per annum in 2015-20, of which two-thirds was for distribution and one-third was for transmission. Amazingly, these numbers step up to $600bn in 2030, >$1trn in the 2040s and can be as large as all primary energy investment.

Download

Download

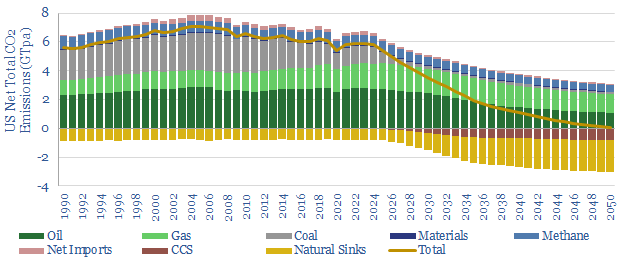

US decarbonization: energy and CO2 emissions?

The US consumes 25,000 TWH of primary energy per year, which equates to 13,000 TWH of useful energy, and emits 6GTpa of CO2. This model captures our best estimates for what a pragmatic and economical decarbonization of the US will look like, reaching net zero in 2050, with energy consumption at 11,500 TWH per year.

Download

Download

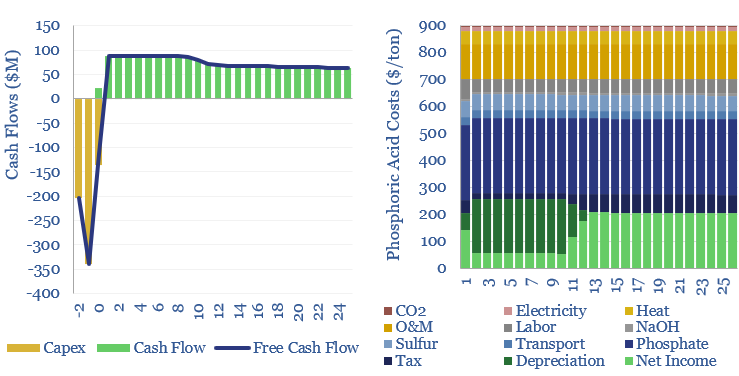

Gas diffusion: how will record prices resolve?

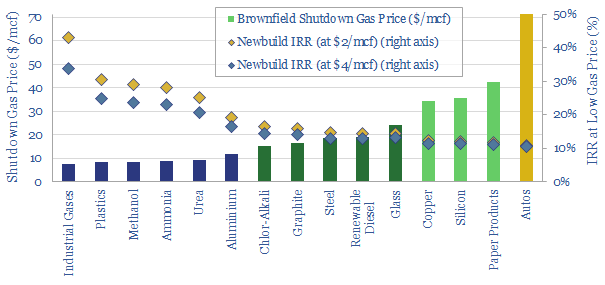

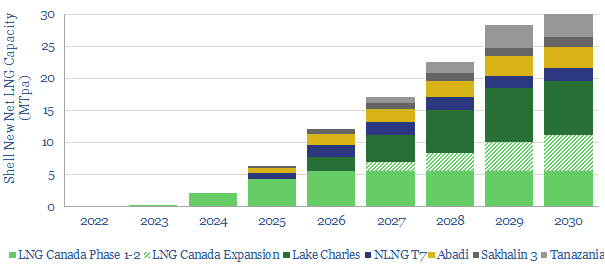

Dispersion in global gas prices has hit new highs in 2022. Hence this 17-page note evaluates two possible solutions. Building more LNG plants achieves 15-20% IRRs. But shuttering some of Europe’s gas-consuming industry then re-locating it in gas-rich countries can achieve 20-40% IRRs, lower net CO2 and lower risk? Both solutions should step up. What implications?

Download

Download

Mining: crushing, grinding and comminution costs?

Mining crushing-grinding costs are typically $10/ton of ore, breaking 3-10cm rubble into 30-100 micron powders. Capex averages $20/Tpa and energy cost averages 20kWh/ton.

Download

Download

Air conditioning: energy demand sensitivity?

This data-file quantifies air conditioning energy demand. In the US each 100 variation in CDDs adds 26 TWH of electricity (0.6%) demand and 200bcf of gas (0.6%). Air conditioning already consumes 7% of all global electricity and could treble by 2050.

Download

Download

Global oil demand: rumors of my death?

‘Rumors of my death have been greatly exaggerated’. Mark Twain’s quote also applies to global oil consumption. This note aggregates demand data for 8 oil products and 120 countries over the COVID pandemic. We see 3.5Mbpd of pent-up demand ‘upside’, acting as a floor on medium-term oil prices.

Download

Download

Carbon Intensity

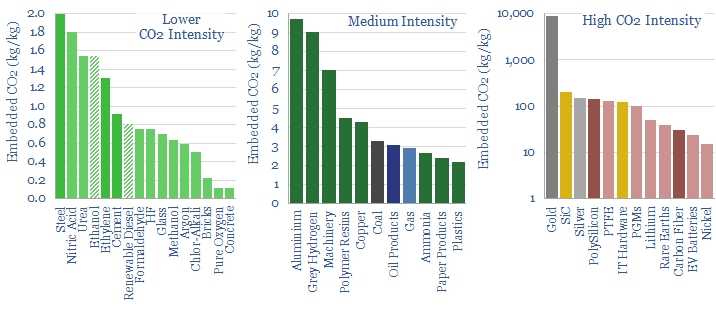

CO2 intensity of materials: an overview?

This data-file tabulates the energy intensity and CO2 intensity of materials, in tons/ton of CO2, kWh/ton of electricity and kWh/ton of total energy use per ton of material. The build-ups are based on 160 economic models that we have constructed to date, and simply intended as a helpful summary reference. Our key conclusions on CO2 intensity of materials are below.

Download

Download

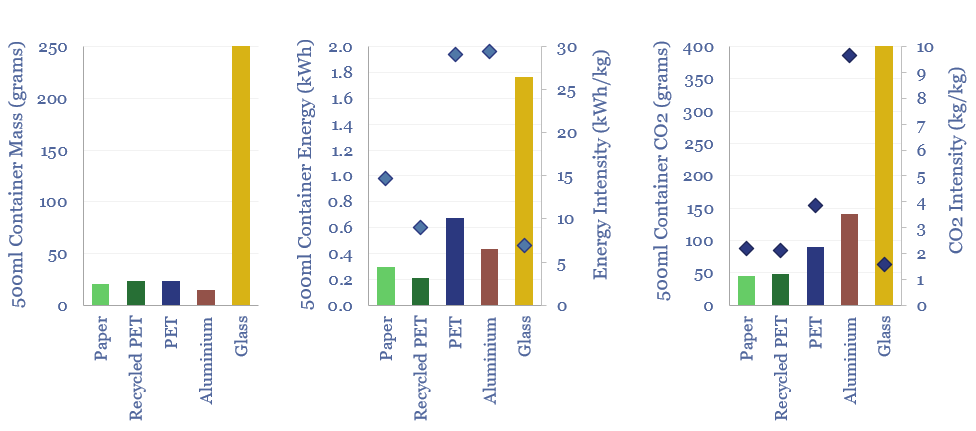

Plastic products: energy and CO2 intensity of plastics?

The energy intensity of plastic products and the CO2 intensity of plastics are built up from first principles in this data-file. Virgin plastic typically embeds 3-4 kg/kg of CO2e. But compared against glass, PET bottles embed 60% less energy and 80% less CO2. Compared against virgin PET, recycled PET embeds 70% less energy and 45% less CO2. Aluminium packaging is also highly efficient.

Download

Download

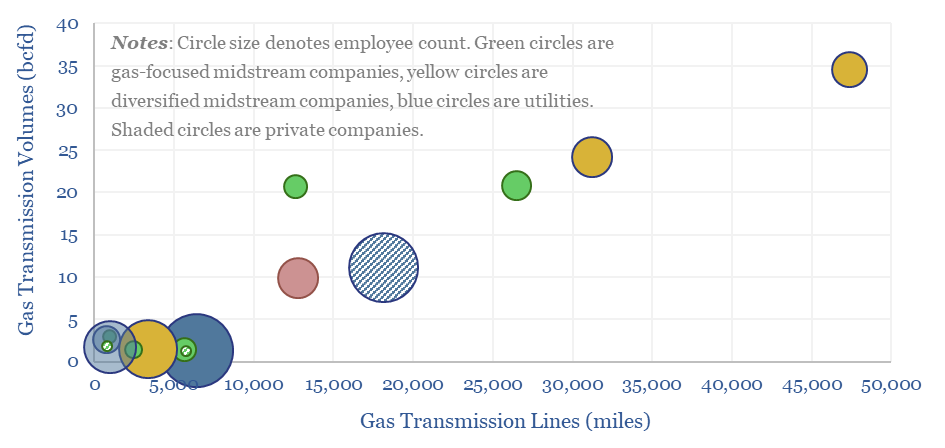

US gas transmission: by company and by pipeline?

This data-file aggregates granular data into US gas transmission, by company and by pipeline, for 40 major US gas pipelines which transport 45TCF of gas per annum across 185,000 miles; and for 3,200 compressors at 640 related compressor stations.

Download

Download

MOSFETs: energy use and power loss calculator?

MOSFETs are fast-acting digital switches, used to transform electricity, across new energies and digital devices. MOSFET power losses are built up from first principles in this data-file, averaging 2% per MOSFET, with a range of 1-10% depending on voltage, switching, on resistance, operating temperature and reverse recovery charge.

Download

Download

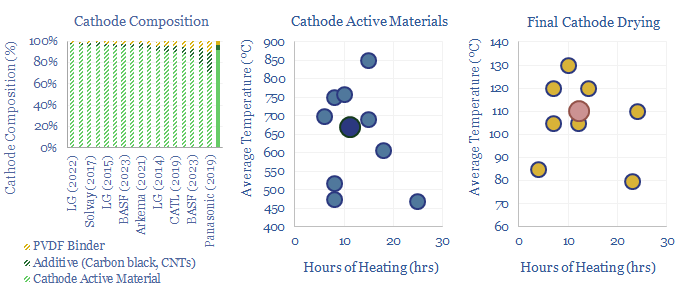

Battery cathode active materials and manufacturing?

Lithium ion batteries famously have cathodes containing lithium, nickel, manganese, cobalt, aluminium and/or iron phosphate. But how are these cathode active materials manufactured? This data-file gathers specific details from technical papers and patents by leading companies such as BASF, LG, CATL, Panasonic, Solvay and Arkema.

Download

Download

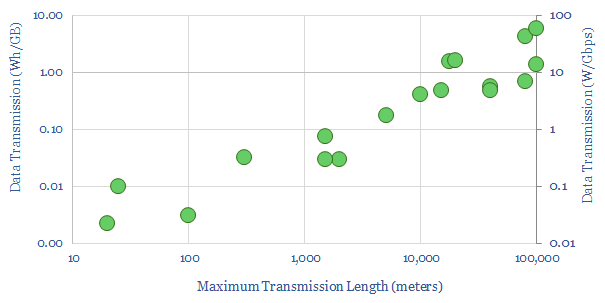

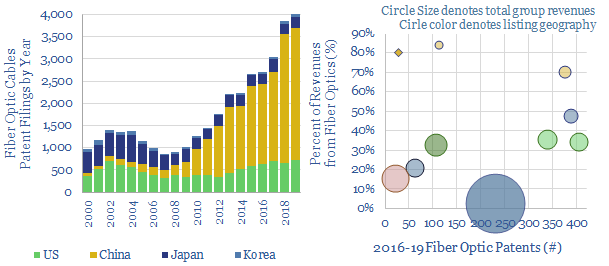

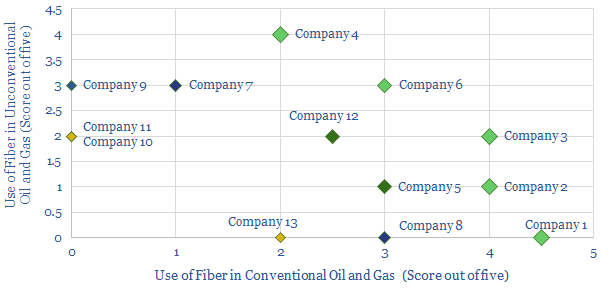

Energy intensity of fiber optic cables?

What is the energy intensity of fiber optic cables? Our best estimate is that moving each GB of internet traffic through the fixed network requires 40Wh/GB of energy, across 20 hops, spanning 800km and requiring an average of 0.05 Wh/GB/km. Generally, long-distance transmission is 1-2 orders of magnitude more energy efficient than short-distance.

Download

Download

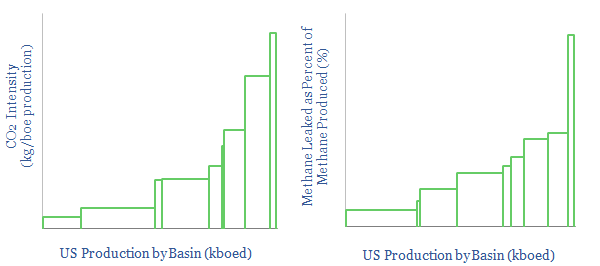

US CO2 and Methane Intensity by Basin

The CO2 intensity of oil and gas production is tabulated for 425 distinct company positions across 12 distinct US onshore basins in this data-file. Using the data, we can aggregate the total upstream CO2 intensity in (kg/boe), methane leakage rates (%) and flaring intensity (in mcf/boe), by company, by basin and across the US Lower 48.

Download

Download

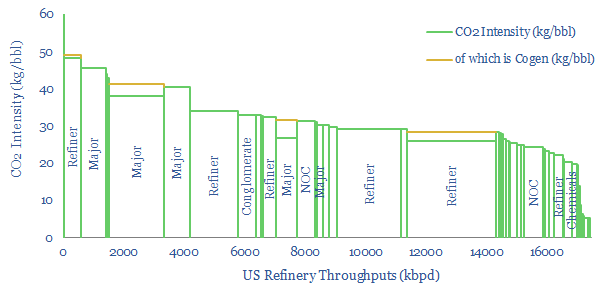

US Refinery Database: CO2 intensity by facility?

This US refinery database covers 125 US refining facilities, with an average capacity of 150kbpd, and an average CO2 intensity of 33 kg/bbl. Upper quartile performers emitted less than 20 kg/bbl, while lower quartile performers emitted over 40 kg/bbl. The goal of this refinery database is to disaggregate US refining CO2 intensity by company and by facility.

Download

Download

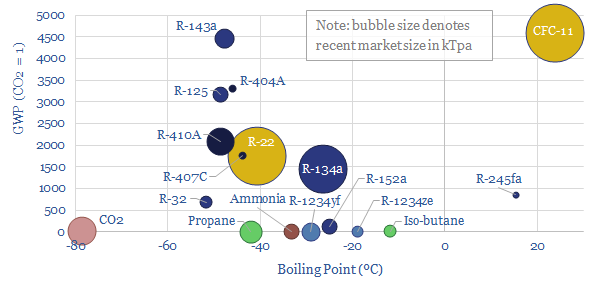

Refrigerants: leading chemicals for the rise of heat pumps?

This data-file is a breakdown of c1MTpa of refrigerants used in the recent past for cooling, across refrigerators, air conditioners, in vehicles, industrial chillers, and increasingly, heat pumps. The market is shifting rapidly towards lower-carbon products, including HFOs, propane, iso-butane and even CO2 itself. We still see fluorinated chemicals markets tightening.

Download

Download

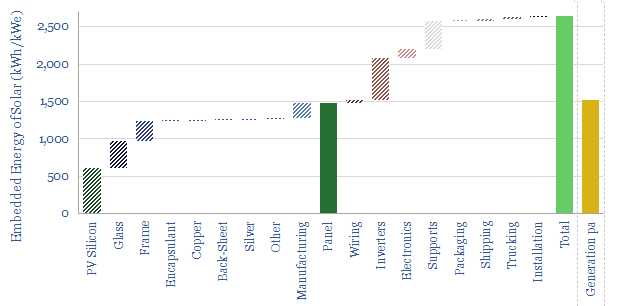

Solar: energy payback and embedded energy?

What is the energy payback and embedded energy of solar? We have aggregated the consumption of 10 different materials (in kg/kW) and around 10 other energy-consuming line-items (in kWh/kW). Our base case estimate is 2.5 MWH/kWe of solar and an energy payback of 1.5-years. Numbers and sensitivities can be stress-tested in the data-file.

Download

Download

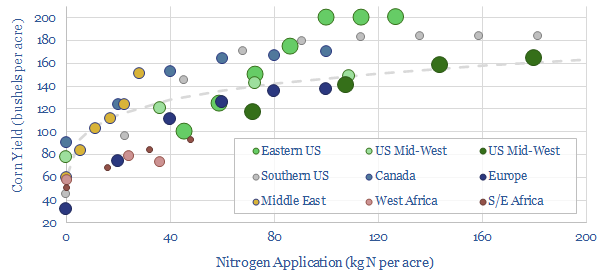

Crop production: how much does nitrogen fertilizer increase yields?

How much does fertilizer increase crop yields? Aggregating all of the global data, a good rule of thumb is that up to 200kg of nitrogen can be applied per acre, increasing corn crop yields from 60 bushels per acre (with no fertilizer) to 160 bushels per acre (at 200 kg/acre). But the relationship is logarithmic, with diminishing returns.

Download

Download

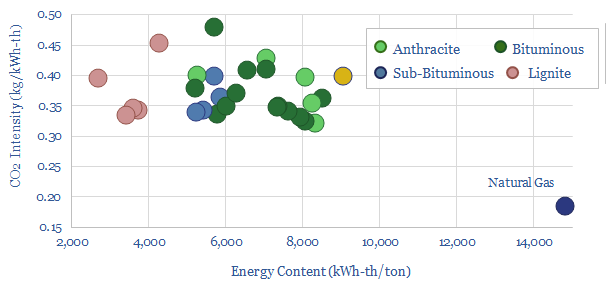

Coal grades: what CO2 intensity?

The CO2 intensity of coal is estimated at 0.37kg/kWh of thermal energy, at a typical coal grade comprising 63% carbon and 6,250 kWh/ton of energy content. This is the average across 25 samples in our data-file, while moisture, ash and sulphur are also appraised. Coal is 2x more CO2 intensive than natural gas.

Download

Download

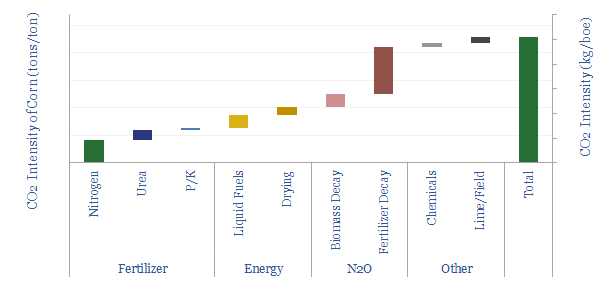

Crop production: what CO2 intensity?

The CO2 intensity of producing corn averages 0.23 tons/ton, or 75kg/boe. 50% is from N2O emissions, a powerful greenhouse gas, from the breakdown of nitrogen fertilizer. Producing 1 kWh of food energy requires 9 kWh of fossil energy.

Download

Download

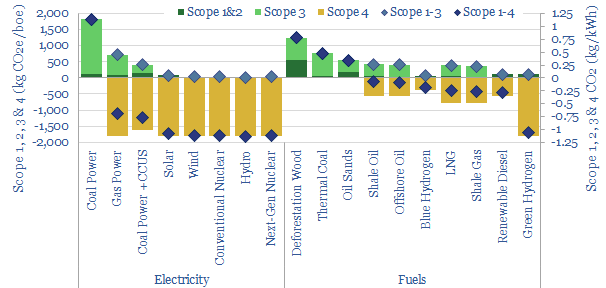

CO2 intensity: Scope 1, 2 & 3 and Scope 4 emissions?

