Our new energies research explores economic opportunities to drive the energy transition. Our definition of new energies is that they are not derived from the combustion of extracted resources. Solar radiation is directly converted to electricity in a photovoltaic cell. Wind and hydro power harness moving masses of fluids to drive turbines. Nuclear energy derives heat from fissioning heavy atoms; possibly in the future, from fusing light atoms. Generally these new energies yield electricity directly (i.e., no heat engines are involved). Electricity can be the highest-grade form of energy. But electricity also requires resilient power grids, sophisticated power electronics and possibly also energy storage via batteries. Achieving an energy transition requires moving ‘Heaven and Earth’, to de-bottleneck bottlenecks in power transmission (heaven) and mined metals and materials (earth). We also consider hydrogen and biofuels among new energies.

Solar Research

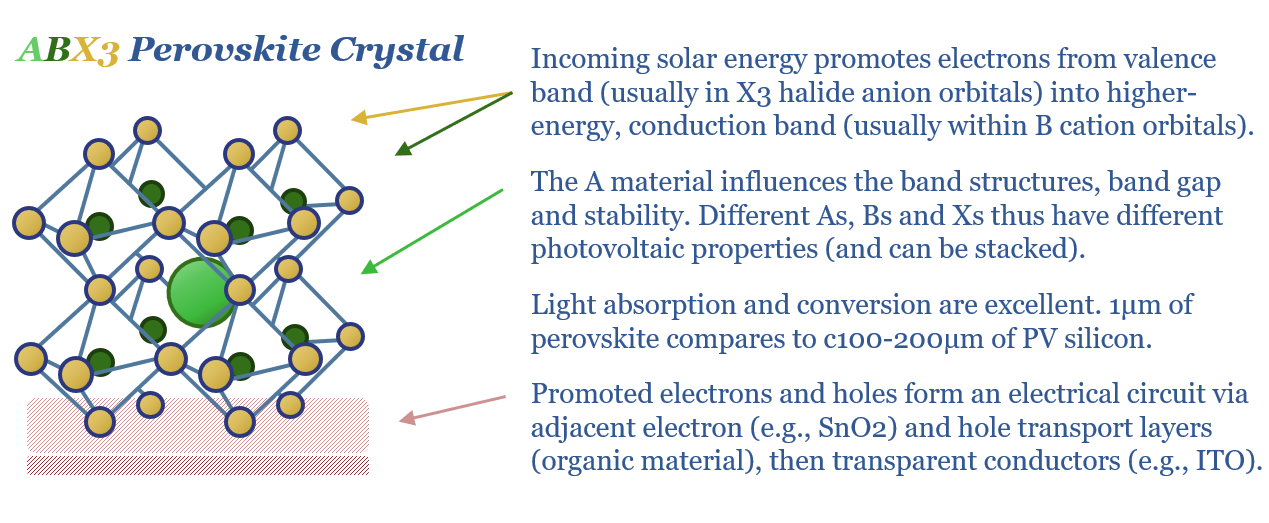

Perovskite solar: beyond silicon?

Download

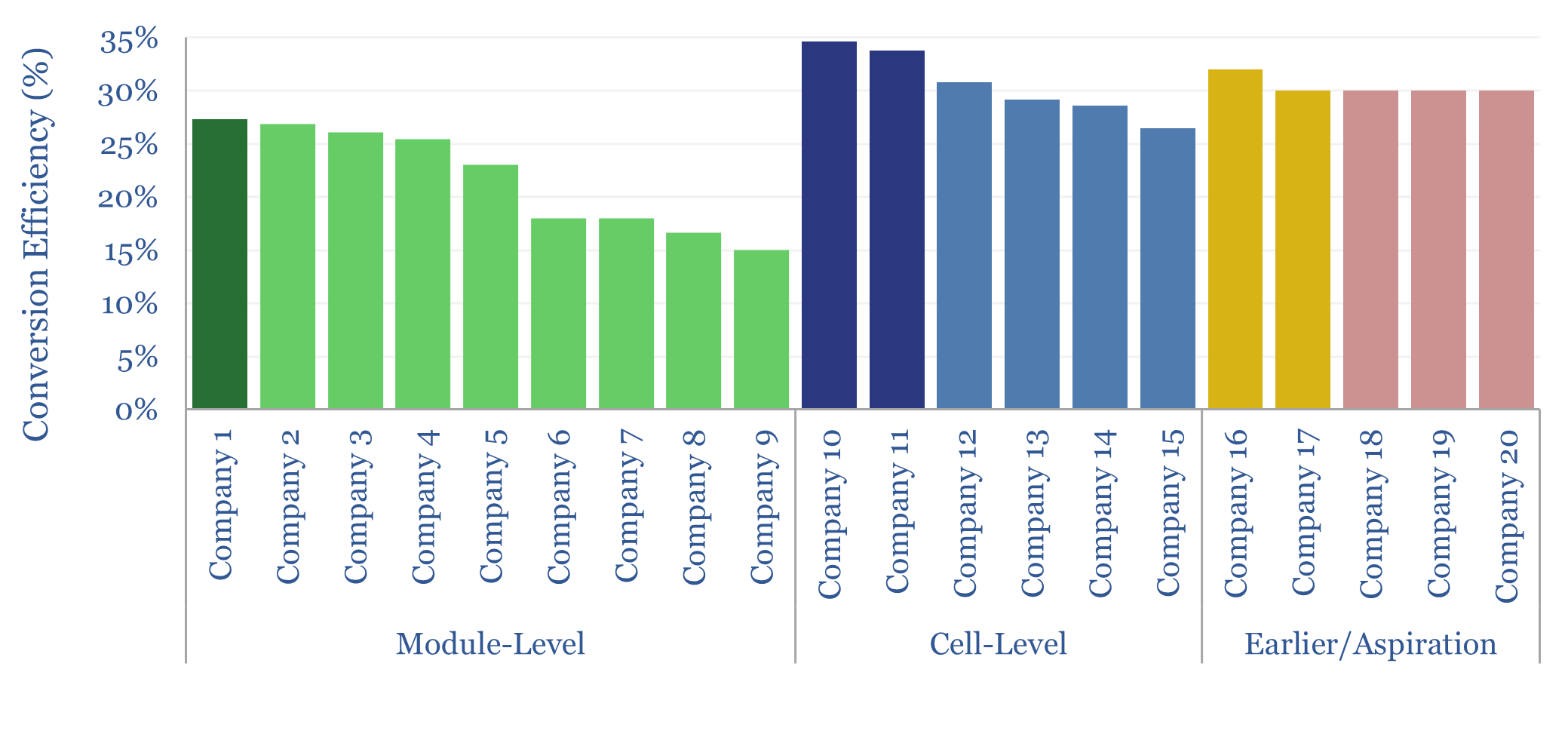

Perovskite solar companies screen?

Download

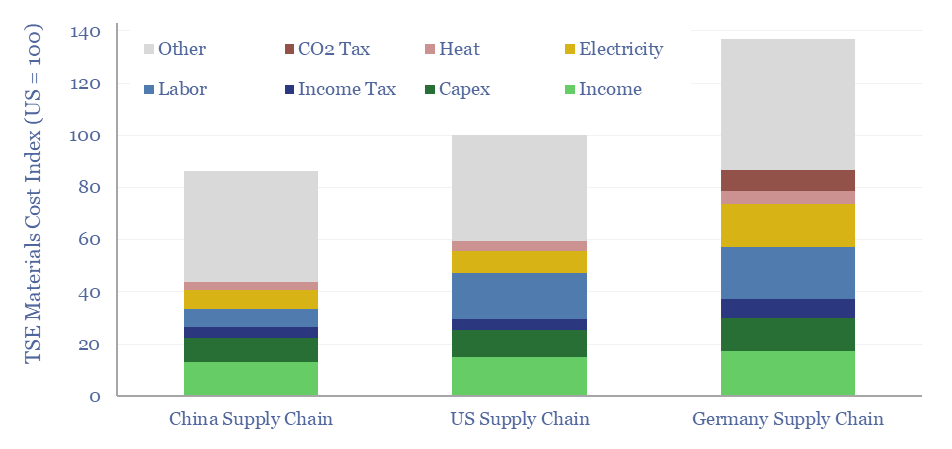

Material and manufacturing costs by region: China vs US vs Europe?

Download

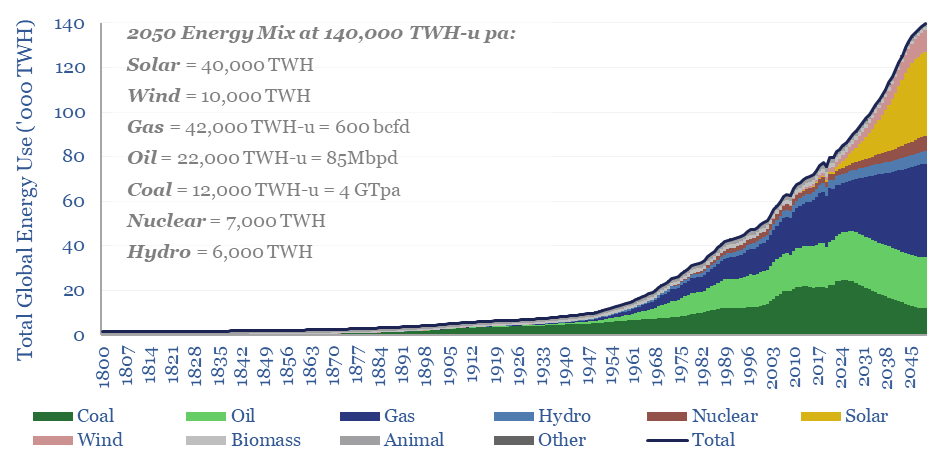

Energy transition: solar and gas -vs- coal hard reality?

Download

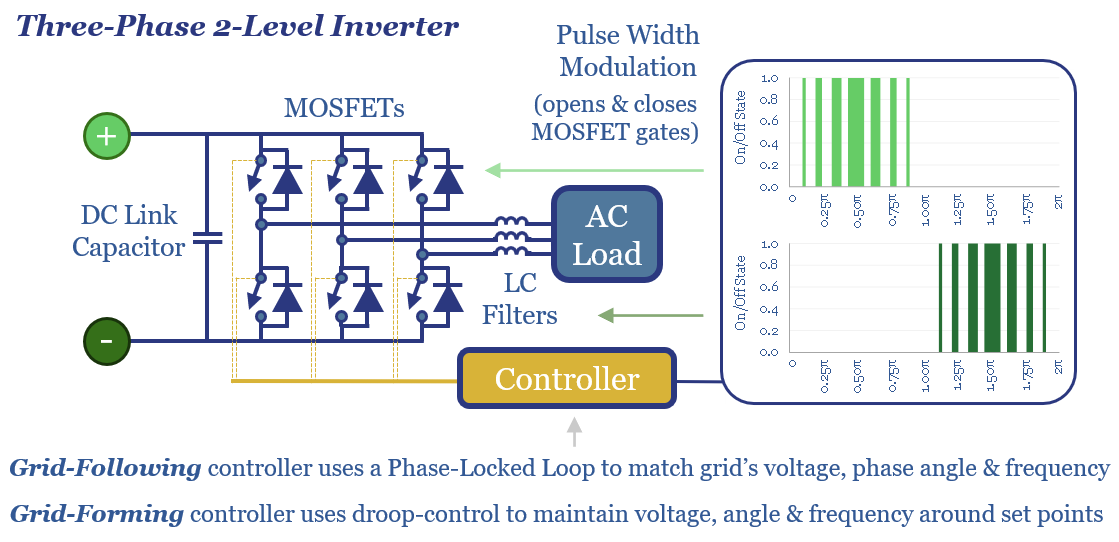

Grid-forming inverters: islands in the sun?

Download

Solar trackers: following the times?

Download

Solar trackers: leading companies?

Download

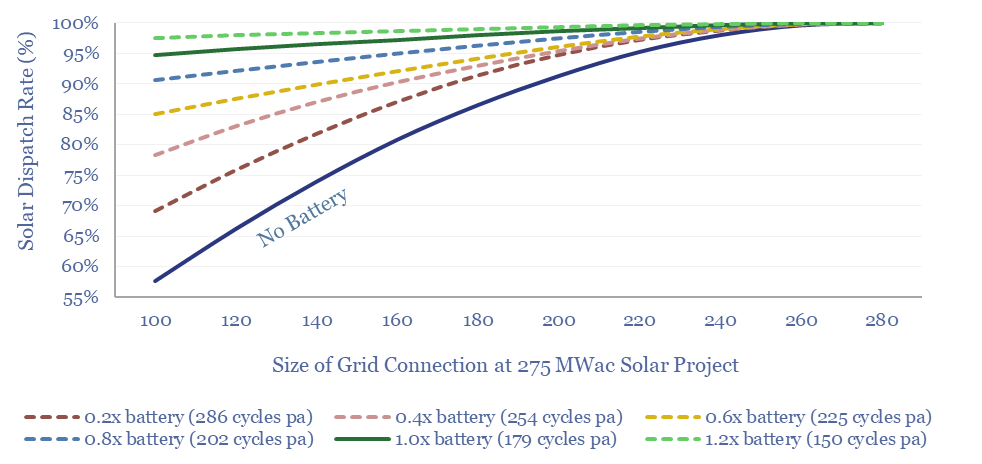

Solar plus batteries: the case for co-deployment?

Download

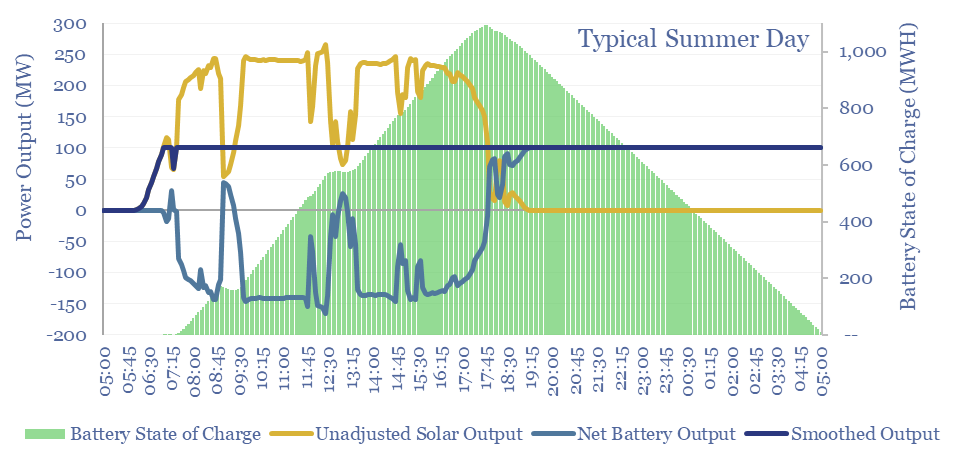

Solar+battery co-deployments: output profiles?

Download

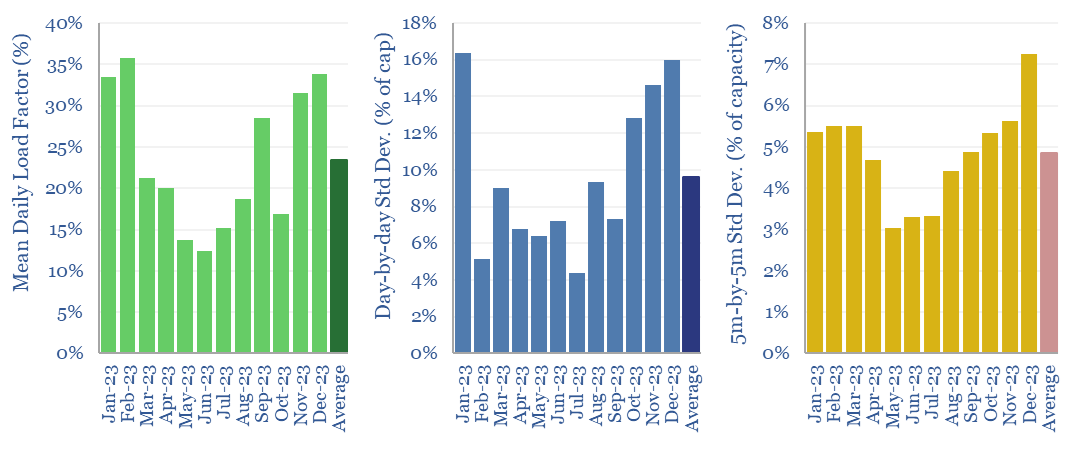

Solar generation: minute by minute volatility?

Download

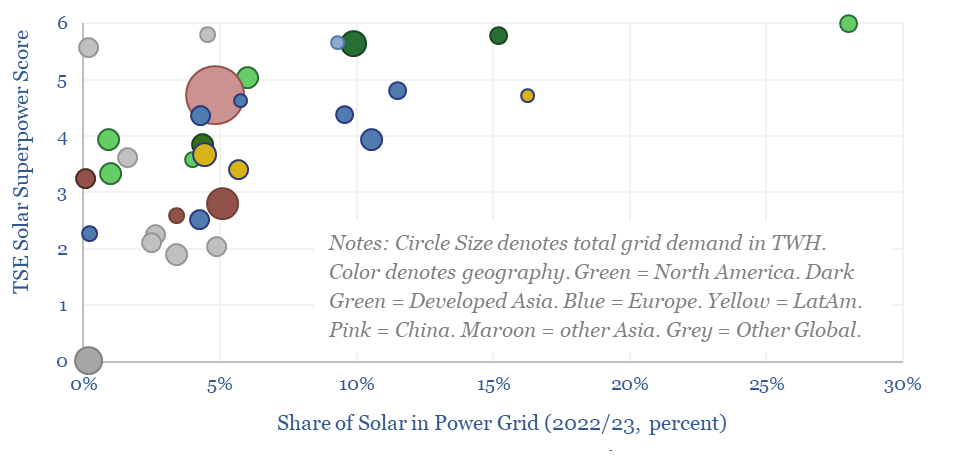

Solar Superpowers: ten qualities?

Download

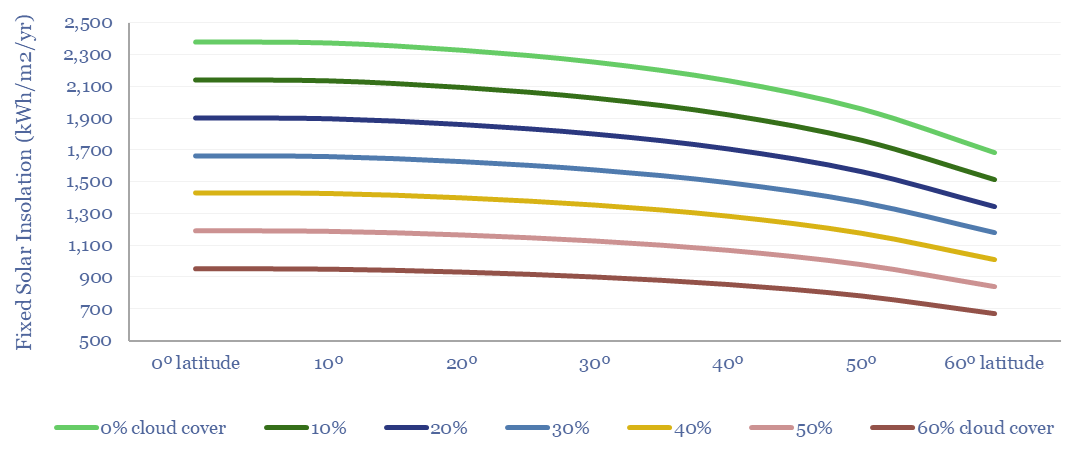

Solar insolation: by latitude, season, date, time and tilt?

Download

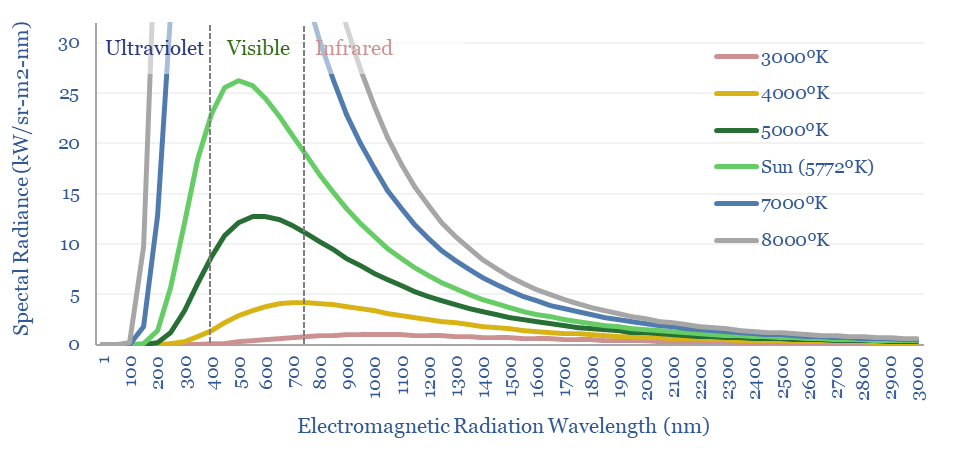

Electromagnetic energy: Planck, Shockley-Queisser, power beaming?

Download

Vapor deposition: leading companies?

Download

Global solar: absorption spectrum?

Download

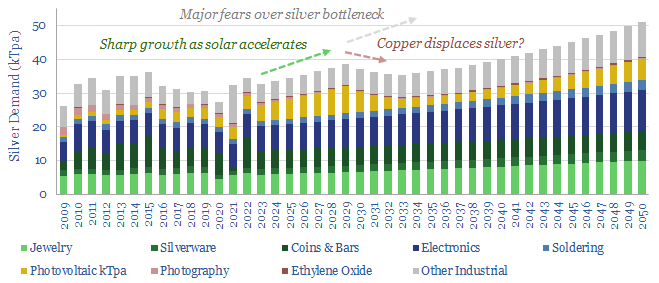

Silver pastes for solar contacts?

Download

LONGi: technology review and solar innovations?

Download

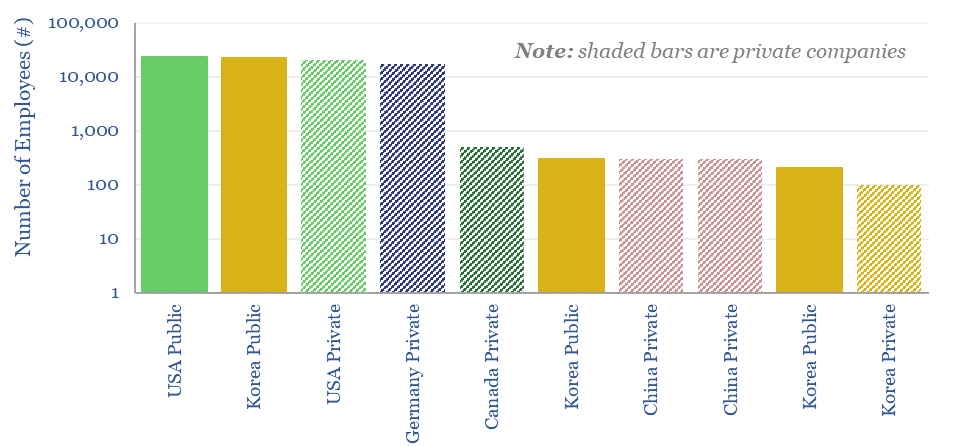

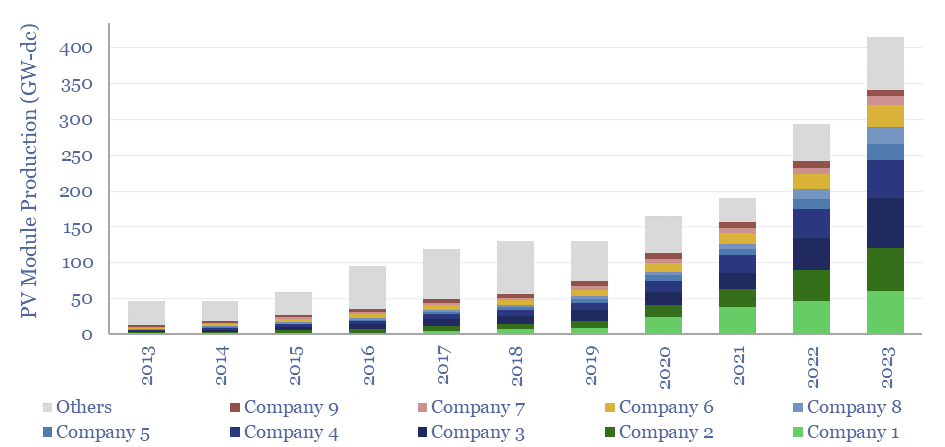

Solar module production by company?

Download

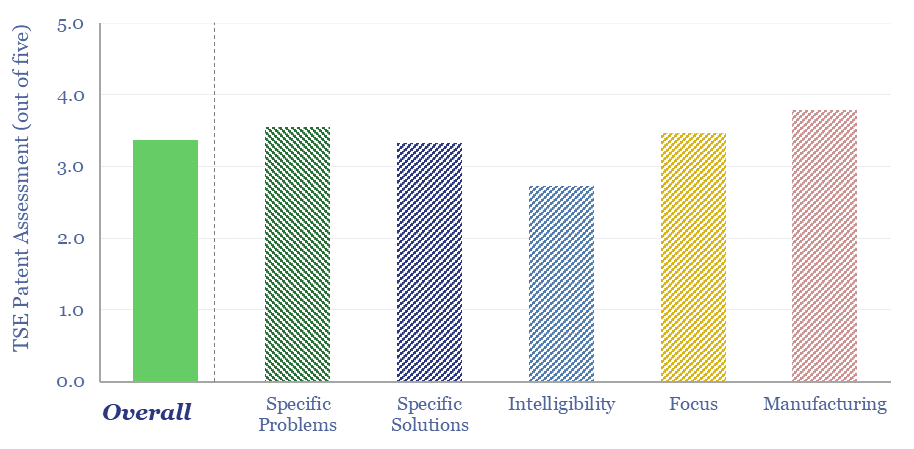

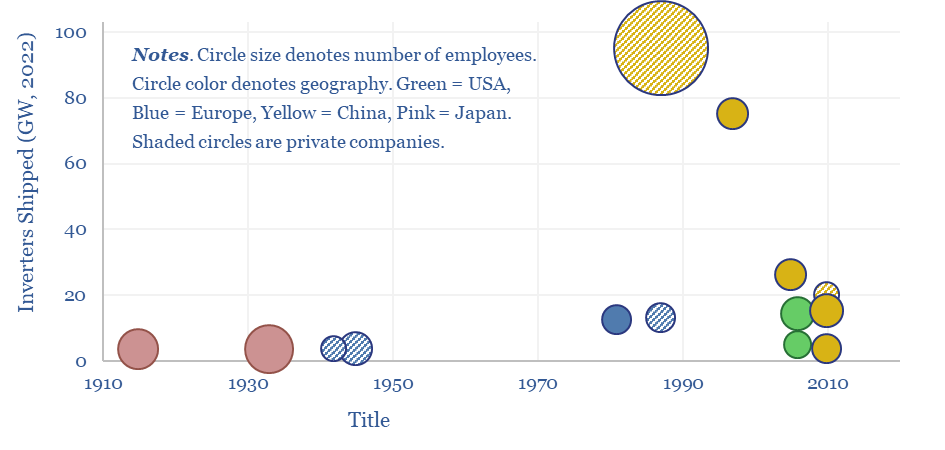

Solar inverters: companies, products and costs?

Download

Semiconductor physics: pièce de resistance?

Download

Semiconductors: conductivity calculations?

Download

Mitsui Chemicals: solar encapsulants?

Download

Global polysilicon production capacity?

Download

New energies: the age of materials?

Download

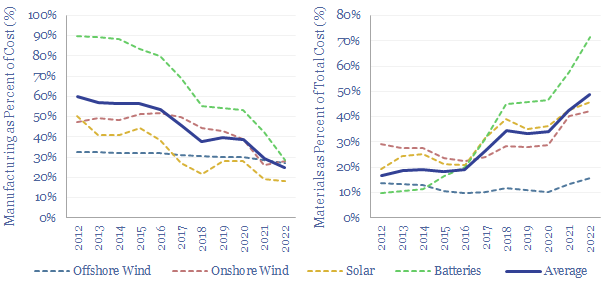

Solar costs: a breakdown over time?

Download

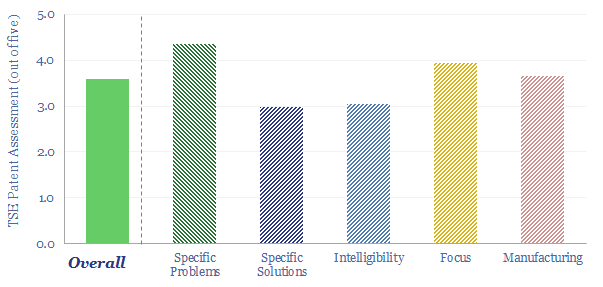

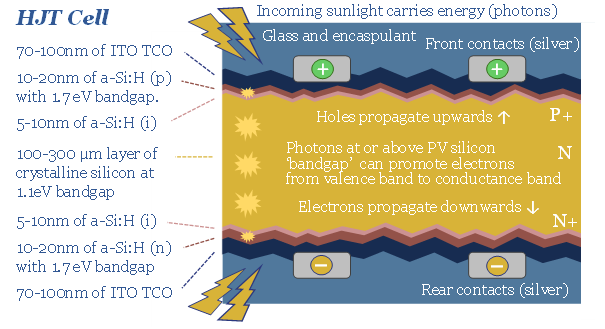

HJT solar: Indium summer?

Download

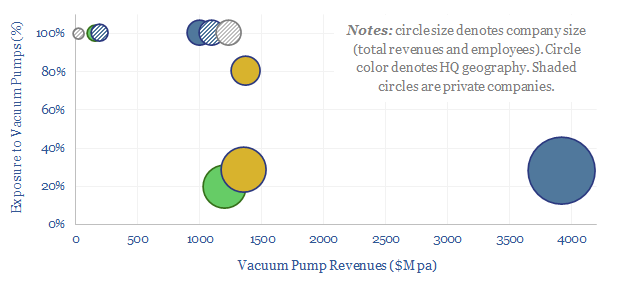

Vacuum pumps: company screen?

Download

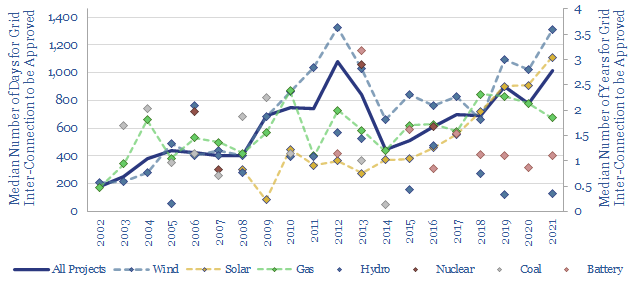

Renewables: how much time to connect to the grid?

