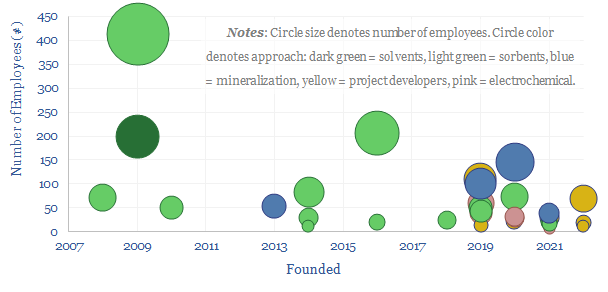

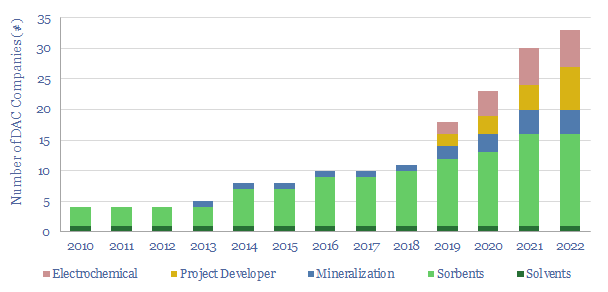

Leading direct air capture companies (DAC companies) are assessed in this data-file, aggregating company disclosures, project disclosures and other data from patents and technical papers. The landscape is evolving particularly rapidly, trebling in the past half-decade, especially towards novel DAC solutions.

Most of the DAC companies in this data-file are private, with an average of c65 employees, and focuses ranging across L-DAC, S-DAC, CO2 mineralizations, project development and novel electrochemical approaches. The data-file covers each company, its approach, headquarters, employee count, capital raising and recent news that stood out to us.

Half a decade ago, the DAC company landscape was dominated by well-known leaders, such as Carbon Engineering, Climeworks and Global Thermostat (all founded in 2009-2010).