Scope 4 CO2 emissions capture the CO2 that is avoided by use of a product. Many energy investments with positive Scope 1-3 emissions have deeply negative Scope 1-4 emissions. Numbers are quantified and may offer a more constructive approach to decarbonization investments.

Download

Download

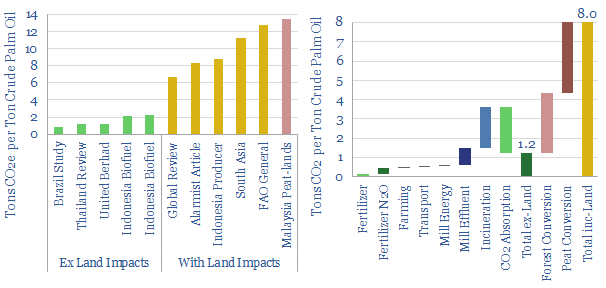

Palm oil: what CO2 intensity?

Global palm oil production runs at 80MTpa, for food, HPC and bio-fuels. Carbon intensity is 1.2 tons CO2e per ton of crude palm oil, excluding land use impacts, and 8.0 tons/ton on a global basis including land use impacts. This means once a bio-fuel has more than c35% palm oil in its feedstock, it is likely to be higher carbon than conventional diesel.

Download

Download

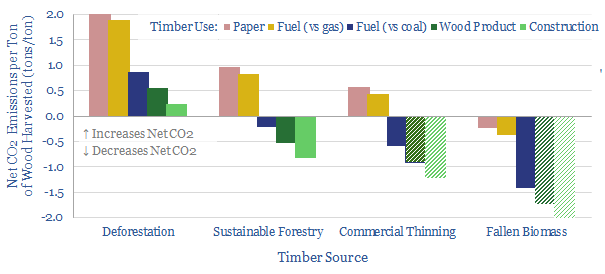

CO2 intensity of wood: context by context?

This data-file calculates the CO2 intensity of wood in the energy transition. Context matters, and can sway the net climate impacts from -2 tons of emissions reductions per ton of wood through to +2 tons of incremental emissions per ton of wood. Calculations can be stress-tested in the data-file.

Download

Download

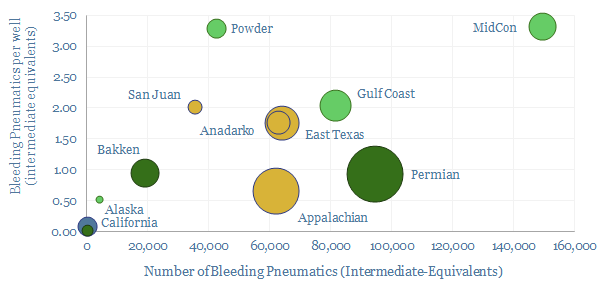

Methane emissions from pneumatic devices: by operator, by basin?

Methane leaks from 1M pneumatic devices across the US onshore oil and gas industry comprise 50% of all US upstream methane leaks and 20% of upstream CO2. This file aggregates the data. Rankings reveal operators with a pressing priority to replace >100,000 medium and high bleed devices, and other best-in-class companies.

Download

Download

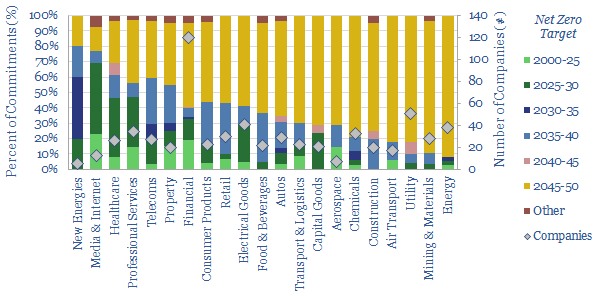

Decarbonization targets: what do the data tell us?

630 companies have now pledged to reach some variant of net zero by early-2022. The average year for this ambition is 2044. Although it varies by sector. 50% of companies are including some Scope 3 emissions in their definitions. This data-file presents our conclusions by sector.

Download

Download

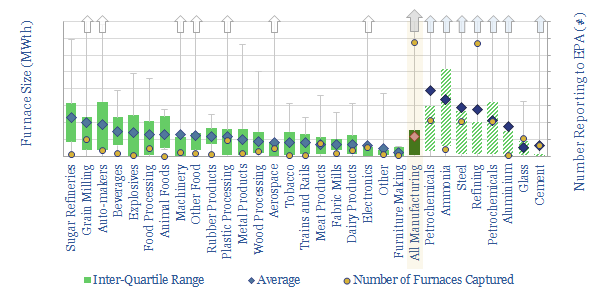

US industrial furnaces: breakdown by size, by industry, by fuel?

There are 1,500 industrial furnaces in the US manufacturing sector, with average capacity of 60MWth, c90% powered by natural gas, and thus explaining over 3.5 bcfd of US gas demand (4-5% of total). This is an unbelievably complex landscape, but we have captured as much facility-by-facility data as possible.

Download

Download

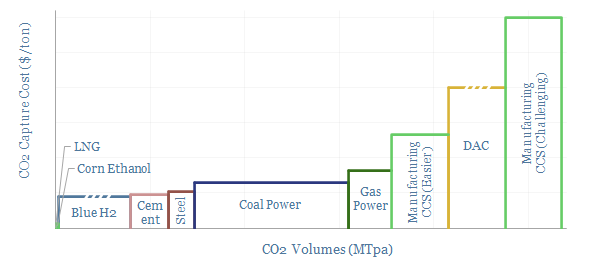

CO2 capture: a cost curve?

This data-file summarizes the costs of capturing CO2. The lowest-cost options are to access pure CO2 streams that are simply being vented at present. Next are blue hydrogen, steel and cement, which could each have GTpa scale. Power stations place next, at $60-100/ton. DAC is carbon negative but expensive.

Download

Download

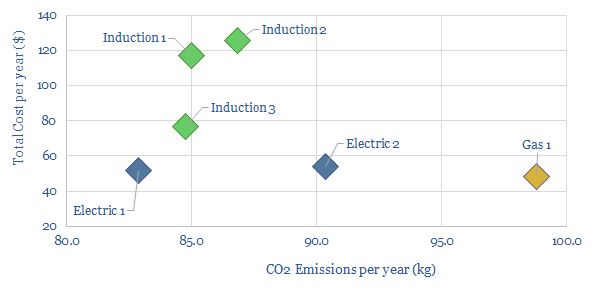

Cost and CO2 intensity of home cooking technologies?

The most important determinant of cooking's CO2 intensity is consumer behaviour. At today's energy costs and grid mix, gas-fired cooking yields the lowest costs. Sometimes electrification of cooking will decrease CO2 and sometimes not. Electric induction is most efficient, but 2-3x more expensive than gas and electric hobs.

Download

Download

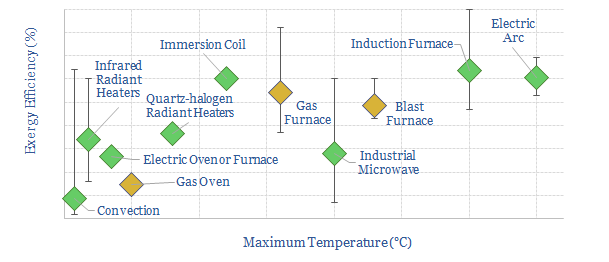

Industrial heating technologies: an overview?

This data-file summarizes over a dozen industrial heating technologies, including their temperatures, efficiency, advantages and challenges. Generally 90% of incoming energy can be converted to industrial process heat and c40% achieves useful exergetic output. But ranges very broadly from 10-90%.

Download

Download

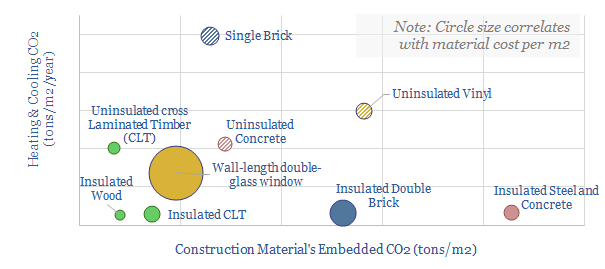

Construction materials: a screen of costs and CO2 intensities?

This data-file calculates the costs, the embedded energy and the embedded CO2 of different construction materials, both during their production and for ongoing heating and cooling. Insulated wood and cross-laminated timber have the lowest CO2 intensities and can be extremely cost competitive.

Download

Download

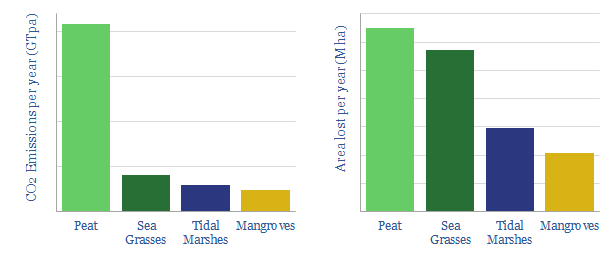

Blue carbon: how much degradation and CO2 emission?

This data-file illustrates the outsized contribution of blue carbon ecosystems in the carbon cycle, looking across mangroves, tidal marshes, sea grasses and peat bogs. Degradation of blue carbon ecosystems continues with vast CO2 consequences, comparable to the entire global cement industry.

Download

Download

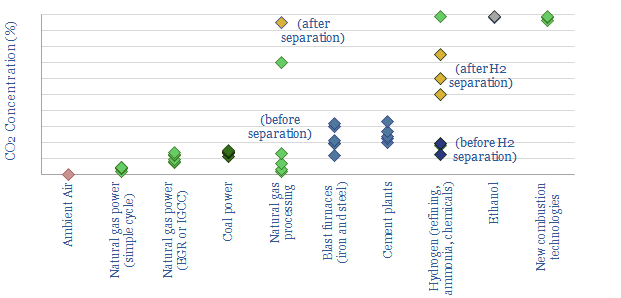

CO2 concentrations in industrial exhaust streams?

The aim of this data-file is to compile CO2 concentrations in industrial exhaust streams, as a molar percentage of flue gas. This matters for the costs of CO2 separation. Most promising CCS candidates are bio-ethanol plants, industrial hydrogen production and some gas processing, followed by cement and steel plants.

Download

Download

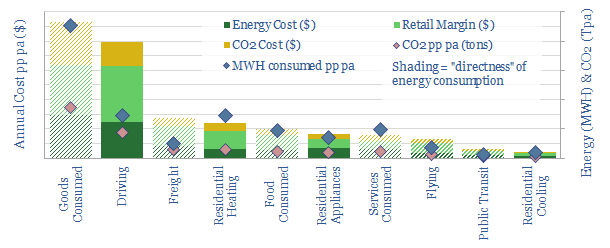

A breakdown of US energy consumption per person per year

The average American consumes 36MWH of energy each year, emits 20 tons of CO2, spends $2,000 directly on energy (6% of income) and $4,500 including the energy embedded in goods and services (15% of income). A CO2 price of $75/ton may fully decarbonize the US but would absorb another 5% of average income.

Download

Download

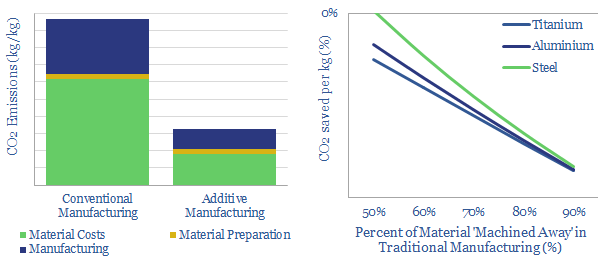

CO2 of metal components: conventional vs additive manufacturing?

Manufacturing metal components can be extremely energy intensive, as 60-95% of original materials are often machined away. Additive manufacturing is thus able to deliver c65% CO2 savings per kg of materials in our base case. This data-file quantifies the CO2 savings based on input variables and technical papers.

Download

Download

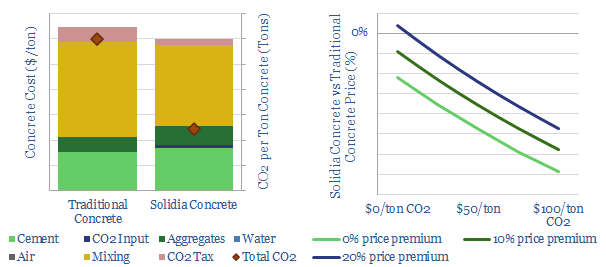

CO2-Cured Concrete: Solidia vs traditional cement?

CO2-cured concrete has c60% lower emissions than traditional concrete, which is the most widely used construction material on the planet, comprising 4bn tons of annual CO2 emissions, or 8% of the global total. This data-file profiles the CO2 and economic costs of Solidia versus traditional cement, to size the opportunity.

Download

Download

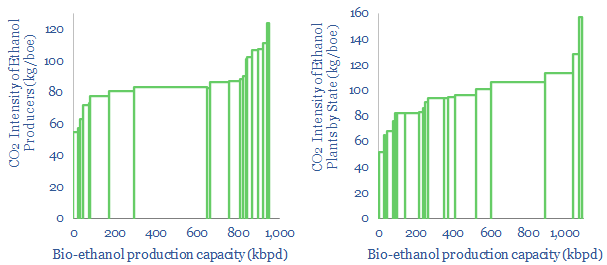

US ethanol plants: what CO2 intensity?

US bioethanol plants produce 1Mbpd of liquid fuels, with an average CO2 intensity of 85kg/boe. Overall, corn-based bioethanol has c40% lower CO2 than oil products. We screened the leaders and laggards by CO2-intensity, covering Poet, Valero, Great Plains, Koch, Marathon and White Energy.

Download

Download

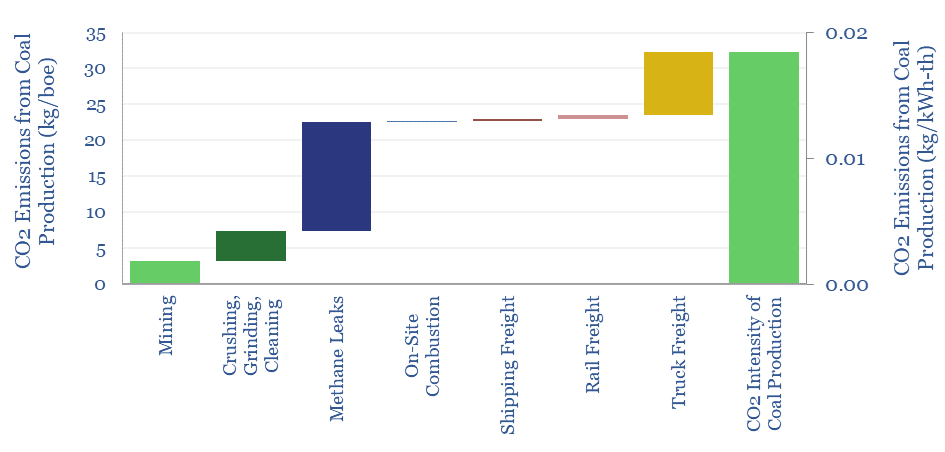

CO2 intensity of coal production?

Producing a ton of coal typically emits 0.19T of CO2, equivalent to 50kg/boe. The numbers comprise mining, methane leaks and transportation. Hence domestic coal production will tend to emit 2x more CO2 than gas production, plus c2x more CO2 in combustion. However, numbers vary widely based on input assumptions, such as methane lakage rates, btu content and transportation distances, which can be flexed in the model.

Download

Download

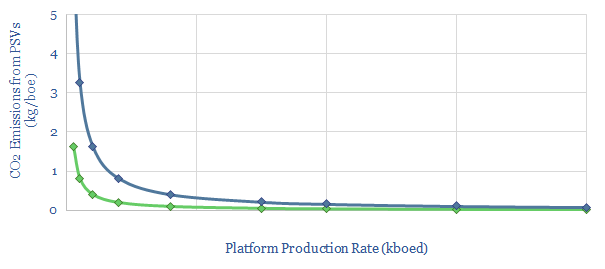

Platform supply vessels: what contribution to CO2?

This data-file calculates the contribution of Platform Supply Vessels (PSVs) to an oil and gas asset's emissions. Our base case estimate is 0.1kg/boe for a productive asset in a well-developed basin. Numbers rise 4x in a remote basin, and by another c4x for smaller fields. 1kg/boe is possible. These emissions can be lowered by 10-20% through by LNG-fuelling or battery-hybridization.

Download

Download

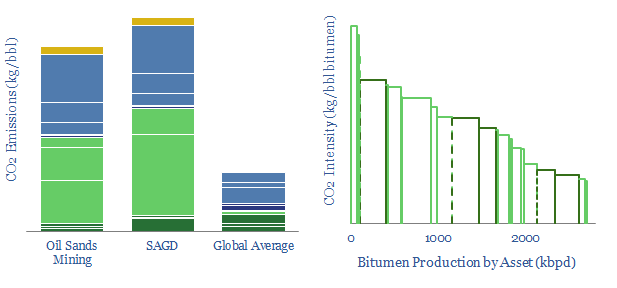

Oil Sands CO2 Intensity

This data-file quantifies the CO2 intensity of oil sands mining and SAGD, line by line, based on real-world data. We also derive a CO2 curve ranking c2.5Mbpd of production across Alberta, to compare different operators. Steam-oil-ratios explain c60% of the variance in SAGD assets' emissions.

Download

Download

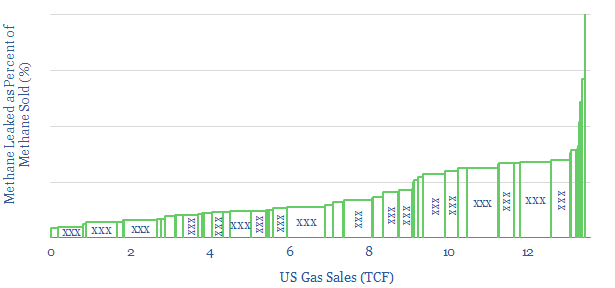

Methane Leaks from Downstream Gas Distribution

Methane leakages average 0.2% when distributing natural gas to end-customers, across the US's 160 retail gas networks. Leakages are most correlated with the share of sales to smaller customers. 80 distinct gas companies are ranked in this data-file. State-owned utilities appear to have 2x higher leakage rates versus public companies.

Download

Download

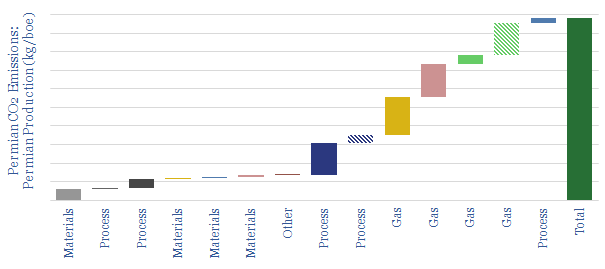

CO2 intensity of shale: breakdown by category?

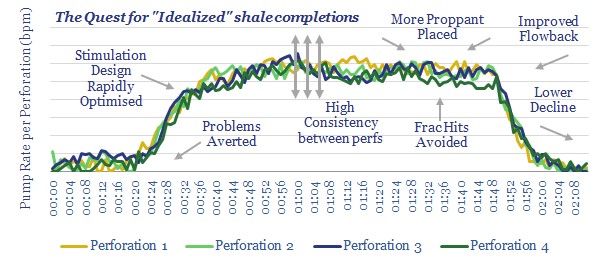

This model disaggregates the CO2 emissions of producing shale oil, across 14 different contributors: such as materials, drilling, fracturing, supply chain, lifting, processing, methane leaks and flaring. CO2 intensity can be flexed by changing the input assumptions. Our 'idealized shale' scenario follows in a separate tab, showing how Permian shale production could become 'carbon neutral'.