Download

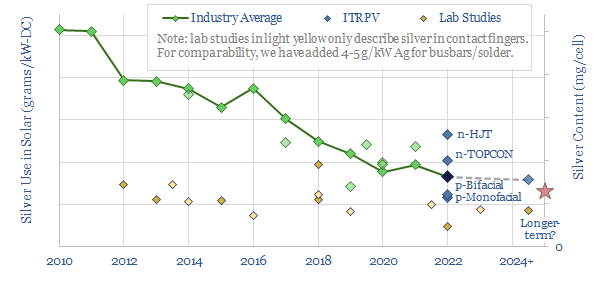

Solar surface: silver thrifting?

Download

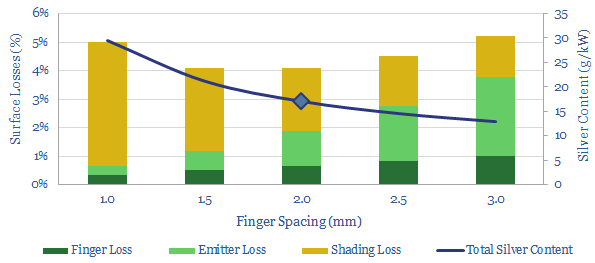

Model of losses in a solar cell: surface, emitter and shading?

Download

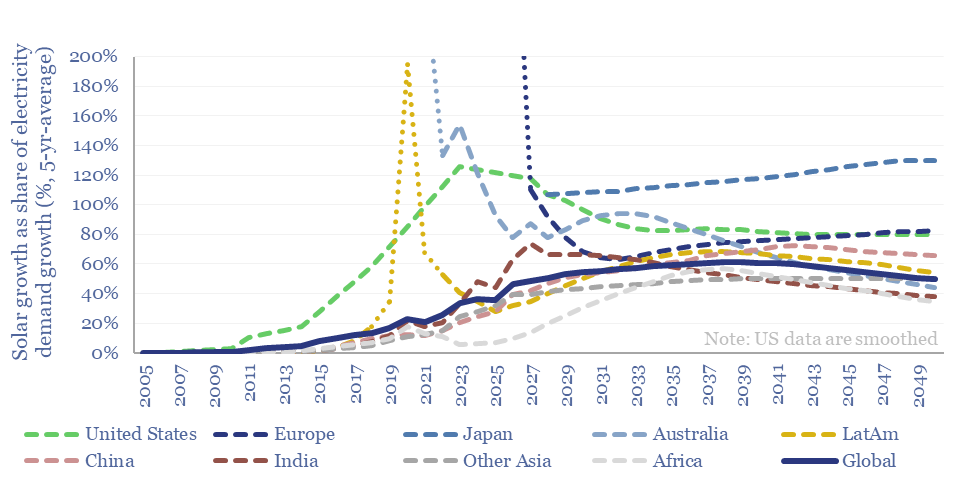

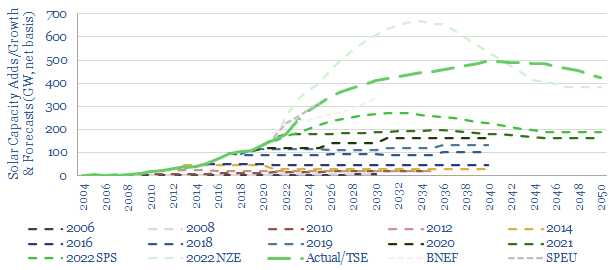

Solar capacity: growth through 2030 and 2050?

Download

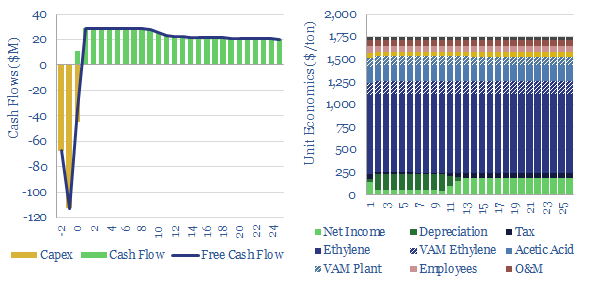

Ethylene vinyl acetate: production costs?

Download

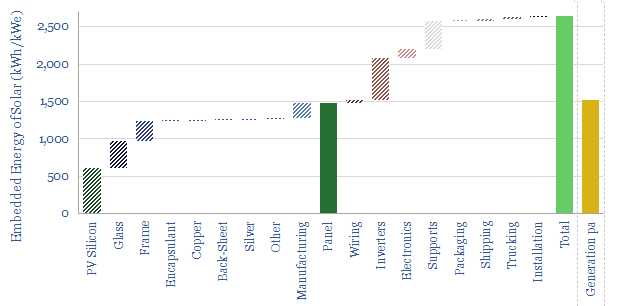

Solar: energy payback and embedded energy?

Download

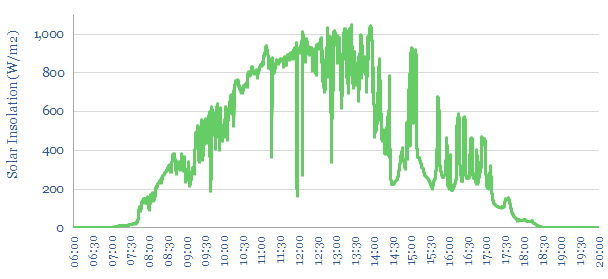

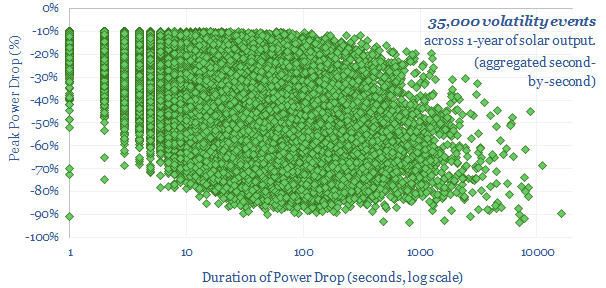

Solar volatility: tell me lies, tell me sweet little lies?

Download

Solar volatility: second by second output data?

Download

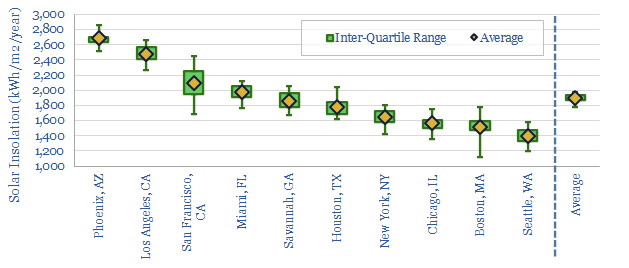

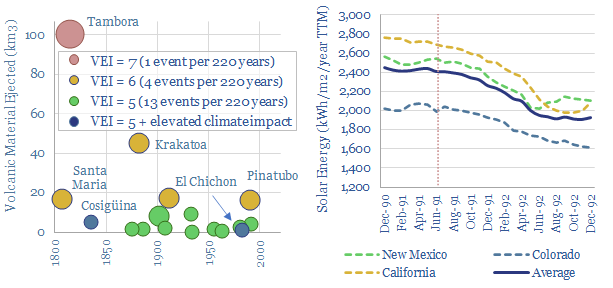

Solar volatility: interconnectors versus batteries?

Download

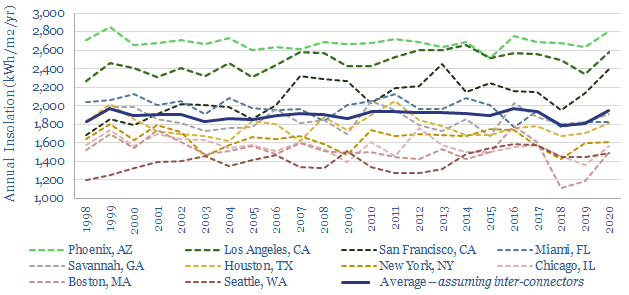

Solar variability: how much does solar energy vary by year?

Download

Power transmission: inter-connectors smooth solar volatility?

Download

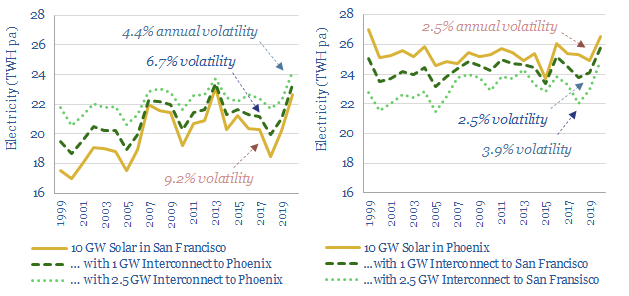

Energy security: volcanos versus solar panels?

Download

Solar contacts: silver bullet?

Download

Wind Research

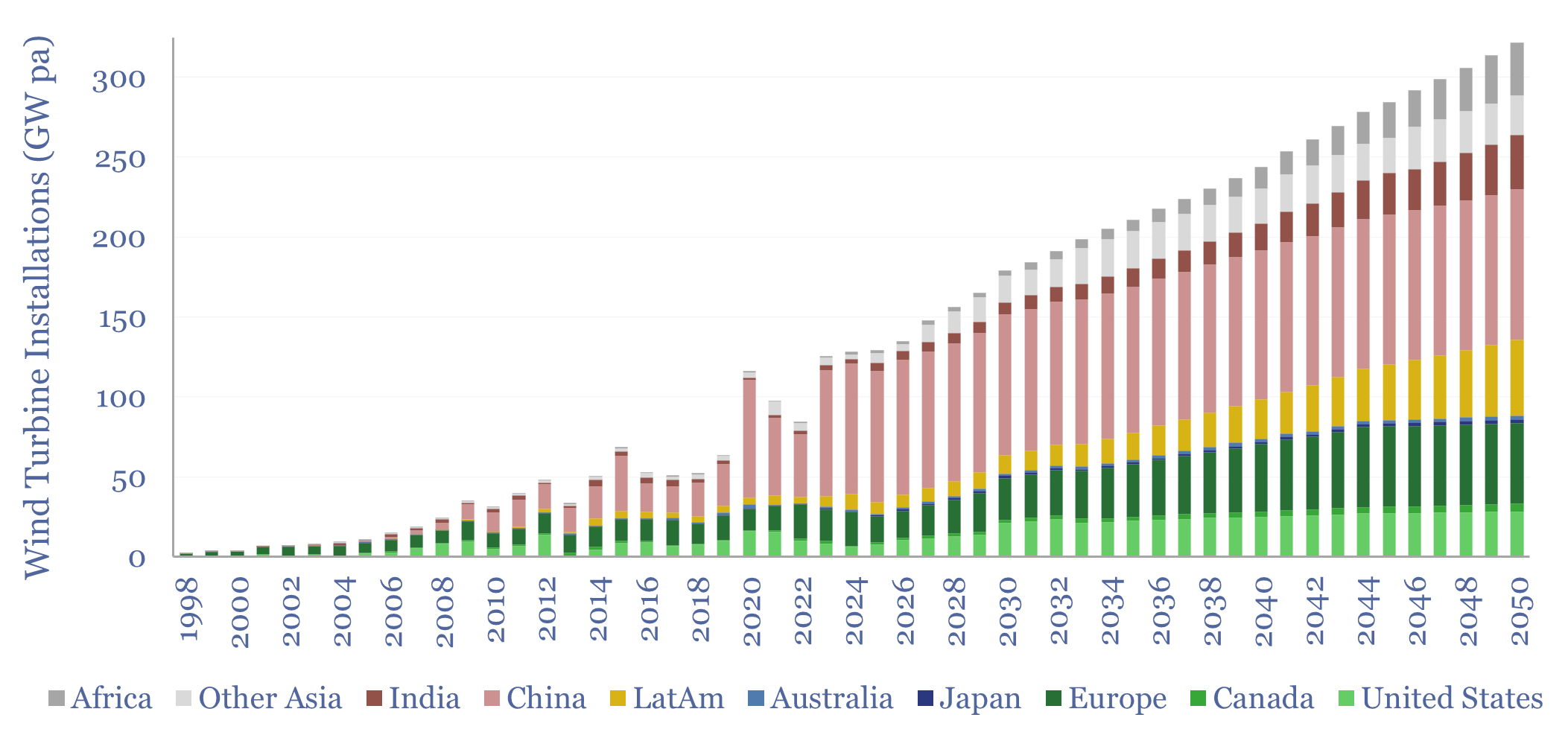

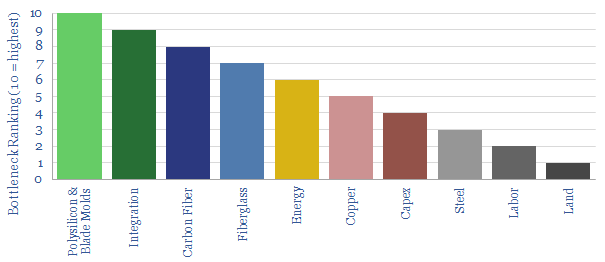

Wind energy: beyond good and evil?

Download

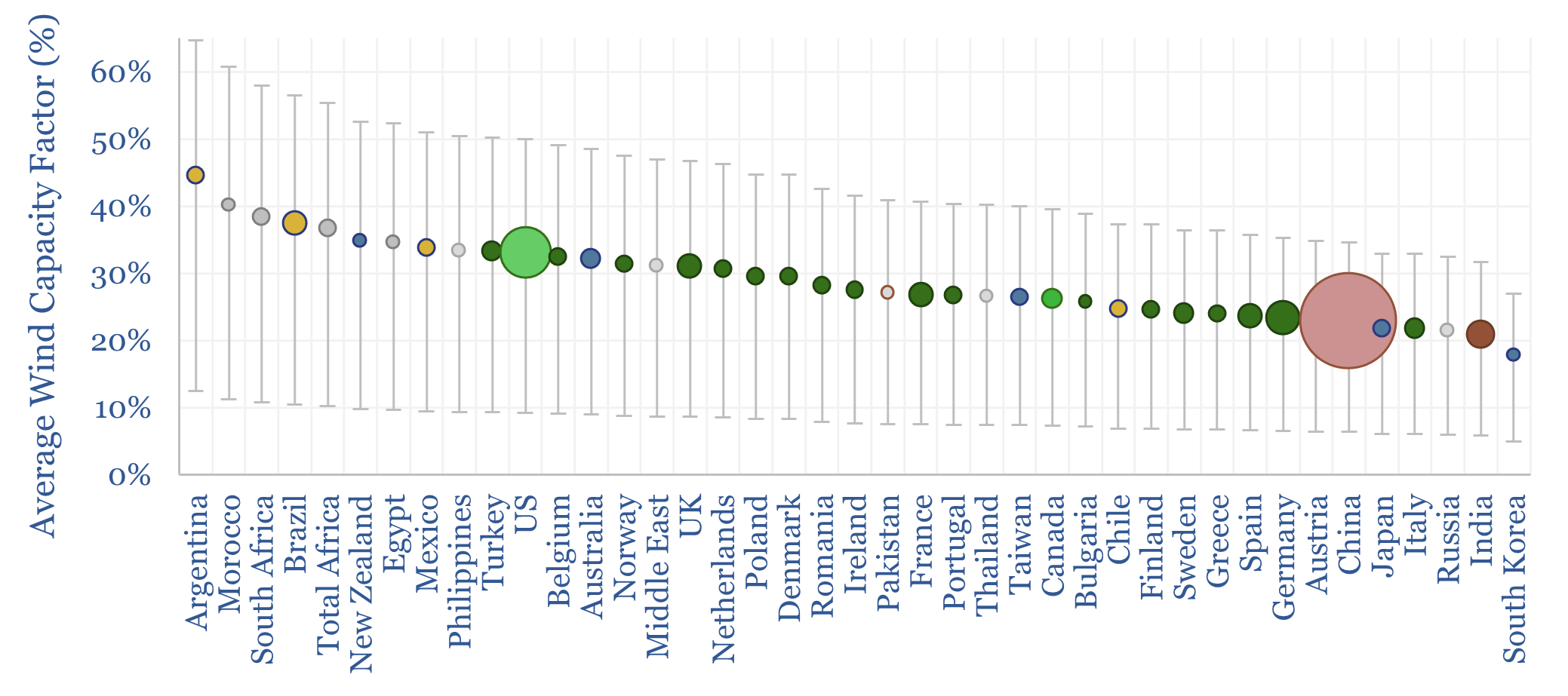

Wind turbine capacity factors: by country, by facility?

Download

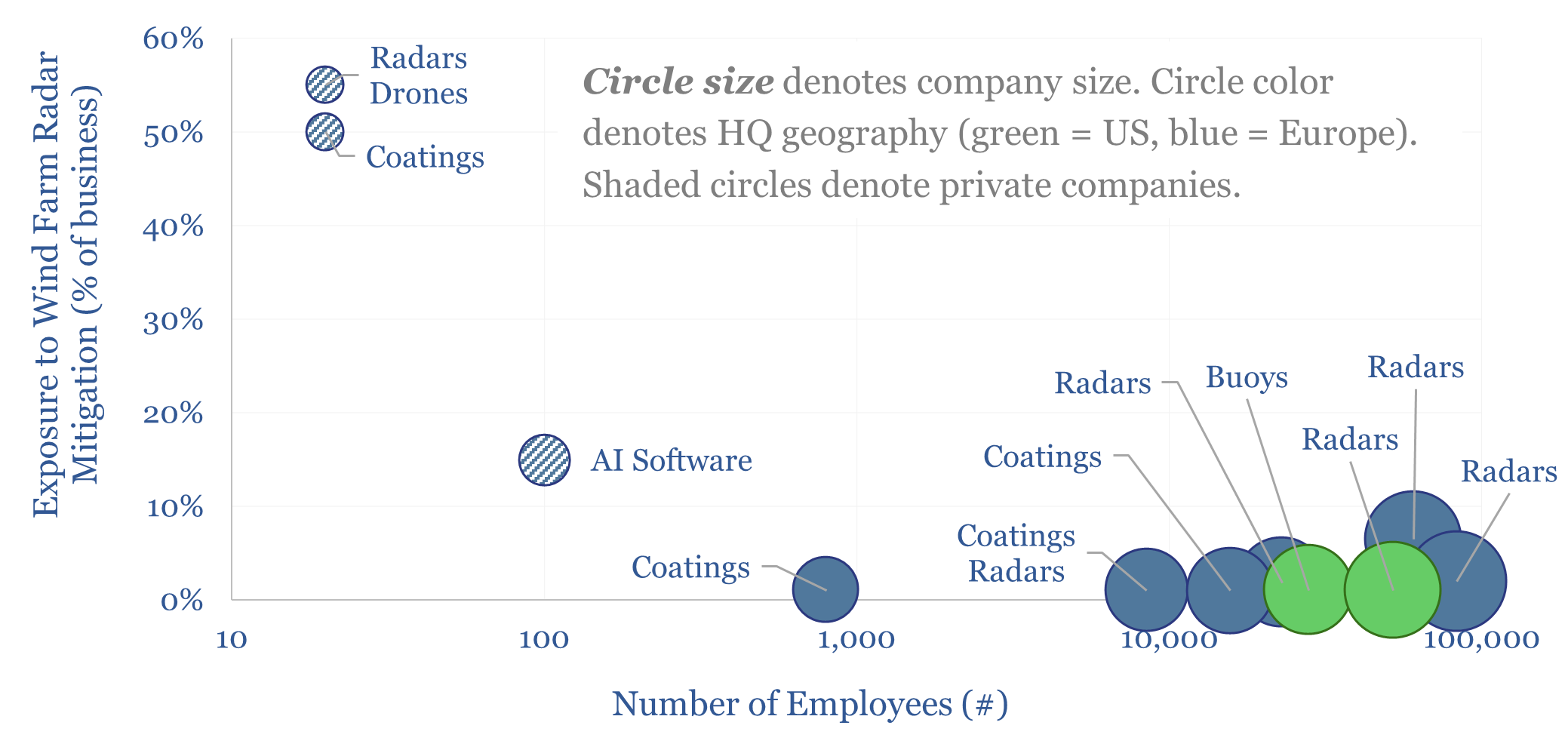

Companies mitigating radar interference of wind turbines?

Download

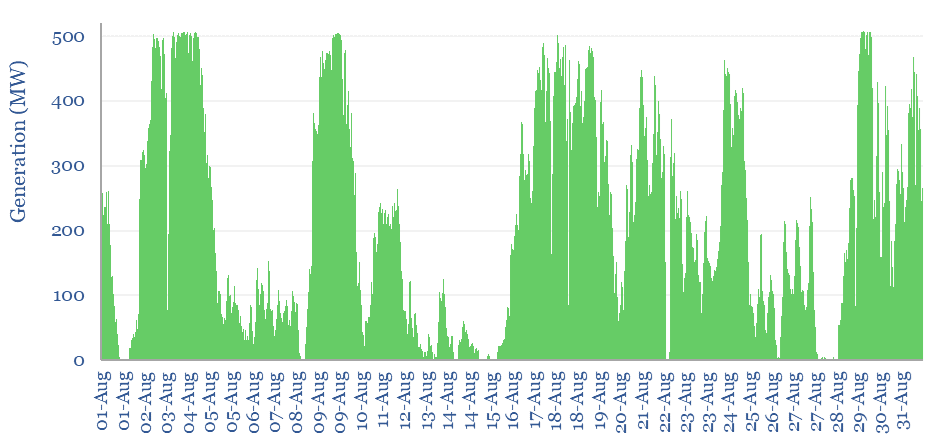

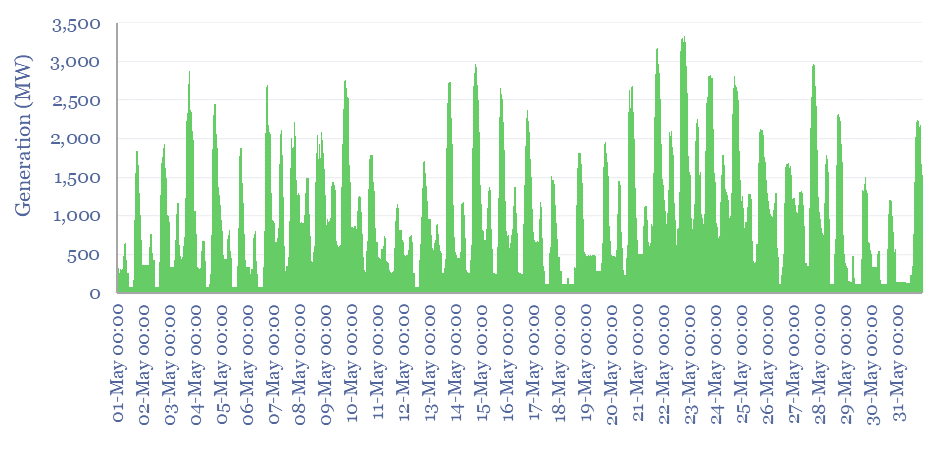

Wind generation case study: minute by minute volatility?

Download

Offshore wind: the lion, the witch and the wardrobe?

Download

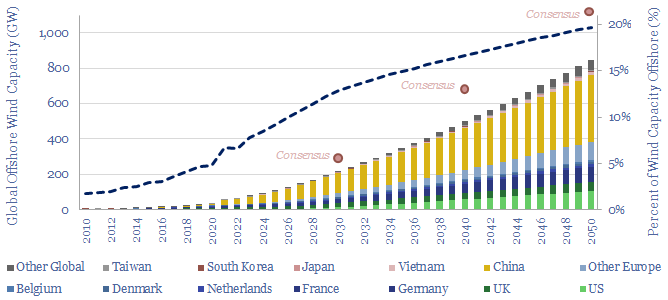

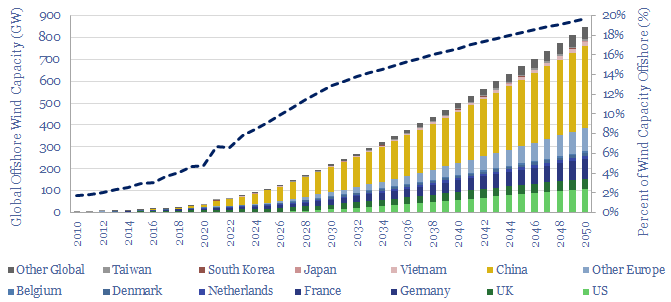

Offshore wind: capacity by country and forecasts?

Download

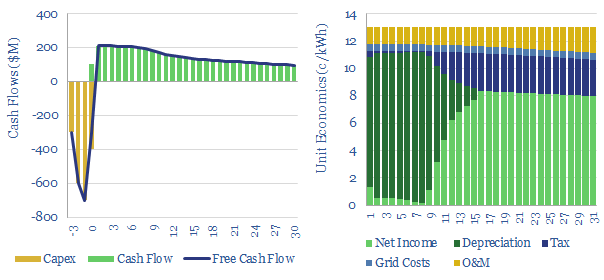

Offshore wind: levelized costs?

Download

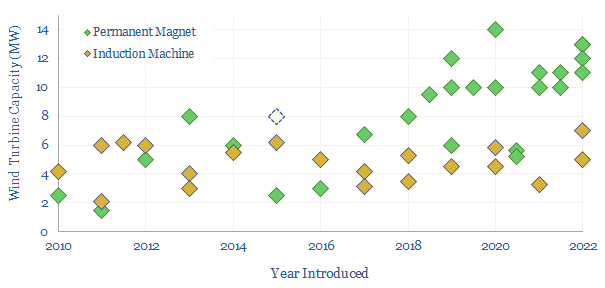

Wind turbine generators: DFIGs or Rare Earth magnets?

Download

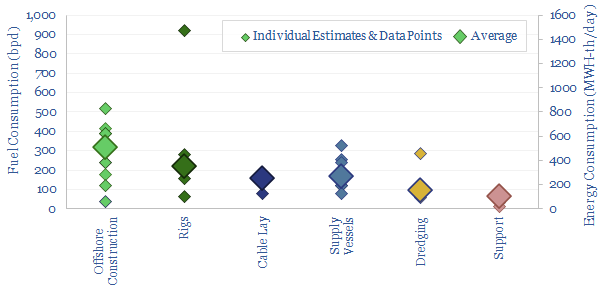

Offshore vessels: fuel consumption?

Download

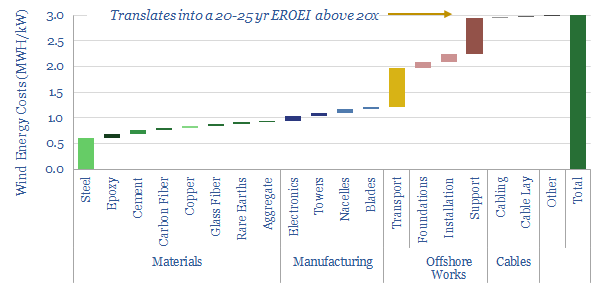

Wind power: energy costs, energy payback and EROEI?

Download

Renewables: how much time to connect to the grid?

Download

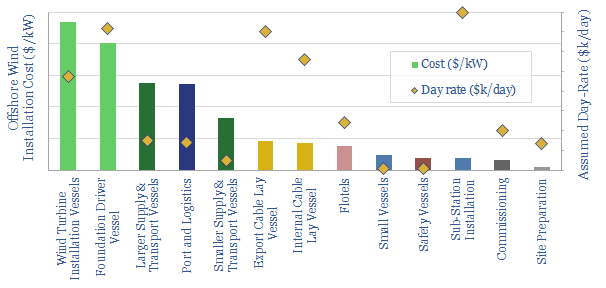

Offshore wind: installation costs by vessel?

Download

Goldwind: frequency response from wind turbines?

Download

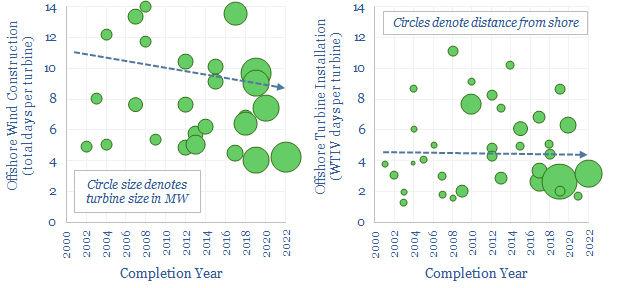

Offshore wind: installation vessels and time per turbine?

Download

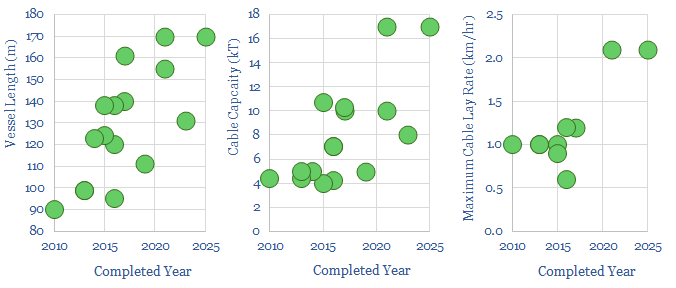

Cable installation vessels: costs and operating parameters?

Download

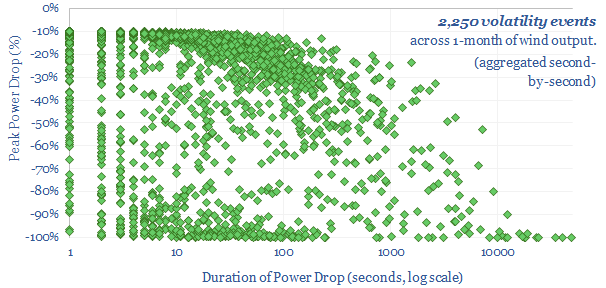

Wind volatility: second by second output data?

Download

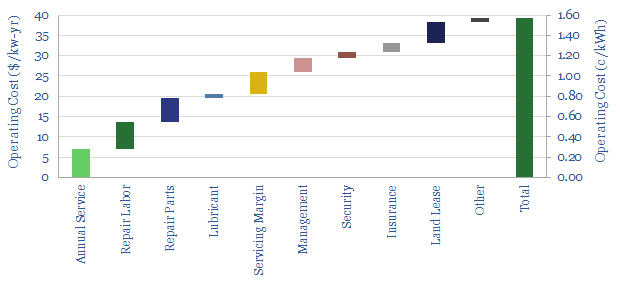

Wind power: operating costs?

Download

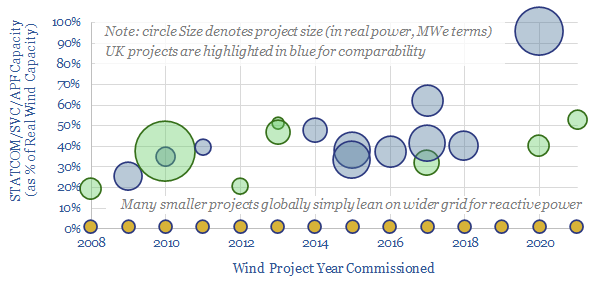

FACTS of life: upside for STATCOMs & SVCs?