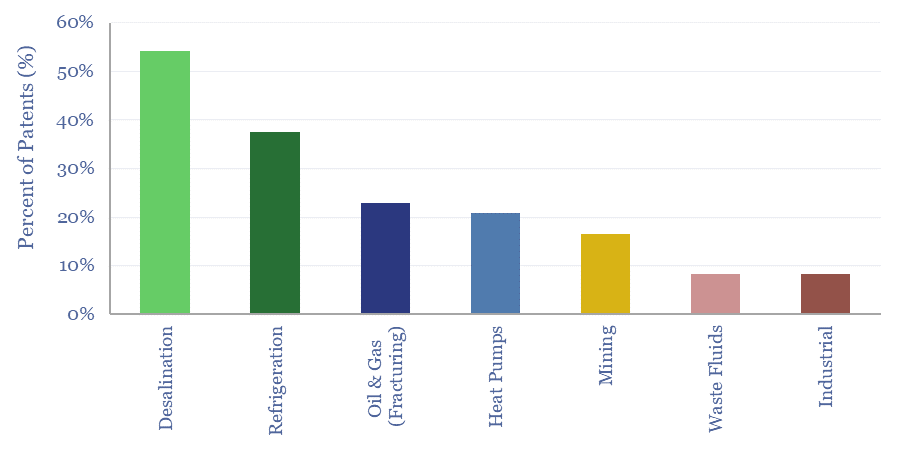

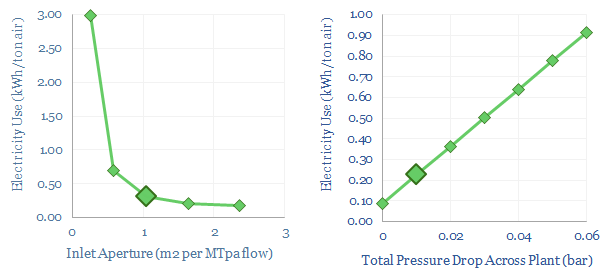

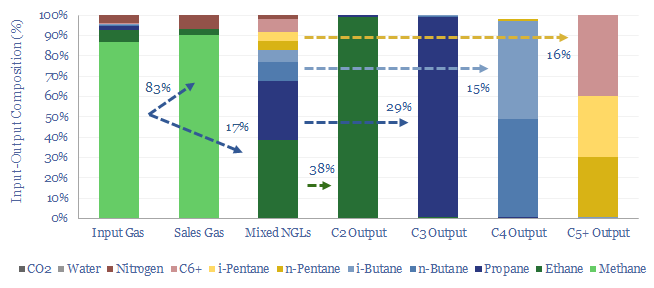

However in the past half-decade, the size of the space has trebled, with a clear focus upon next-generation DAC designs (or as we call it, ‘DAC to the future‘) which could confer materially lower energy intensities and financial costs, using advanced sorbents, passive DAC, mineralization and electrochemical systems. Many are at the pilot stage.

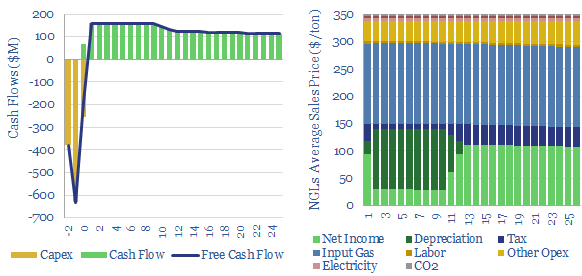

Large projects are compiled in the projects tab, ranging from Climeworks’ 4kTpa Orca demonstration plant that started up in 2021 using geothermal energy in Iceland; through to the first 1MTpa-scale projects being progressed by 1PointFive, the consortium between Occidental and Carbon Engineering. The largest proposed project we have seen is 5MTpa.

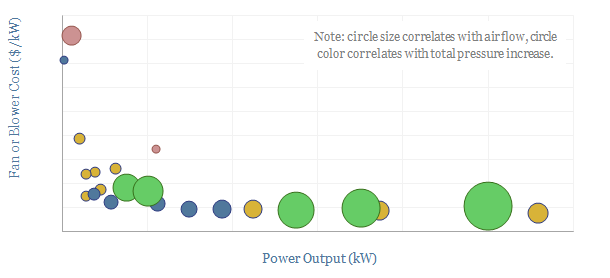

Modularity is also a growing topic amongst emerging DAC companies, which may not build MTpa-scale plants but tens of thousands of 10-1,000 Tpa modules, which will be cheaper to manufacture and can integrate with other facilities.

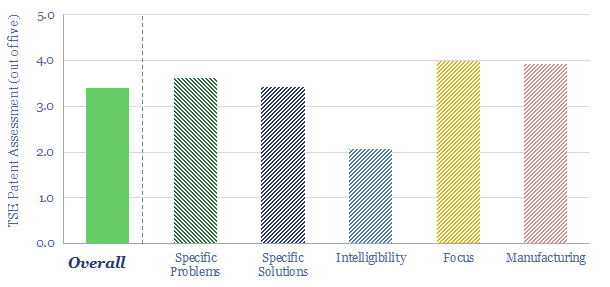

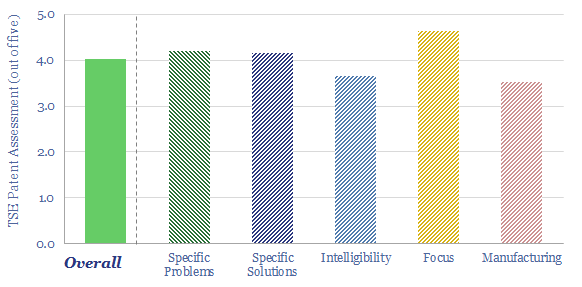

Electrochemical DAC excites us most and we will undertake TSE patent reviews into some of these companies in due course.