Download

Download

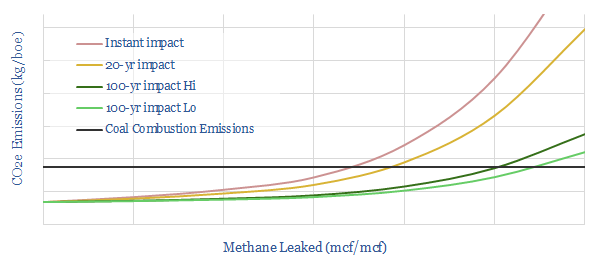

Methane emissions detract from natural gas?

With methane emissions fully controlled, burning gas is c60% lower-CO2 than burning coal. However, taking natural gas to cause 120x more warming than CO2 over a short timeframe, the crossover (where coal emissions and gas emissions are equivalent) is 4% methane intensity. The gas industry must work to mitigate methane.

Download

Download

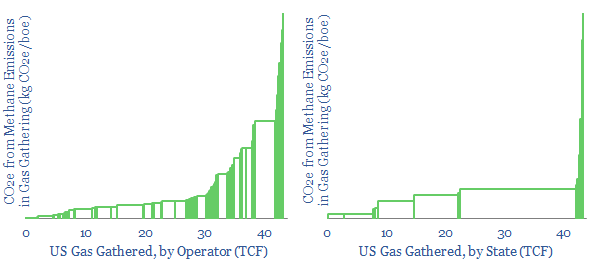

Gas Gathering: how much CO2 and Methane?

Gas gathering and gas processing are 50% less CO2 intensive than oil refining. Nevertheless, these processes emitted 18kg of CO2e per boe in 2018. Methane matters most, explaining 1-7kg/boe of gas industry CO2-equivalents. This data-file assesses 850 US gas gathering and processing facilities, to screen for leaders and laggards, by geography and by operator.

Download

Download

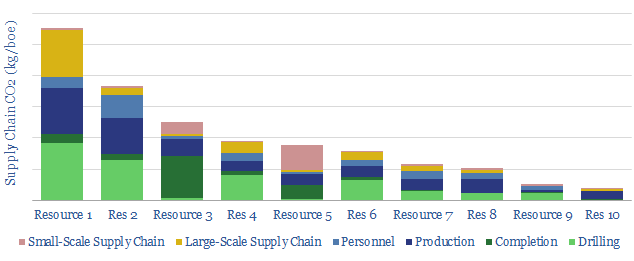

CO2 Intensity of Oilfield Supply Chains

What is more CO2-intensive: the c4,000 truck trips needed to complete a shale well, or giant offshore service vessels (OSVs), which each consume >100bpd of fuel? This data-file quantifies the CO2 intensity of supply-chains, for 10 different resource types, as a function of 30 input variables.

Download

Download

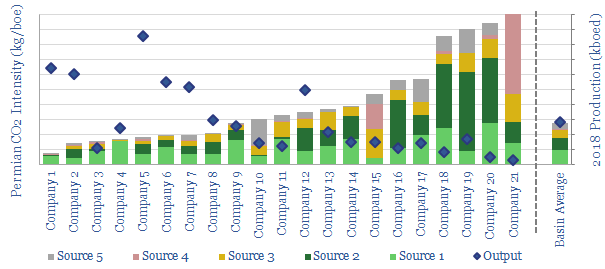

Permian CO2 Emissions by Producer

This data-file tabulates Permian CO2 intensity, based on regulatory disclosures from 20 of the leading producers to the EPA. The data are disaggregated by company, across 18 different categories, such as combustion, flaring, venting, pneumatics, storage tanks and methane leaks. There are opportunities to lower emissions.

Download

Download

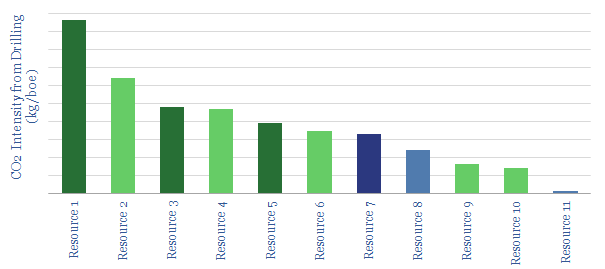

CO2 Intensity of Drilling Oil Wells?

This data-file estimates the CO2 intensity of drilling oil wells, based on the fuel consumption of different rig types. Drilling wells is not the largest portion of the oil industry's total CO2 intensity. Nevertheless there is a 50x spread between the best barrels at prolific onshore fields and the worst barrels at mature deepwater assets.

Download

Download

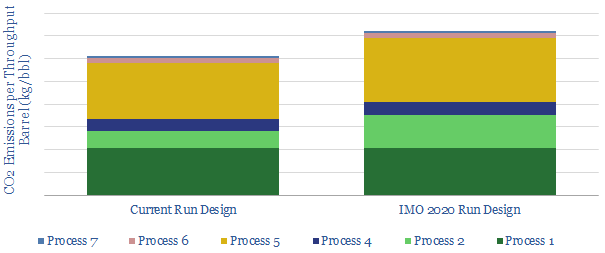

Carbon Costs of IMO 2020?

CO2 intensity of oil refineries could rise by 20% due to IMO 2020 sulphur regulations, if all high-sulphur fuel oil is upgraded into low-sulphur diesel, we estimate. The drivers are an extra stage of cracking, plus higher-temperature hydrotreating, which will also increase hydrogen demands. This one change could undo 30-years of efficiency gains.

Download

Download

Energy Efficiency

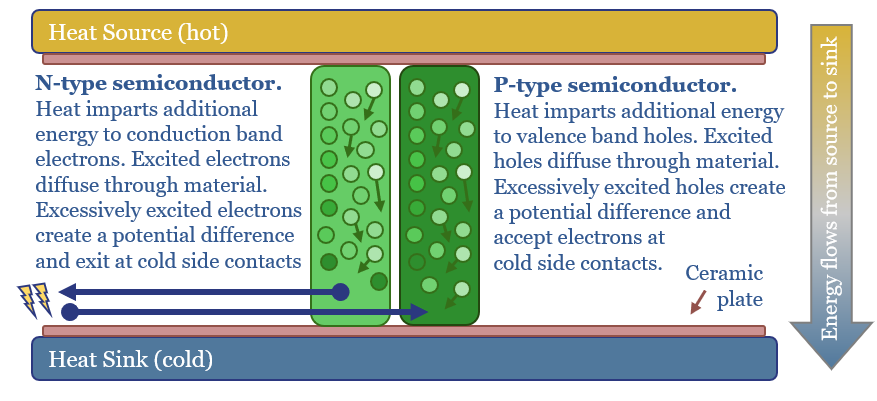

Seebeck Effect: are thermoelectrics the next solar?

Solar semiconductors have changed the world, converting light into clean electricity. Hence can thermoelectric semiconductors follow the same path, converting heat into electricity with no moving parts? This 14-page report reviews the opportunity, challenges, efficiency, costs and companies.

Download

Download

MOSFETs: energy use and power loss calculator?

MOSFETs are fast-acting digital switches, used to transform electricity, across new energies and digital devices. MOSFET power losses are built up from first principles in this data-file, averaging 2% per MOSFET, with a range of 1-10% depending on voltage, switching, on resistance, operating temperature and reverse recovery charge.

Download

Download

Energy Recovery Inc: pressure exchanger technology?

Pressure exchangers transfer energy from a high-pressure fluid stream to a low-pressure fluid stream, and can save up to 60% input energy. Energy Recovery Inc is a leading provider of pressure exchangers, especially for the desalination industry, and increasingly for refrigeration, air conditioners, heat pump and industrial applications. Our technology review finds a moat.

Download

Download

LEDs: seeing the light?

Lighting is 2% of global energy, 6% of electricity, 25% of buildings’ energy. LEDs are 2-20x more efficient than alternatives. Hence this 16-page report is our outlook for LEDs in the energy transition. We think LED market share doubles to c100% in the 2030s, to save energy, especially in solar-heavy grids. But demand is also rising due to ‘rebound effects’ and use in digital devices. We have screened 20 mature and (mostly) profitable pure plays.

Download

Download

LED lighting: leading companies in LEDs?

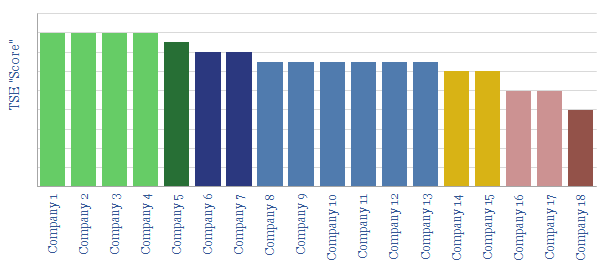

20 leading companies in LED lighting are compared in this data-file, mostly mid-caps with $2-10bn market cap and $1-8bn of lighting revenues, listed in the US, Europe, Japan, Taiwan. Operating margins averaged 8% in 2022, due to high competition, fragmentation and inorganic activity. The value chain ranges from LED semiconductor dyes to service providers installing increasingly efficient lighting systems as part of the energy transition.

Download

Download

AirJoule: Metal Organic Framework HVAC breakthrough?

Montana Technologies is developing AirJoule, an HVAC technology that uses metal organic frameworks, to lower the energy costs of air conditioning by 50-75%. The company is going public via SPAC and targeting first revenues in 2024. Our AirJoule technology review finds strong rationale, technical details and challenges.

Download

Download

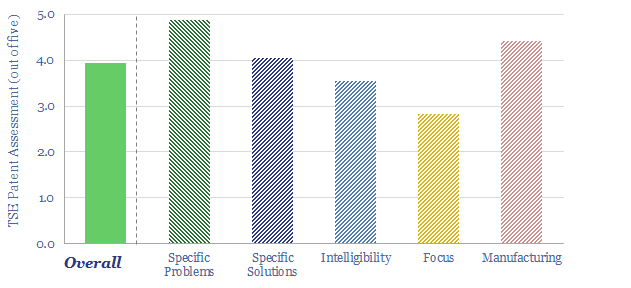

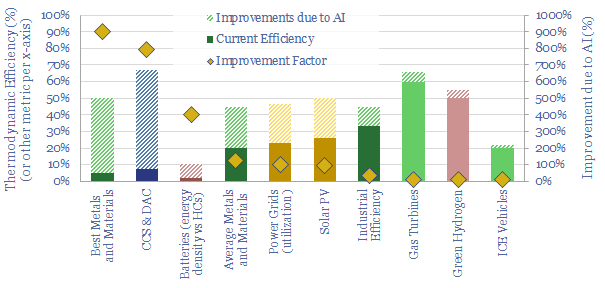

Omniscience: how will AI reshape the energy transition?

AI will be a game-changer for global energy efficiency, saving 10x more energy than it consumes directly, closing 'thermodynamic gaps' where 80-90% of all primary energy is wasted today. Leading corporations will harness AI to lower costs and accelerate decarbonization. This 19-page note explores opportunities.

Download

Download

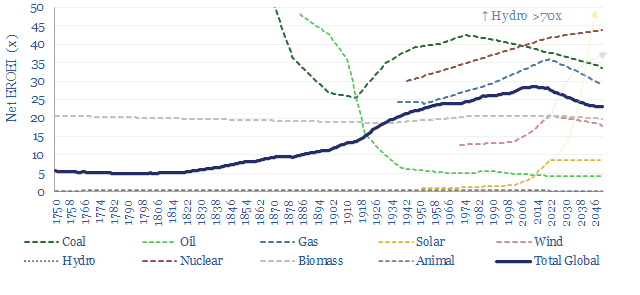

EROEI: energy return on energy invested?

EROEI is the best metric for comparing end-to-end energy efficiencies. Wind and solar currently have EROEIs that are lower and ‘slower’ than today’s global energy mix; stoking upside to energy demand and capex. But future wind and solar EROEIs could improve 2-6x. This 13-page report explores whether this will be the make-or-break factor determining the ultimate share of renewables?

Download

Download

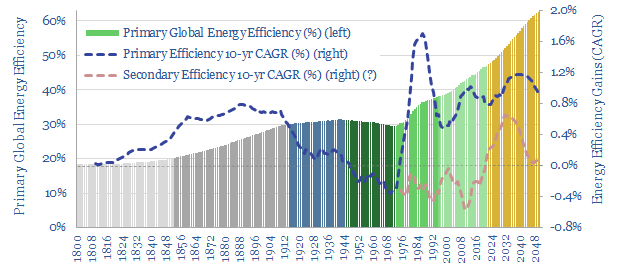

Energy efficiency: a riddle, in a mystery, in an enigma?

Projections of future global energy demand depend on energy efficiency gains, which are hoped to step up from 1% per year since 1970, to above 3% per year to 2050. But there is a problem. Energy efficiency is vague. And hard to measure. This 17-page note explains why we are worried that global energy demand will surprise to the upside as efficiency gains disappoint optimistic forecasts.

Download

Download

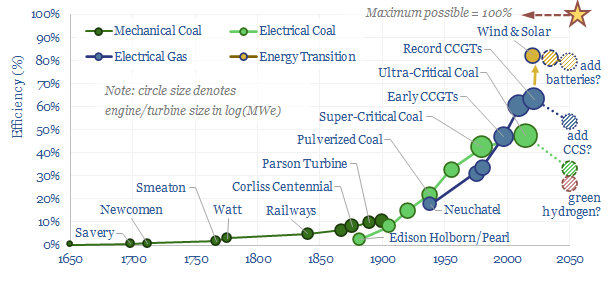

Prime movers: efficiency of power generation over time?

How has the efficiency of prime movers increased across industrial history? This data-file profiles the continued progress in the efficiency of power generation over time, from 1650 to 2050e. As a rule of thumb, the energy system has shifted to become ever more efficient over the past 400-years.

Download

Download

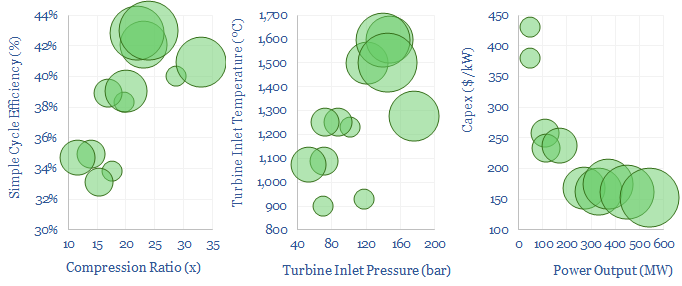

Gas turbines: operating parameters?

A typical simple-cycle gas turbine is sized at 200MW, and achieves 38% efficiency, as super-heated gases at 1,250ºC temperature and 100-bar pressure expand and drive a turbine. Efficiency rises to 58% in a combined cycle. The purpose of this data-file is to tabulate typical operating parameters of gas turbines.

Download

Download

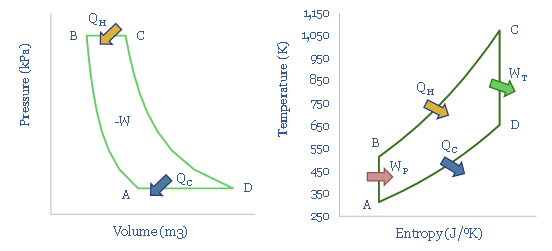

Thermodynamics: Carnot, Rankine, Brayton & beyond?

Engines convert heat into work. They are governed by thermodynamics. This note is not a 1,000 page textbook. The goal is to explain different heat engines, simply, in 13-pages, covering what we think decision makers in the energy transition should know. The theory underpins the appeal of electrification, ultra-efficient gas turbines, CHPs, nuclear HTGRs and new super-critical CO2 power cycles.

Download

Download

Refrigerants: leading chemicals for the rise of heat pumps?

This data-file is a breakdown of c1MTpa of refrigerants used in the recent past for cooling, across refrigerators, air conditioners, in vehicles, industrial chillers, and increasingly, heat pumps. The market is shifting rapidly towards lower-carbon products, including HFOs, propane, iso-butane and even CO2 itself. We still see fluorinated chemicals markets tightening.

Download

Download

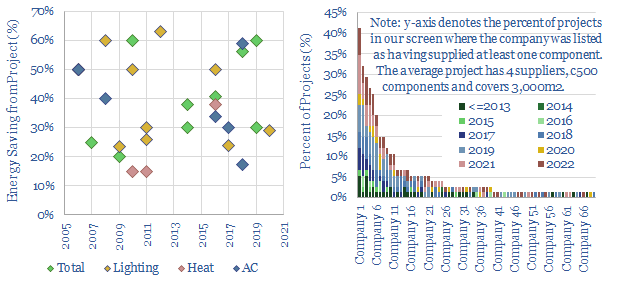

Building automation: energy savings, KNX case studies and companies?

High-quality building automation typically saves 30-40% of the energy needed for lighting, heating and cooling a building. This matters amidst energy shortages, and reduces payback times on $100-500k up-front capex. This data-file aggregates case studies of KNX energy savings, and screens 70 companies, from Capital Goods giants to private pure-plays.

Download

Download

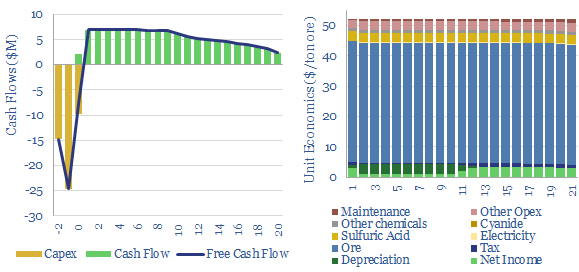

Heap leaching: energy economics?

This data-file captures the energy economics of leaching in the mining industry, especially the costs of heap leaching, for the extraction of copper, nickel, gold, silver, other precious metals, uranium, and Rare Earths. The data-file allows you to stress test costs in $/ton of ore, $/ton of metal, capex, opex, chemicals costs, energy intensity and CO2 intensity.

Download

Download

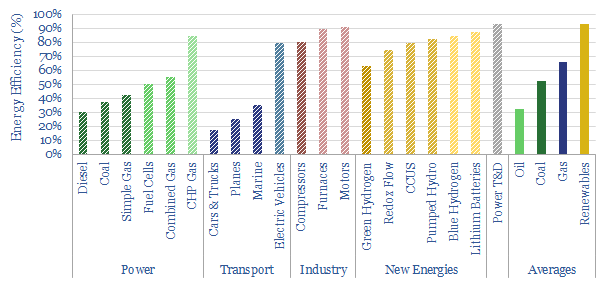

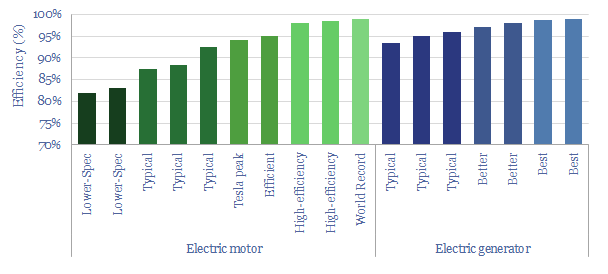

Energy efficiency: an overview?

This data-file is an overview of energy efficiency. The average power generation facility is c40% efficient. The average ICE is 20%. The average EV is 80%. The average industrial process is 85%. Some new energies have efficiency losses.