Download

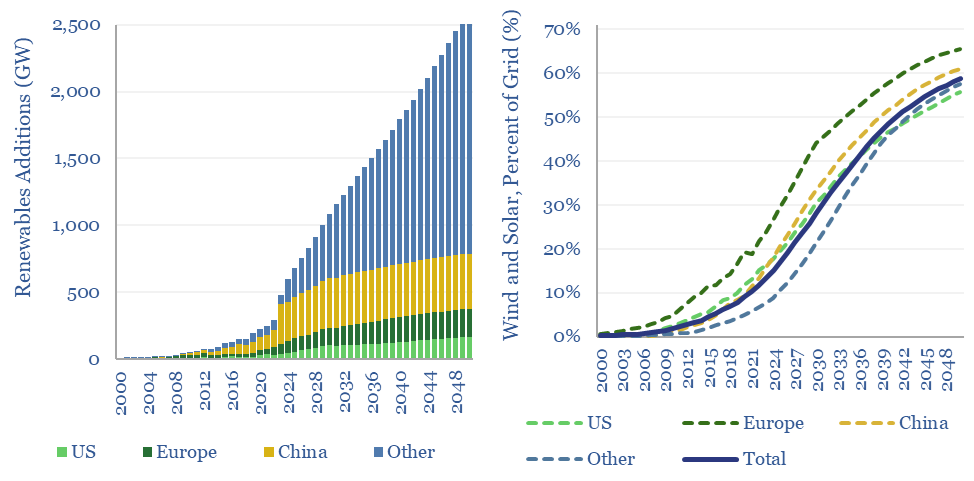

Wind and solar capacity additions?

Download

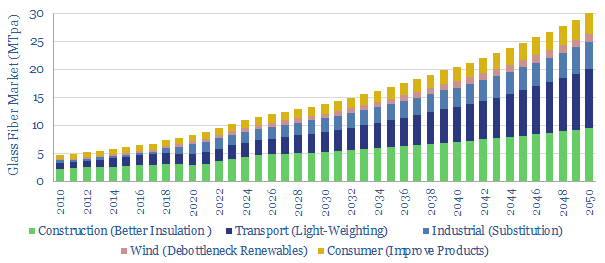

Glass fiber: what upside in the energy transition?

Download

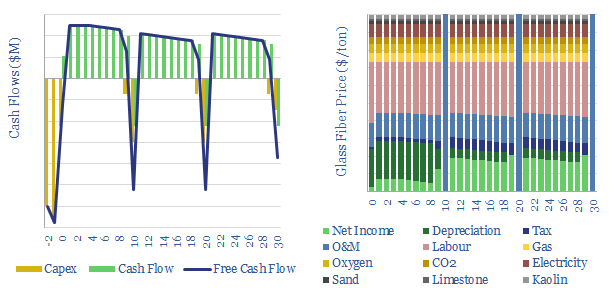

Glass fiber: the economics?

Download

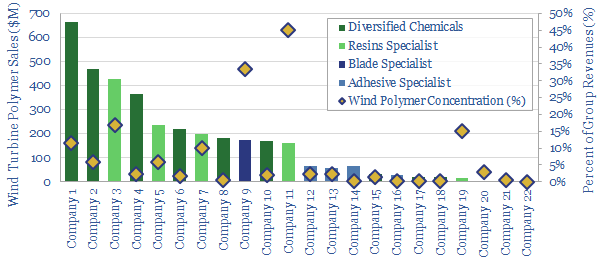

Wind turbines: screen of resin and polymer specialists?

Download

Renewables: can they ramp up faster?

Download

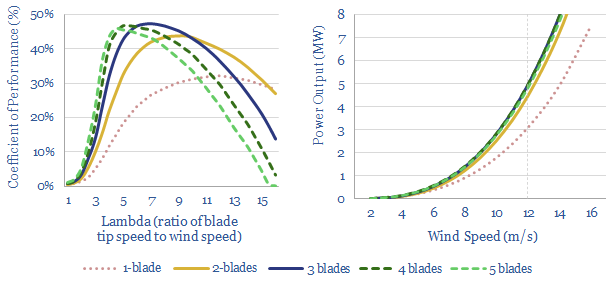

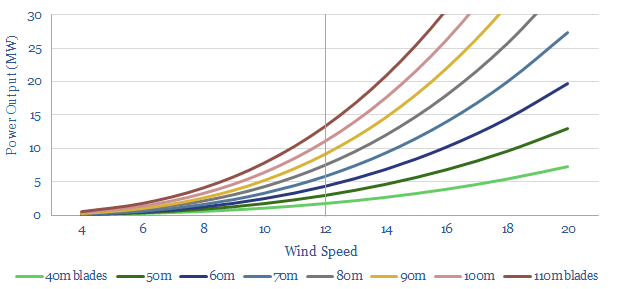

Windy physics: how is power of a wind turbine calculated?

Download

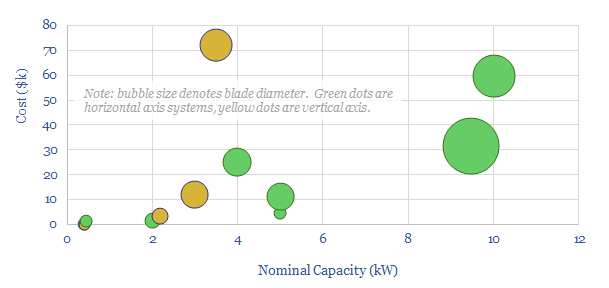

Small-scale wind turbines: leading companies?

Download

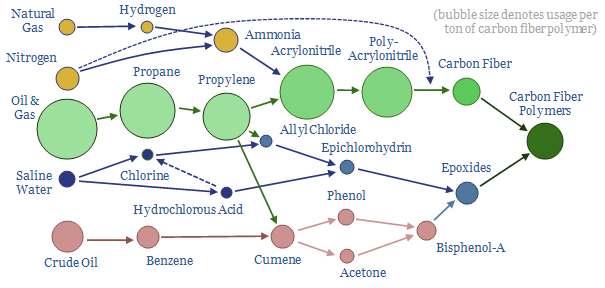

Carbon fiber: the miracle material?

Download

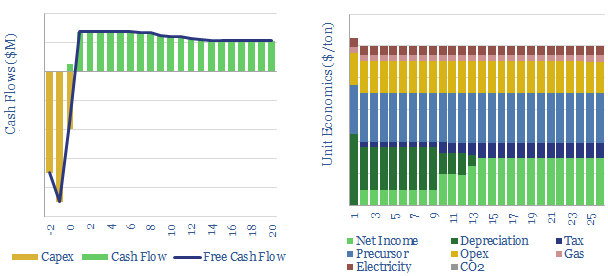

Carbon fiber: energy economics?

Download

Offshore wind: will costs follow Moore’s Law?

Download

Siemens Gamesa: giant wind turbine breakthroughs?

Download

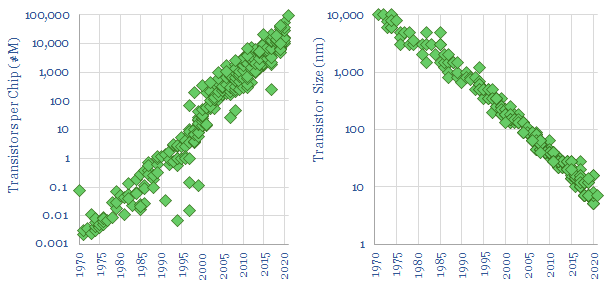

Moore’s law: causes and new energies conclusions?

Download

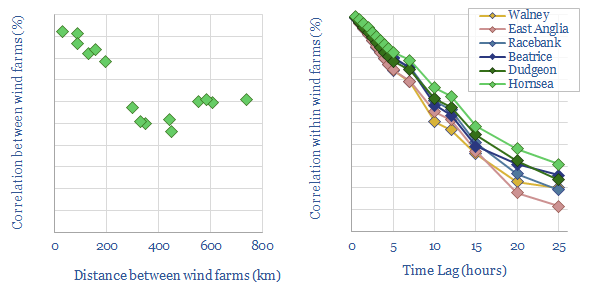

Inter-correlations between offshore wind farms?

Download

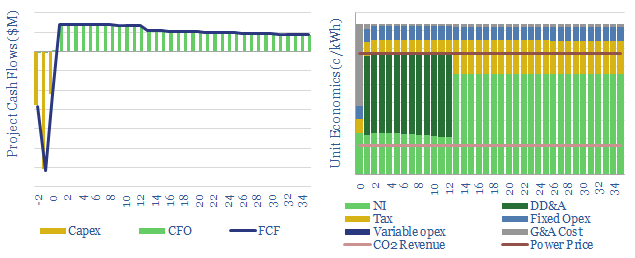

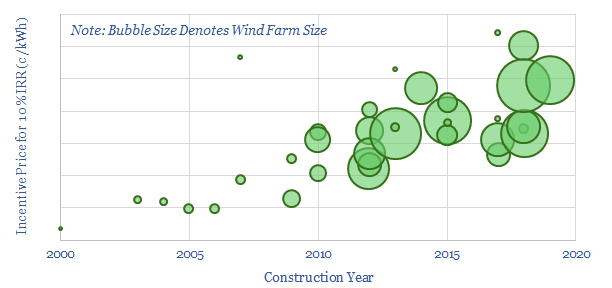

Onshore wind: the economics?

Download

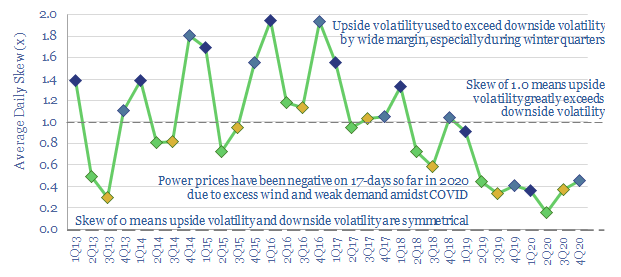

Prevailing wind: new opportunities in grid volatility?

Download

Floating offshore wind: what challenges?

Download

Floating offshore wind: what challenges?

Download

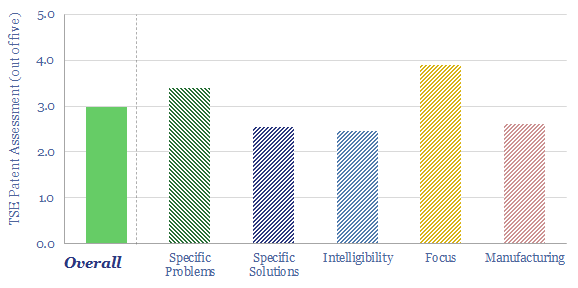

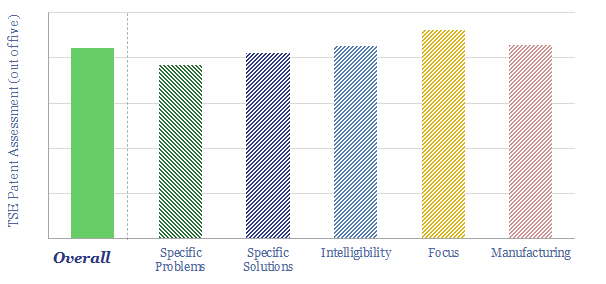

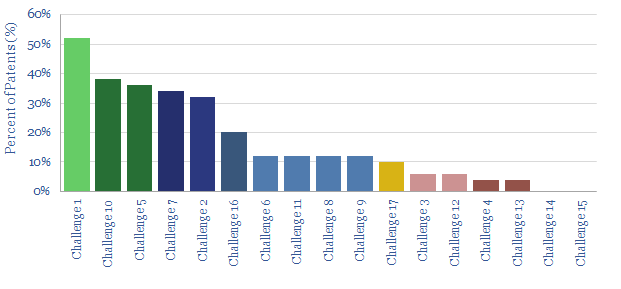

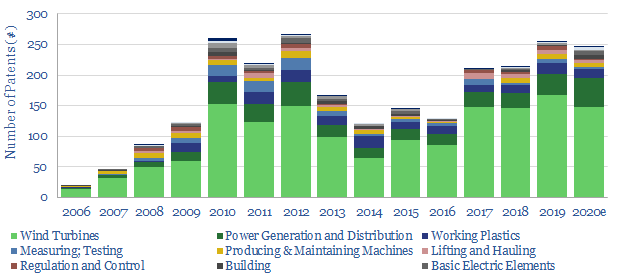

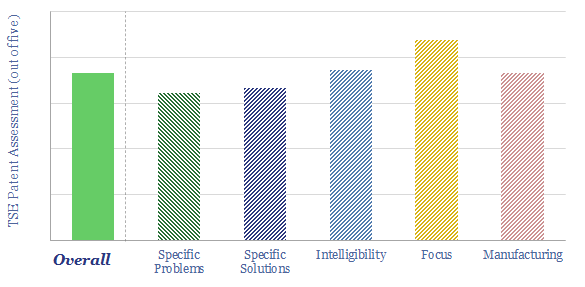

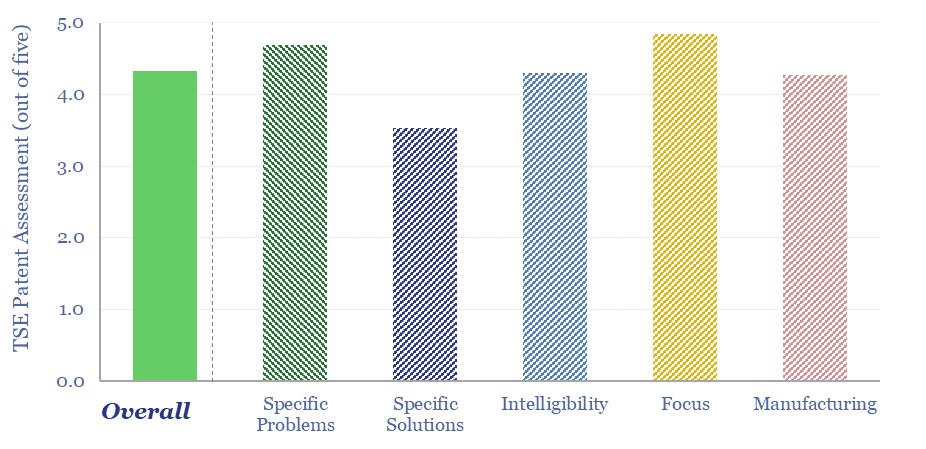

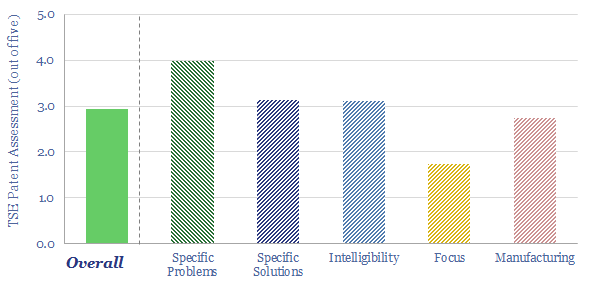

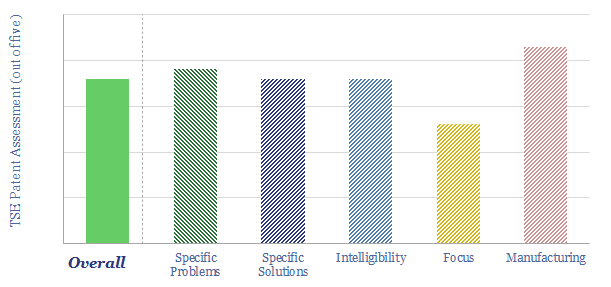

Vestas: where’s the IP?

Download

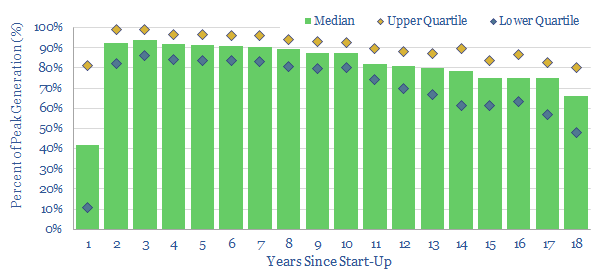

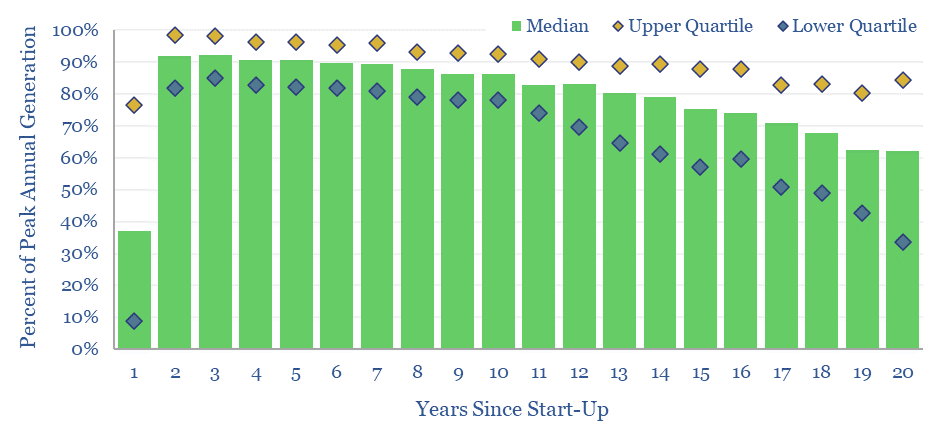

Wind power: decline rate conclusions?

Download

Wind power: decline rates?

Download

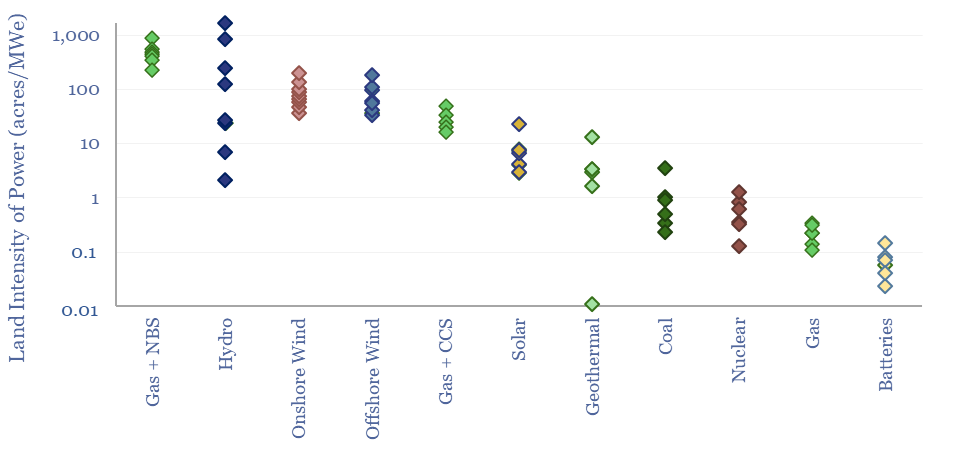

Land intensity of energy transition: acres per MW and per ton?

Download

Offshore wind costs are inflating?

Download

Nuclear Research

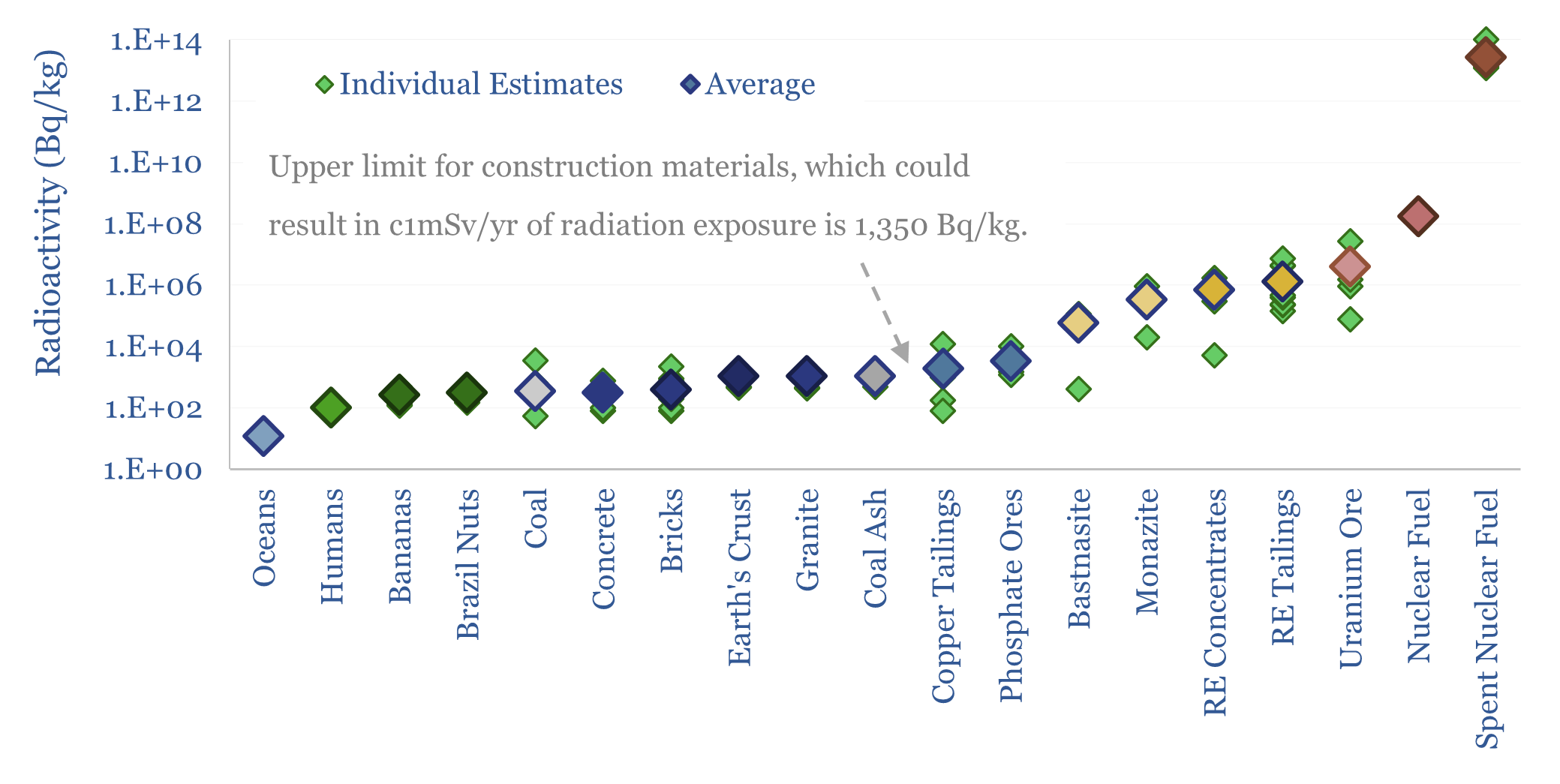

Radioactivity of materials: energy, Rare Earths and nuclear?

Download

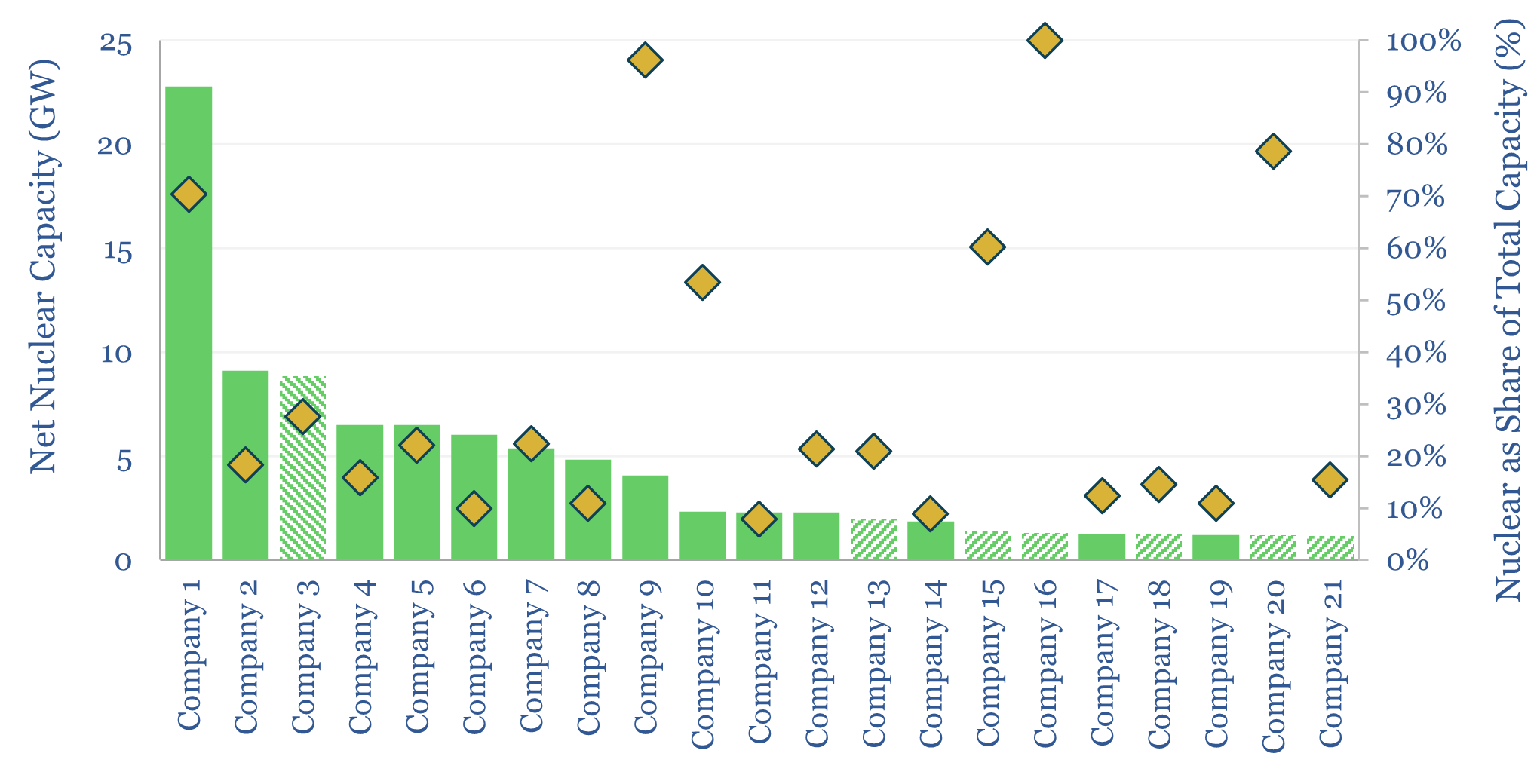

US nuclear generation by company?

Download

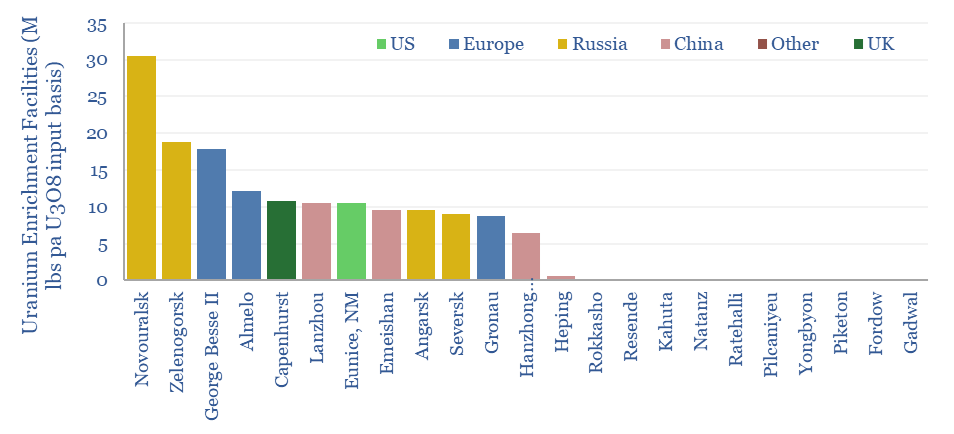

Uranium enrichment: by country, by company, by facility?

Download

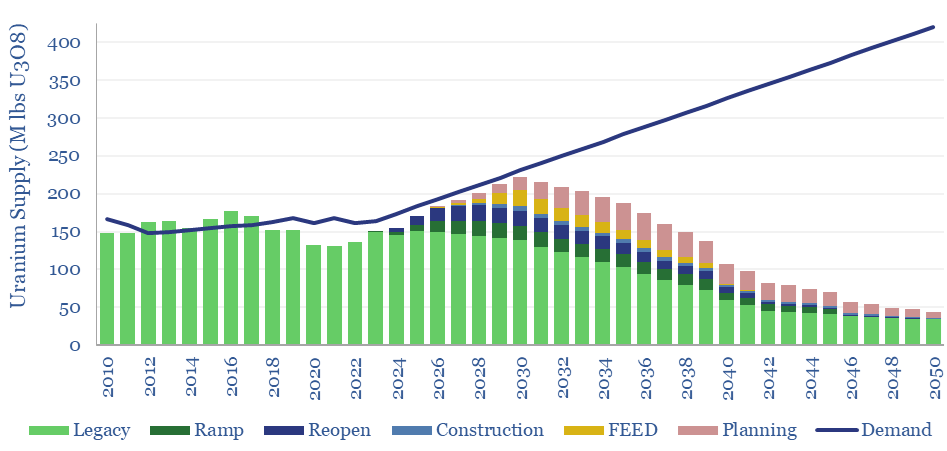

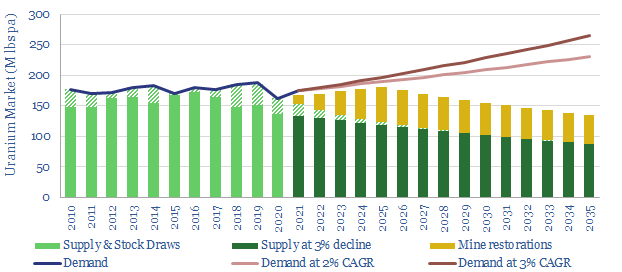

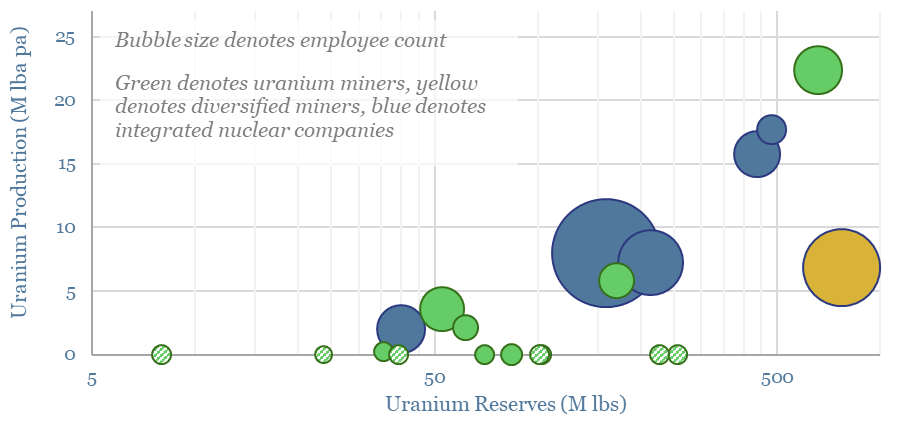

Global uranium supply-demand?

