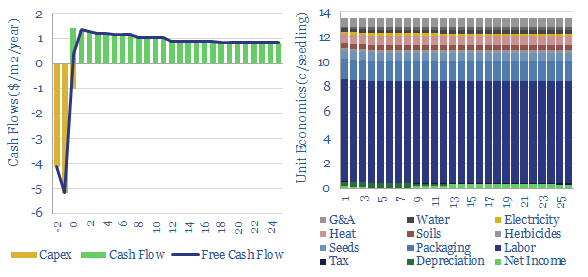

The US plants over 1.3bn tree seedlings per year. Especially pine. These seedlings are typically 8-10 months old, with heights of 25-30mm, root collars of 5mm, and total mass of 5-10 grams, having been grown by dedicated producers. This data-file captures the costs of tree seedlings, to support afforestation, reforestation or broader forestry. Costs should average 13.5c/seedling. A detailed cost breakdown of tree seedlings is also given in $/m2 and $/seedling terms.

Growing practices vary. We think bare root seedlings, grown in open fields, in warmer climates, have a typical cost of 7c/seedling. Conversely, in colder climates, seedlings maybe grown in containers, in heated greenhouses, which also has the advantage of permitting earlier growing and better transportability, despite higher costs, closer to 15c/seedling. Typical costs of tree seedlings are disaggregated in $/m2 and $/seedlings for both categories.

At 13.5c/seedling prices, and a typical planting density of 500 seedlings per acre, seedling costs might explain $70/acre of the total up-front costs in a reforestation project, which might run around $300-400/acre (ex land acquisition).

Operational leverage is very high in the seedling industry. At least compared with other industries captured in our economic models. Net margins are likely in the low single digit percentages in normal times, as costs are spread across labor, packaging materials, soil materials, seeds, herbicides, fertilizers, irrigation, maintenance G&A; and in greenhouses, also heat and electricity. Labor is the large cost line, but the other lines add up too.

This does raise the question whether a rapidly growing market for reforestation could create meaningful upside. A 1c/kWh (c7%) increase in end pricing, e.g., due to under-supply, might flow through to double the net margins of a seedling producer.

ArborGen stood out as one of the leading pure-play companies producing seedlings, in the US and Brazil. It is listed. And it has historically sold 80% of “Mass Control Pollinated” seedlings, which are selected from the best cultivars, adapted to regional conditions, especially in the Southern US. High-quality seedlings should command a premium.

This data-file also includes our notes from technical papers, with some details into the differences between bare-root and greenhouse growing. Weyerhaeuser is another company up in the works, which is backwards integrated and produces tens of millions of seedlings per year.