Download

Download

PureCycle: polypropylene recycling breakthrough?

PureCycle was founded in 2015, went public via SPAC in 2021 and aims to recycle waste polypropylene into virgin-like polypropylene saving 79% of the usual input energy and 35% of the input CO2. Despite recent controversies, our PureCycle technology review is able to de-risk several ambitions.

Download

Download

Aurubis: copper recycling breakthrough?

Aurubis produces copper products from 1MTpa of recycled materials and 2.25MTpa of concetrates. Energy use and CO2 emissions are two-thirds lower than primary copper production. Our technology review finds a partial moat.

Download

Download

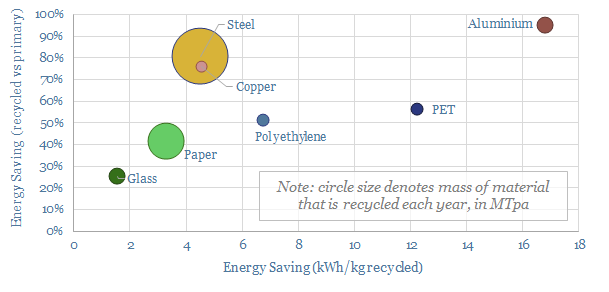

Recycling: a global overview of energy savings?

1GTpa of material is recycled globally, across steel, paper, glass, plastics and other metals. On average, 35% of these materials are produced from recycled feeds, saving 70% of the energy and CO2, with upside in the Energy Transition.

Download

Download

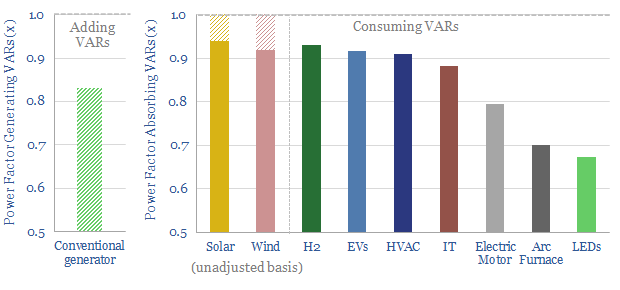

Capacitor banks: raising power factors?

Power factor corrections could save 0.5% of global electricity, with $20/ton CO2 abatement costs in normal times, and 30% pure IRRs during energy shortages. They will also be needed to integrate more new energies into power grids. This note outlines the opportunity in capacitor banks, their economics and leading companies.

Download

Download

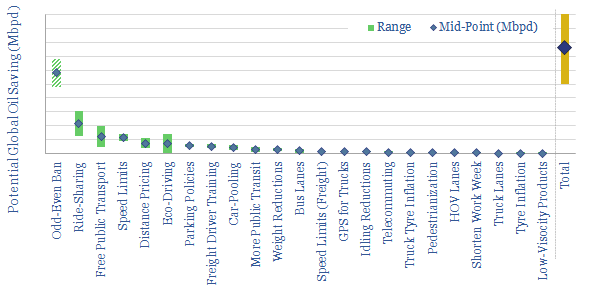

Oil demand: how much can you save in a crisis?

Oil consuming countries are encouraged to have emergency plans to save 7-10% of their demand in a crisis. This data-file outlines how. c10Mbpd could be saved globally. But it requires extreme measures. Largest are odd-even rationing, ride-sharing, free public transit and lower highway speed limits.

Download

Download

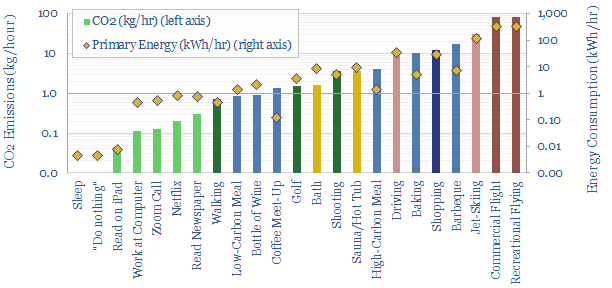

CO2 emissions per hour of activity?

The purpose of this data-file is to tabulate our best estimates for the CO2 associated with different activities. The average US person emits about 2.2kg of CO2e per hour. Food and transport choices have a large impact. Among the lowest carbon is reading at home on a tablet.

Download

Download

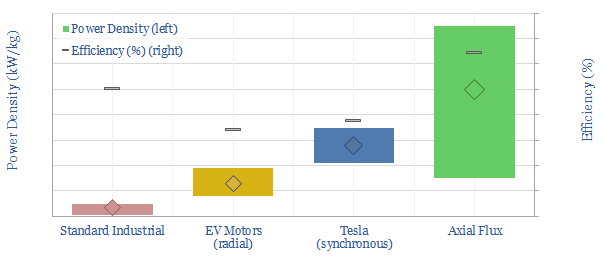

Electric motors: state of flux?

This 15-page note explores whether axial flux motors could come to dominate in the future of transportation. They promise 2-3x higher power densities, even versus Tesla’s world-leading PMSRMs; and 10-15x higher than clunky industrial AC induction units; while also surpassing c96% efficiencies.

Download

Download

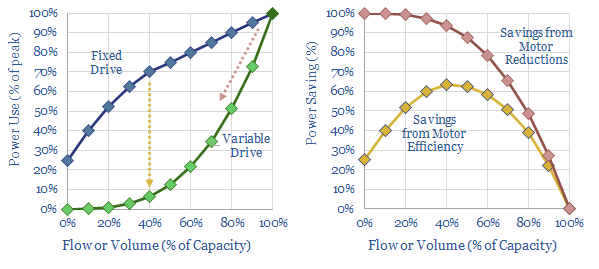

Electric motors: variable star?

Variable frequency drives precisely control motors. Amazingly they could reduce global electricity demand by c10%. We expect a sharp acceleration due to sustained energy shortages, increasingly renewable-heavy grids and excellent 20-50% IRRs. Hence this 14-page note reviews the opportunity and who benefits.

Download

Download

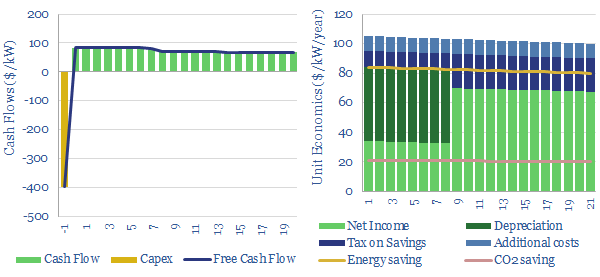

Variable frequency drives: the economics?

Variable frequency drives optimize the operating speeds of electric motors. Average energy saving are 34% and average costs are $250/kW. Hence our modelling calculates >15% IRRs installing a VFD at a typical industrial motor. This data-file captures the economics.

Download

Download

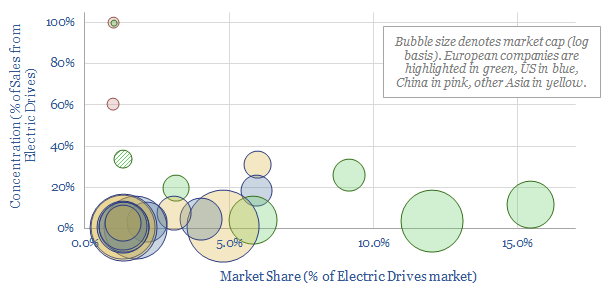

Variable frequency drives: leading companies?

This data-file outlines the top twenty companies producing variable frequency drives to precisely control electric motors. The top three companies are European capital goods players. High-quality VFDs may protect against growing competition from China.

Download

Download

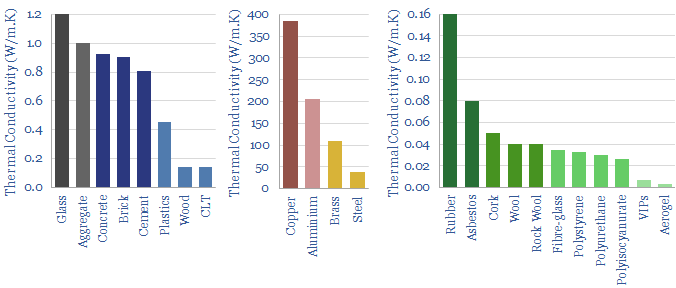

Aspen Aerogels: insulation breakthrough?

Aerogels have thermal conductivities that are 50-80% below conventional insulators. Target markets include preventing thermal runaway in electric vehicle batteries and cryogenic industrial processes (e.g., LNG). This data-file notes some challenges, using our usual patent review framework.

Download

Download

Insulation: deliver us from gas shortages?

Insulating materials slow the flow of heat from a warm house by 30-100x. But 60-90% of today’s housing stock is 30-70% under-insulated. We think renovation rates could treble as gas shortages re-prioritize energy savings. This 12-page note screens who might benefit.

Download

Download

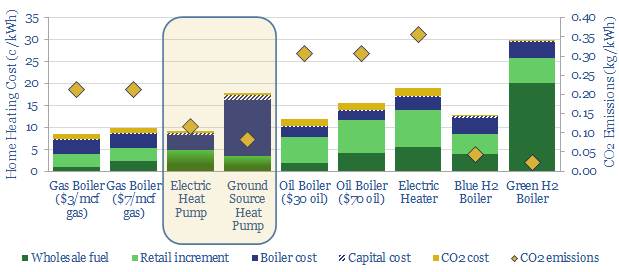

Heat pumps: hot and cold?

Some policymakers now aspire to ban gas boilers and ramp heat pumps 10x by 2050. In theory, the heat pump technology is superior. But in practice, there are ten challenges. It could become a political disaster. The most likely outcome is a 0-2% pullback in European gas by 2030.

Download

Download

Heat pumps: a screen of providers and reviews?

This data-file tabulates our subjective opinions on c20 different heat pump companies, based on their consumer reviews, pricing, reliability, efficiency, company size, models, integration, and visual/acoustic properties. We conclude heat pumps are opaque and must be selected carefully.

Download

Download

Absorption chillers: the economics?

This data-file approximates the costs of absorption chillers, which perform the thermodynamic alchemy of converting waste heat (e.g., from a CHP turbine) into coldness. This will be increasingly important to shore up future, renewables-heavy grids. 10% IRRs can also be generated with $50/ton CO2 abatement costs.

Download

Download

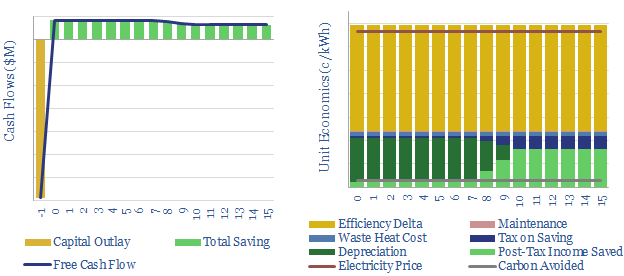

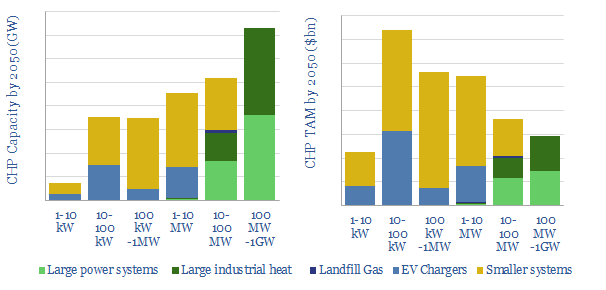

Combined heat and power turbines: market sizing?

The purpose of this data-file is to ballpark the ultimate potential market size for combined heat and power systems in the US (CHPs). Our build-up looks across five main categories: large power facilities, large industrial heating facilities, landfill gas, electric vehicle charging and smaller-scale commercial and multi-family usage.

Download

Download

Energy efficiency of motors and power generators?

This data-file estimates the efficiency of electric motors and power generators, using specific examples and data-points. This matters as there are around 50bn motors in the world, consuming c45% of global electricity. Efficiency ratings are generally high, above 90%, although lagging and non-optimized motors can be in the 70-80% range.

Download

Download

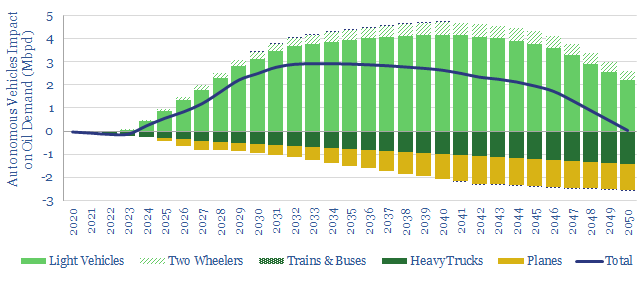

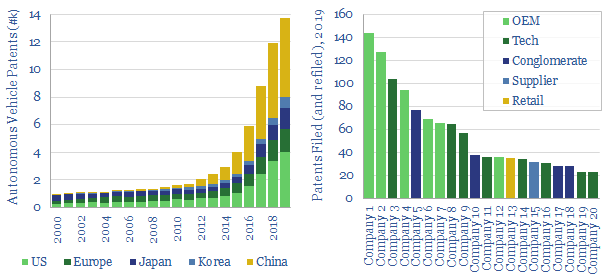

Oil demand: the rise of autonomous vehicles?

We are raising our medium-term oil demand forecasts by 2.5-3.0 Mbpd to reflect the growing reality of autonomous vehicles. AVs improve fuel economy in cars and trucks by 15-35%, and displace 1.2Mbpd of air travel. But their convenience also increases travel. This note outlines the opportunity.

Download

Download

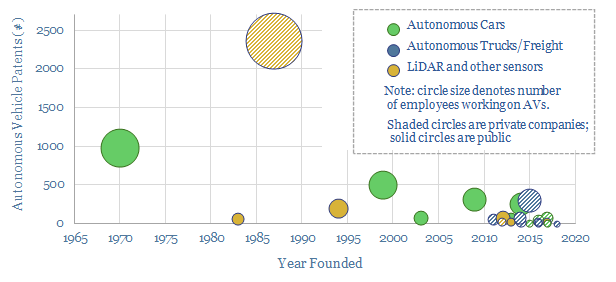

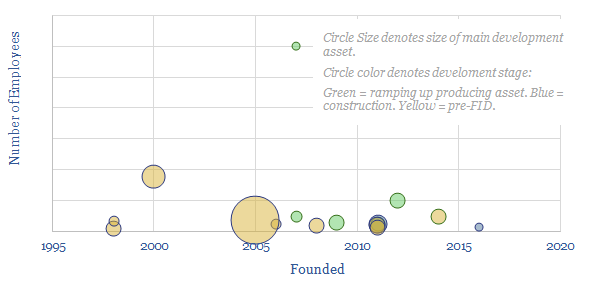

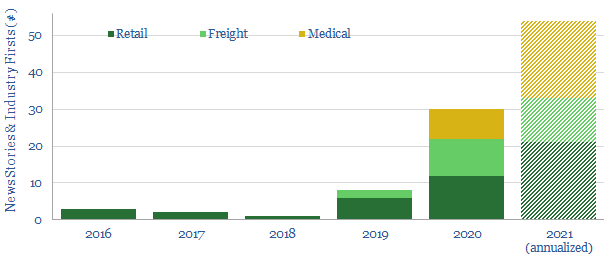

Autonomous vehicles: technology leaders?

We have screened 25 leading companies in autonomous vehicles (public and private), tabulating their technical progress and proposals for Level 4-5 autonomy. 75% of the companies were founded in the last decade. Leaders are focused on freight, cars, taxis and LiDAR sensing.

Download

Download

Cost and CO2 intensity of home cooking technologies?

The most important determinant of cooking's CO2 intensity is consumer behaviour. At today's energy costs and grid mix, gas-fired cooking yields the lowest costs. Sometimes electrification of cooking will decrease CO2 and sometimes not. Electric induction is most efficient, but 2-3x more expensive than gas and electric hobs.

Download

Download

Industrial heating technologies: an overview?

This data-file summarizes over a dozen industrial heating technologies, including their temperatures, efficiency, advantages and challenges. Generally 90% of incoming energy can be converted to industrial process heat and c40% achieves useful exergetic output. But ranges very broadly from 10-90%.

Download

Download

Lighting: historical costs and energy efficiency?

This data-file assesses lighting solutions throughout history, from candles, to whale oil, to incandescent bulbs, to modern LEDs. Overall, the best LEDs now achieve over 80% useful energy efficiency. Lighting costs have improved by 100x over the past century, while efficiency has improved 13x.

Download

Download

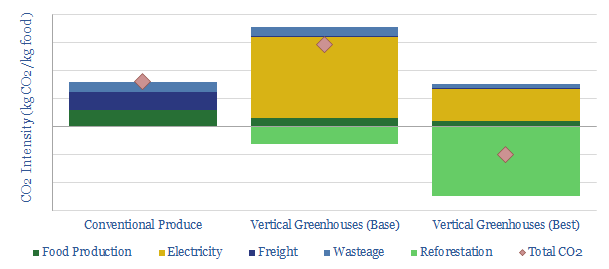

Vertical greenhouses: what future in the transition?

Vertical greenhouses achieve 10-400x greater yields per acre than field-growing, stacking layers of plants indoors, and illuminating each layer with LEDs. Economics are exciting. CO2 intensity varies. But it can be carbon-negative if powered by renewables. This 17-page case study outlines the opportunity.

Download

Download

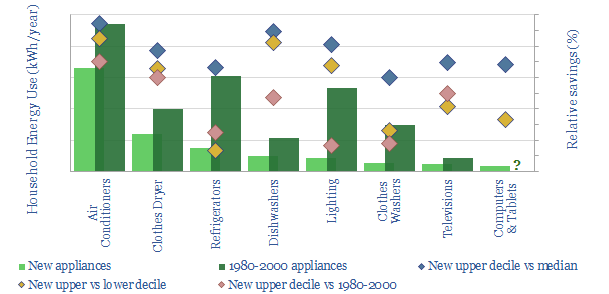

Energy efficiency of household appliances?

We estimate a house equipped with the best modern appliances will likely have 60% lower energy demand versus 30-years ago. 40% is from improvements over time, and 20% is from choosing the best modern appliances in each category. We present 20,000 data-points across eight categories.

Download

Download

Vehicles

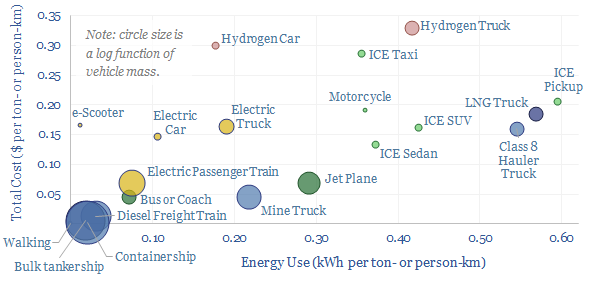

Vehicles: energy transition conclusions?

Vehicles transport people and freight around the world, explaining 70% of global oil demand, 30% of global energy use, 20% of global CO2e emissions. This overview summarizes all of our research into vehicles, and key conclusions for the energy transition.