Download

Oklo: fast reactor technology?

Download

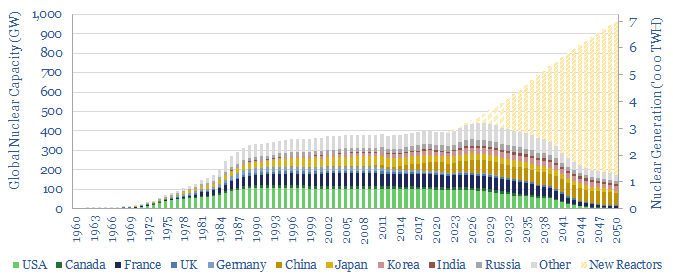

Reaching criticality: nuclear re-accelerates?

Download

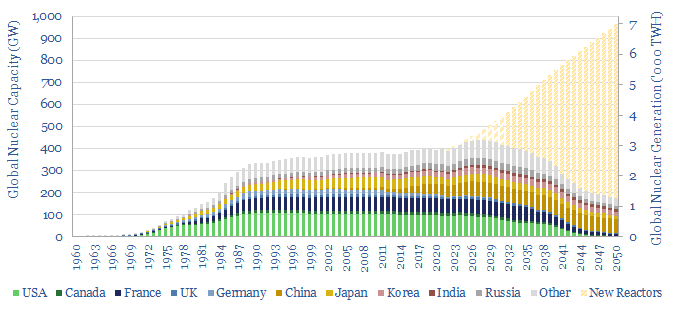

Nuclear capacity: forecasts, construction times, operating lives?

Download

X Energy: nuclear fuel breakthrough?

Download

TerraPower: nuclear breakthrough?

Download

Terrestrial Energy: small modular reactor breakthrough?

Download

General Fusion: magnetized fusion breakthrough?

Download

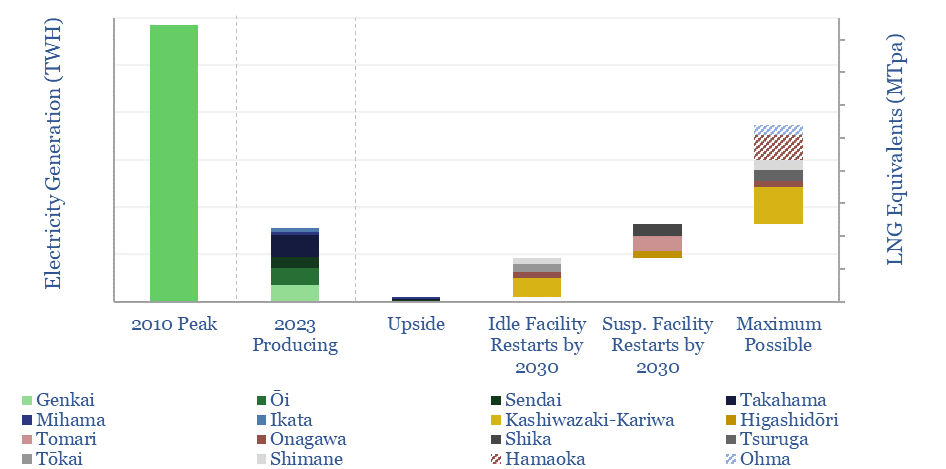

Japan: nuclear restart tracker?

Download

Commonwealth Fusion: nuclear fusion breakthrough?

Download

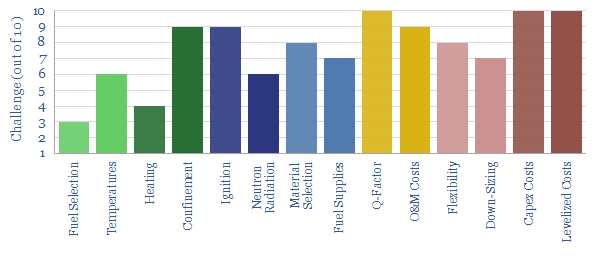

Nuclear fusion: what are the challenges?

Download

NuScale: small modular reactor breakthrough?

Download

Back-stopping renewables: the nuclear option?

Download

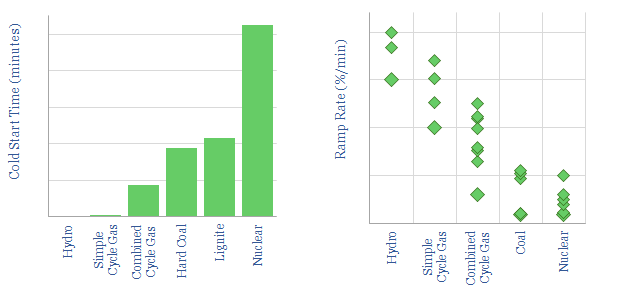

Power plants: cold starts and ramp rates?

Download

Nuclear power: what role in the energy transition?

Download

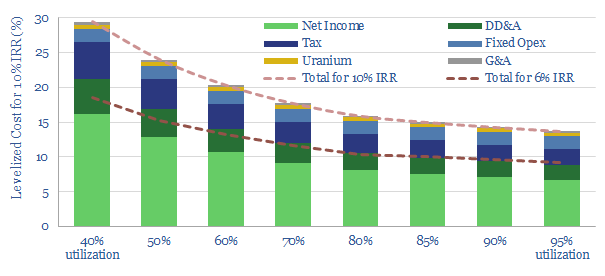

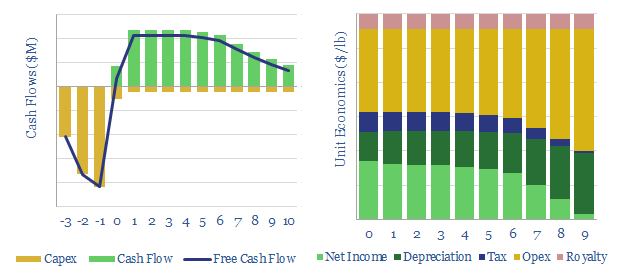

Uranium mining: the economics?

Download

Uranium production: by company and by country?

Download

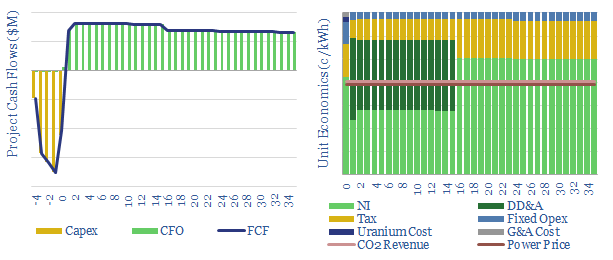

Nuclear Power Project Economics

Download

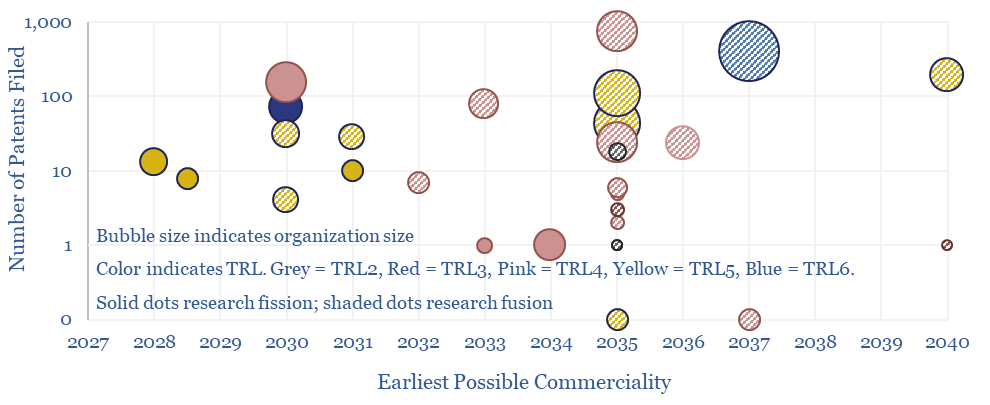

Next-generation nuclear companies: future fission and fusion?

Download

Batteries Research

Energy storage: top conclusions into batteries?

Download

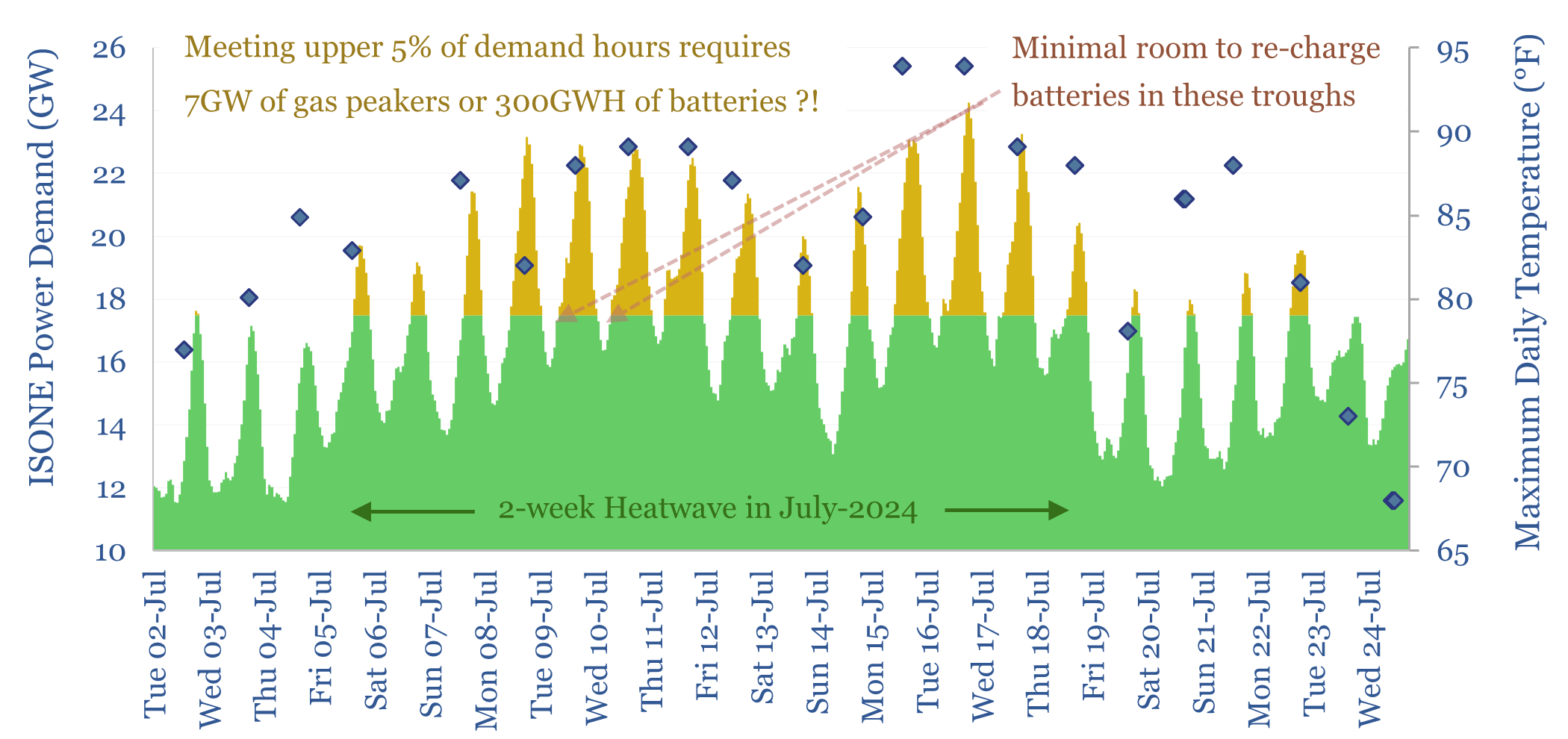

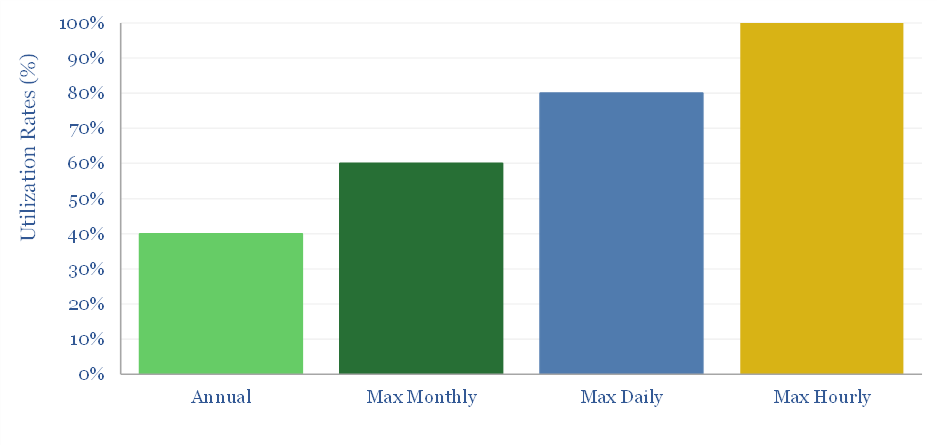

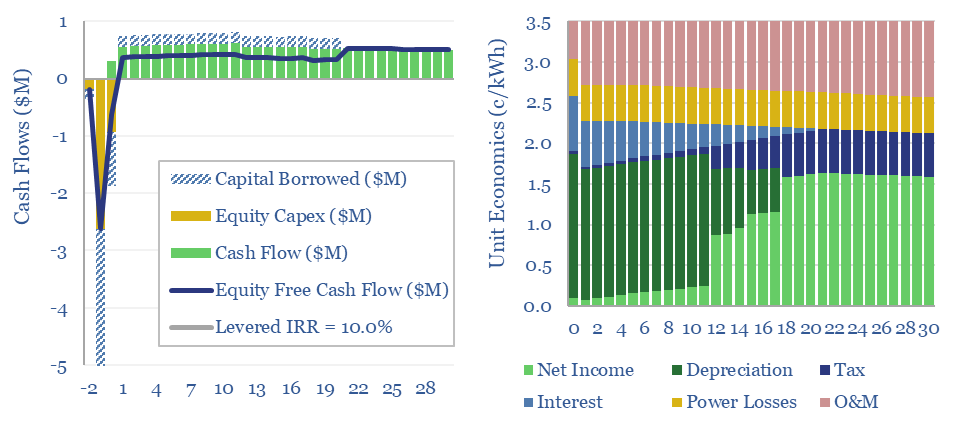

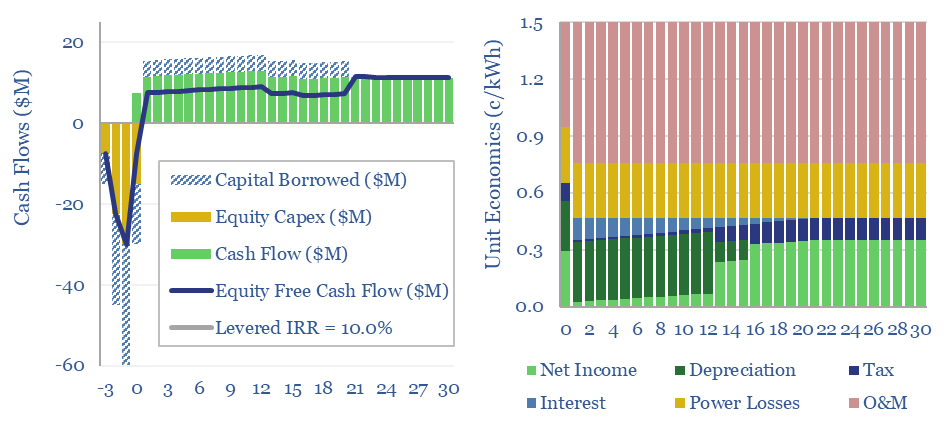

Peak loads: can batteries displace gas peakers?

Download

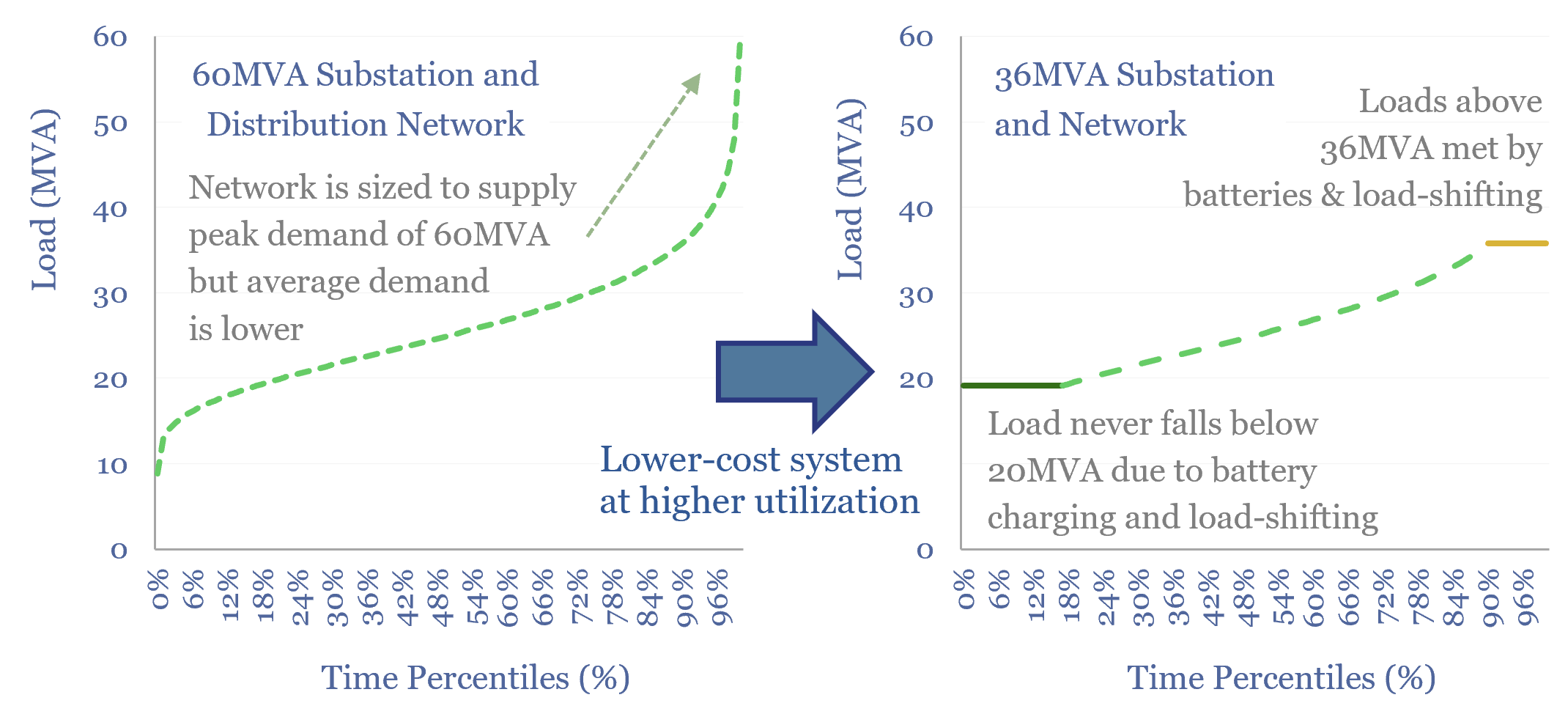

Power grid bottlenecks: flattening the curve?

Download

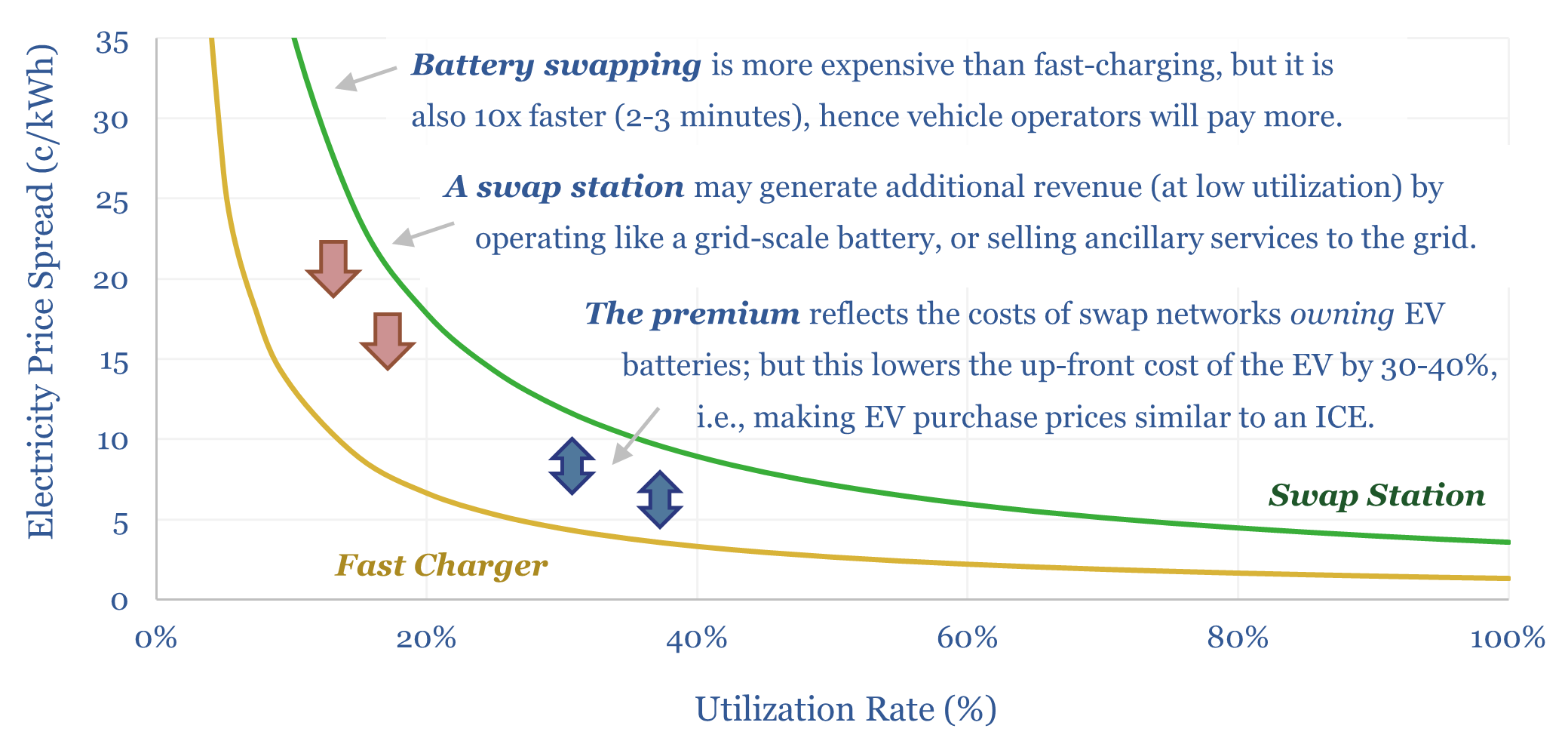

Battery swapping: off to the races?

Download

Solar plus batteries: the case for co-deployment?

Download

Solar+battery co-deployments: output profiles?

Download

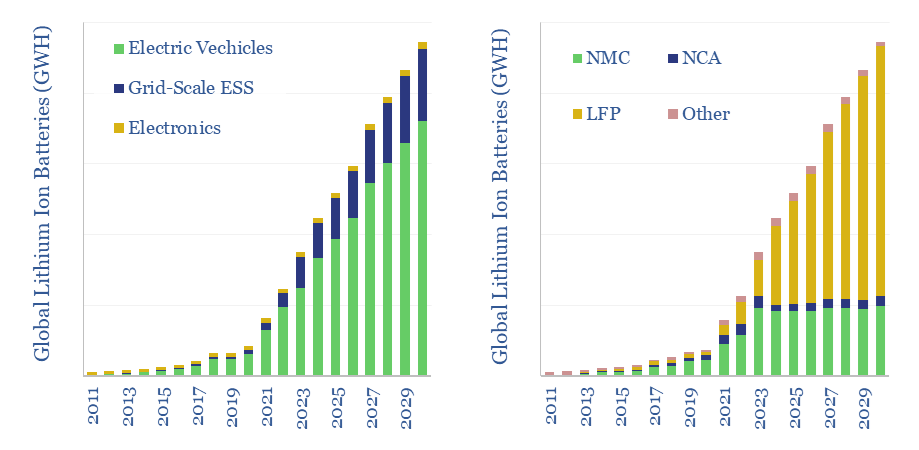

Lithium ion battery volumes by chemistry and use?

Download

LFP batteries: cathode glow?

Download

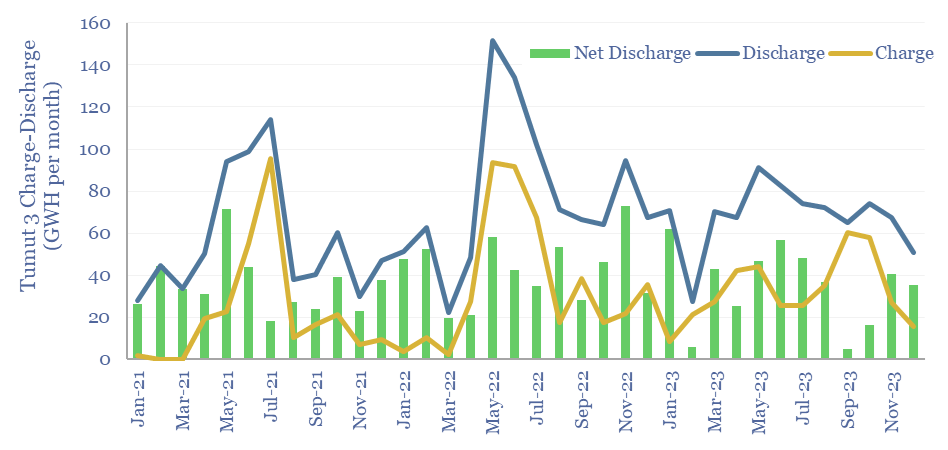

Pumped hydro: generation profile?

Download

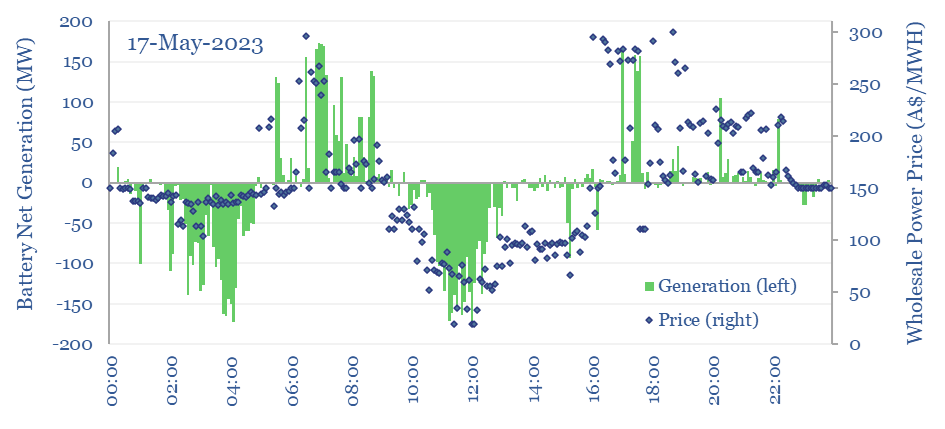

Grid-scale battery operation: a case study?

Download

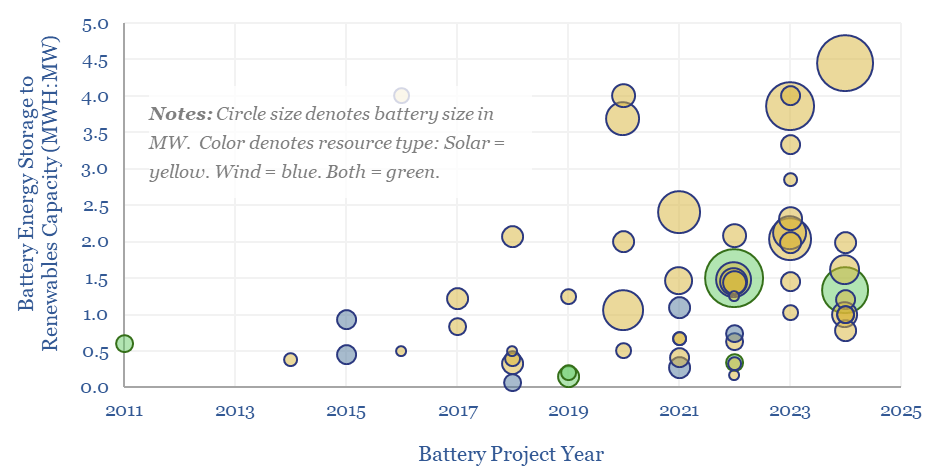

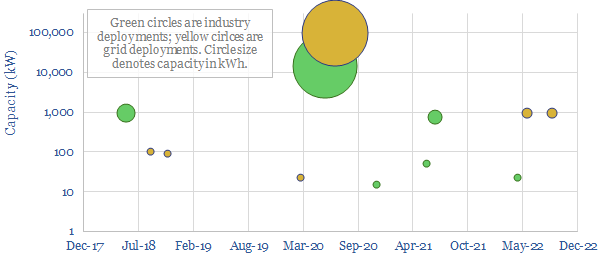

Renewables plus batteries: co-deployments over time?

Download

Compressed air energy storage: costs and economics?

Download

Electrochemistry: redox potential?

Download

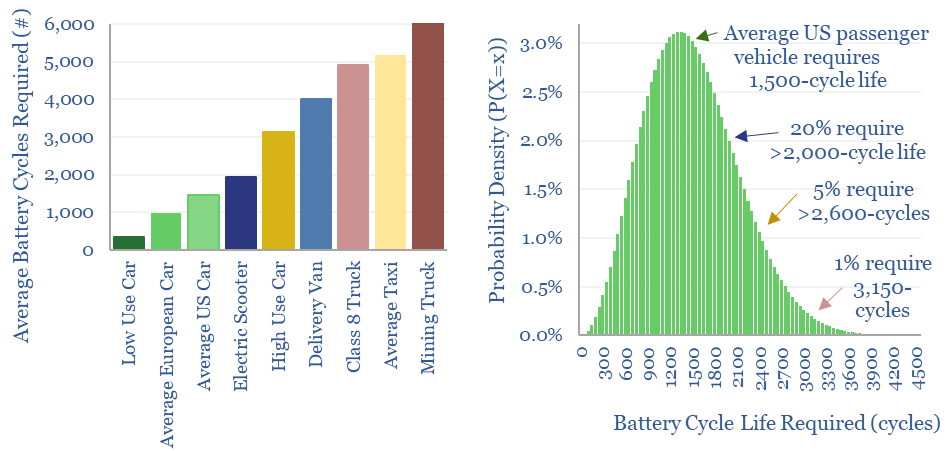

Electric vehicle: battery life?

Download

Thermal energy storage: heat of the moment?

Download

Thermal energy storage: cost model?

Download

Renewable grids: solar, wind and grid-scale battery sizing?

Download

Thermal energy storage: leading companies?

Download

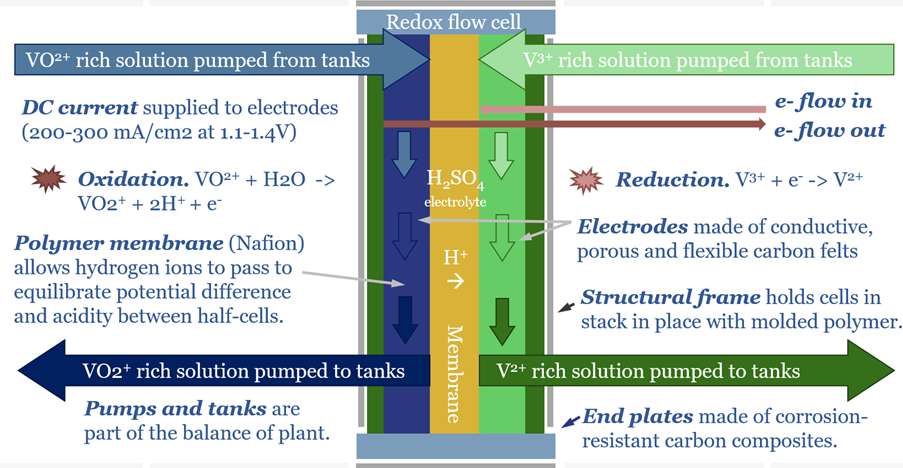

Redox flow batteries: for the duration?

Download

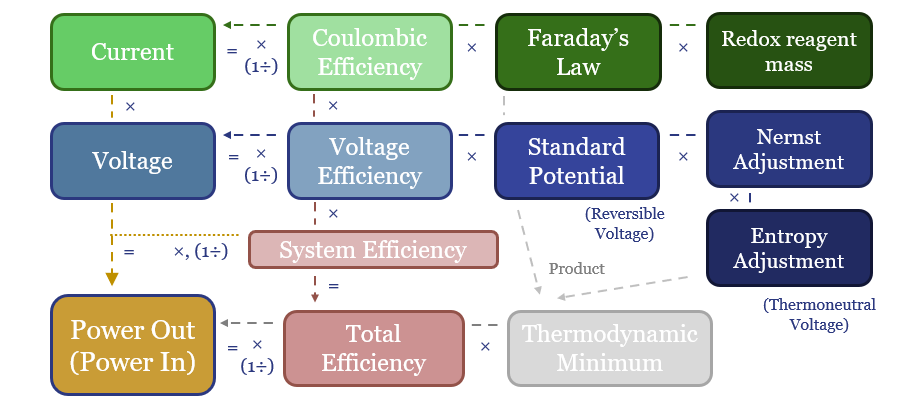

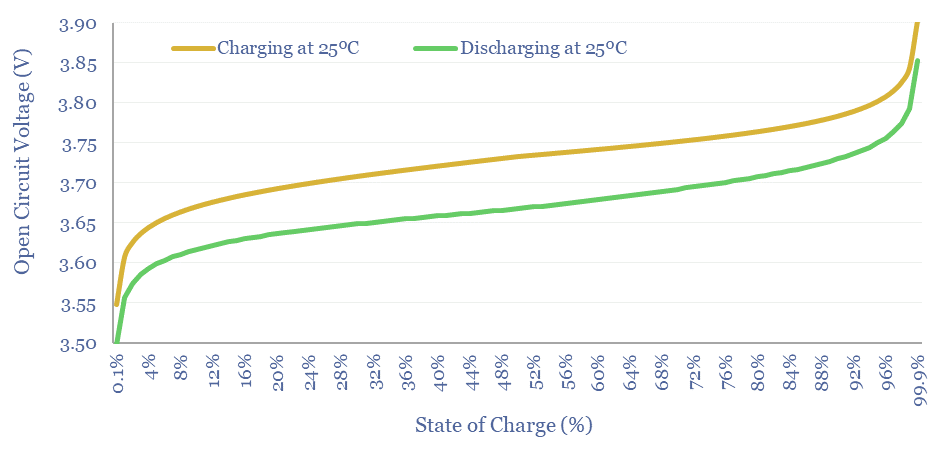

Electrochemistry: battery voltage and the Nernst Equation?

Download

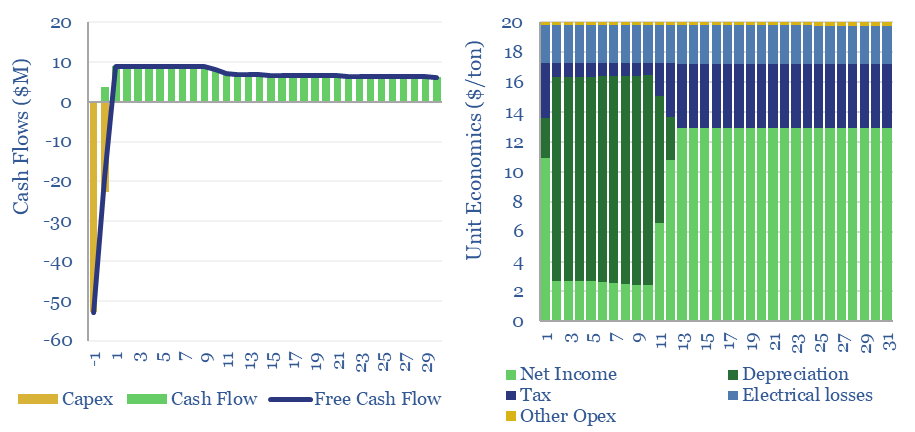

Redox flow batteries: costs and capex?

Download

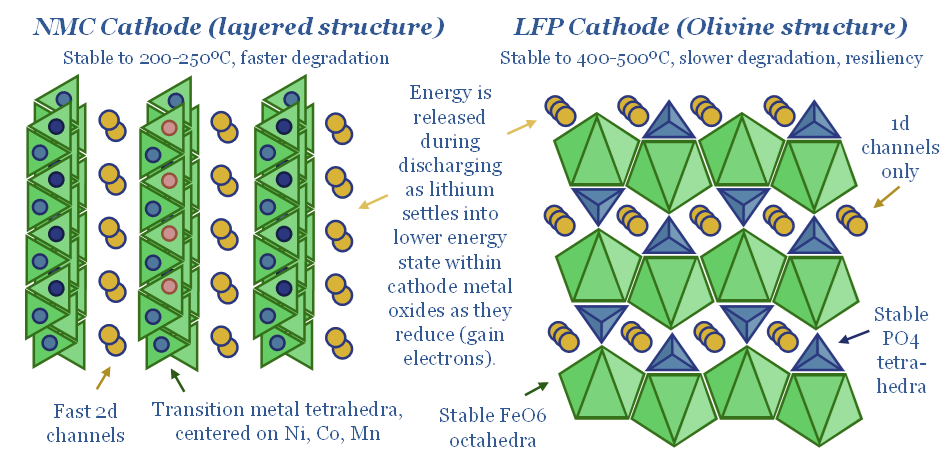

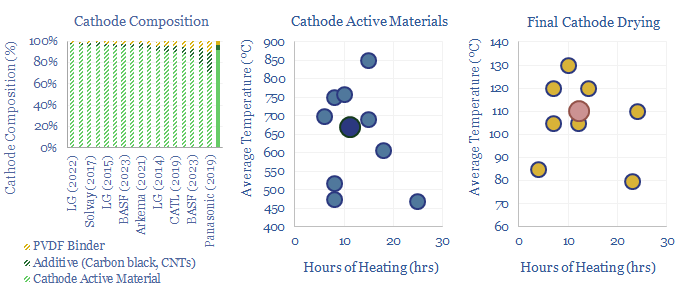

Battery cathode active materials and manufacturing?

Download

Solvay: lithium ion battery binders and additives?

Download

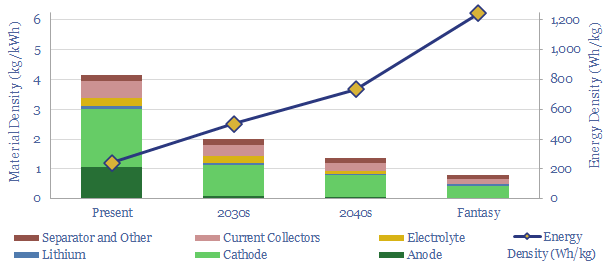

Lithium ion batteries: energy density?

Download

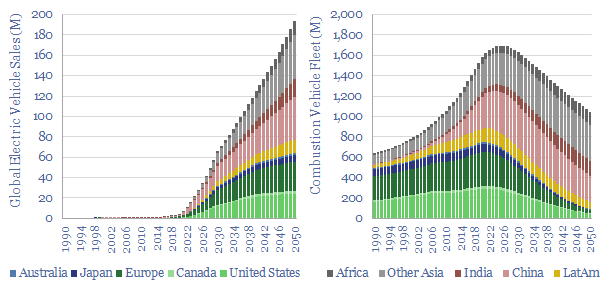

Electric vehicles: breaking the ICE?

Download

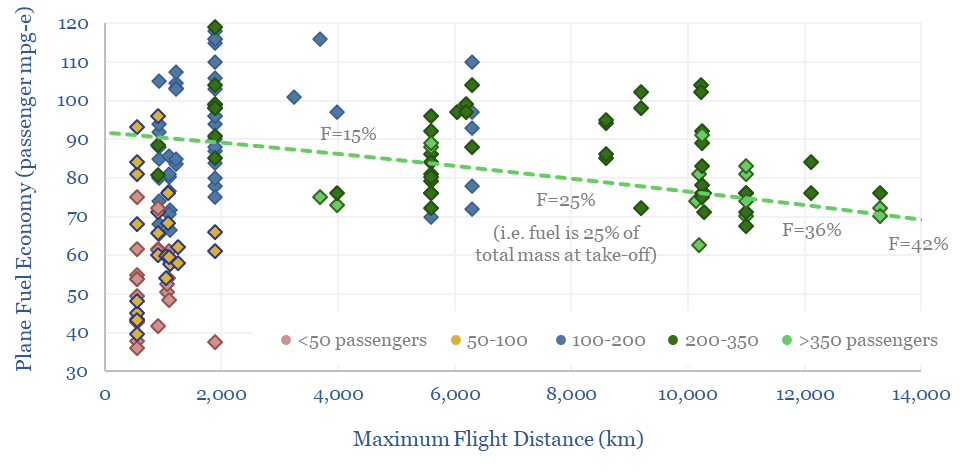

Commercial aviation: fuel economy of planes?

Download

Amprius: silicon anode technology review?

Download

Hillcrest: ZVS inverter breakthrough?

Download

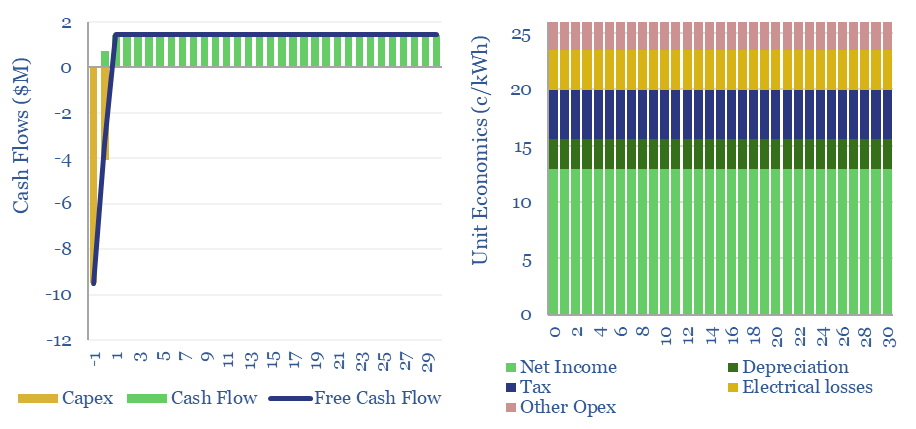

Grid-scale battery costs: the economics?

Download

Eaton: breakdown of revenues by product category?

Download

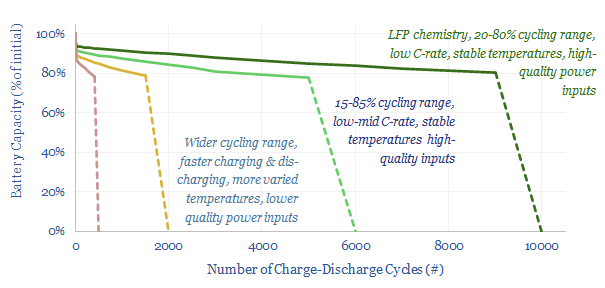

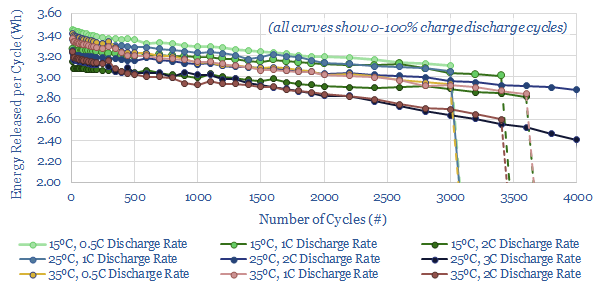

Battery degradation: causes, effects & implications?

Download

Battery degradation: what causes capacity fade?

Download

Supercapacitors: case studies for renewable-heavy grids?

Download

Powin: grid-scale battery breakthrough?

Download

Solar volatility: interconnectors versus batteries?

Download

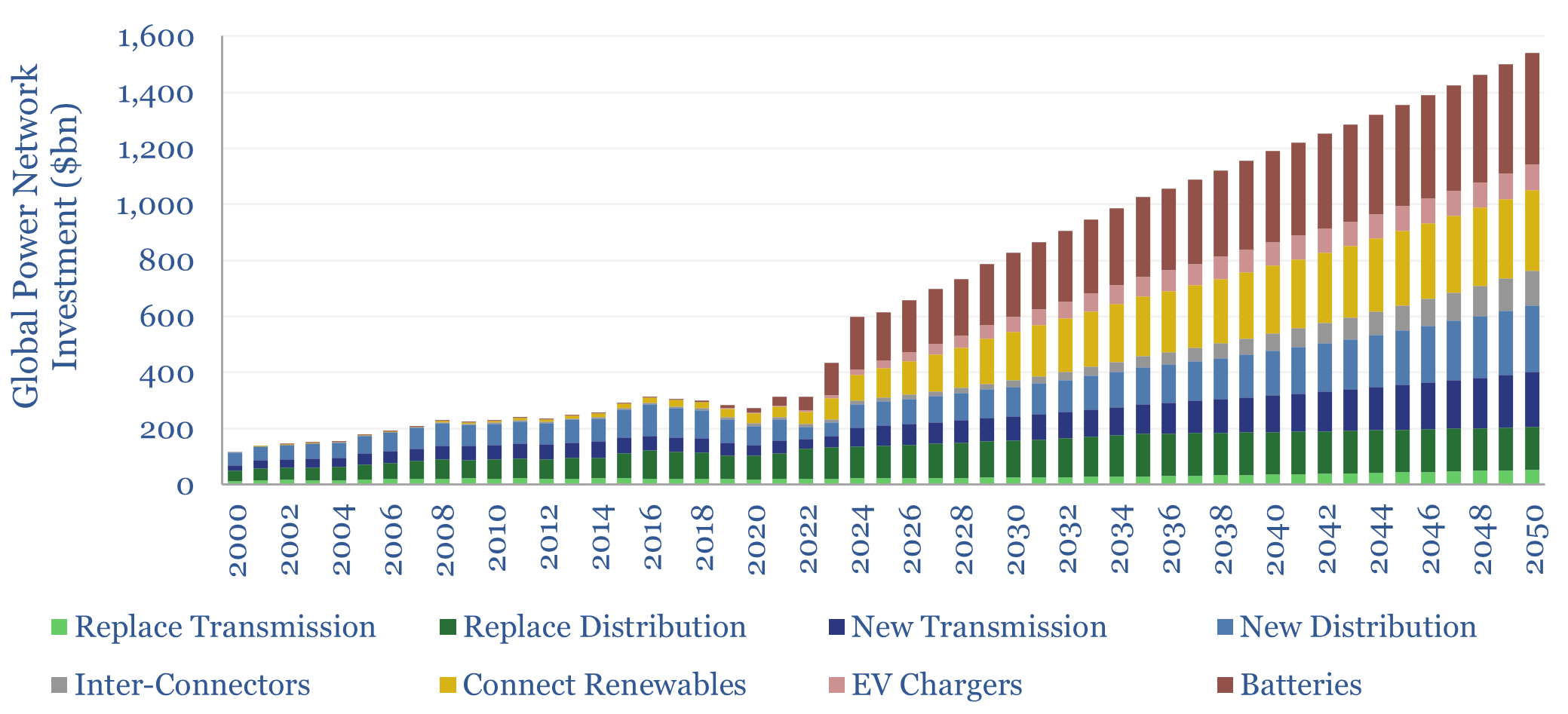

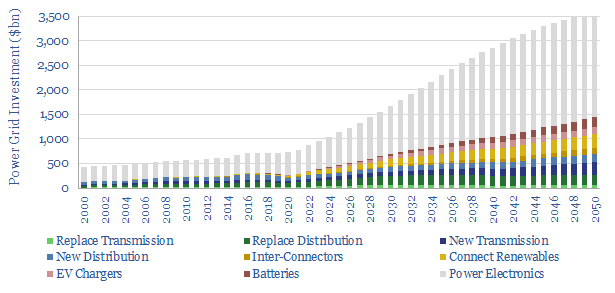

Power grids: global investment?

Download

Nostromo: thermal energy storage breakthrough?

Download

24M: semi-solid battery breakthrough?

Download

Pumped hydro: the economics?

Download

CATL: sodium ion battery breakthrough?

Download

Power Grids and Power Electronics Research

Wicked smart: what if AI re-shaped the power grid?

Download

Power grids: opportunities in the energy transition?

Download

Smart meter installations by region over time?

Download

Itron: smart energy network technology?

Download

Peak loads: can batteries displace gas peakers?

Download

Peak power demand by region (and case studies)

Download

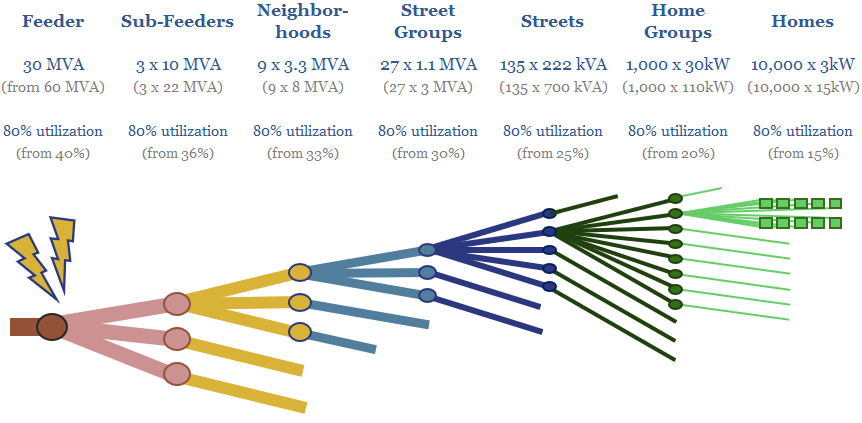

Power grid bottlenecks: flattening the curve?

Download

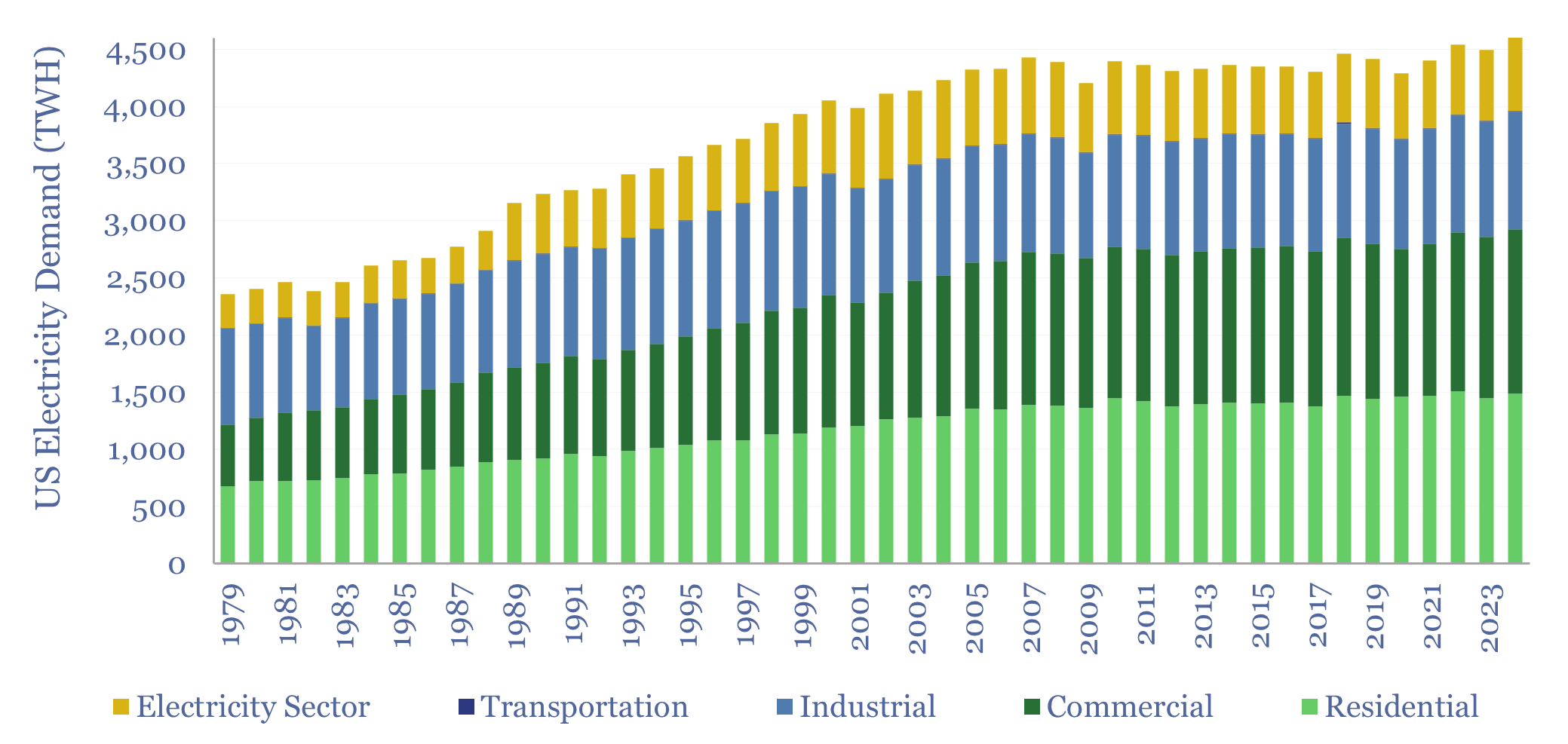

US electricity demand: by sector, by use, over time?

Download

Load profiles in power grids?

Download

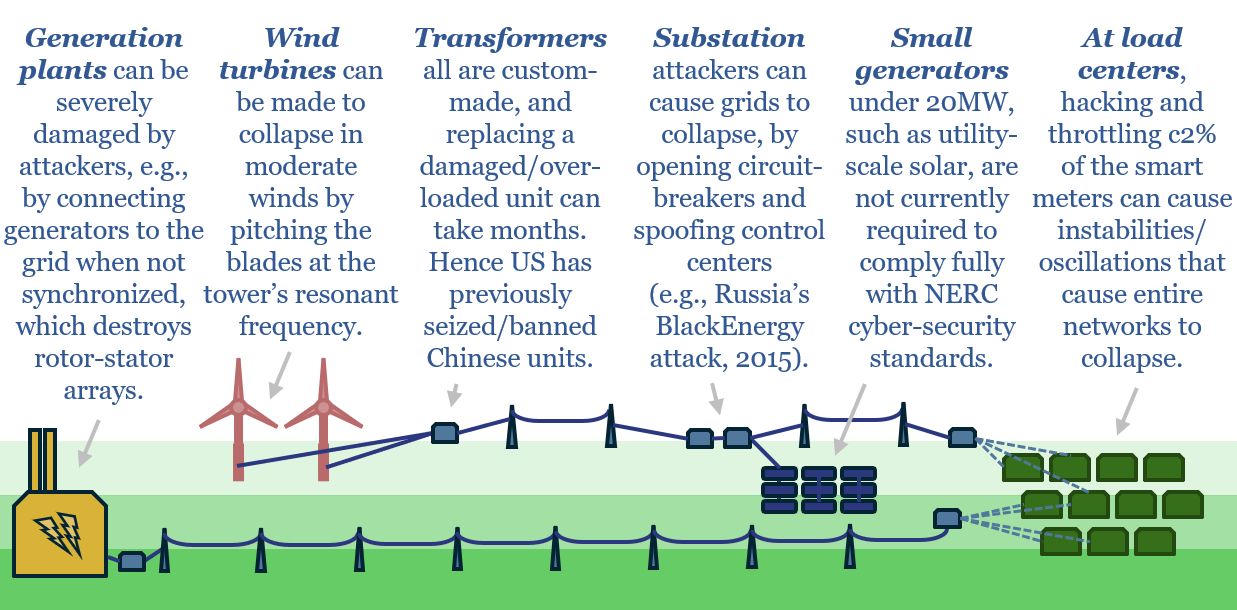

Energy and national security: network risk?

Download

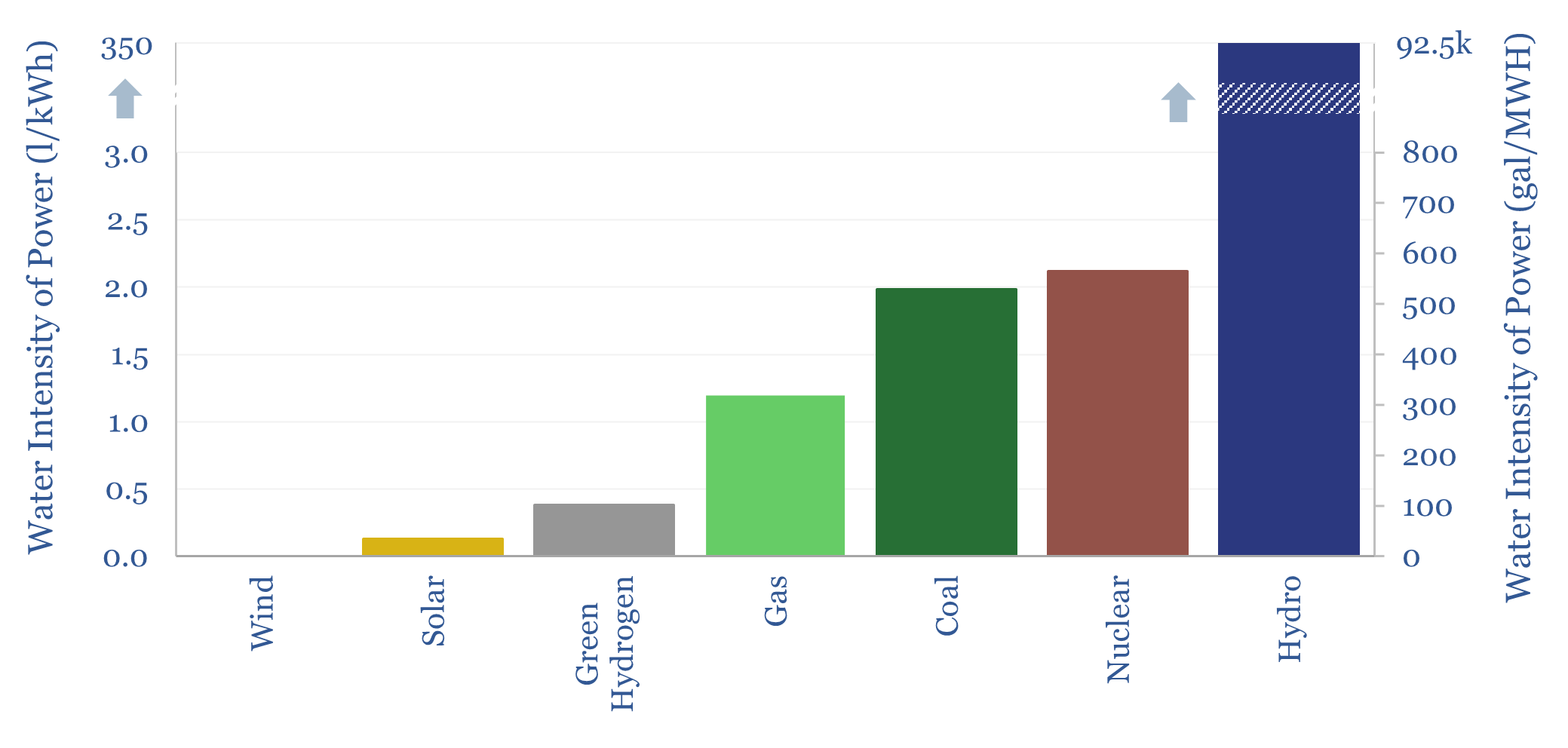

Water intensity of power generation?

Download

Residential energy prices: reasons for optimism?