Download

Download

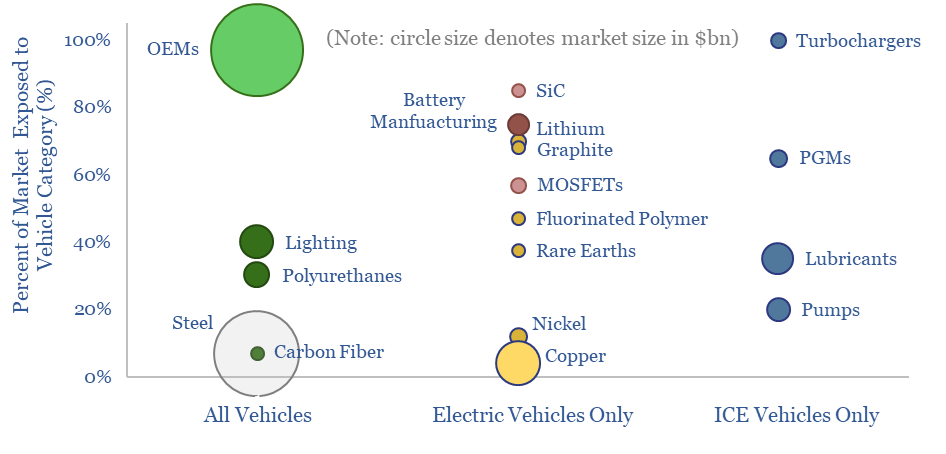

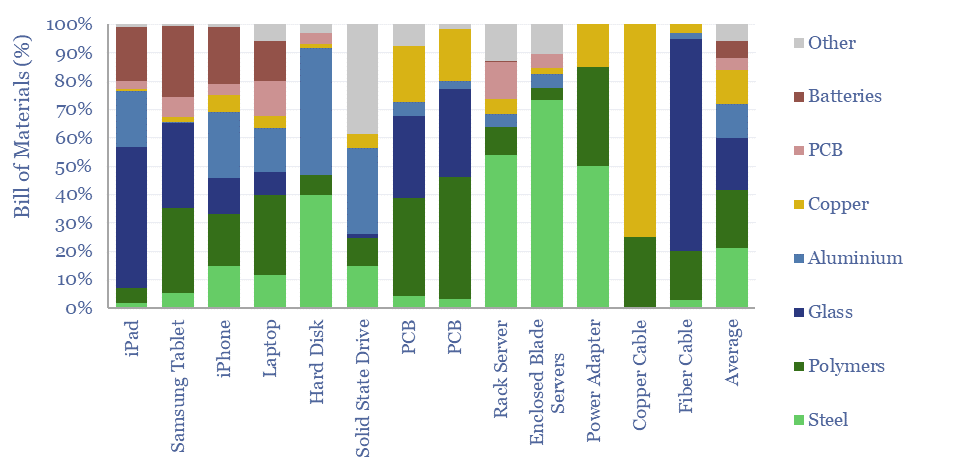

Mapping vehicle value chains?

Who is impacted if vehicle sales, EVs or ICE volumes surprise? Autos are a $2.7 trn pa global market, a vast 2.5% of global GDP. 15% is gross margin for OEMs. The other 85% is spread across metals, materials and capital goods. Hence this 14-page note highlights 200 companies from our database of 1,500 companies. Some are geared to ICEs. Some to EVs. And some to both.

Download

Download

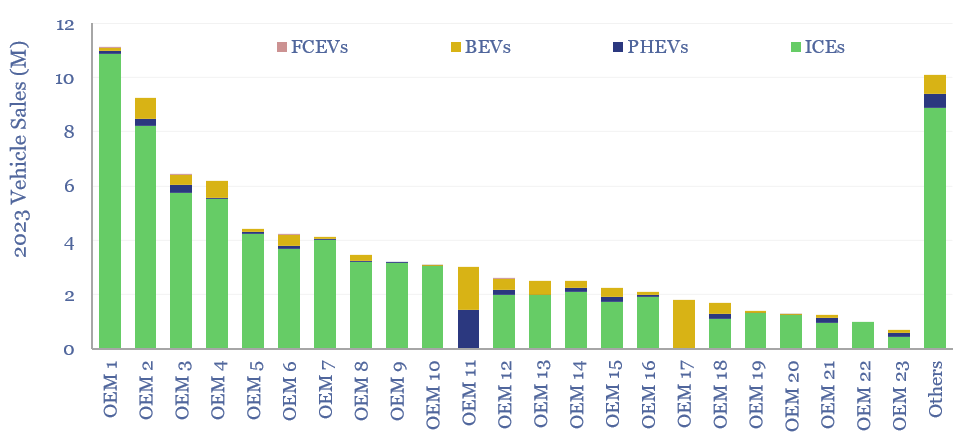

Global vehicle sales by manufacturer?

Global vehicle sales by manufacturer are broken down in this screen. 20 companies produce 85% of the world's vehicles, led by Toyota, VW, Stellantis, GM and Ford. The data-file contains key numbers and notes on each company, including each company's sales of BEVs, PHEVs, general EV strategy, and how it has been evolving in 2024.

Download

Download

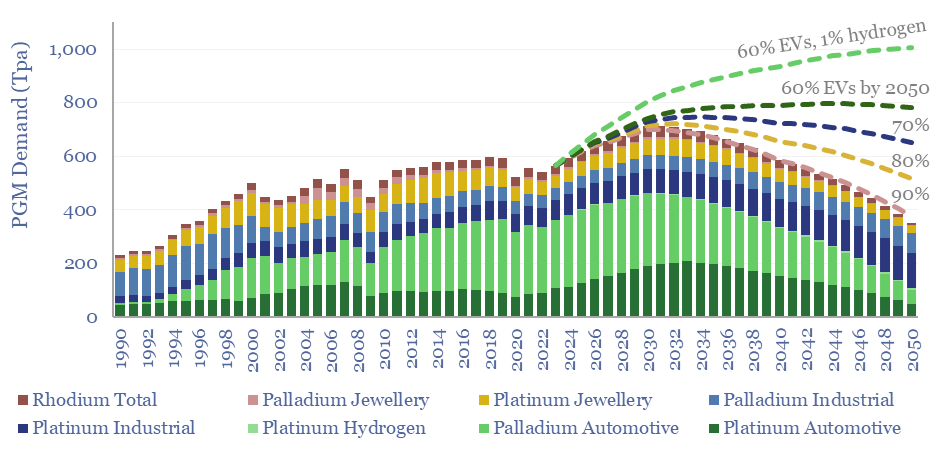

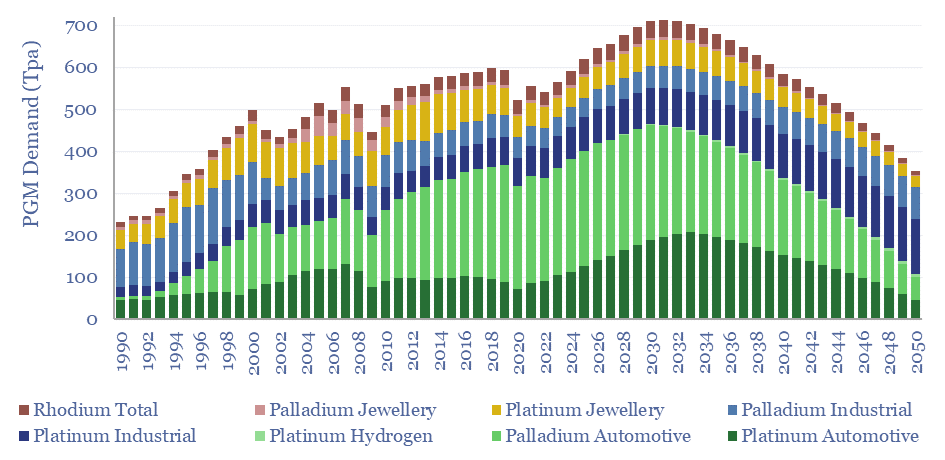

Going platinum: PGMs in energy transition?

Could PGMs experience another up-cycle through 2030, on more muted EV sales growth in 2025-30, and rising catalyst loadings per ICE vehicle? This 16-page note explores global supply chains for platinum and palladium, the long-term demand drivers for PGMs in energy transition, and profiles leading PGM producers.

Download

Download

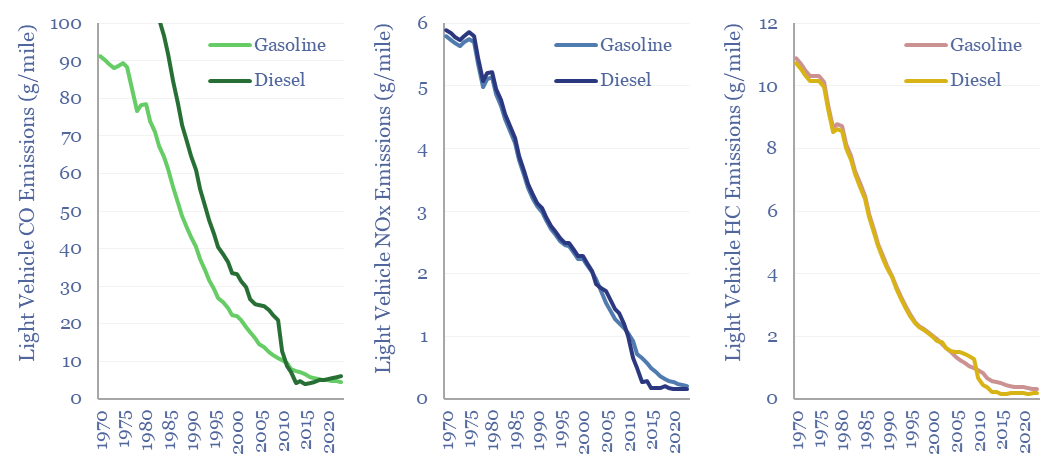

Vehicle emissions of CO, NOx and HCs?

There has been a remarkable reduction in the negative air quality impacts of combustion vehicles since 1970, as quantified in this data-file and over time. Vehicle emissions of CO, NOx and HCs have all fallen by 20-60x over the past 50-years, to 5 grams/mile, 0.2 grams/mile and 0.3 grams per mile, respectively. This data-file quantifies … Continue reading "Vehicle emissions of CO, NOx and HCs?"

Download

Download

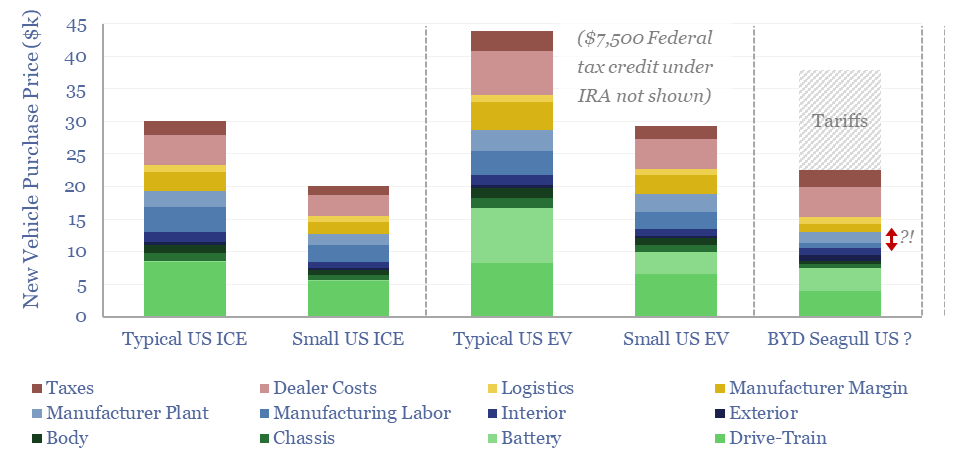

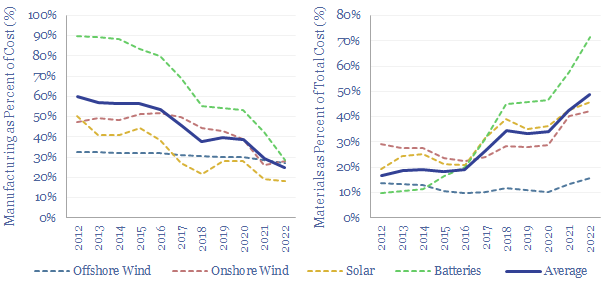

Electric vehicles: the road to cost parity?

Could electric vehicles deflate towards cost parity with ICEs in 2025-30, helping to re-accelerate EV adoption? This 13-page report contains a granular sum-of-the-parts cost breakdown for EVs vs ICEs. Then we consider battery deflation, power train deflation, small urban EVs, tax incentives, and the representativeness of low-cost Chinese EVs.

Download

Download

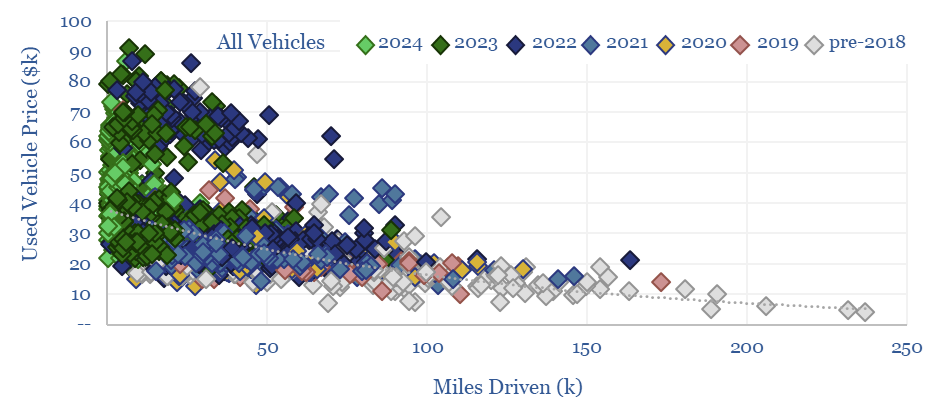

Vehicle depreciation rates: EVs versus ICEs?

This data-file quantifies the cost per mile of vehicle ownership across different categories by correlating second hand car prices with their accumulated mileage. Hybrids and regular passenger cars are most economical. SUVs and EVs are 2x more expensive. Hydrogen vehicles depreciate fastest and will have lost over 90% of their value after 100,000 miles.

Download

Download

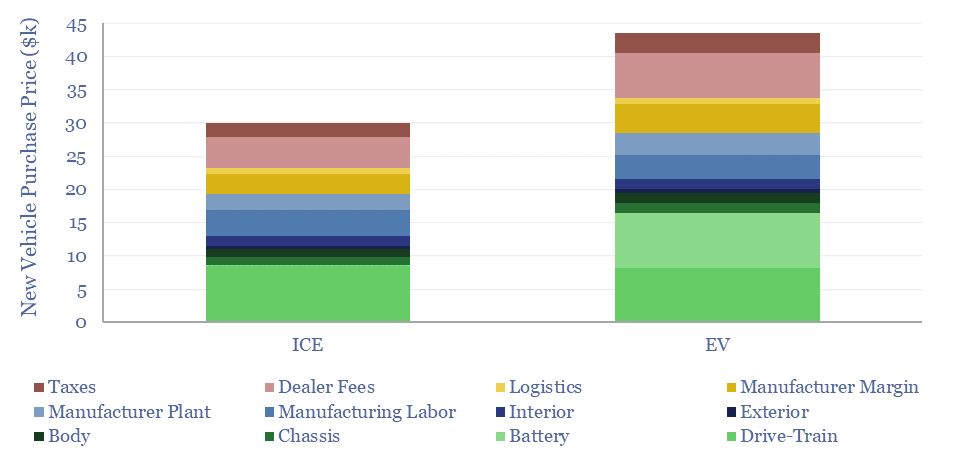

Electric vehicle cost breakdown by component?

This data-file disaggregates the $30k total cost of a typical new ICE and the c$45k total cost of a typical new EV, as a sum-of-the-parts, across 25 cost lines. Drivetrain costs are similar at $8-9k each. The key challenge for the EV is the battery. The electric vehicle cost breakdown shows promise for improving power electronics and smaller batteries.

Download

Download

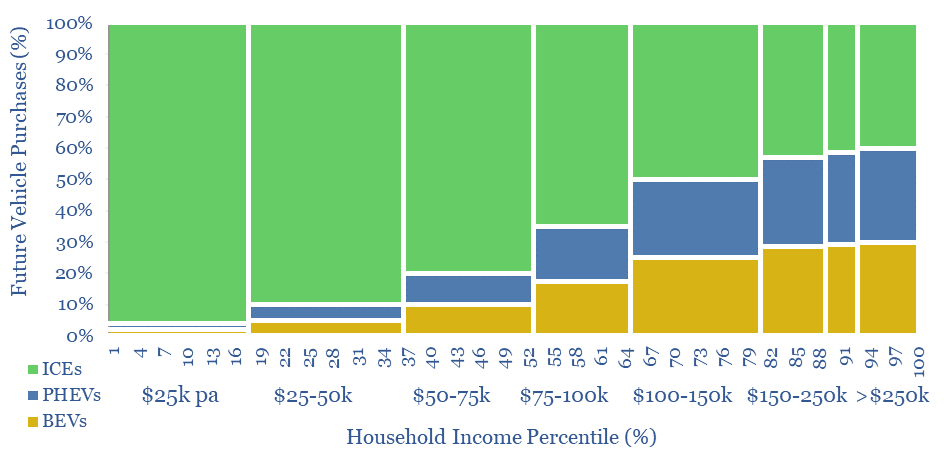

Electric vehicles: saturation point?

Energy transition technologies are often envisaged to follow S-curves: rapidly inflecting, then reaching 100% market adoption. However, this 17-page report argues electric vehicles will more likely saturate at 15-30% of sales in 2025-30. EVs were already at 15% of sales in 2023. So what would the more limited EV upside mean for energy and materials?

Download

Download

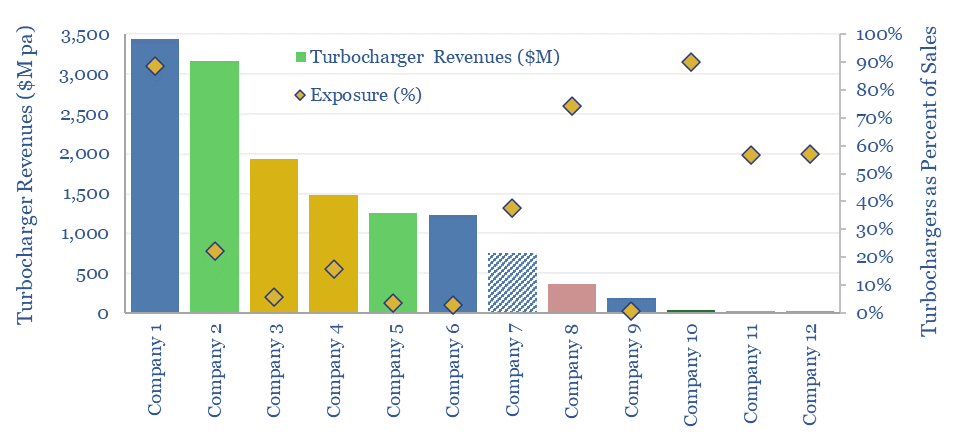

Turbochargers: leading companies?

Six leading companies in turbochargers control two-thirds of the $15-20bn pa global turbochargers market. 55% of ICE vehicles now have turbochargers, which can improve fuel economy my as much as 10%, by enabling smaller and better utilized engines to achieve higher peak power ratings. What opportunities ahead, to adapt for vehicle electrification, or even if EV sales accelerate less than expected in 2025-30?

Download

Download

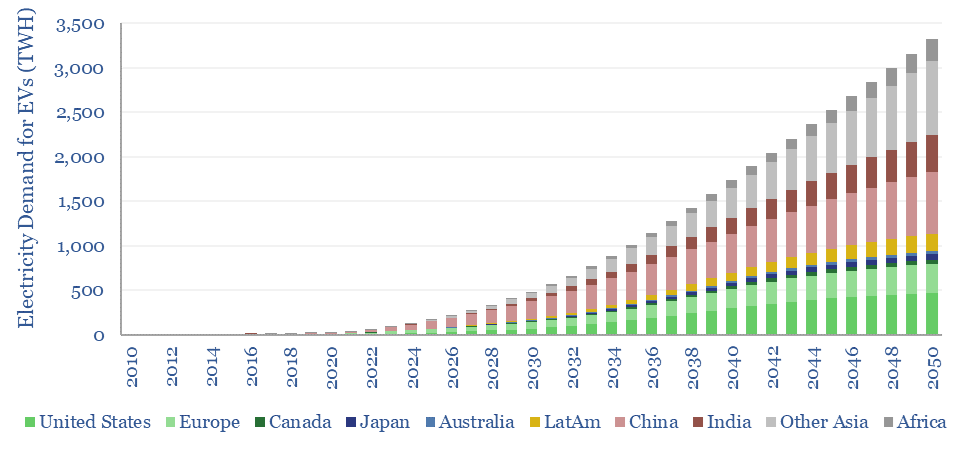

Electricity demand for electric vehicles?

Global electricity demand for electric vehicles will rise from 120TWH in 2024 to 500 TWH in 2030 and 3,300 TWH in 2050, ultimately adding 11% upside to today's global electricity demand, as part of our roadmap to net zero. This data-file quantifies electricity demand for EVs by region and over time, including data into the real-world fuel economy of EVs.

Download

Download

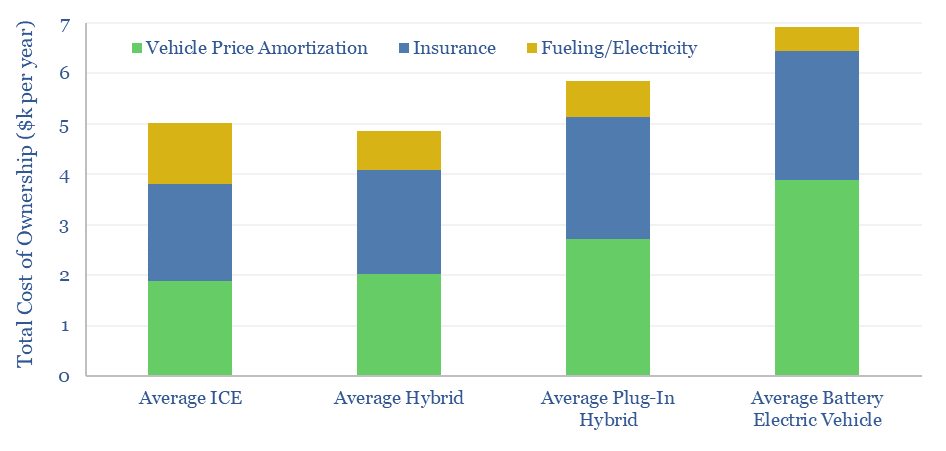

Electric vehicles: total cost of ownership?

Electric vehicles' total cost of ownership remains 40% higher than ICE vehicles, at $7,000 per year, versus $5,000 per year, all based on the latest 2024 data, for 50 vehicles. Electric vehicle up-front prices are 55% higher, insurance costs are 30% higher, while energy costs are 60% lower. 20 different pricing metrics are compared and contrasted in this data-file.

Download

Download

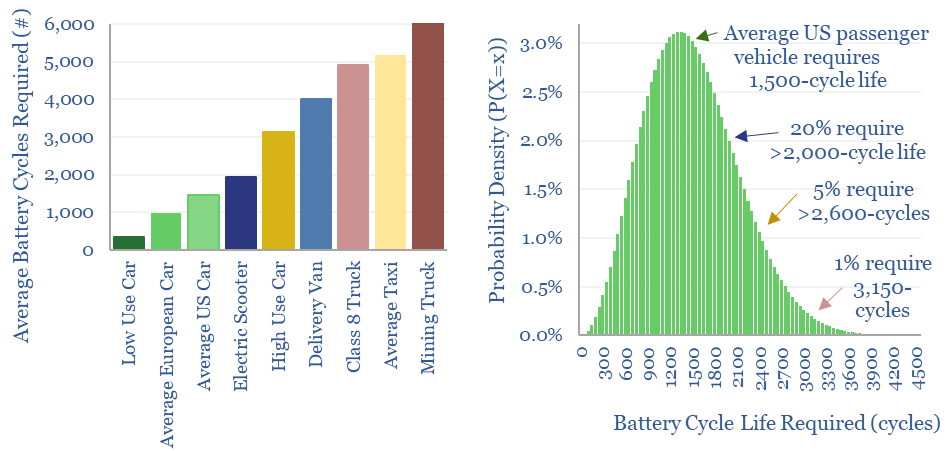

Electric vehicle: battery life?

Electric vehicle battery life will realistically need to reach 1,500 cycles for the average passenger vehicle, 2,000-3,000 cycles after reflecting a margin of safety for real-world statistical distributions, and 3,000-6,000 cycles for higher-use commercial vehicles. This means lithium ion batteries may be harder to displace with novel chemistries?

Download

Download

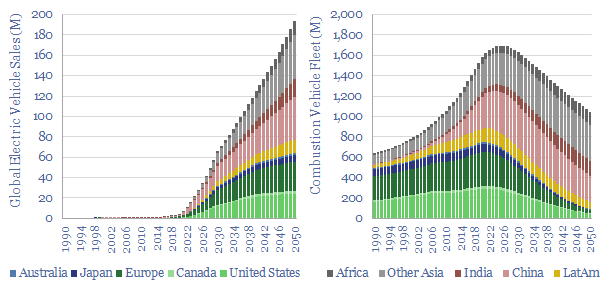

Electric vehicles: breaking the ICE?

Electric vehicles are a world-changing technology, 2-6x more efficient than ICEs, but how quickly will they ramp up to re-shape global oil demand? This 14-page note finds surprising ‘stickiness’. Even as EV sales explode to 200M units by 2050 (2x all-time peak ICE sales), the global ICE fleet may only fall by 40%. Will LT oil demand surprise to the upside or downside?

Download

Download

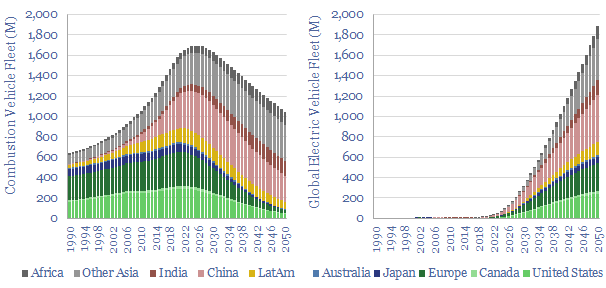

Global vehicle fleet: vehicle sales and electrification by region?

We have modeled the global light vehicle fleet, light vehicle sales by region, and the world's shift from internal combustion engines (ICEs) towards electric vehicles (EVs) through 2050. Our base case model sees almost 200M EV sales by 2050, and a c40% decline to around 1bn combustion vehicles in the world's fleet by 2050.

Download

Download

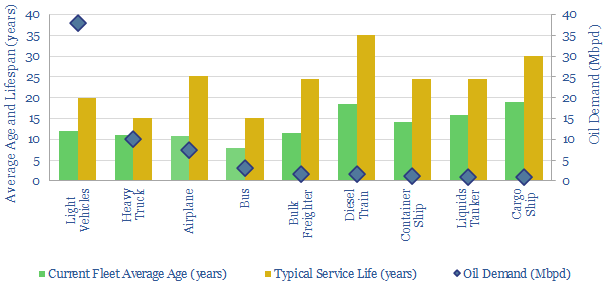

Vehicle fleets: service life and retirement age by vehicle type?

The weighted-average combustion vehicle in the world has a current age of 12-years and an expected service life of 20-years. In other words, a new combustion vehicle entering the global fleet in 2023 will most likely be running through 2043. Useful data and notes are compiled overleaf.

Download

Download

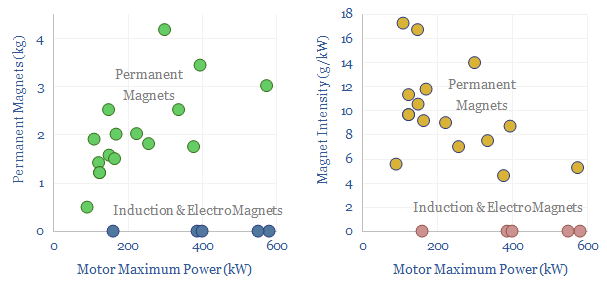

Electric vehicles: motors and magnets?

This data-file assesses electric vehicle magnets, permanent magnets and the use of Rare Earth materials such as neodymium (NdFeB). 80-90% of recent EVs have used Rare Earth permanent magnets, averaging 1.5 kg per vehicle, or 7.5g/kW of drive-train power, across the data-file. But the numbers vary vastly. From 0-4 kg per vehicle. 20 vehicles from different OEMs are tabulated in the data-file.

Download

Download

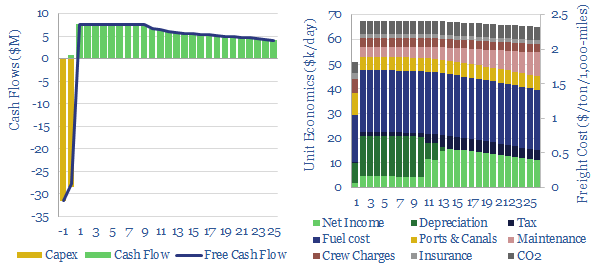

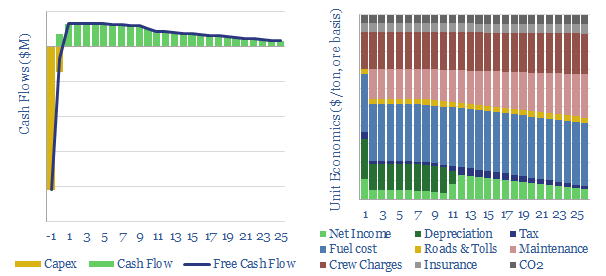

Bulk shipping: cost breakdown?

Bulk carriers move 5GTpa of commodities around the world, explaining half of all seaborne global trade. This model is a breakdown of bulk shipping cost. We estimate a cost of $2.5 per ton per 1,000-miles, and a CO2 intensity of 5kg per ton per 1,000-miles. Marine scrubbers increasingly earn their keep and uplift IRRs from 10% to 12% via fuel savings.

Download

Download

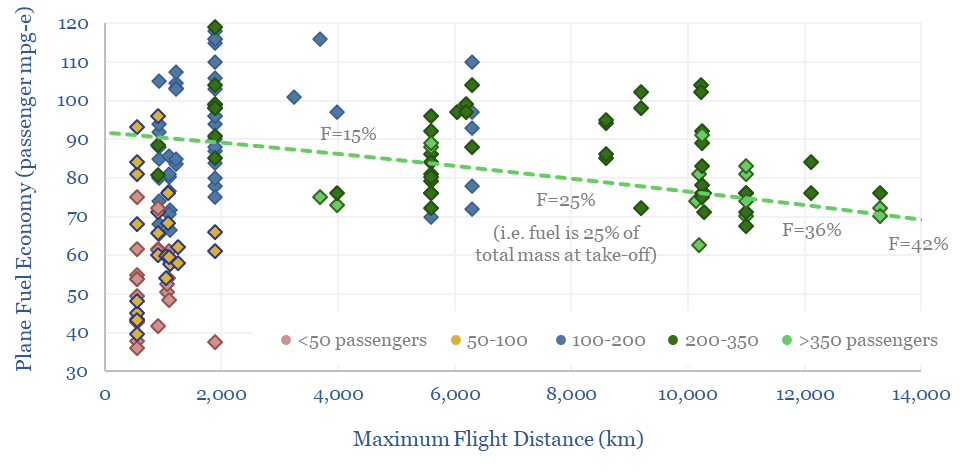

Commercial aviation: fuel economy of planes?

This data-file calculates the fuel economy of planes from first principles, using physics to calculate lift and drag, and comparing with actual data from aircraft manufacturers. The typical fuel economy of a plane is 80 passenger-mpg to carry 400 passengers, 8,000km at 900kmph, using jet fuel with 12,000 Wh/kg energy density. What sensitivities and decarbonization opportunities?

Download

Download

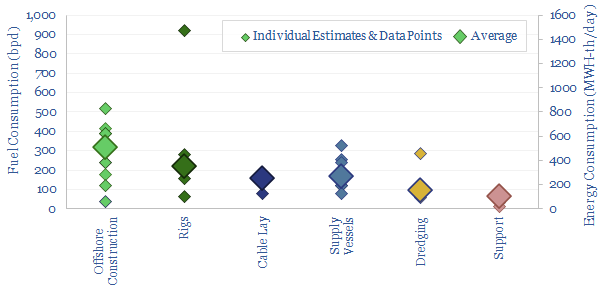

Offshore vessels: fuel consumption?

This database tabulates the typical fuel consumption of offshore vessels, in bpd and MWH/day. We think a typical offshore construction vessel will consume 300bpd, a typical rig consumes 200bpd, supply vessels consume 150bpd, cable-lay vessels consume 150bpd, dredging vessels consume 100bpd and medium-sized support vessels consume 50bpd. Examples are given in each category, with typical variations in the range of +/- 50%.

Download

Download

Hillcrest: ZVS inverter breakthrough?

Hillcrest Energy Technologies is developing an ultra-efficient SiC inverter, which has 30-70% lower switching losses, up to 15% lower system cost, weight, size, and thus interesting applications in electric vehicles. How does it work and can we de-risk the technology?

Download

Download

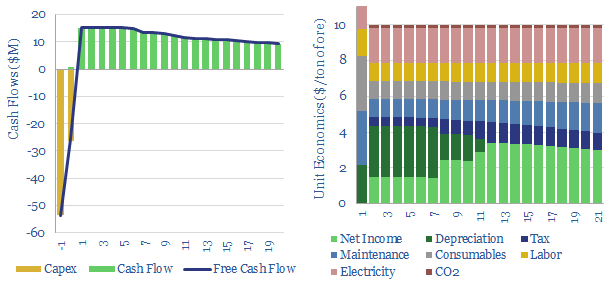

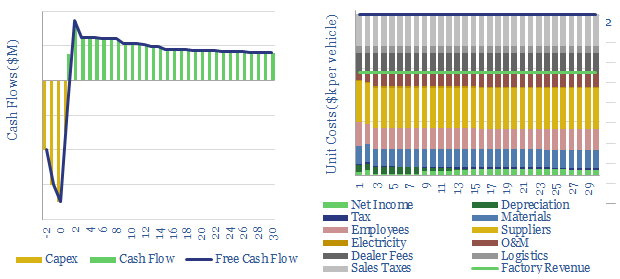

Auto manufacturing: the economics?

This is a simple model, to break down the $30k sales price of a typical mass-market automobile. c25% accrues to suppliers, c20% is sales taxes, c20% is dealer costs/logistics, c10% employees, c10% material inputs, c10% O&M, 1% electricity and c5% auto-maker margins. Prices may inflate 60% amidst industrial shortages.

Download

Download

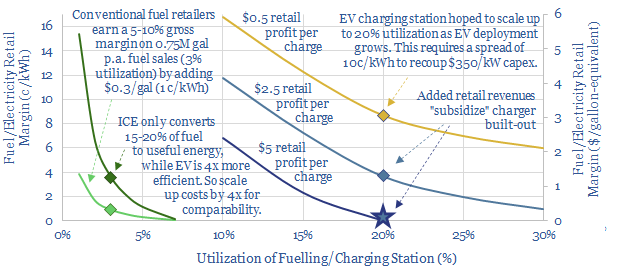

EV fast charging: opening the electric floodgates?

This 14-page note explains the crucial power-electronics in an electric vehicle fast-charging station, running at 150-350kW. Most important are power-MOSFETs, comprising c5-10% of charger costs. The market trebles by the late 2020s.

Download

Download

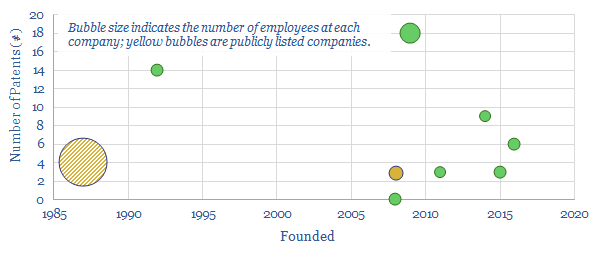

Power-MOSFETs: leading companies?

Power MOSFETs are an energy transition technology, the building block behind inverters, DC-DC converters, EV drive trains, EV chargers and other renewables-battery interfaces. Hence this data-file is a screen of companies making power MOSFETs, especially new and higher-efficiency devices using Silicon Carbide as the semi-conductor.

Download

Download

Electric vehicles: chargers of the light brigade?

This 14-page note compares the economics of EV charging stations with conventional fuel retail stations. Our main question is whether EV chargers will ultimately get over-built. Hence prospects may be best for charging equipment and component manufacturers.

Download

Download

Electric motors: state of flux?

This 15-page note explores whether axial flux motors could come to dominate in the future of transportation. They promise 2-3x higher power densities, even versus Tesla’s world-leading PMSRMs; and 10-15x higher than clunky industrial AC induction units; while also surpassing c96% efficiencies.

Download

Download

Axial flux motors: leading companies and products?

This data-file profiles leading companies and products in the space of axial flux motors, with an average power density of almost 8kW/kg, which is 10x higher than a typical AC induction motor in heavy industry. Leading companies are profiled, based on reviewing over 1,200 patents.

Download

Download

Mine trucks: transport economics?

There are around 50,000 giant mining trucks in operation globally. The largest examples are 15m long, 10m wide, 8m high, can carry around 350-450 tons and reach top speeds of 40mph. This data-file captures the economics, costs and inflationary impacts of decarbonization.

Download

Download

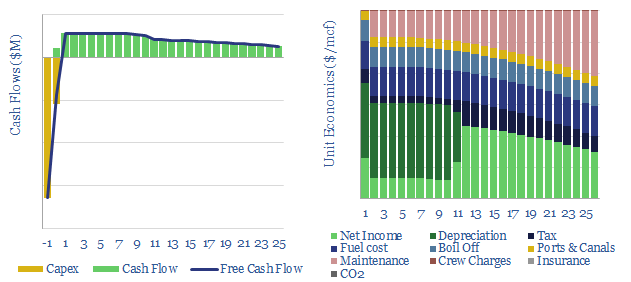

LNG transport: shipping economics?

This data-file breaks down the cost of shipping cryogenic cargoes in seaborne tankers. LNG costs $1-3/mcf. The most important input variable is transport distance. Although switching to e-fuels (green hydrogen, ammonia, methanol) can double total cost.

Download

Download

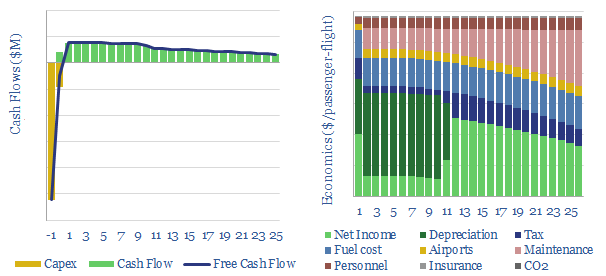

Commercial aviation: air travel economics?

This data-file estimates the economics of a passenger jet, over the course of its life: i.e., what ticket price must be charged to earn a 10% IRR after covering the capex costs of the plane, fuel costs, crew, maintenance and airport and air traffic charges. Decarbonization is challenging.