Download

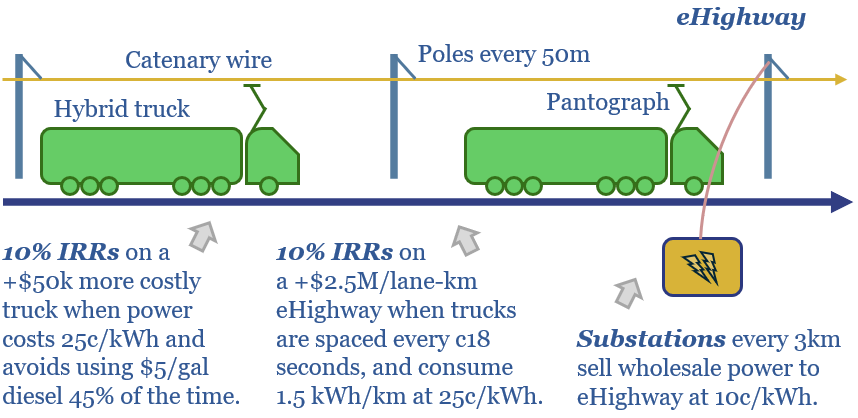

eHighways: trucking by wire?

Download

Smart Wires: grid capacity breakthroughs?

Download

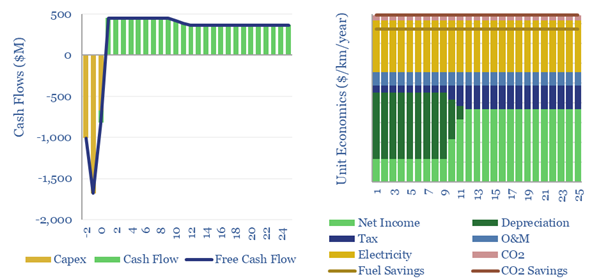

eHighway economics: costs of electrifying heavy trucks?

Download

Grid-forming inverters: islands in the sun?

Download

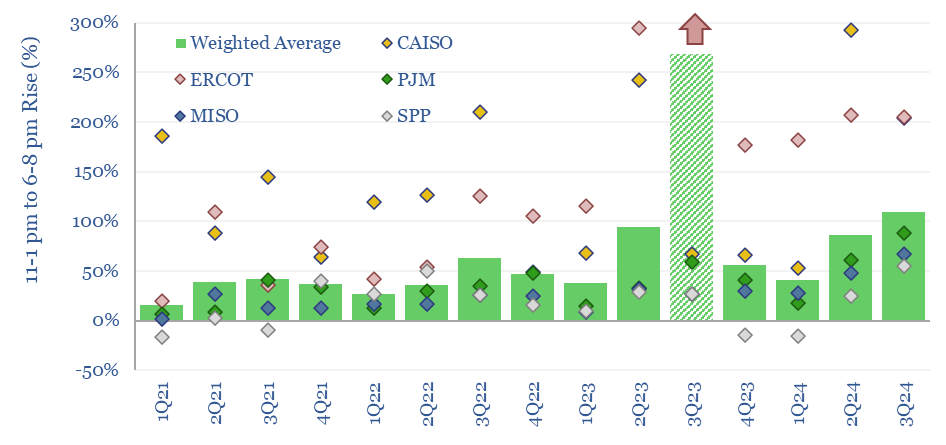

Duck curves: US power price duckiness over time?

Download

Kraken Technologies: smart grid breakthrough?

Download

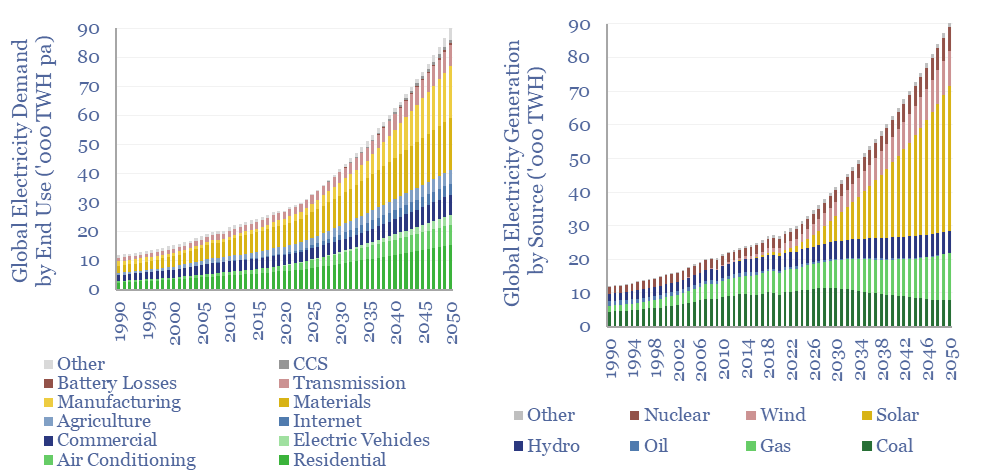

Global electricity: by source, by use, by region?

Download

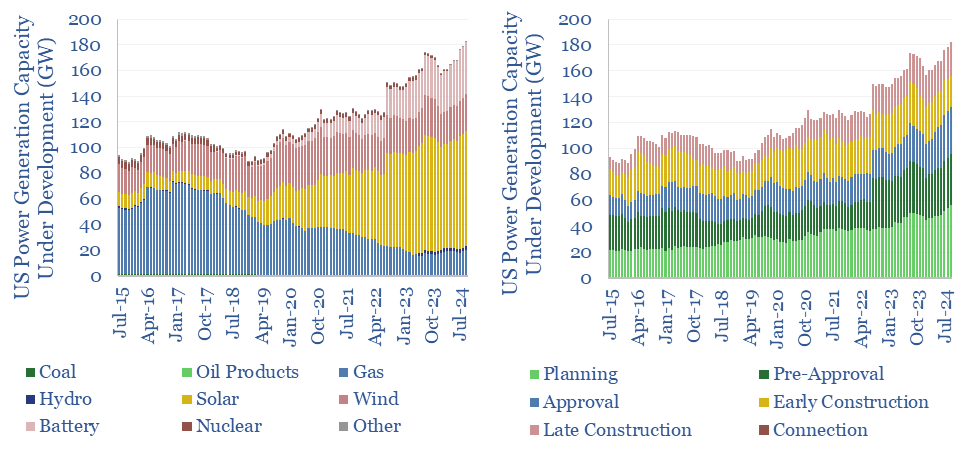

US power generation under development over time?

Download

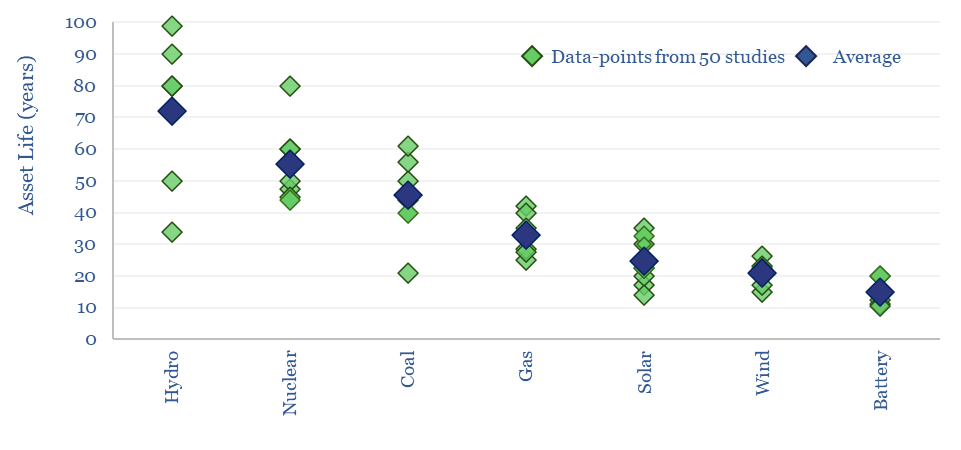

Power generation: asset lives?

Download

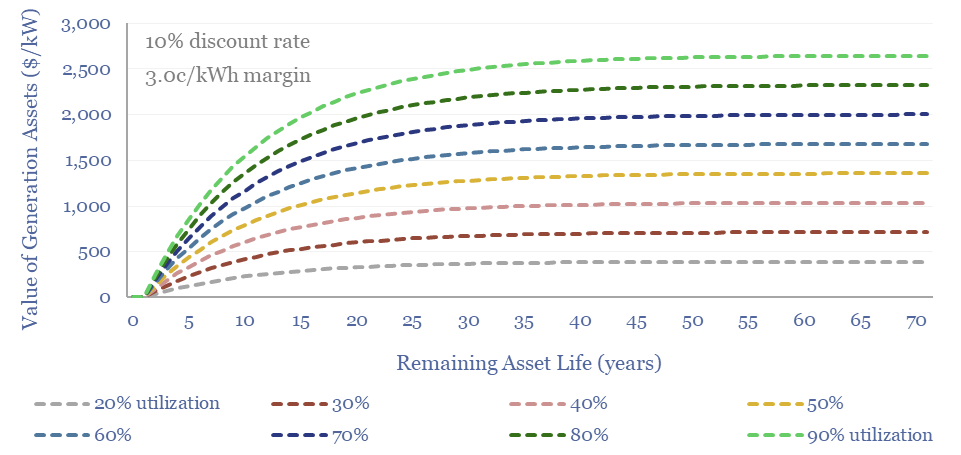

Purchasing power: what are generation assets worth?

Download

Prysmian E3X: reconductoring technology?

Download

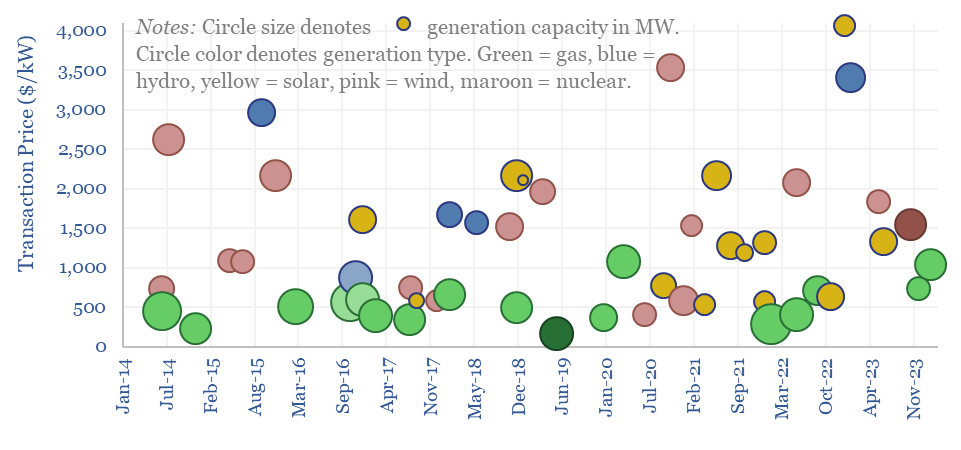

Transaction prices for power generation assets?

Download

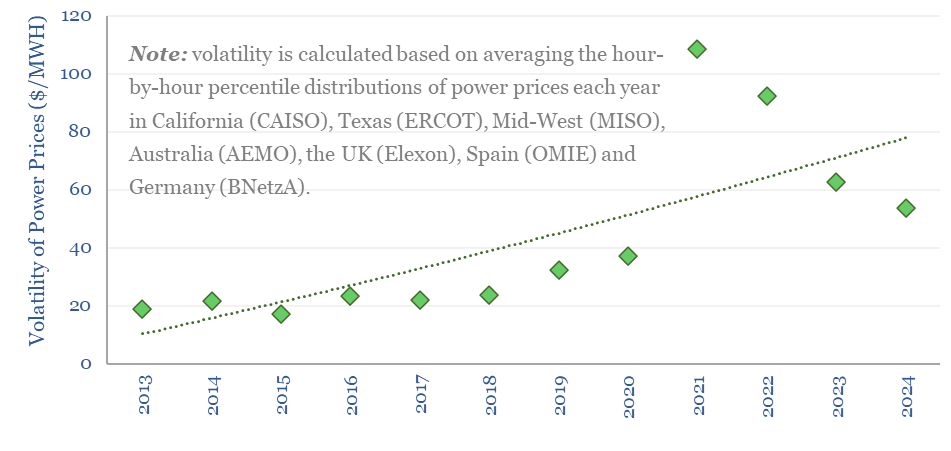

Global power price volatility tracker?

Download

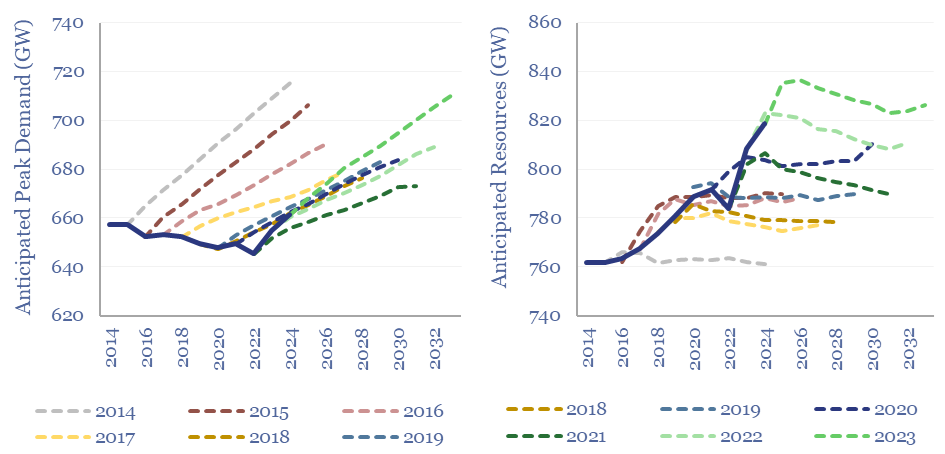

Reserve margins: by ISO and over time?

Download

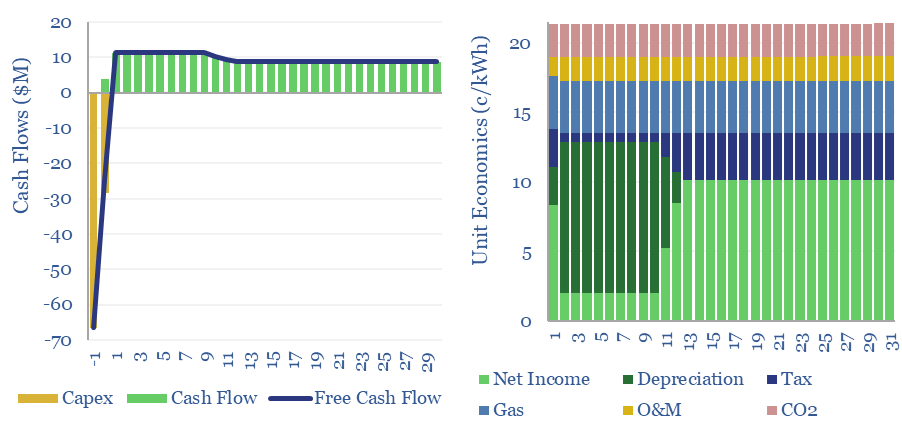

Gas peaker plants: the economics?

Download

Gas power generation across five-minute intervals?

Download

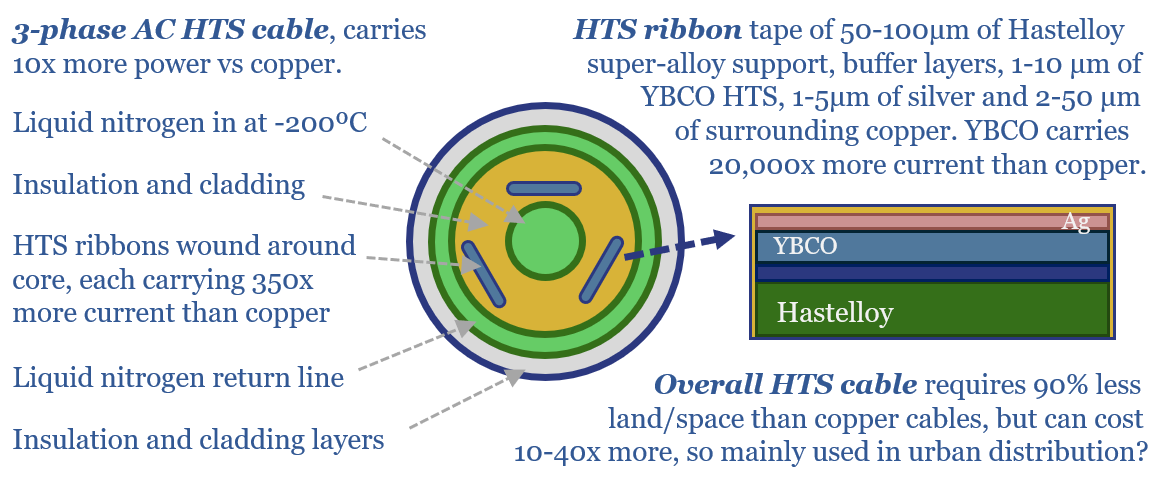

Superconductors: distribution class?

Download

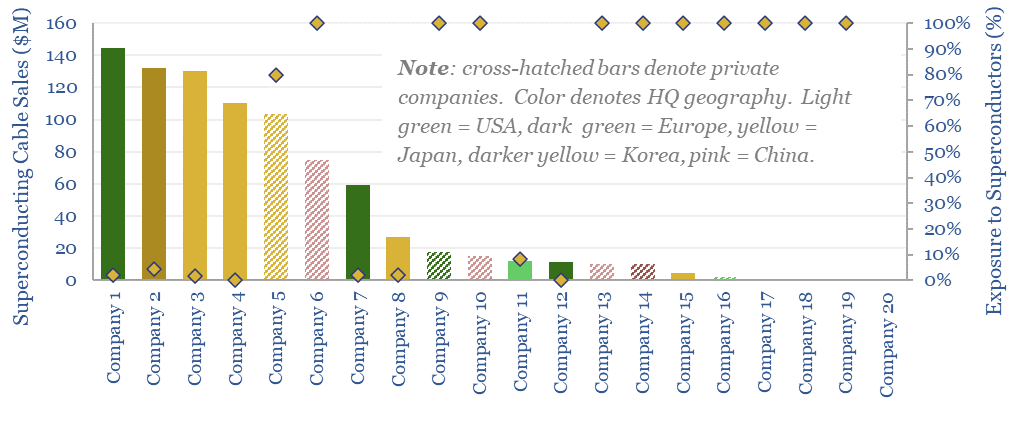

Superconductor screen: projects, materials, companies?

Download

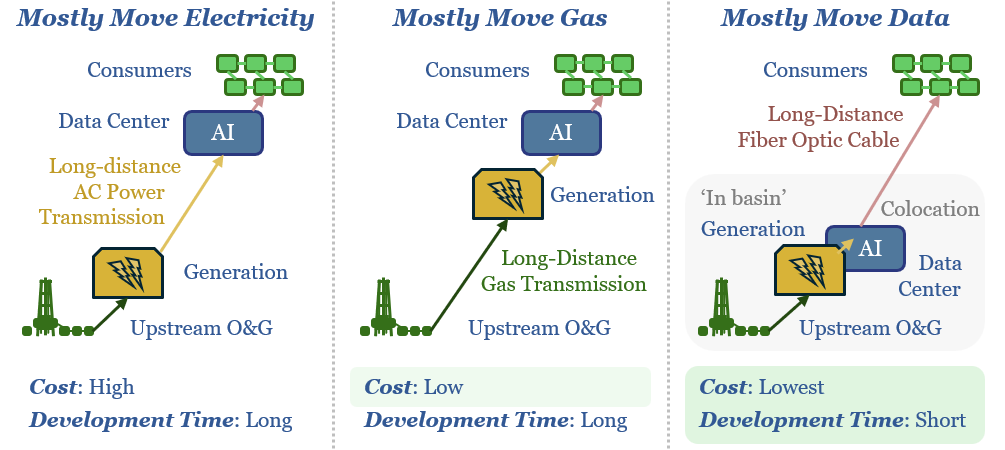

Moving targets: molecules, electrons or bits ?!

Download

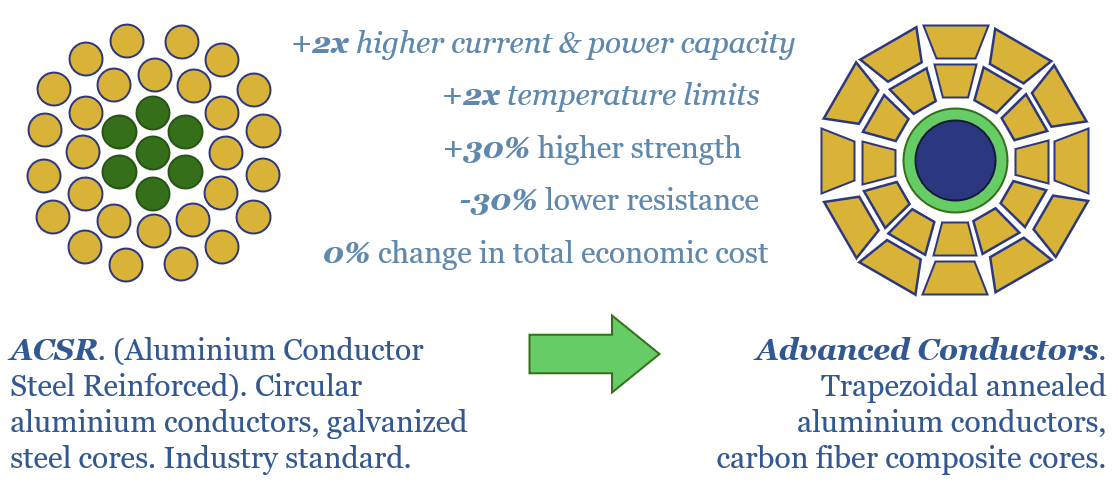

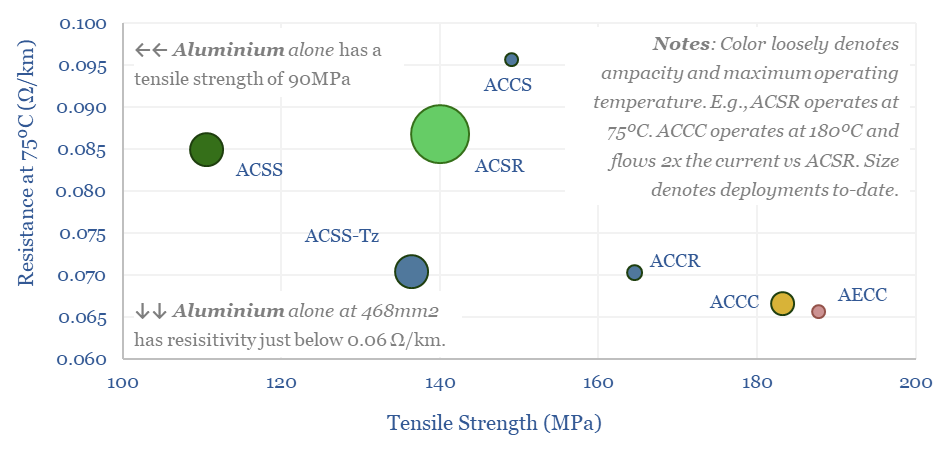

Advanced Conductors: current affairs?

Download

Gas power: does low utilization entail spare capacity?

Download

Power distribution: the economics?

Download

Power transmission: the economics?

Download

Advanced Conductors versus ACSR: costs and companies?

Download

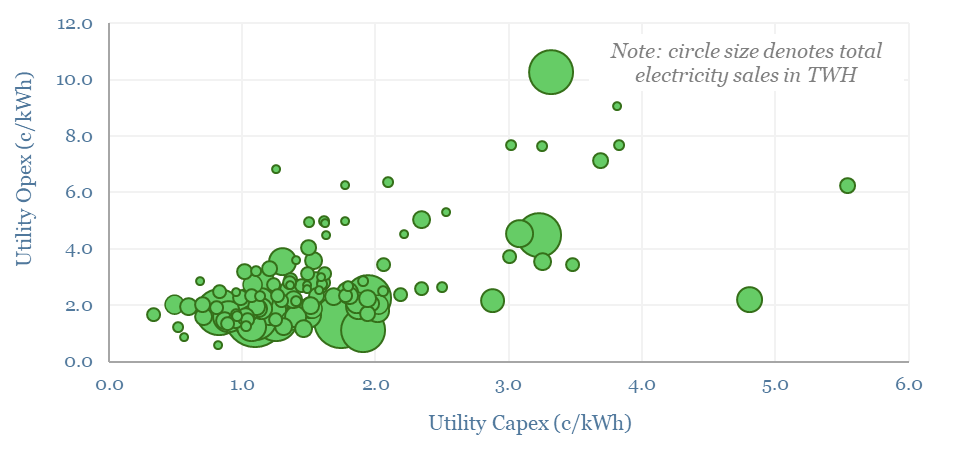

US electric utilities: transmission and distribution costs?

Download

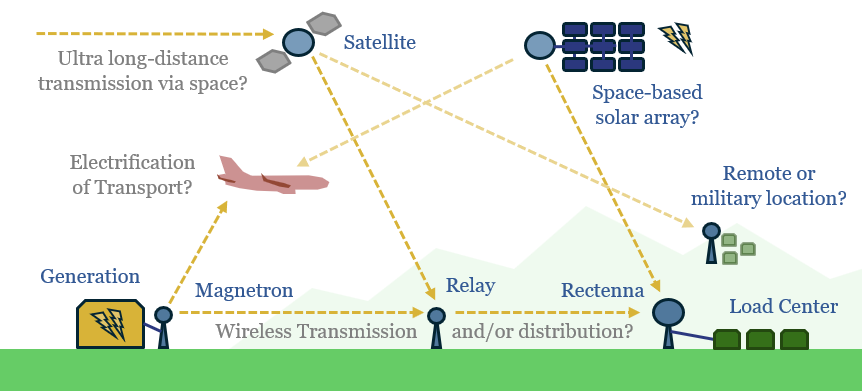

Into thin air: beaming power as microwaves?

Download

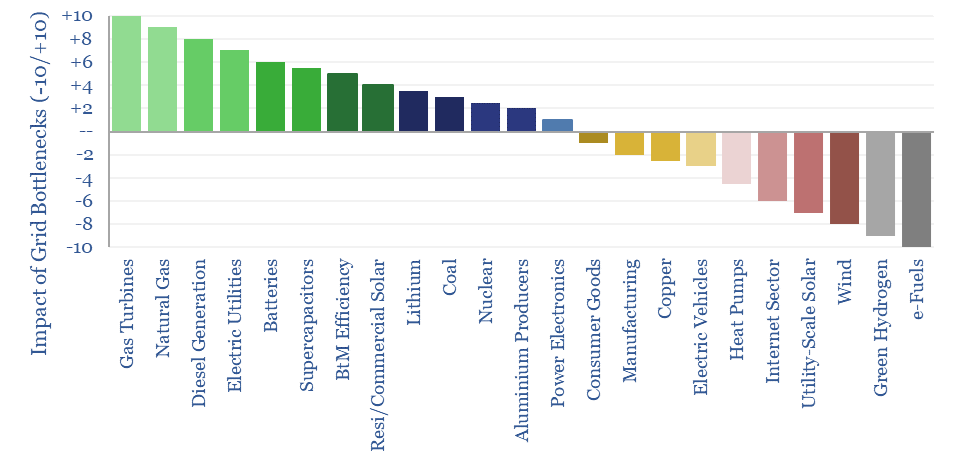

Bottlenecked grids: winners and losers?

Download

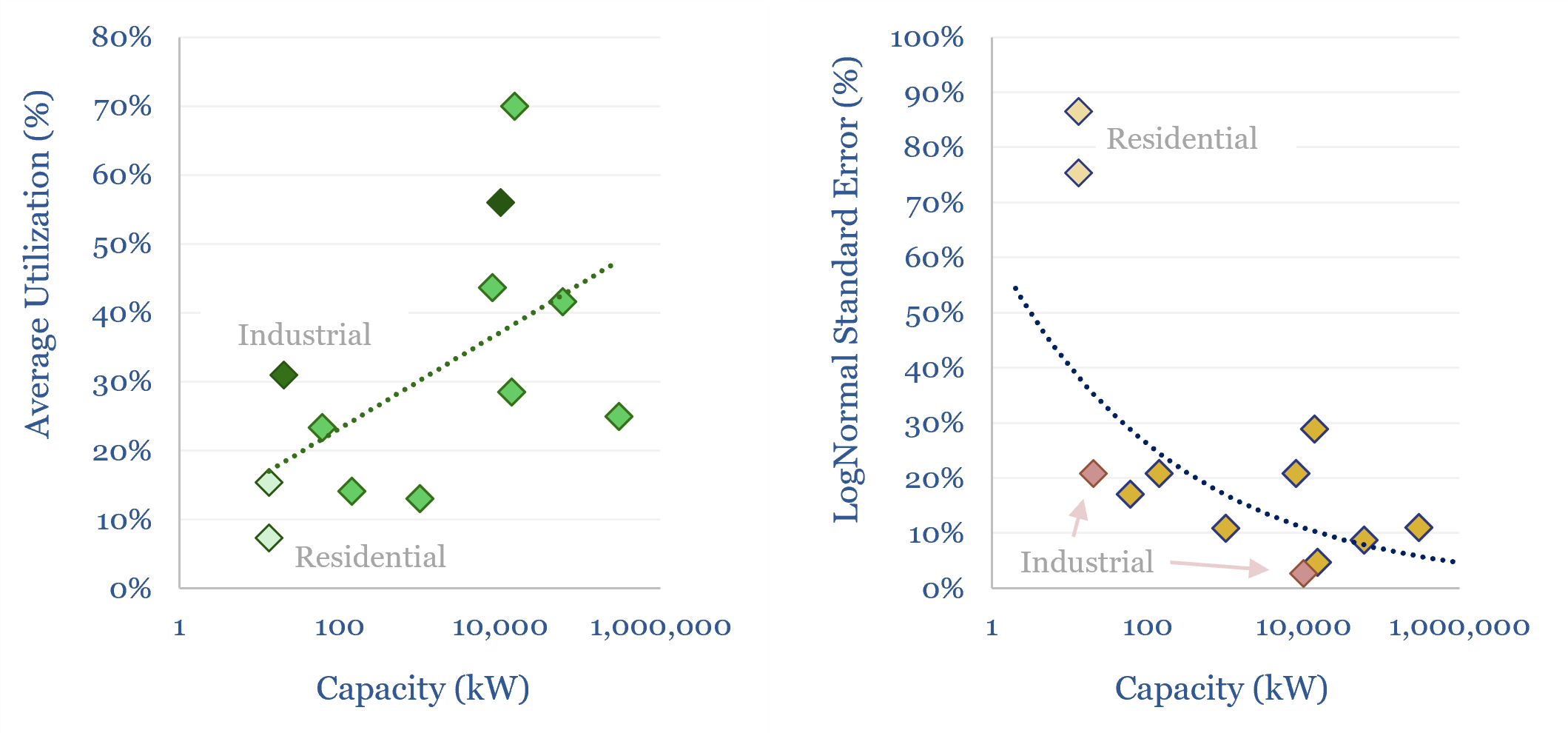

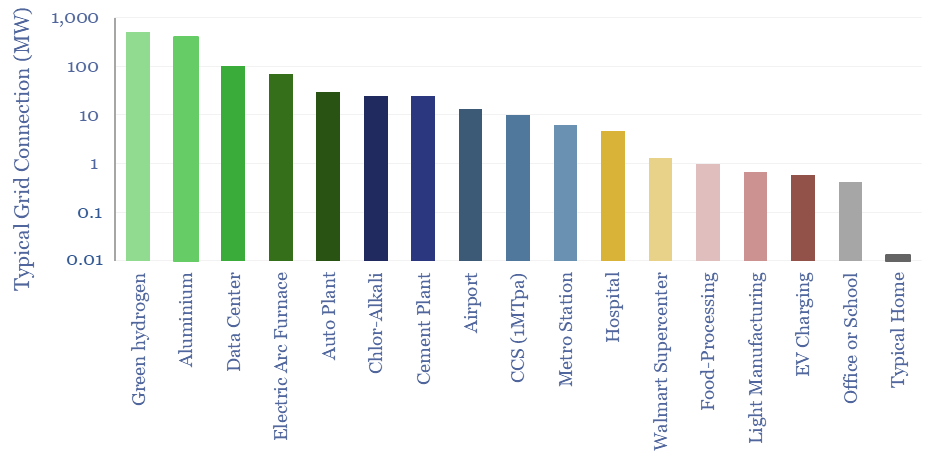

Grid connection sizes: residential, commercial and industrial?