Download

Download

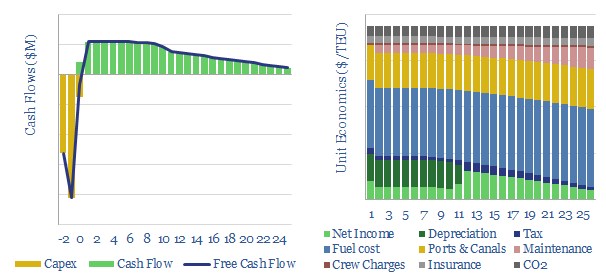

Container freight: shipping economics?

This data-file models the total costs of shipping a container c10,000 nautical miles from China to the West, in a 20,000 TEU vessel. Emerging fuels can lower the CO2 intensity of shipping from their baseline of 0.15kg/TEU-mile, by 60-90%, but freight costs inflate by 30%-3x.

Download

Download

ChargePoint: electric vehicle charging edge?

ChargePoint is the leading provider of Level 2 EV charging stations in the US and aims to help electrify mobility and freignt. Our review finds a library of simple, clear, specific and easy-to-understand patents. More debatable are the technology edge and future IP defensability.

Download

Download

Vehicle mass: what opportunities to improve fuel economy?

Steel comprises c50% of the volume and c80% of the weight of materials in a vehicle. Each 1% reduction in mass yields a 1% improvement in fuel econome. Carbon fiber repays its extra costs after 30-70k miles, while hybridisation repays its extra costs after 10-30k miles.

Download

Download

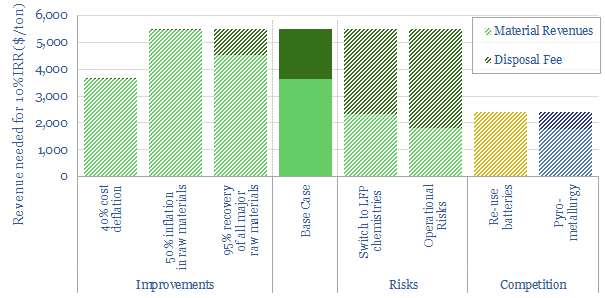

Battery recycling: long division?

Recycling lithium batteries could be worth $100bn per year by 2040 while supporting electric vehicles’ ascent. Hence new companies are emerging to recapture 95% of spent materials with environmentally sound methods. Our 15-page note explores what it would take for battery-recycling to become both practical and compelling.

Download

Download

Nio: EV-charging breakthrough?

Nio is a listed, electric vehicle manufacturer, headquartered in Shanghai. It operates over 200 "battery swap" stations, and the 2-millionth battery swap was completed in March-2021, with swap times soon falling to 3-minutes. Our patent analysis suggests a genuine moat in swappable batteries, which could only have been built up by an auto-maker.

Download

Download

Oil demand: the rise of autonomous vehicles?

We are raising our medium-term oil demand forecasts by 2.5-3.0 Mbpd to reflect the growing reality of autonomous vehicles. AVs improve fuel economy in cars and trucks by 15-35%, and displace 1.2Mbpd of air travel. But their convenience also increases travel. This note outlines the opportunity.

Download

Download

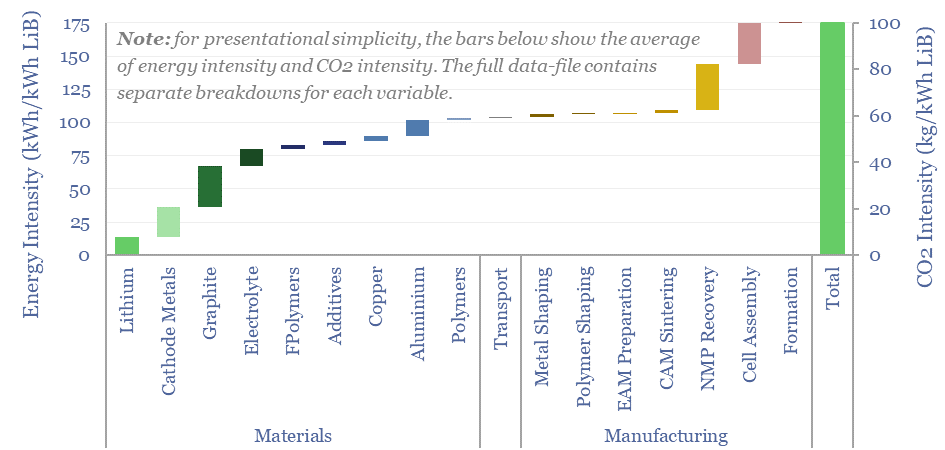

Energy costs of lithium ion batteries?

This data-file estimates the energy costs of lithium ion batteries across 17 lines. Our best estimate in 2024 is that manufacturing 1 kWh of lithium ion batteries requires 175 kWh of useful energy and emits 100kg of CO2. When a lithium ion battery is used in an electric vehicle, these up-front energy and CO2 costs should be repaid 10x over.

Download

Download

Autonomous vehicles: technology leaders?

We have screened 25 leading companies in autonomous vehicles (public and private), tabulating their technical progress and proposals for Level 4-5 autonomy. 75% of the companies were founded in the last decade. Leaders are focused on freight, cars, taxis and LiDAR sensing.

Download

Download

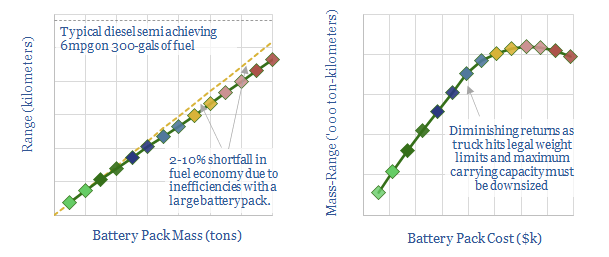

Electric trucks: what battery sizes?

An electric truck would need a 15 ton battery to match the c2,500-mile range of a diesel truck. However, larger batteries above c8-tons detract 10% from fuel economy and may cause trucks to exceed regulatory weight limits, lowering their payload capacities. 4-6 ton batteries with 700-1,000km ranges are optimal.

Download

Download

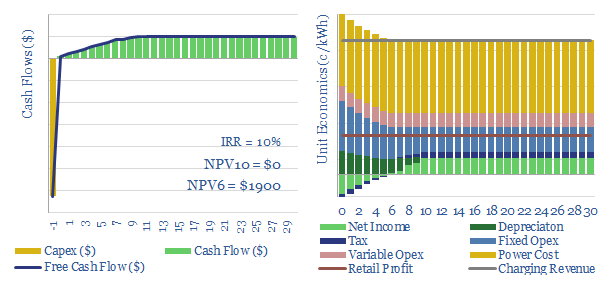

Electric vehicle charging: the economics?

This data-file models the economics of electric vehicle chargers, by disaggregating the costs of different charger types. Economics are most favorable where they lead to incremental retail purchases and for faster chargers. Economics are least favorable around apartments, charging at work and for slower charging speeds.

Download

Download

Metals

Going platinum: PGMs in energy transition?

Could PGMs experience another up-cycle through 2030, on more muted EV sales growth in 2025-30, and rising catalyst loadings per ICE vehicle? This 16-page note explores global supply chains for platinum and palladium, the long-term demand drivers for PGMs in energy transition, and profiles leading PGM producers.

Download

Download

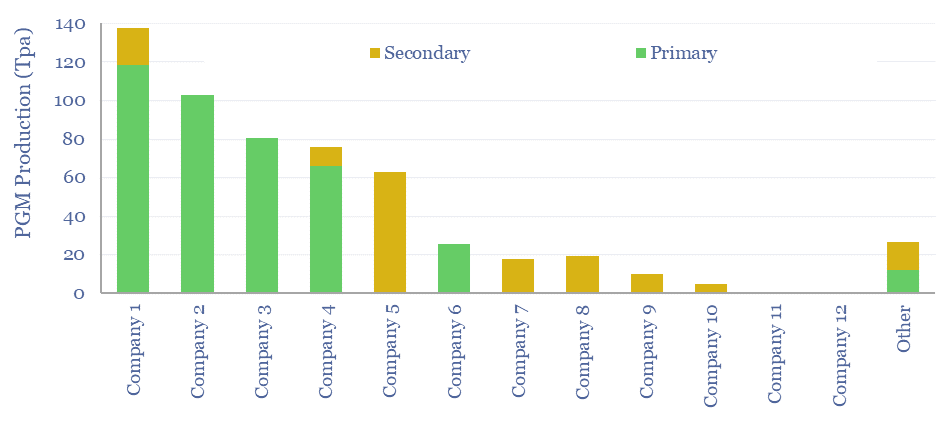

Leading PGM producers: mining, refining and recycling?

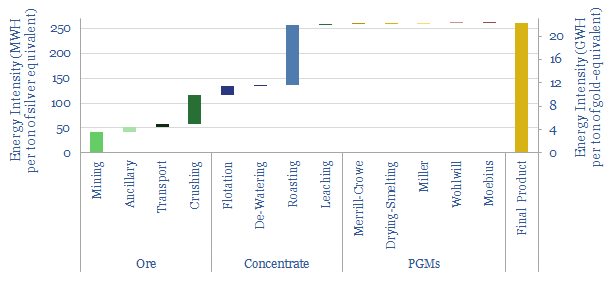

This data-file is a screen of leading PGM producers and recyclers. Eight companies control 90% of global production. Most are mid-caps. Four have primary listings in South Africa. Three are listed in Europe and the UK. Ore grades average 4 grams/ton, and recovery requires 60GWH/ton of energy, emitting 40kT/ton of CO2. But do recent company disclosures suggest that the gloom over PGMs is lifting?

Download

Download

Global PGM demand: breakdown by metal and use?

Core global PGM demand ran at 565 tons in 2023, which remains c6% lower than the all-time peak demand of 600Tpa in 2019. We model a recovery to 700 Tpa of demand for platinum, palladium and rhodium in 2030, then a long run decline to 350Tpa if EVs ultimately reach 90% of vehicle sales by 2050. Numbers can be stress-tested in this model.

Download

Download

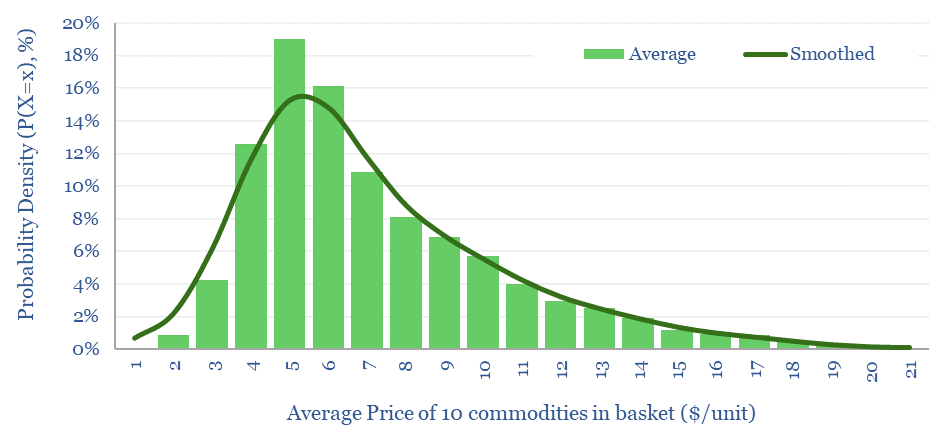

Commodity price volatility: energy, metals and ags?

Commodity price volatility tends to be lognormally distributed, based on the data from ten commodities, over the past 50-years. Means are 20% higher than medians. Skew factors average +1.5x. Standard errors average 50%, while more volatile prices have more upside skew.

Download

Download

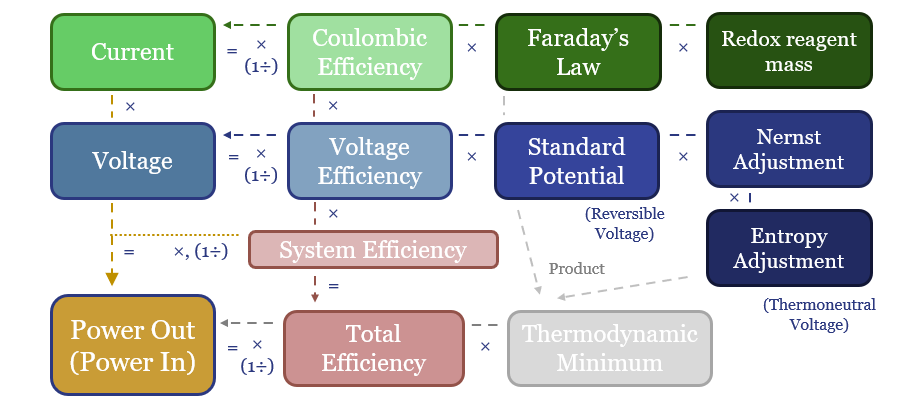

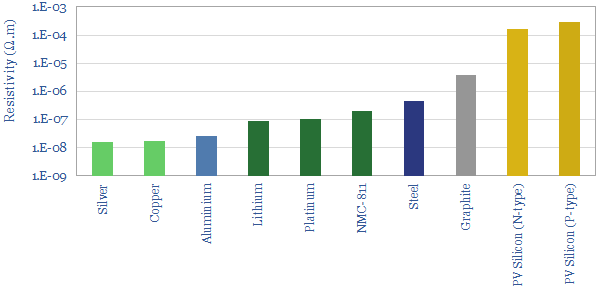

Electrochemistry: redox potential?

Batteries, electrolysers and cleaner metals/materials value chains all hinge on electrochemistry. Hence this 19-page note explains the energy economics from first principles. The physics are constructive for lithium and next-gen electrowinning, but perhaps challenge green hydrogen aspirations?

Download

Download

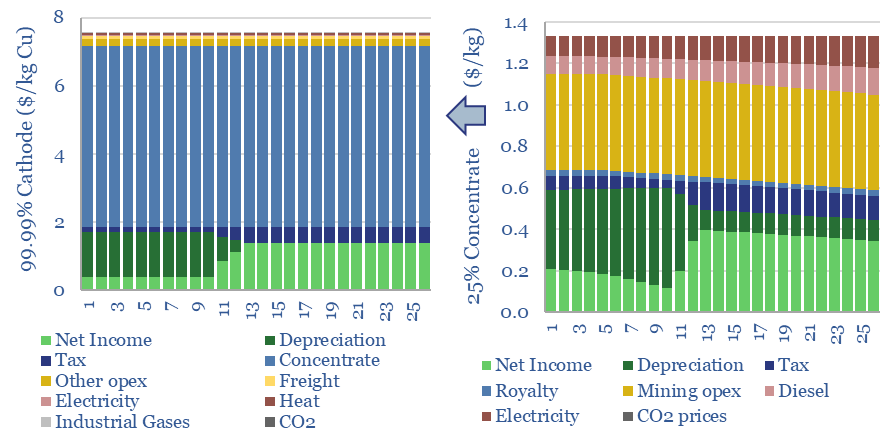

Copper: the economics?

The economic cost of copper production is build up from first princples in this model, from mine, to concentrator, to smelter to 99.99% pure copper cathodes. Our base case is $7.5/kg copper cathode, with 4 tons/ton CO2 intensity, after starting from an 0.57% ore grade. Numbers vary sharply and can be stress-tested in the data-file.

Download

Download

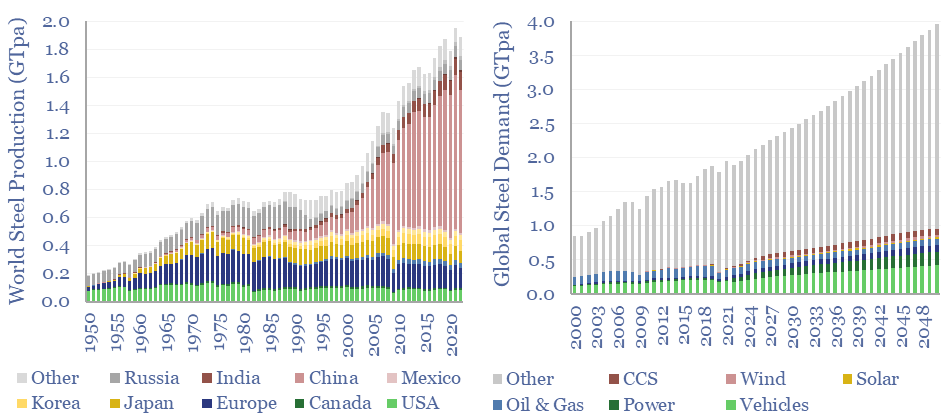

Global steel supply-demand model?

Global steel supply-demand runs at 2GTpa in 2023, having doubled since 2003. Our best estimate is that steel demand rises another 80%, to 3.6GTpa by 2050, including due to the energy transition. Global steel production by country is now dominated by China, whose output exceeds 1GTpa, which is 8x the #2 producer, India, at 125MTpa.

Download

Download

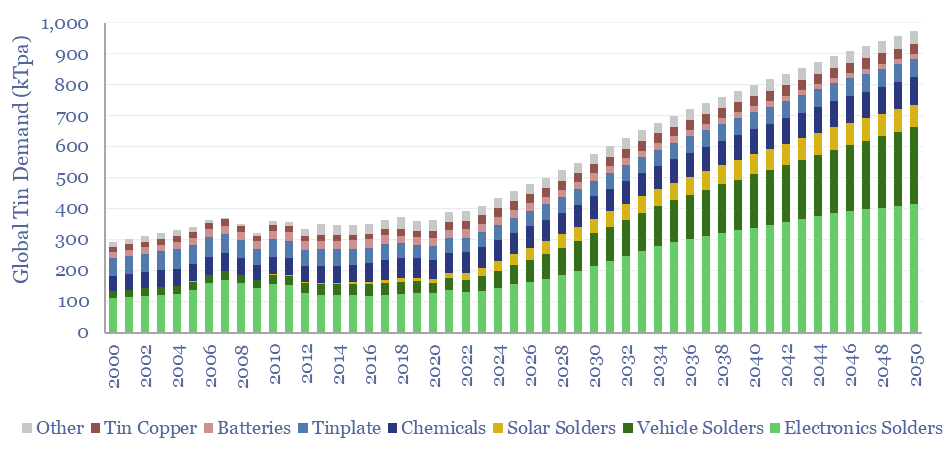

Global tin demand: upside in energy transition?

Global tin demand stands at 400kTpa in 2023 and rises by 2.5x to 1MTpa in 2050 as part of the energy transition. 50% of today's tin market is for solder, which sees growing application in the rise of the internet, rise of EVs and rise of solar. Global tin supply and demand can be stress-tested in the model.

Download

Download

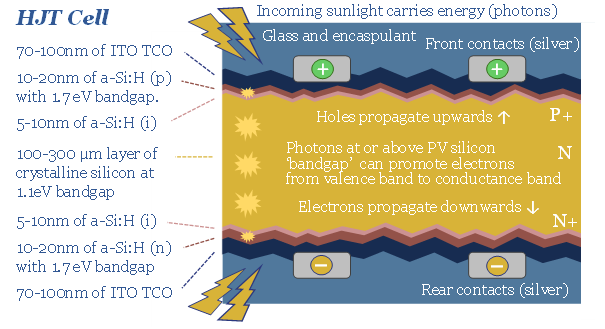

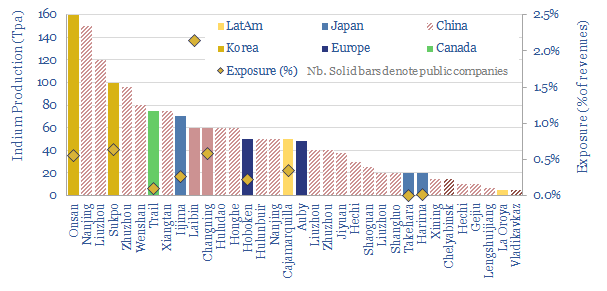

HJT solar: Indium summer?