Download

Hydrogen Research

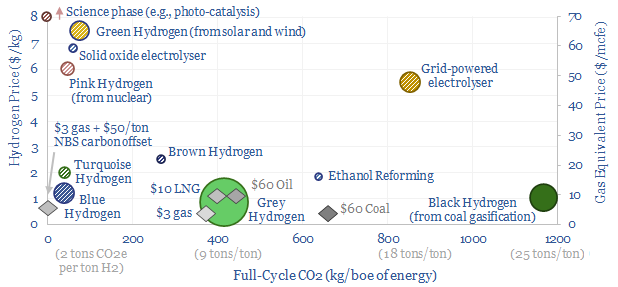

Hydrogen: overview and conclusions?

Download

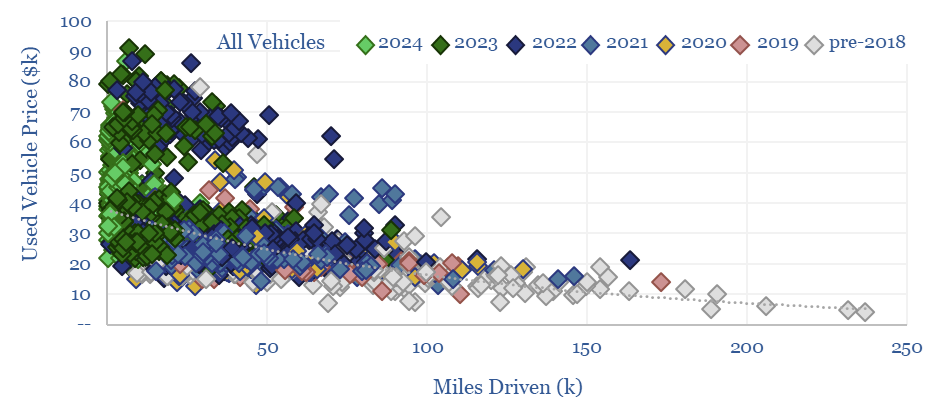

Vehicle depreciation rates: EVs versus ICEs?

Download

Air Products: ammonia cracking technology?

Download

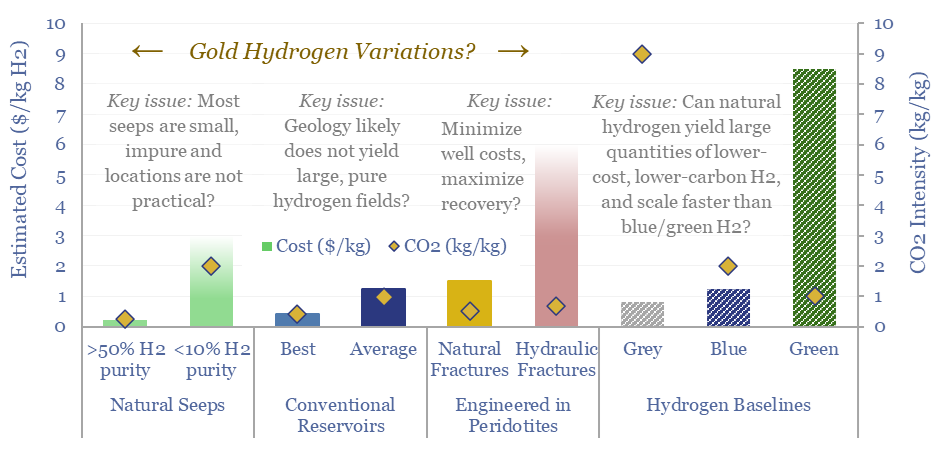

Natural hydrogen: going for gold?

Download

Cemvita Factory: microbial breakthroughs?

Download

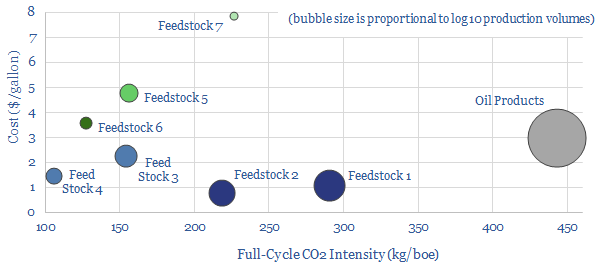

Gold hydrogen: the economics?

Download

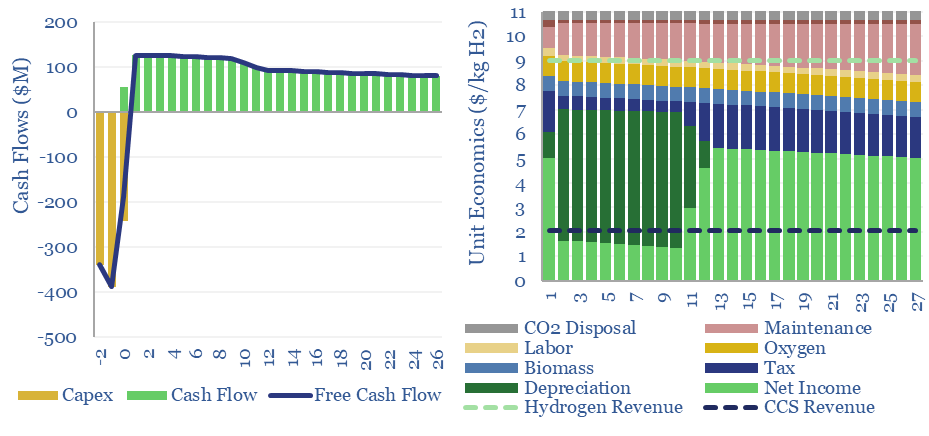

Bright green hydrogen from biomass gasification?

Download

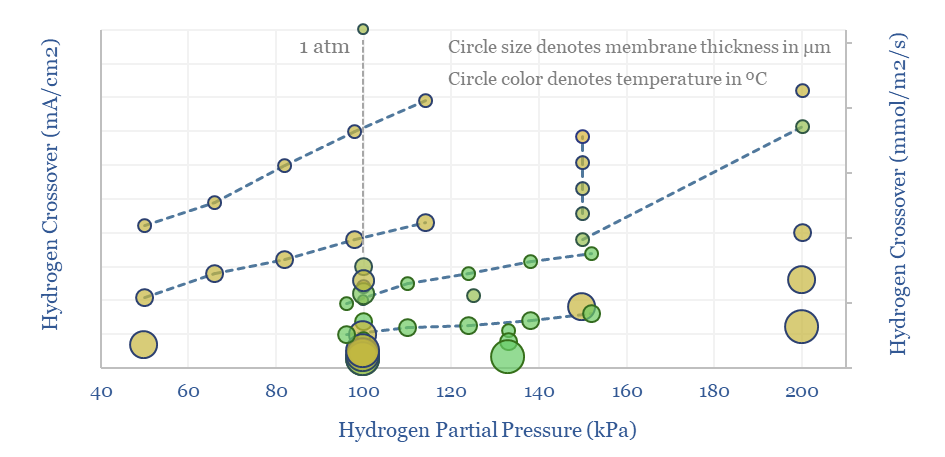

Nafion membranes: costs and hydrogen crossover?

Download

Electrochemistry: redox potential?

Download

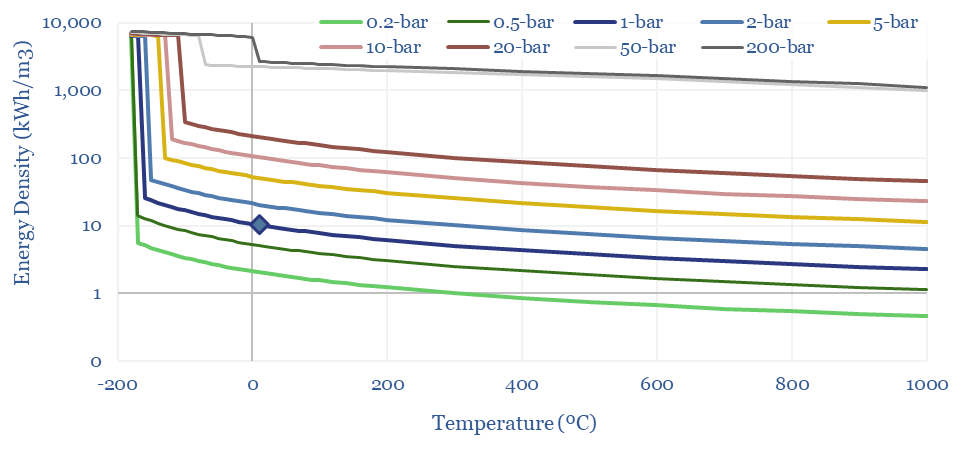

Density of gases: by pressure and temperature?

Download

Hydrogen evolution: outlook for industrial gases?

Download

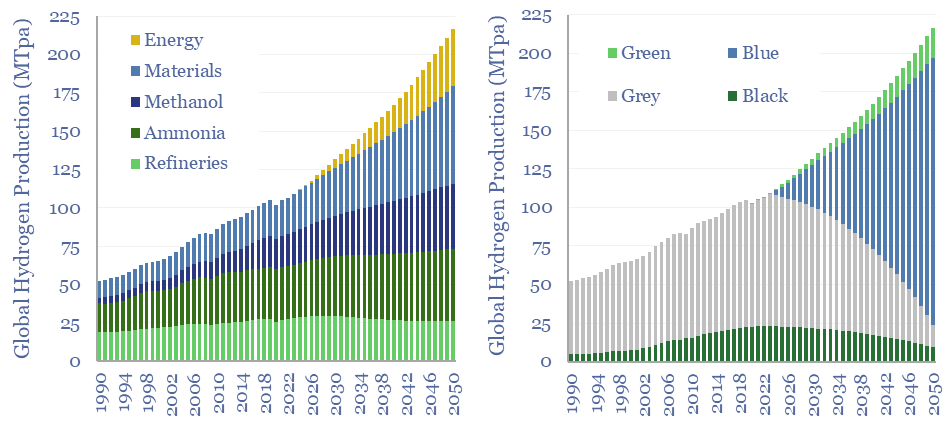

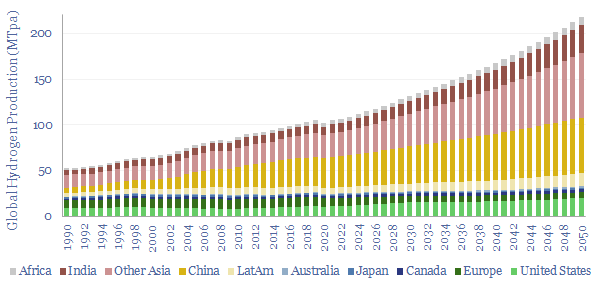

Global hydrogen supply-demand: by region, by use & over time?

Download

Plug power: green hydrogen breakthroughs?

Download

MIRALON: turquoise hydrogen breakthrough?

Download

Bloom Energy: solid oxide fuel cell technology?

Download

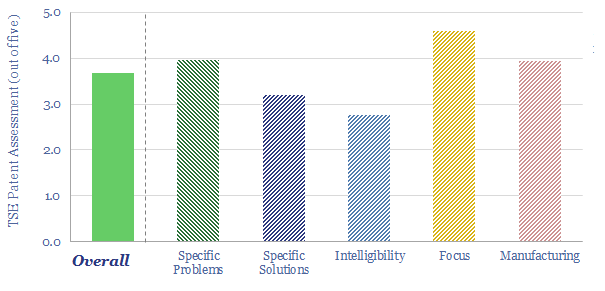

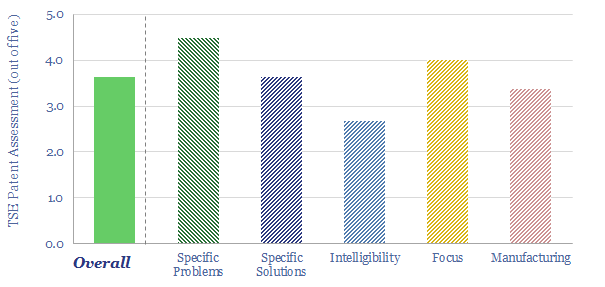

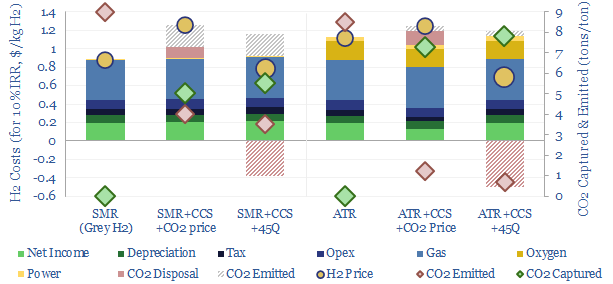

Hydrogen reformers: SMR versus ATR?

Download

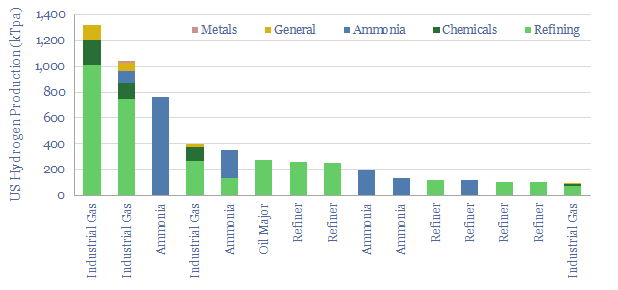

US hydrogen production: by facility and by company?

Download

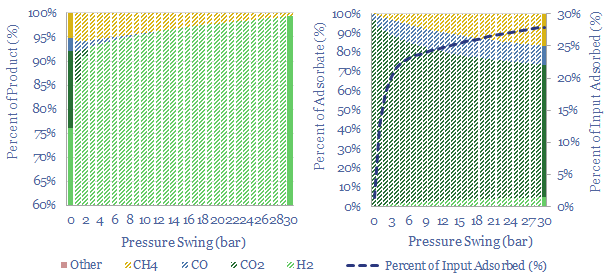

Industrial gas separation: swing producers?

Download

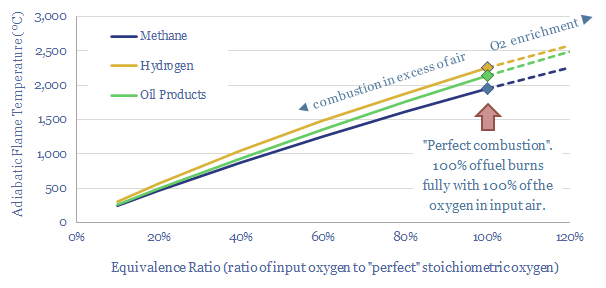

Adiabatic flame temperature: hydrogen, methane and oil products?

Download

Topsoe: autothermal reforming technology?

Download

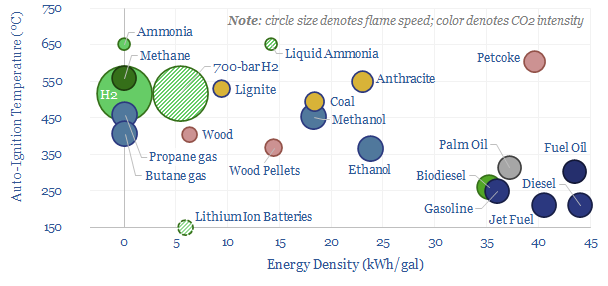

Combustion fuels: density, ignition temperature and flame speed?

Download

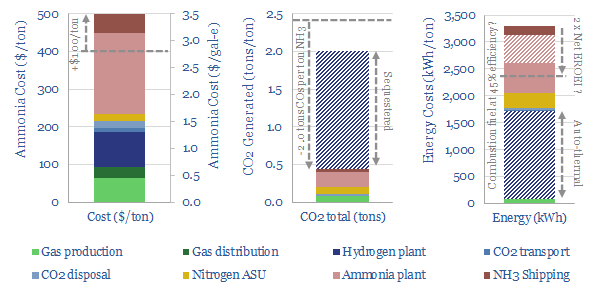

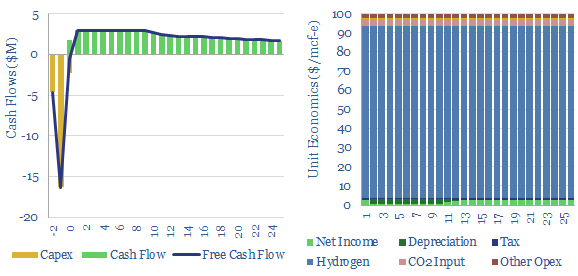

Blue ammonia: options strategy?

Download

Sabatier process: synthetic natural gas costs?

Download

NEL: green hydrogen technology review?

Download

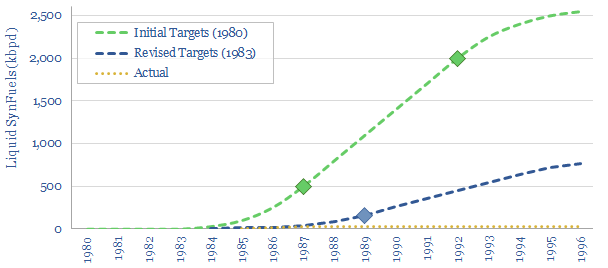

Energy policy: unleashing new technologies?

Download

Costs of hydrogen from coal gasification?

Download

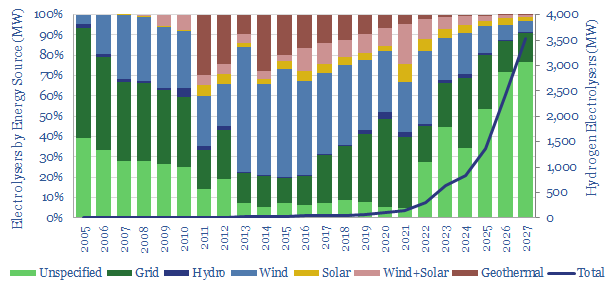

Green hydrogen: can electrolysers run off renewables?

Download

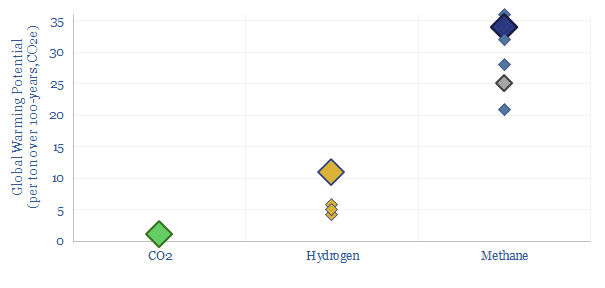

Hydrogen: what GWP and climate impacts?

Download

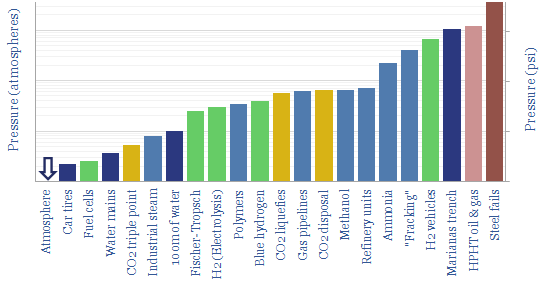

Pressure ratings: industrial and energy processes?

Download

Monolith: turquoise hydrogen breakthrough?

Download

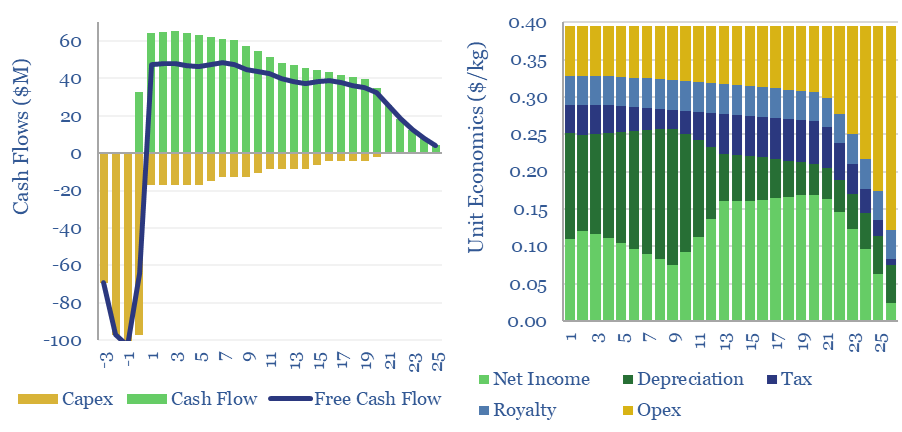

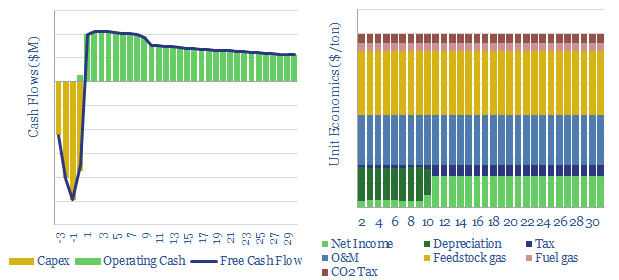

Turquoise hydrogen from methane pyrolysis: economics?

Download

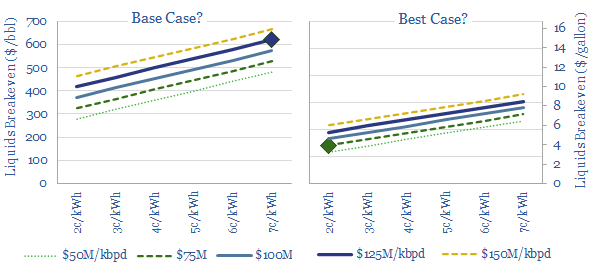

Electro-fuels: start out as a billionaire?

Download

Green hydrogen electrolysers in Europe: a database?

Download

Power-to-liquids: companies commercializing electro-fuels?

Download

Power-to-liquids: the economics?

Download

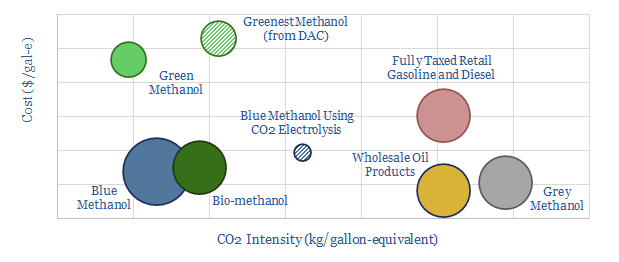

Methanol: the next hydrogen?

Download

Methanol production: the economics?

Download

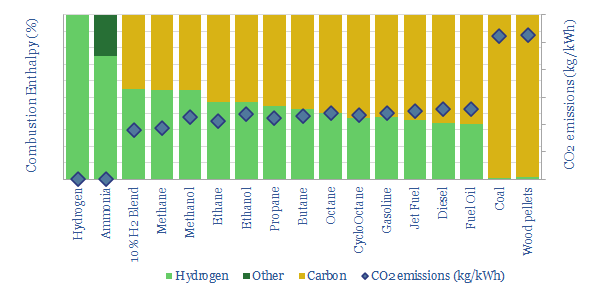

Energy economics: energy content of combustion fuels?

Download

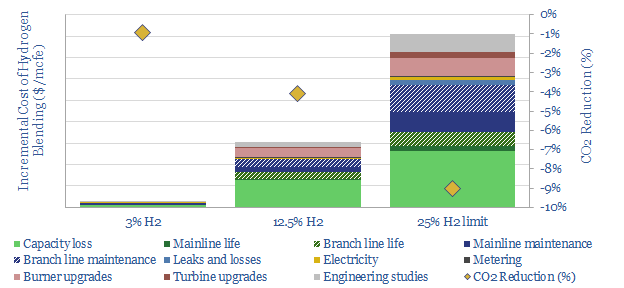

Hydrogen blending: costs and complexities?

Download

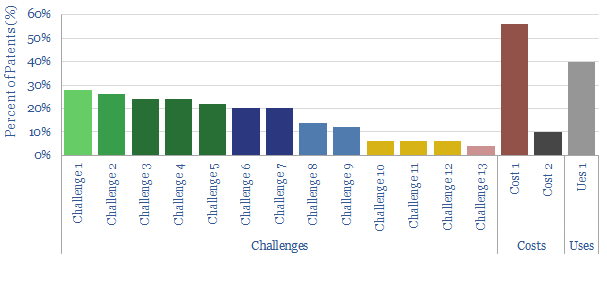

Proton exchange membrane fuel cells: what challenges?

Download

Biofuels Research

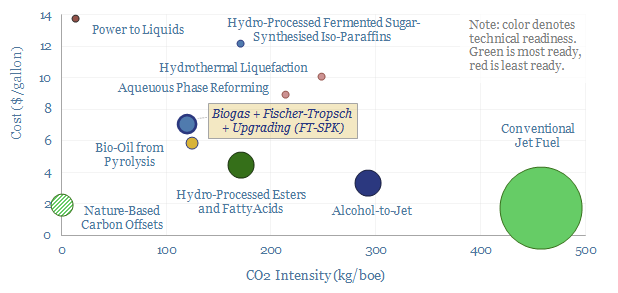

Biofuel technologies: an overview?

Download

Sustainable aviation fuel: flight path?

Download

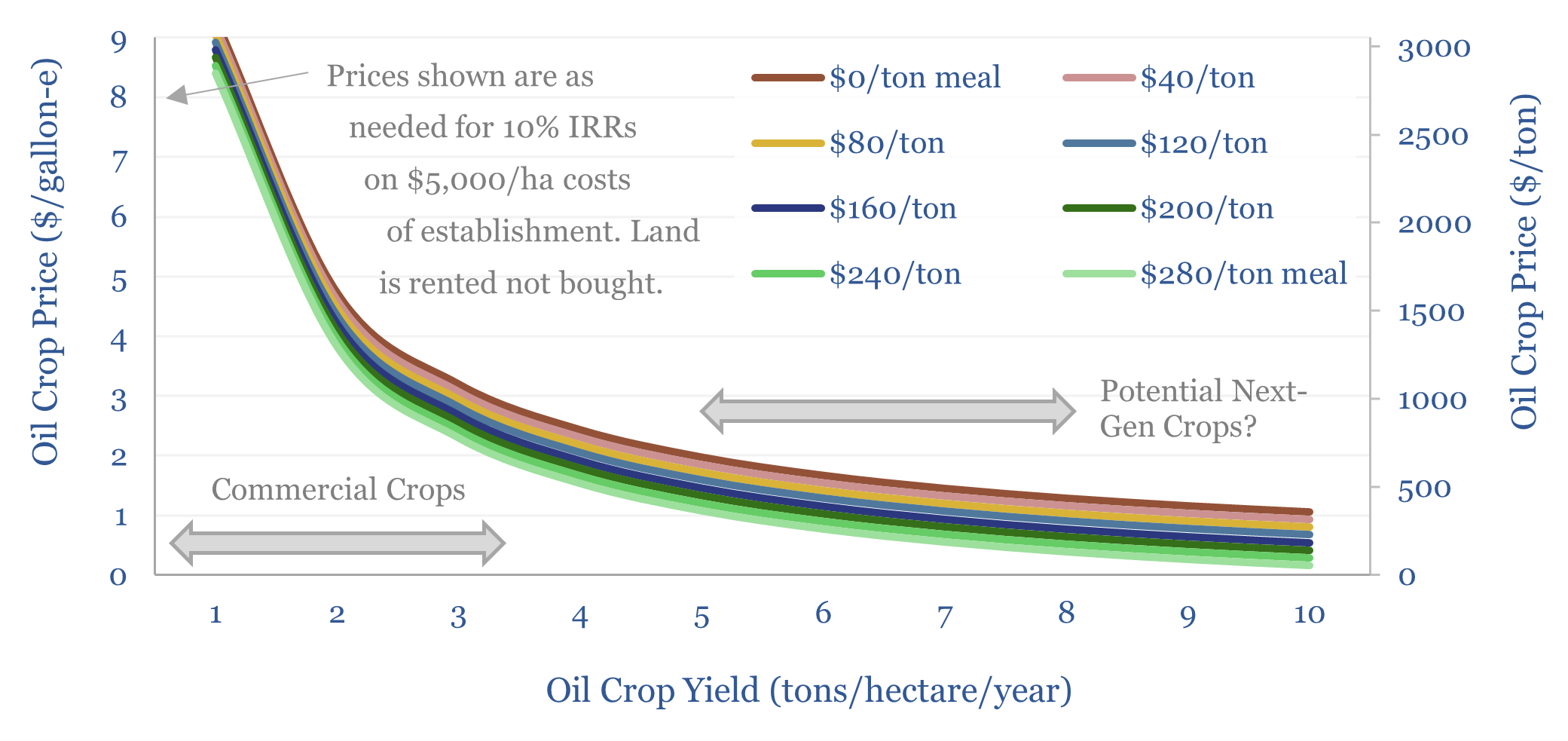

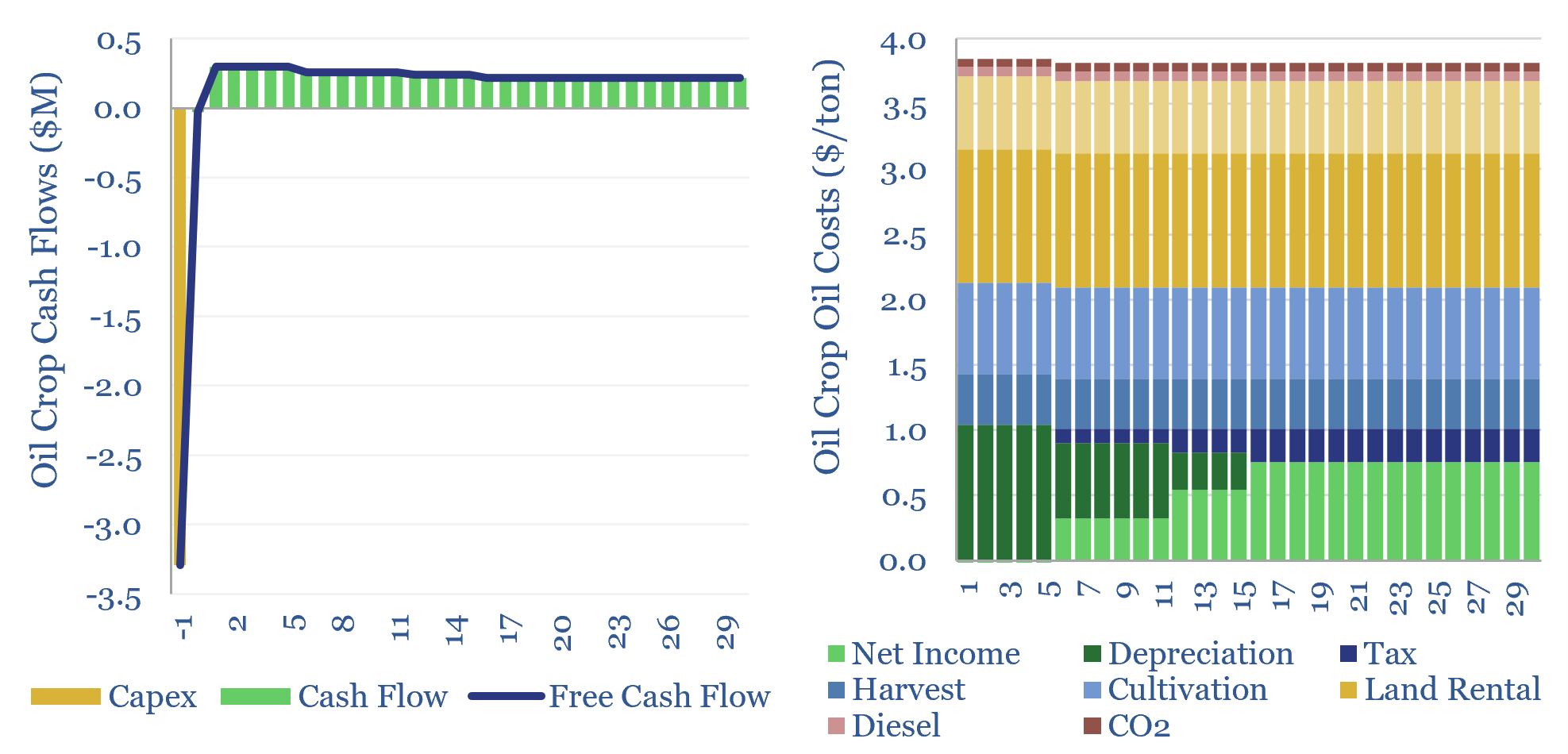

Oil crops: the economics?

Download

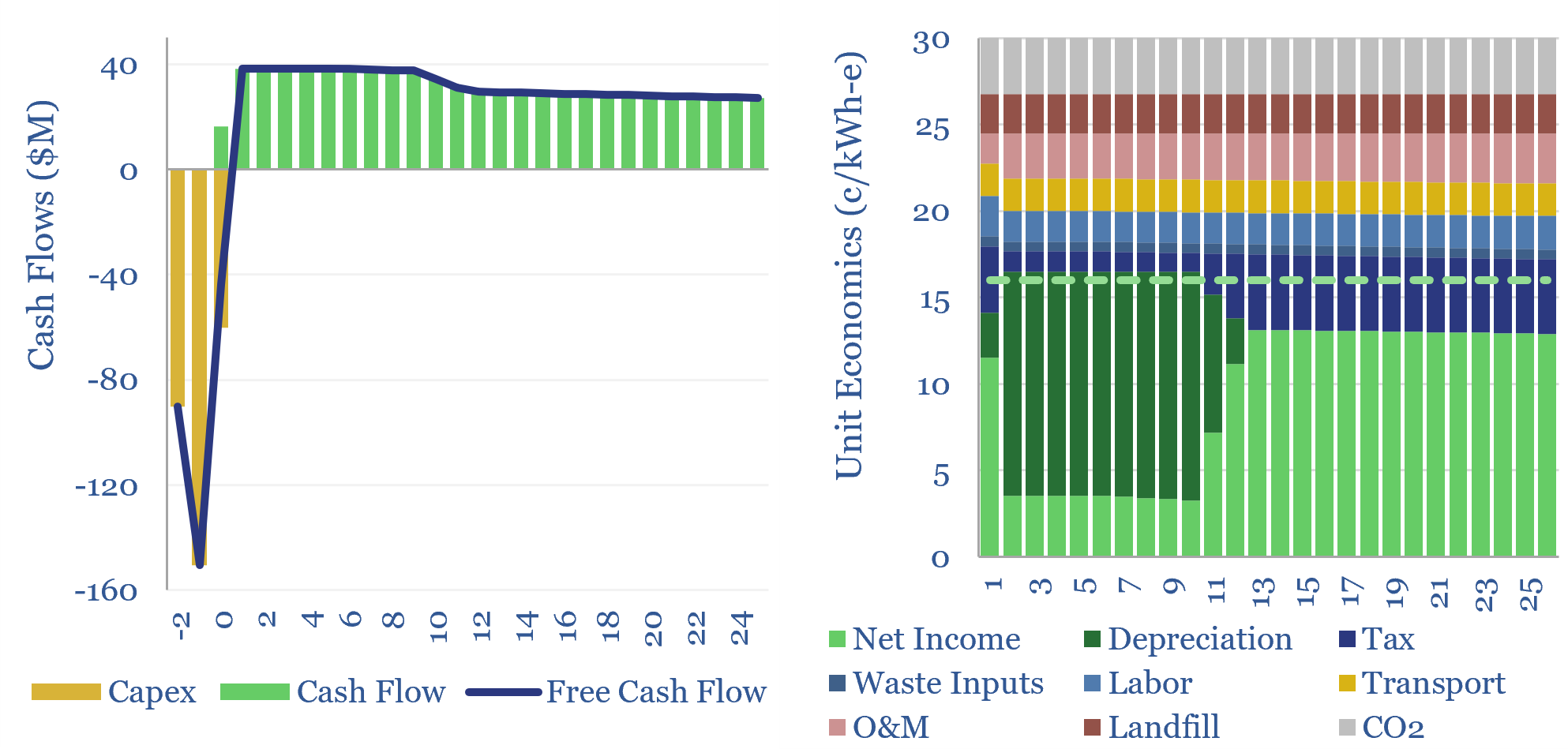

Waste-to-energy: levelized costs of electricity?

Download

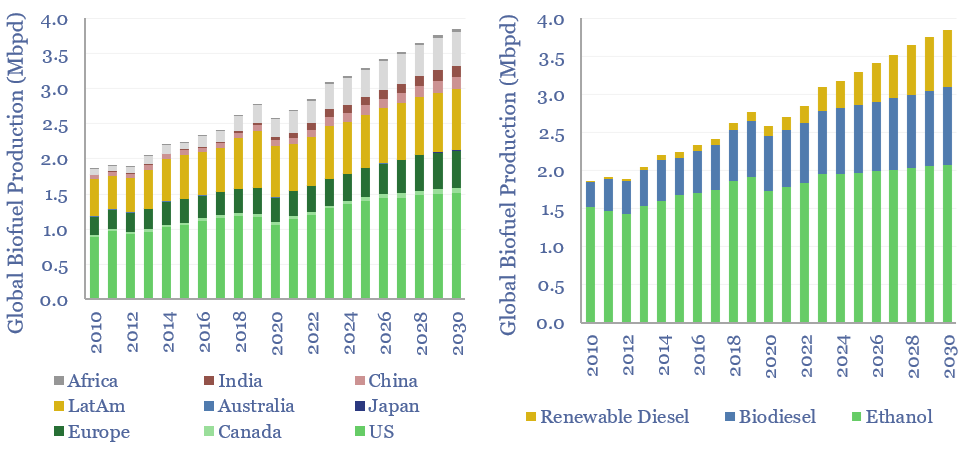

Global biofuel production: by region, by liquid fuel?

Download

Costs of biogas upgrading to biomethane?

Download

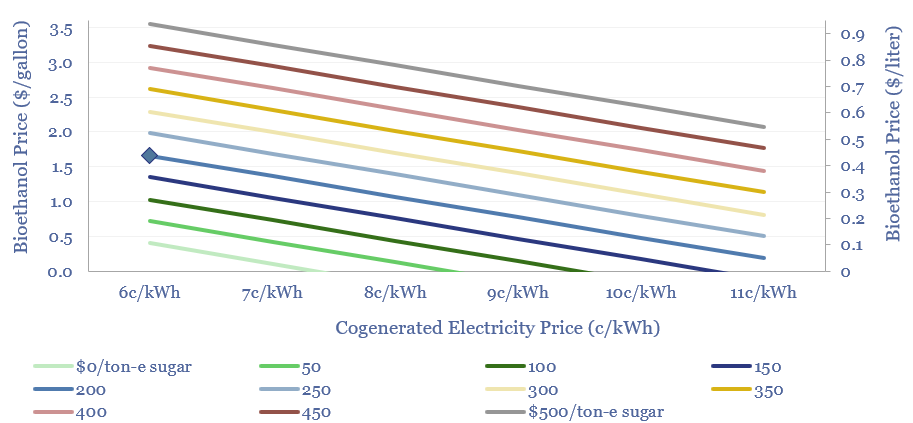

Sugar to ethanol: value in volatility?

Download

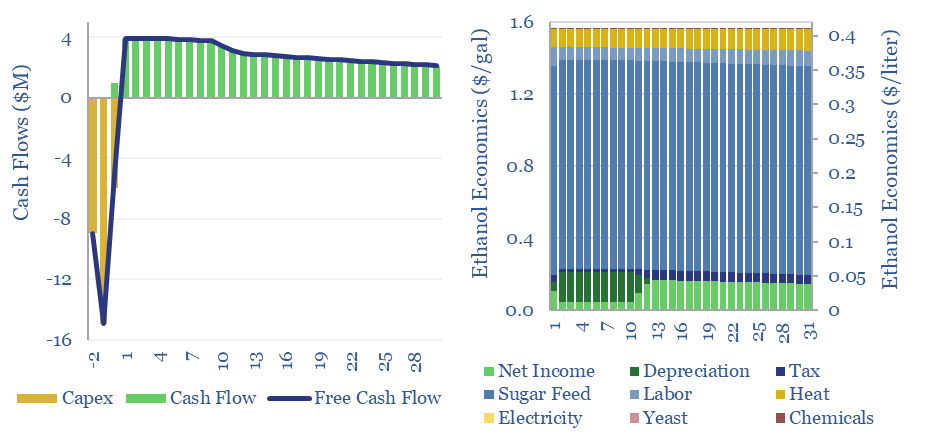

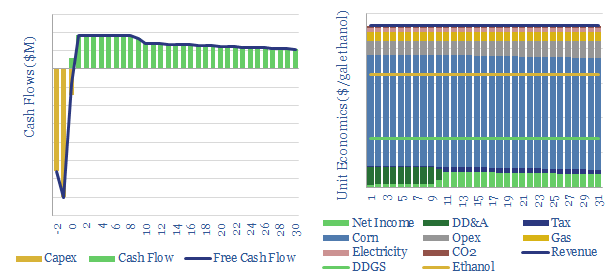

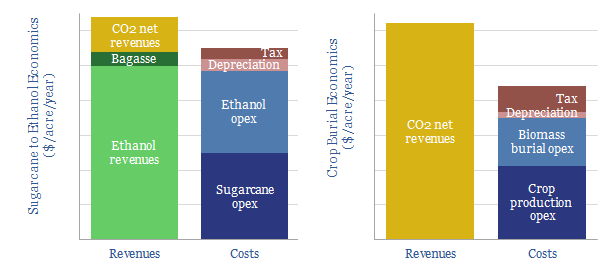

Sugar to ethanol: the economics?

Download

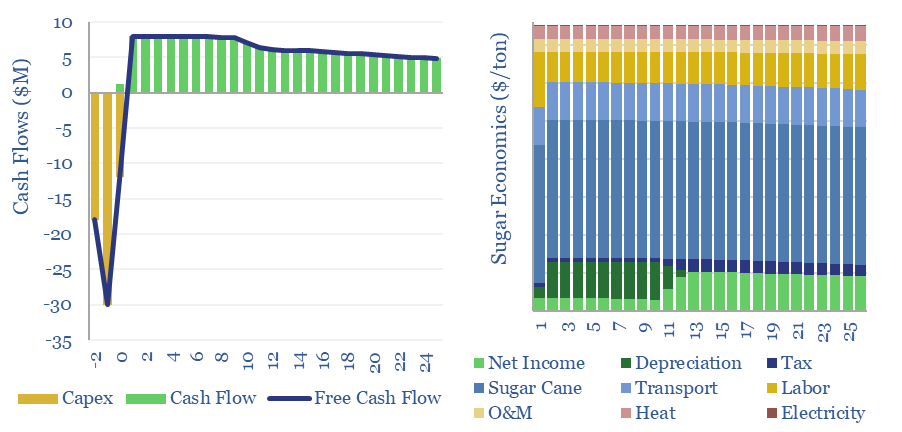

Sugar production: the economics?

Download

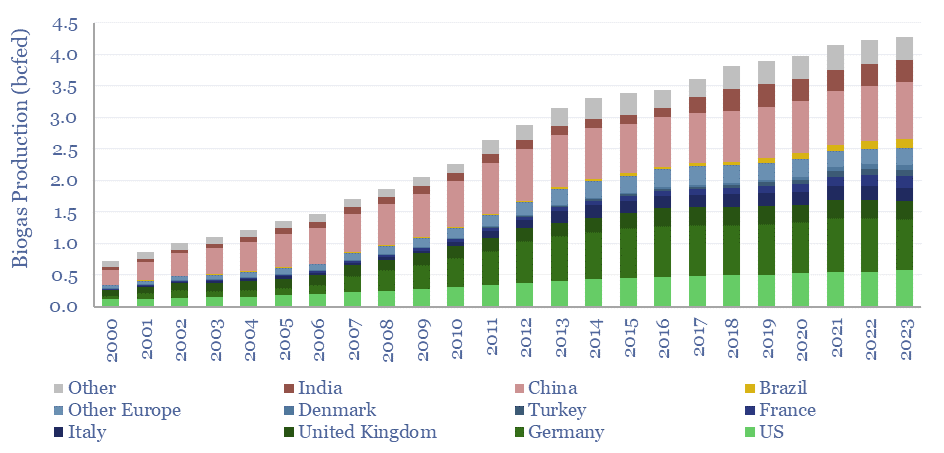

Global biogas production by country?

Download

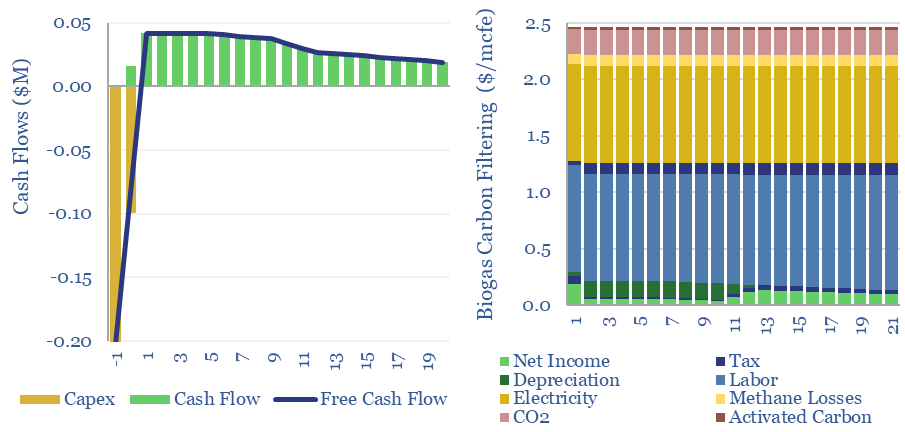

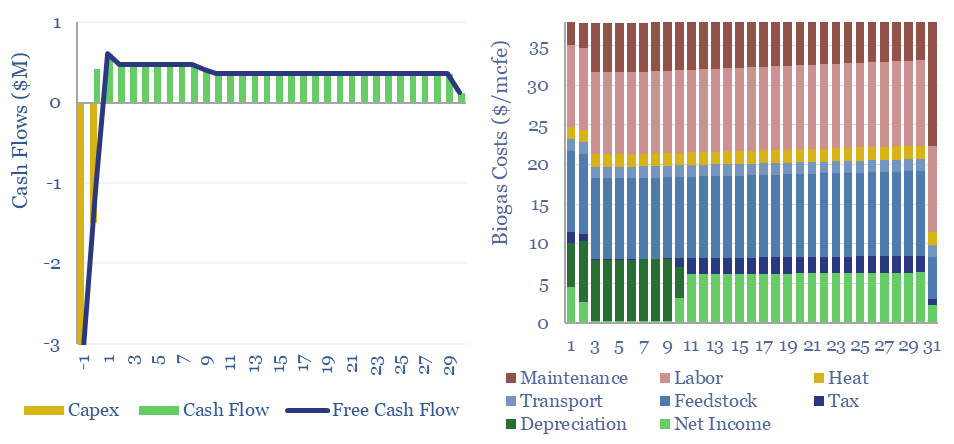

Biogas: the economics?

Download

Verbio: bio-energy technology review?

Download

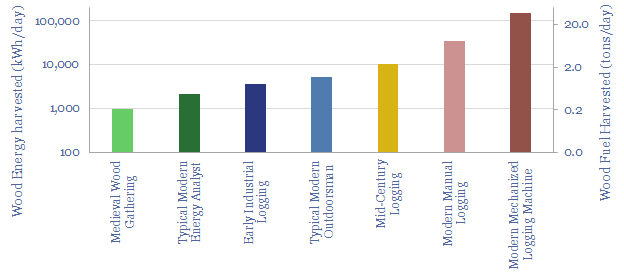

Energy history: how much wood can be cut in a day?

Download

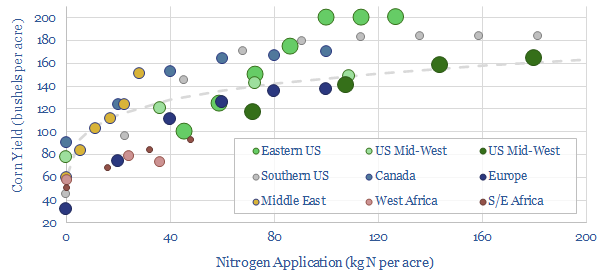

Crop production: how much does nitrogen fertilizer increase yields?

Download

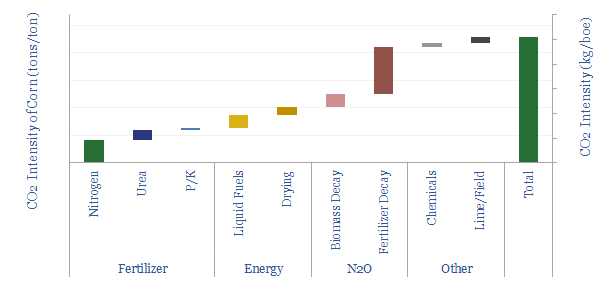

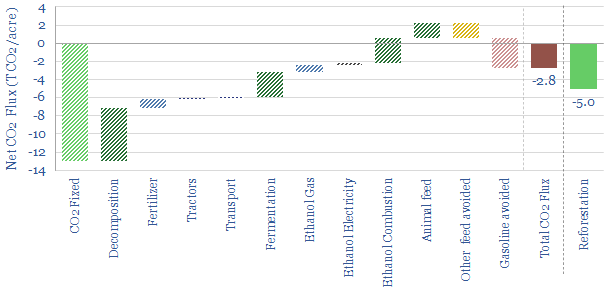

Crop production: what CO2 intensity?

Download

Bio-coke: energy economics?

Download

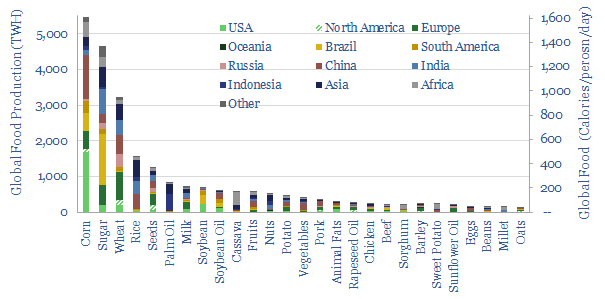

World food production: energy breakdown by crop by country?

Download

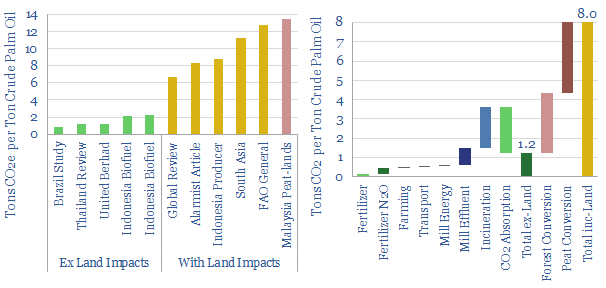

Palm oil: what CO2 intensity?

Download

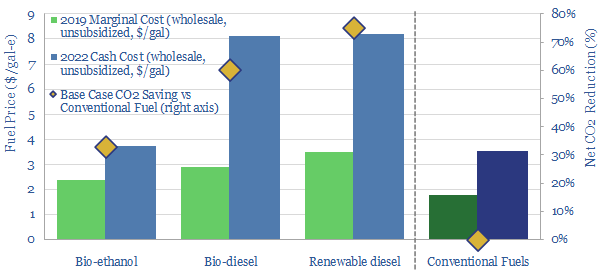

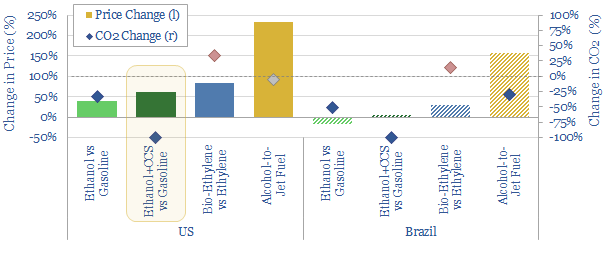

Biofuels: the best of times, the worst of times?

Download

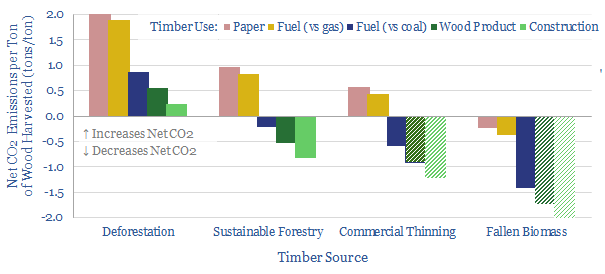

Wood use: what CO2 credentials?

Download

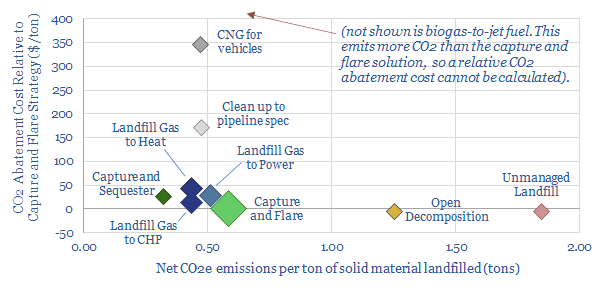

Landfill gas: rags to riches?

Download

Landfill gas: the economics?

Download

Danimer: bio-plastics breakthrough?

Download

LanzaTech: biofuels breakthrough?

Download

Origin Materials: bio-plastics breakthrough?

Download

Ethanol: hangover cures?

Download

Ethanol-to-ethylene: the economics?

Download

Ethanol: getting wasted?

Download

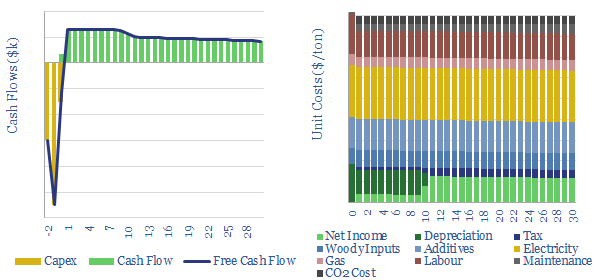

Ethanol from corn: the economics?

Download

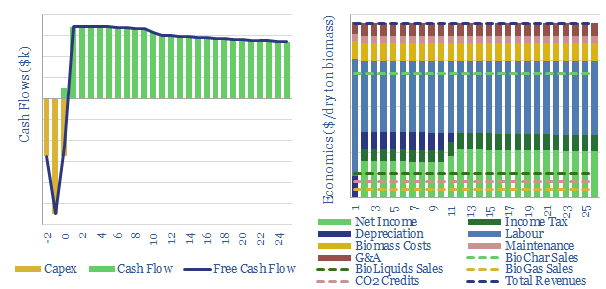

Biogas-to-liquids: decarbonize aviation fuels?

Download

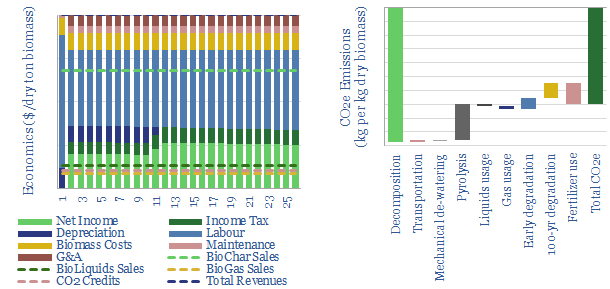

Biochar: burnt offerings?

Download

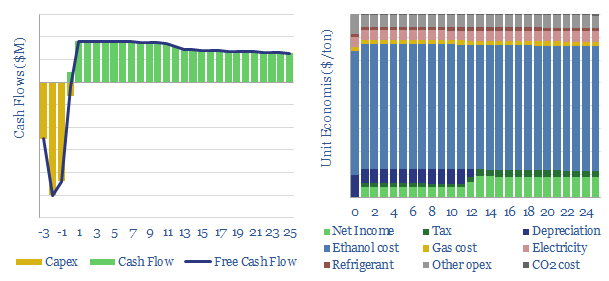

Biomass to biochar: the economics?

Download

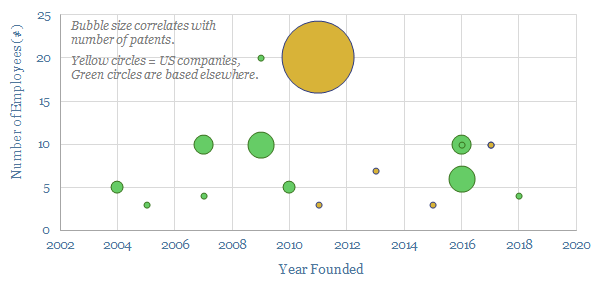

Leading companies in biochar?

Download

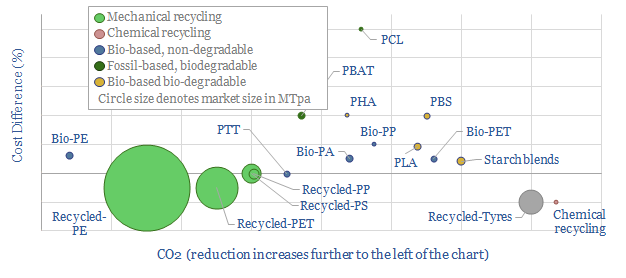

Next-generation plastics: bioplastic, biodegradable, recycled?

Download

Methanol production: the economics?

Download

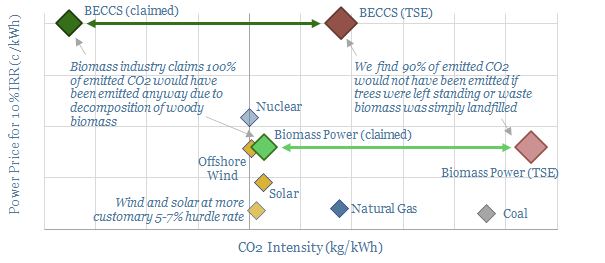

Biomass and BECCS: what future in the transition?

Download

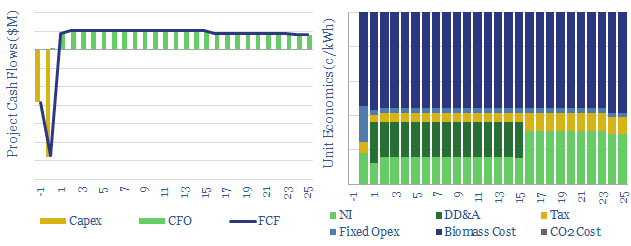

Biomass power: costs, levelized costs and BECCS?

Download

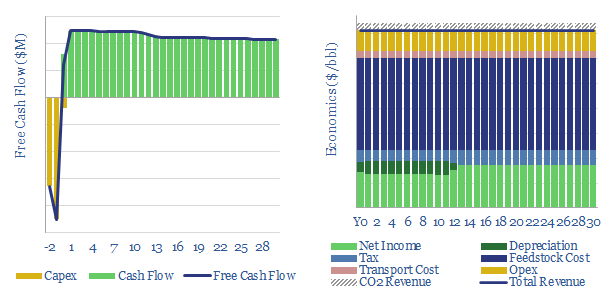

Renewable diesel: the economics?

Download

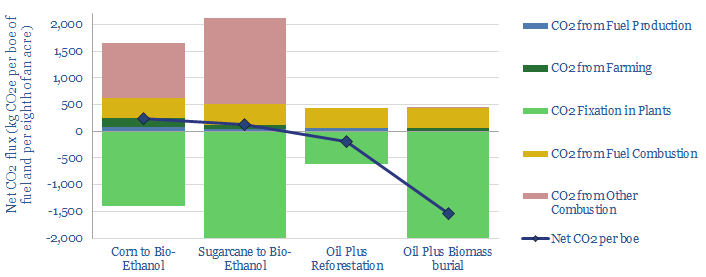

Biofuels: better to bury than burn?

Download

Biomass to biofuel, or biomass for burial?

Download