HJT solar modules are accelerating, as they are highly efficient, and easier to manufacture. But HJT could also be a kingmaker for Indium metal, which is used in transparent and conductive thin films (ITO). Our forecasts see primary Indium use rising 4x by 2050. Indium is 100x rarer than Rare Earth metals. It could be a bottleneck. What implications?

Download

Download

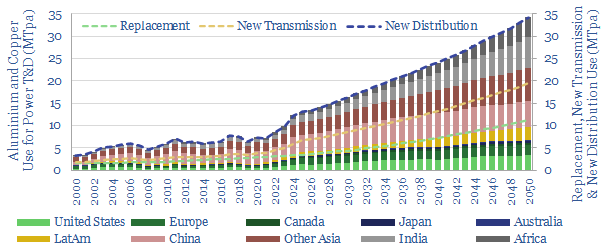

Power grids: down to the wire?

Power grid circuit kilometers need to rise 3-5x in the energy transition. This trend directly tightens global aluminium markets by over c20%, and global copper markets by c15%. Slow recent progress may lead to bottlenecks, then a boom? This 12-page note quantifies the rising demand for circuit kilometers, grid infrastructure, underlying metals and who benefits?

Download

Download

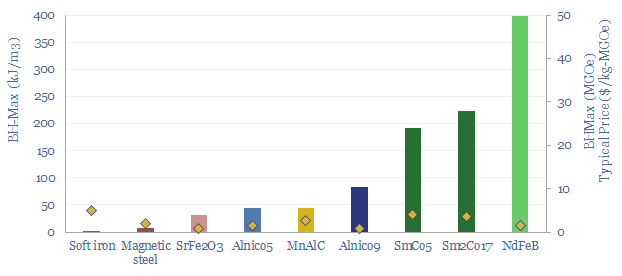

Magnets and energy: fundamental attraction?

Electric currents create magnetic fields. Moving magnets induce electric currents. These principles underpin 95% of global electricity, while 50% of wind turbines and 95% of electric vehicles use permanent magnets with Rare Earth metals. This 15-page overview of magnets explains key magnet concepts and controversies for the energy transition.

Download

Download

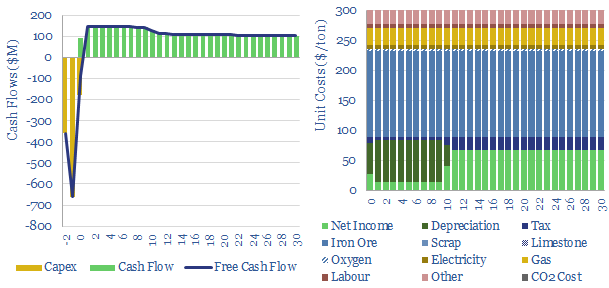

Blue steel: construction boom?

The DRI+EAF pathway already underpins 6% of global steel output, with 50% lower CO2 than blast furnaces. But could IRA incentives encourage another boom here? Blue hydrogen can reduce CO2 intensity to 75% below blast furnaces, and unlock 20% IRRs at $550-600/ton steel? This 13-page report explores the opportunity, and who benefits.

Download

Download

Electrasteel: renewable steel breakthrough?

Electra is developing an electrochemical refining process, to convert iron ore into high purity iron, and ultimately into steel, using only renewable electricity. It has raised c$100M, gained high-profile backers, and is working towards a test plant. This 9-page note reviews an exceptionally detailed patent, finds clear innovations, but also some remaining risks and cost question marks.

Download

Download

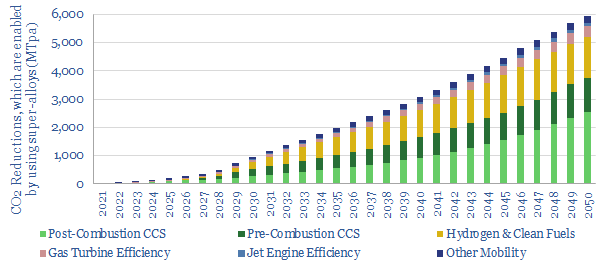

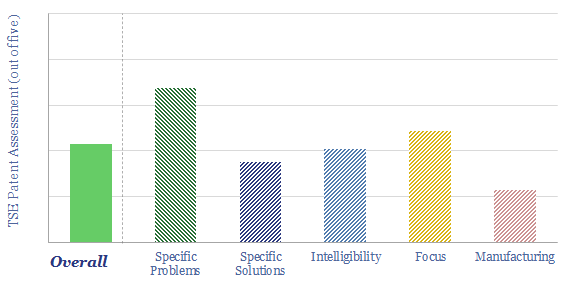

Super-alloys: what role in energy transition?

Super-alloys have exceptionally high strength and temperature resistance. They help to enable 6GTpa of decarbonization, across efficient gas turbines, jet engines (whether fueled by oil, hydrogen or e-fuels), vehicle parts, CCS, and geopolitical resiliency. Hence this 15-page report explores nickel-niobium super-alloys, energy transition upside, and leading companies.

Download

Download

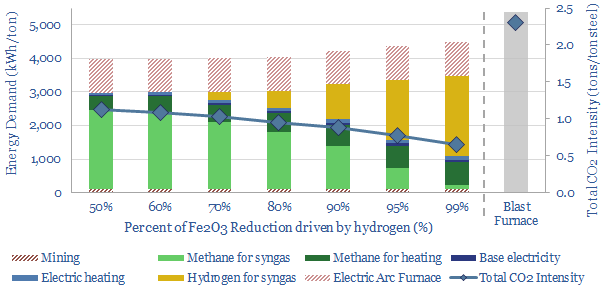

Direct reduced iron: costs and projects?

Direct reduced iron (DRI) is produced by reacting iron ore with H2-CO syngas, fueled by natural gas, in over 150 facilities worldwide. Direct reduction iron costs $300/ton, consuming 3,000kWh/ton of energy and CO2 intensity of 0.6 tons/ton. The process can be decarbonized via low-carbon hydrogen in the syngas, as the world strives towards decarbonized steel.

Download

Download

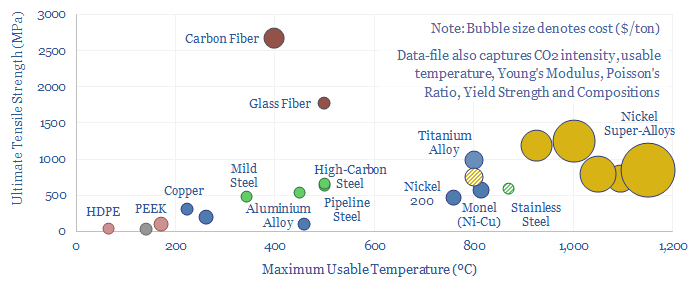

Metals and materials: strength and temperature resistance?

This data-file aggregates information into the strength, temperature resistance, rigidity, costs and CO2 intensities of important metals and materials. These are used in gas turbines, wind turbines, pipelines, CCS, power transmission.

Download

Download

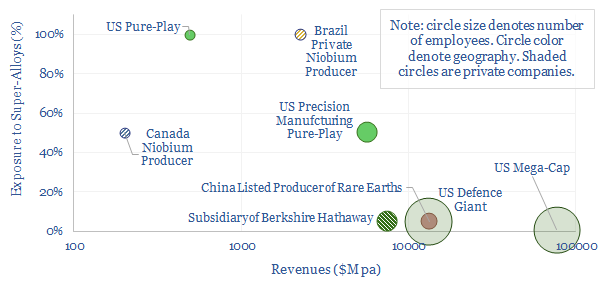

Leading companies in super-alloys?

This data-file is a screen of leading companies in super-alloys, covering US pure-plays, mega-caps in industrials and defence, and emerging world producers of Rare Earth metals. In each case, we have included our notes and observations.

Download

Download

Boston Metal: molten oxide electrolysis of steel?

Boston Metal aims to decarbonize steel, using molten oxide electrolysis, absorbing 4MWH/ton of steel. This data-file is a Boston Metal technology review, based on assessing 55 patents across 3 families. We were unable to de-risk the technology. A key challenge is conveying current into the cell, as it operates around 1,600C, which is above the melting point of most feasible conductor materials.

Download

Download

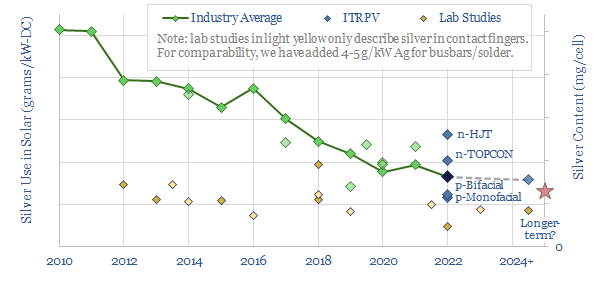

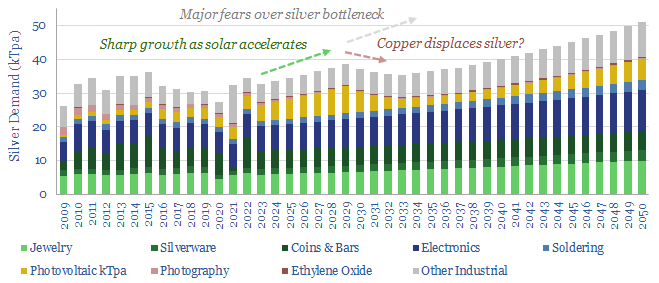

Solar surface: silver thrifting?

Ramping new energies is creating bottlenecks in materials. But how much can material use be thrifted away? This is a case study of silver intensity in the solar industry, which halved in the past decade, and could halve again. Conclusions matter for solar companies, silver markets, other bottlenecks.

Download

Download

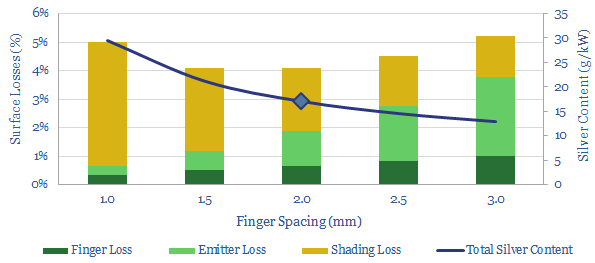

Model of losses in a solar cell: surface, emitter and shading?

This data-file calculates the losses in a solar cell from first principles. Losses on the surface of the cell are typically c4%, due to contact resistance, emitter resistance and shading. Sensitivity analysis suggests there may be future potential to halve silver content in a solar cell from 20g/kW to 10g/kW without materially increasing the losses beyond 4%.

Download

Download

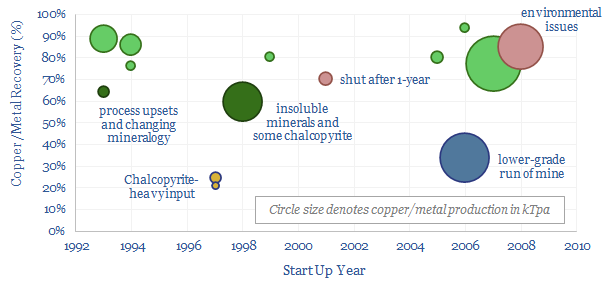

Bioleaching: case studies and examples?

Bioleaching uses bacteria to metabolize insoluble sulfides and iron complexes. It produces 20% of the world's copper; with 50% lower capex, at least 50% less CO2 and up to 80-90% recoveries; but it is currently limited to specific mineralogies. A prospect for the 2020s is that new technologies may unlock more minerals.

Download

Download

Jetti Resources: copper leaching breakthrough?

Jetti Resources has developed a breakthrough technology to recover copper from low-grade sulfide ores, by leaching with sulphuric acid, thiocarbonyls, ferric iron (III) sulphates and oxidizing bacteria. The patents lock up the technology, with detailed experimental data. But what are the costs of copper production, what CO2 intensity and what technical challenges remain?

Download

Download

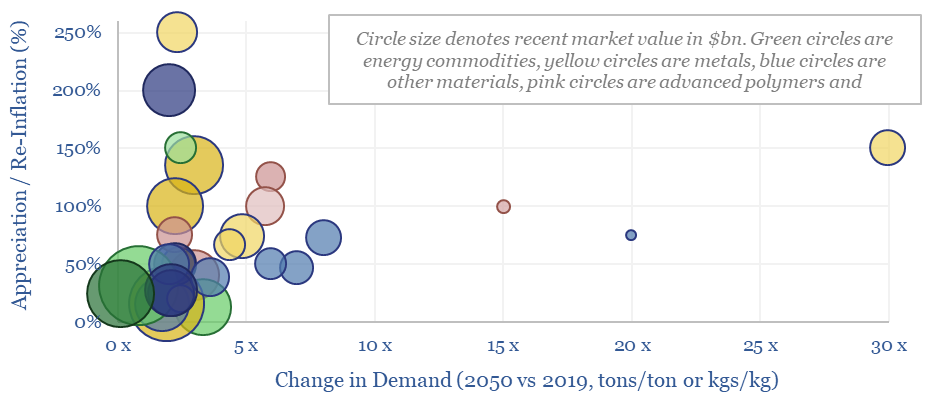

Energy transition: top commodities?

This data-file summarizes our latest thesis on ten commodities with upside in the energy transition. The average one will see demand rise by 3x and price/cost appreciate or re-inflate by 100%. The data-file contains a 6-10 line summary of our work into each commodity.

Download

Download

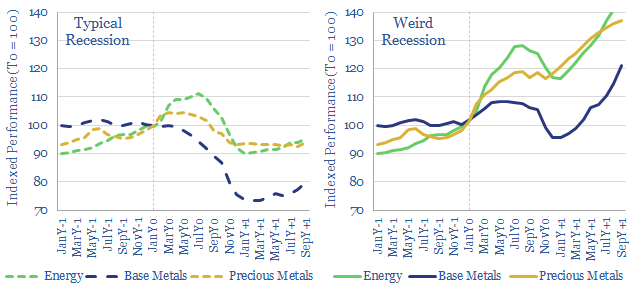

Weird recessions: can commodities de-couple?

In a ‘weird recession’, GDP growth turns negative, yet commodity prices continue surprising to the upside. This 10-page note explores three reasons that 2022-24 may bring a ‘weird recession’. There is historical precedent, prices must remain high to attract new investment and buyers may stockpile bottlenecked materials. How will this affect different industries?

Download

Download

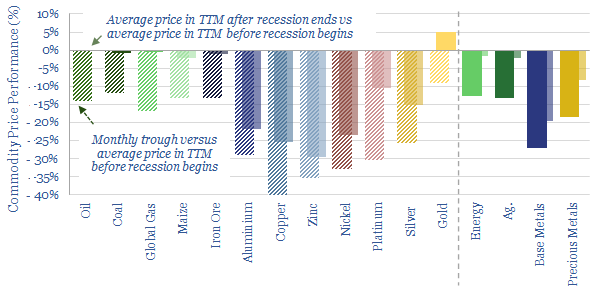

How do commodities perform during recessions?

How do commodities perform in recessions? Industrial metals are usually hit hardest, falling 35% peak-to-trough. Energy price spikes partly cause two-thirds of recessions, then typically trade back to pre-recession levels. Precious metals, mainly gold, tend to appreciate in financial crises. Data are compiled in this file, across recessions back to 1970.

Download

Download

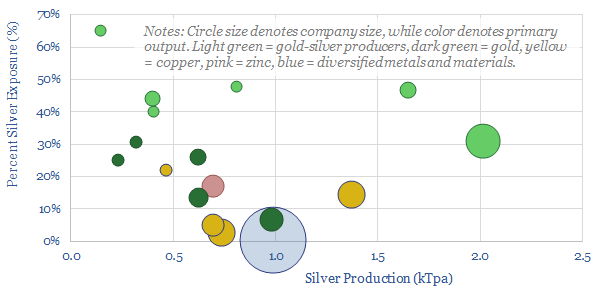

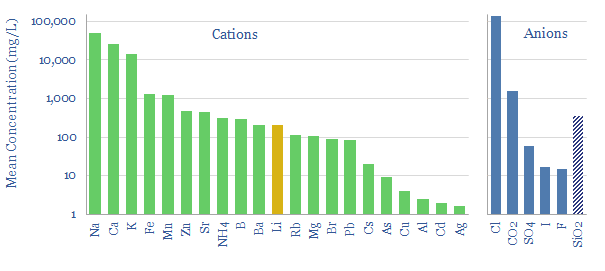

Silver and gold: medal winners?

Gold and silver are stores of value, especially in a world of persistently high inflation and low rates. Silver is also likely to be the main bottleneck for solar in the 2020s. Hence our 18-page note models the end-to-end mining and refining of these metals. We find very steep energy/CO2 curves, and fear supply shortages. What upside for well-run gold-silver incumbents?

Download

Download

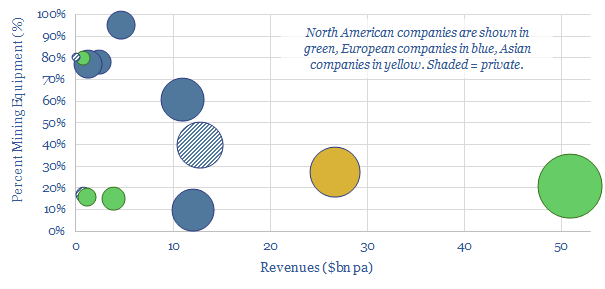

Overview of mining equipment companies?

This data-file is an overview of mining equipment companies. For each company, we have noted its location, size, age, number of employees, number of patents, latest revenues, operating margins, exposure to the mining equipment industry, and a few short summary sentences. Where possible, we have also broken down the company's revenues by end-market or by commodity.

Download

Download

Silver and gold: the economics?

This data-file captures the marginal cost of silver and gold production, at an integrated mining-refining operation. In our base case, a 10% IRR requires a silver price of $17/Oz and a gold price of $1,750/Oz, while the energy and CO2 intensities are an eye watering 100-150 tons/ton and 9,000 tons/ton, respectively. Numbers vary widely on ore grade.

Download

Download

Heap leaching: energy economics?

This data-file captures the energy economics of leaching in the mining industry, especially the costs of heap leaching, for the extraction of copper, nickel, gold, silver, other precious metals, uranium, and Rare Earths. The data-file allows you to stress test costs in $/ton of ore, $/ton of metal, capex, opex, chemicals costs, energy intensity and CO2 intensity.

Download

Download

Electrowinning: costs and energy economics?

Electrowinning costs and energy economics are built up in this data-file. A charge of $900/ton is required to earn a 10% IRR on a $3,000/kTpa plant with a median energy consumption of 2-3 MWH/ton. Although this will vary metal by metal.

Download

Download

Froth flotation: the economics?

The costs of froth flotation are aggregated in this data-file, building up the typical capex costs (in $/Tpa), energy costs (in kWh/ton) and other opex lines (in $/ton) of one of the most important processes for the modern metals and materials industry. A good rule of thumb is $10/ton costs to concentrate a material by over 4x.

Download

Download

Bio-coke: energy economics?

Bio-coke is a substitute for coal-coke in steel-making and other smelting operations. We model it will cost c$450/ton, c50% more than coal-coke, but saves 2 - 2.5 tons/ton of CO2. Abatement costs can be as low as $70/ton. Although not always, and there are comparability issues.

Download

Download

Mining: crushing, grinding and comminution costs?